SPDR Portfolio S&P 500 Growth ETF's Exposure To Technology Stocks Is Advantageous

by Ploutos InvestingSummary

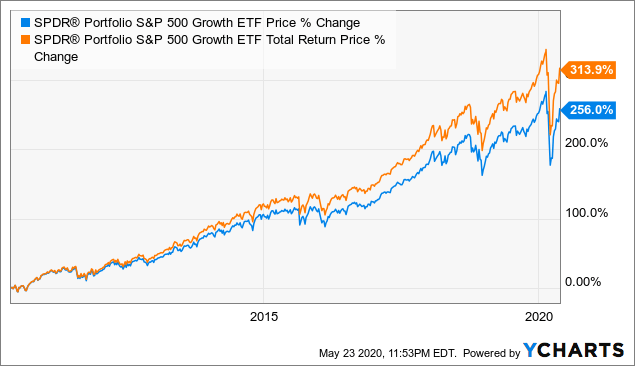

- SPYG invests in large-cap growth stocks in the S&P 500 Index.

- The fund’s relatively lower exposure to cyclical sectors is advantageous as the impact of COVID-19 may last for several years.

- SPYG's high exposure to technology stocks should help it to deliver better performance as many technology stocks will benefit from the trend of people working and staying at home.

ETF Overview

The SPDR Portfolio S&P 500 Growth ETF (SPYG) owns a portfolio of large-cap growth stocks in the S&P 500 Index. The fund’s relatively higher exposure to information technology sector and lower exposure to cyclical sectors are advantageous for the following reasons: 1) Cyclical sectors are expected to continue to underperform unless a vaccine for COVID-19 is developed quickly, and 2) many technology stocks in SPYG’s portfolio will continue to outperform as trend of many people working and staying at their homes continue. Therefore, SPYG appears to be a good choice for investors in a post-COVID-19 world.

Fund Analysis

SPYG constructs its portfolio based on stocks’ growth characteristics

To have a better idea about SPYG, we should first understand how it is constructed. SPYG basically tracks the S&P 500 Growth Index. The index selects stocks exhibiting the strongest growth characteristics in the S&P 500 Index based on these three factors: sales growth, earnings change to price ratio, and momentum. The index implements a market cap-weighted approach to select stocks that fits these three criteria. For more information about the pros and cons of this approach, please read our previous article on how SPYG's portfolio is constructed.

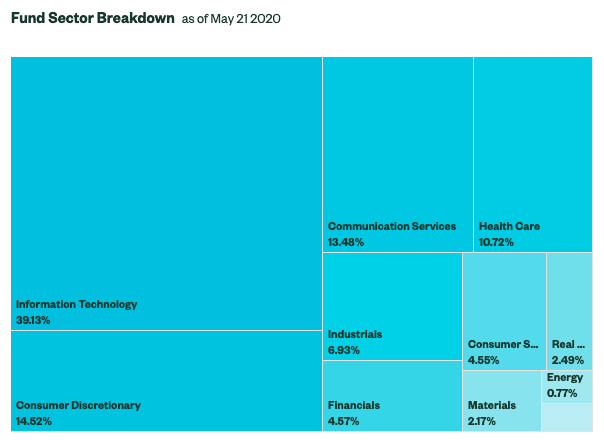

High exposure to technology and low exposure to cyclical sectors are advantageous

SPYG has a high exposure to the information technology sector. In fact, the information technology sector represents about 39.1% of its total portfolio. On the other hand, it has low exposure to cyclical sectors. These cyclical sectors such as consumer discretionary (14.52% of the portfolio), industrials (6.93%), financials (4.57%), materials (2.17%), real estates (2.49%), and energy (0.77%) sectors represent a total of 31.5% of the portfolio. Defensive sectors such as communication services, health care, consumer staples, represent about 30% of the portfolio.

Source: SPDR Website

SPYG’s higher exposure to technology and other defensive sectors and relatively lower exposure to cyclical sectors are actually advantageous in a post-COVID-19 world. This is because consumer confidence level will take several years to return to pre-COVID-19 level unless a vaccine or an effective drug to treat COVID-19 is developed. At this moment, it may take at least 12–18 months before a vaccine can be developed. Even if a vaccine is developed, the efficacy is still uncertain. Therefore, cyclical sectors may continue to struggle in the next 1 to 2 years as many people continue to practice social distancing. Therefore, SPYG’s relatively lower exposure to cyclical sectors is advantageous. On the other hand, its higher exposure to information technology sector is advantageous because many of these technology stocks are benefiting from the practice of social distancing. Companies in SPYG’s portfolio such as Microsoft (MSFT) and Amazon (AMZN) are benefiting from this trend. Microsoft’s cloud services are used by many businesses as they enable their employees to work from home. Amazon’s e-commerce services are also needed by people who prefer to shop online and have products and groceries delivered to their homes.

Risks and Challenges

Concentration risk

SPYG has considerable concentration risk as its top 10 holdings represent about 42.7% of its total portfolio. Therefore, any earnings disappointment by any of its top holdings can impact SPYG’s fund price negatively.

Investor Takeaway

We like SPYG and its high exposure to information technology sector especially in a post-COVID-19 world. We believe investors can continue to own this fund as it should continue to outperform the broader market until COVID-19 is behind us.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This is not financial advice and that all financial investments carry risks. Investors are expected to seek financial advice from professionals before making any investment.