GEO Group: Uninvestable Until A Dividend Cut As Deleveraging Or A Buyback Is A Better Use Of Capital

by Double S CapitalSummary

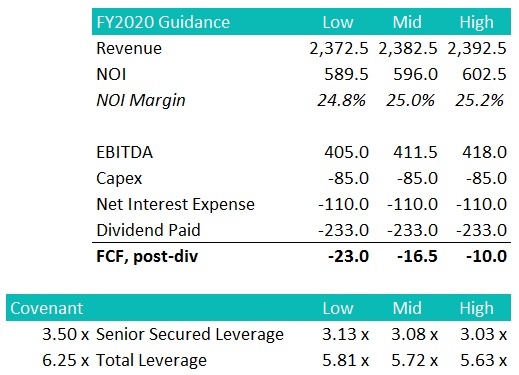

- GEO is guiding negative FCF after paying dividend in FY2020.

- GEO's leverage ratio is running against its covenant at FY2020 guidance.

- The cost of debt is higher in the ESG-focused world.

- Redirecting capital to deleveraging and stock buyback is a better use of capital.

Free Cash Flow & Debt Covenants

GEO's dividend is not as defensible as other SA authors have indicated. A simple calculation based on the management guidance shows that the company will generate negative FCF after paying dividends in FY2020. Even at the high-end of the guidance, GEO is still drawing ~$10 million on its credit facility to pay the dividend. Also at the high-end of the guidance, the senior secured leverage and total leverage is about ~0.5x away from tripping over the covenants.

However, I understand that the management is being conservative with the guidance and if things normalize in 2H2020, the cash burn could be avoided.

Source: 10-K, Company Presentation

Implied Cost of Debt is Higher

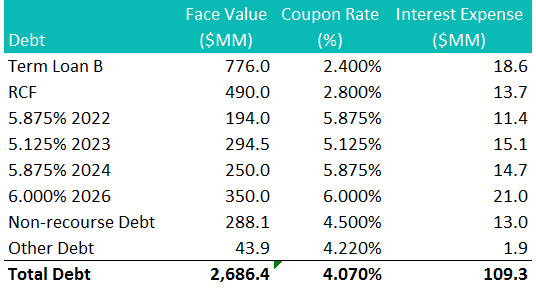

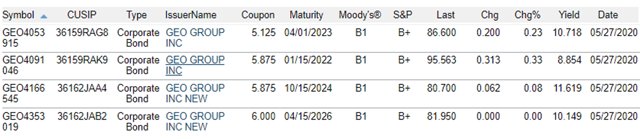

The YTM of the bond can be interpreted as the coupon rate required by the market on a refinancing. Roughly speaking, the cost of debt should be closer to 10% than to the 5-6% coupon on the outstanding senior notes.

This is not surprising given the investment community is increasingly focused on ESG factors and GEO (whether justifiable or not) requires to provided an "ESG premium" to attract capital.

Consequently, GEO's longer-term free cash flow generation ability is reduced as any subsequent refinancing will likely come at a higher coupon rate.

Source: TRACE

In addition, close to 50% of GEO long-term debt is consisted of revolving credit facilities and senior secured term loan, with cost of debt below 3%. With numerous financial institutions that publicly cut ties with their private prison customers, GEO might have to look for alternative financing sources to replace the credit facilities, which in my opinion will come at a higher cost.

Capital Allocation

There's nothing wrong in of itself with paying out 15% of its current market cap a year in cash (i.e. GEO's dividend yield is ~15%), but the management should always debate on what's the best use of capital. It's likely that the dividend is supporting the stock price for the moment (and a dividend cut could push the stock lower), I think in addition to funding growth projects, GEO should instead use its free cash flow to aggressive deleverage to better position itself for the new ESG-focused world, or aggressively buy back stocks, or the combination of the two.

Deleveraging - GEO's contractual business model certainly supports a reasonable level of debt, however with COVID-19 and an upcoming US election, it's impossible to predict what the macroeconomic and political environment are going to be for GEO. But we know the senior notes are trading at a $5-15 discount to par in the market and GEO is not being aggressive enough taking advantage of the discount (to be fair, GEO has been buying back bonds in the market). Simply put, why gamble with the company's future when you can de-risk the balance sheet and reduce bankruptcy probabilities, while generating ~10% IRR on the capital?

Share Buyback - if the management is confident in the business to keep paying the dividend, which implies the management isn't concerned about any liquidity issue, then buying back the share at the current level is a much better use of cash, all else equal - shrinking the share count means shareholders own more of the company, and its ~15% IRR venture. Given the retail-oriented investor base in the equity, the stock is very likely to trade down aggressively if the dividend was cut, and the management should take advantage of the initial selloff.

Conclusion

To be clear, I'm bullish on GEO's longer-term prospect and I don't think there is any imminent risk with their balance sheet. However, I believe the market is presenting the company with an opportunity to make some drastic change to its capital allocation policy and improve shareholders' long-term, overall, risk-adjusted return.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in GEO over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.