Broadwind Has Towering Potential And A Not So Towering Valuation

by Steve ZachritzSummary

- Broadwind's 1Q20 report was stronger than expected.

- In the wake of the quarterly call we spoke with the company to address a few additional questions we had. We came away more confident in the story.

- Our view is that the 2020/21 "outlook" remains robust despite suspension of formal guidance due to Covid-19.

This is a Z4 Research quick update. We spent a little time on the phone with management in the wake of the 1Q20 call. Note that these are our perceptions of the story at present and our comments are not necessarily endorsed by management. Please also see:

- Our initial piece for Seeking Alpha on Broadwind was here.

- And our coverage of the strong 1Q20 results here.

Guidance for 2020 was suspended but our sense is it's still achievable. Were it not for Covid-19 uncertainties, with more tower capacity in hand for the year, earlier in the year, our sense is that management would have very likely reiterated at least the low end of full year guidance with the quarterly release. Tower demand is intact and strong. The supply chain has, so far, not been greatly impacted. At this point they think they are good through 3Q20 on components for their orders which we view as positive and their customers are working with them where possible to keep fabrication on schedule. Management also noted that despite their confidence in their original view it would be a little awkward to have maintained guidance while many in the wind space including some of their customers have suspended guidance due to Covid-19.

They now build towers for 3 of the top 4 U.S. wind turbine OEMs ... Siemens-Gamesa is #1, Nordex is #2 (they will deliver orders including some really tall 5 section towers here in the second and third quarters), and a new customer, for which they announced a $5 mm order announced with the quarterly release. Vestas and GE round out the big four and we note that VWDRY has their own tower facility in Colorado but we don't know who customer #3 is for certain. Broadwind sees the potential for additional orders this year and next from all three OEMs. For 2020, their tower manufacturing capacity is expected to be filled out towards their optimal level (about 80% of their nameplate capacity of 1,650 sections) in the next few months. In our view this lends a lot of confidence in the lower end of the original revenue guidance for 2020.

... and new orders are being scheduled slightly sooner than usual. Normally Broadwind has orders in hand 4 to 5 months ahead of revenues. That cycle appears to be lengthening (in a positive way) with OEMs booking towers earlier than usual perhaps to ensure turbine makers have their towers when they need them during these Covid-19 influenced times. We know that part of the recent $19 mm order announced before 1Q20 is for 2021 and we expect to begin to see 2021 order flow over the summer months of 2020.

Tower size is growing and pricing remains robust. We are likely to see higher implied average selling prices for towers this year and potentially next due to larger towers in the mix and high demand. In the past we've assumed a 3.25 section average per tower with mostly 3 and some 4 section towers. In 2020 the number of 4 and in some cases 5 section super tall towers in the mix is higher. In our view, pricing should also aided by the under-domestically-supplied nature of the U.S. market (about 9 GW of annual tower capacity relative to almost 14 GW of demand in 2020 and 2021).

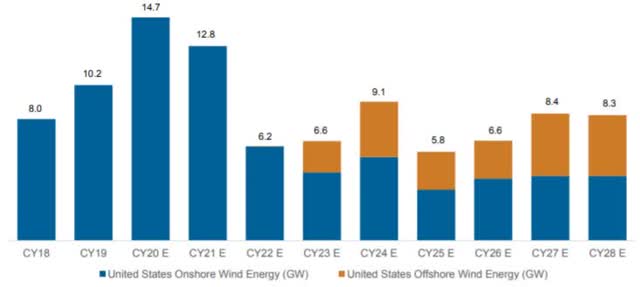

Source: Wood MacKenzie 1Q20 Wind Sector Outlook

Meanwhile, as we look further into the future, the idea of becoming an offshore tower supplier remains front burner.

- Take another look at the chart above and note that orange wedge beginning in 2023. While U.S. wind is set to see stable but smaller additions for the next several years the wind industry anticipates faster growth in the U.S. offshore market.

- Our view is that management is increasingly serious about expanding into the offshore tower market potentially via a greenfield facility on the east coast. An east coast facility could provide a cost effective solution for OEMs looking to capitalize on this new growth and would be aligned with Broadwind's core competencies. And the players involved are their current customers.

- This would not be a small deal for them and we'd like to see a majority equity weighted mix on funding (along with other possible local incentives) which would take care of some of the thin trader status the name currently labors under while avoiding balance sheet stress. We see this as a potential game changer for the company as it keeps them front and center in the upcoming U.S. wind trend.

- Also we note that Siemens Gamesa (OTCPK:GCTAF), their largest tower customer, just announced what will be the world's largest turbine (onshore or offshore) at 14 MW. Given the strong, long term ties between Siemens Gamesa and Broadwind it would be only natural for Broadwind to be in the running for a portion of that future market.

- We know they are checking out the tower specs now on offshore designs and we would expect to see a go/no go decision regarding expansion into the offshore tower market within 12 months. This should give allow for permitting, funding, and construction with an eye on a mid 2022 on line date.

- Alternatively, the company could, with less capital, serve the offshore market via their Manitowoc, Wisconsin fabrication facility. The site has deepwater access that could transport towers to the east coast via the Saint Lawrence Seaway and would require more modest upgrades for manipulating and moving the heavier sections. While this option could serve as an interim step our view is that it would be a half measure and ultimately less desirable. Go big or stick with the onshore market.

A few other items:

- The cranes business should provide a stable portion of non wind revenue for the next several years. We just wanted to clarify prior Z4 comments. Last year we noted orders from their customer Konacranes for the U.S. Navy. There were little if any revenues for this in 2019 but for the next approximately five years Broadwind expects orders in the $5 to $7 mm per year range for parts for heavy lift cranes used at naval facilities related to submarine operations.

- The name sports a solid balance sheet with more than adequate liquidity ($28 mm vs capex that should be around $5 mm) for their 2020 needs.

Nutshell: Broadwind trades at just 3x 2020 estimated EBITDA.

- We see the name as inadequately discounting near term strong onshore wind and other heavy fabrication (crane business) demand.

- We see valuation of the name as having largely ignored the recent diversification of their tower customer base and the safety and opportunity this diversification provides.

- We see new protections from tower dumping, previously discussed in basic piece linked above as bearing fruit now but again, largely ignored in this valuation.

- Furthermore, we see the valuation as completely ignoring the potential for a new growth avenue via the offshore wind market (this is more understandable given that they haven't made the leap yet), but also provides upside as this is something Wood MacKenzie sees as very much on the medium term horizon and the future growth of U.S. wind.

- We think the company labors under a micro cap moniker within the industrial space and that it lacks sufficient sellside coverage.

- We don't think the market yet has confidence in 2021 but will gain confidence as orders arrive earlier for next year than is customary.

- These are ALL issues we see as being addressed by Broadwind. As the name gains more exposure as a renewables/green player our sense is that the potential for EBITDA multiple expansion to a 4x or 5x metric driving a 12 month upside potential target of $3.50 (splitting the mid) is achievable.

Disclosure: I am/we are long BWEN, VWDRY, GE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.