Target: Discount Unjustified

by Gainsboro CapitalSummary

- Target recently reported Q1 numbers, posting strong sales growth coupled with compressed margins.

- Following the report, we believe the company remains well-positioned going forward - we are optimistic about like Shipt, which we believe is underappreciated.

- We see opportunity in the company's shares, with upside over 40%.

The recent outbreak of COVID-19 has forced the shutdown of many businesses nationwide. For many brick-and-mortar retailers this proved to be a deadly blow. In the past several weeks, retail icons J.Crew, Neiman Marcus, and JCPenney have all filed for bankruptcy protection. However, some essential businesses have been experiencing strong demand.

Source: Target

Target lies under this umbrella, selling a wide range of goods including groceries. Stores have remained open and the company quickly adapted to operate under COVID-related rules (e.g., distancing, capacity). The company recently reported their Q1 earnings, delivering robust top-line results much like many would have expected – however, this came alongside increased costs which dampened profitability. Despite this, we continue to be optimistic and expect margins to recover going forward. In addition, we believe the current situation may provide an opportunity for the retailer to increase market share by leveraging their subsidiaries like Shipt.

Q1, in Review

Sales in the quarter reached $19.4 billion, increasing ~11.3% year-over-year. Same-store sales grew by 10.8%, comprised heavily by digital sales. As stay-at-home regulations were implemented throughout the country, consumers found themselves shopping less frequently. Management highlighted this trend noting that although shopping trips dropped, average basket sizes grew by 12.%. What was impressive in the quarter was just how strong the company’s digital presence is – by April, digital comparable sales were up 282%.

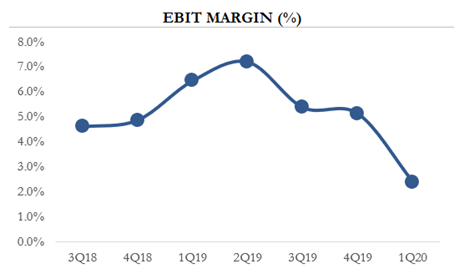

Of course, increased sales do not always translate into increased profits. Throughout the quarter, an increased cost structure dampened profitability with operating margins ultimately being sliced in half. As consumers flocked to purchase basic necessities – which produce lower margins – average margins pulled back. Other key drivers included digital and supply chain costs and costs related to labor (wages & benefits).

As states move to slowly reopen their economies, there will certainly be industries that struggle to return to full capacity – entertainment and hospitality will likely see a longer road to recovery than other industries. We believe Target is well-positioned to continue experiencing healthy sales levels. Additionally, we see the opportunity for Target to ramp up market share which we don’t see being relinquished going forward.

Through their subsidiaries like Shipt – which serves as a platform for other retailers as well – they were able to competitively service increased demand. Even in a situation where peers play catch-up with delivery, Target can benefit.

Valuation Commentary

With these factors at play, we don’t expect any meaningful revenue contractions below pre-COVID levels. Additionally, we don’t believe the recent increased cost structure is here to stay and we expect to return to pre-COVID operating margins sooner than expected. Following this pandemic, we believe it's possible for the retailer to emerge with a higher share of the market and a better-positioned delivery platform.

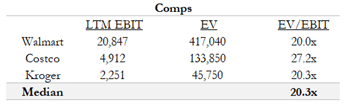

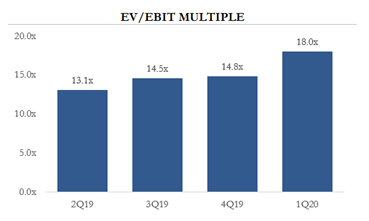

At a quick glance, we can see that out of other larger retailers and grocery stores, the company is being valued at a discount. We feel the market is overplaying cost pressures and has significant opportunities other retailers do not. When looking at public comparables, the median EV/EBIT multiple sits at ~20x.

Today, Target trades at ~18x EBIT – this is higher than usual, largely due to margin compression. Over the past several quarters, the firm’s valuation has typically ranged between 13-14x EBIT.

Takeaway

We don’t expect sales to fully recede – additionally, we expect operating margins to recuperate to pre-COVID levels of ~6% largely driven by reduced labor costs and supply chain improvements. We believe the business’ discount to peers is overstated, and although some retailers like Costco and Walmart boast immense advantages, we see Target as a business that is just as well-positioned (and has evidently seen share gains).

Applying the median peer multiple of ~20x EV/EBIT on our FY21 EBIT estimate we arrive at a price target of ~$170 implying upside of just over 40%.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.