Charter's Q1 2020: Gushing Cash After Integrating TWC

by Greg WajdaSummary

- With 2 large acquisitions almost integrated, capex is falling and FCF is up.

- The internet segment is the key driver, but a slowdown in fleeing TV and voice customers is a nice boost.

- The valuation remains extremely high with the stock recovering all of its March losses.

Introduction

In these tough times, cable operators seem like a safe bet on the surface. The argument might be as simple as the fact that they are monopolized providers of internet and related services in most areas, and today, we are relying on the internet more than ever before.

The reality is a bit more complicated, as it often is. Today, let's look at Charter Communication's (CHTR) Q1 and future as the second-largest titan in this industry.

Q1 2020

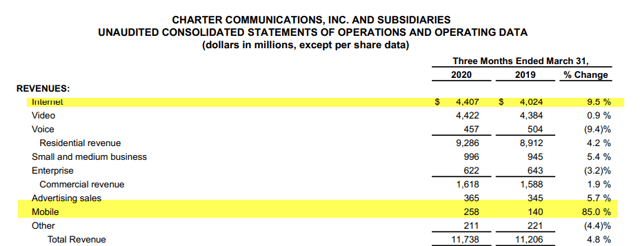

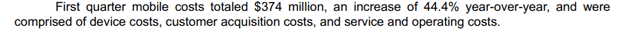

In Q1, Charter continued the trend of gaining residential customers for internet service but losing them in voice and video. The good news is that the pace of losses slowed compared to Q1 2019.

Source: Q1 2020 Earnings Release

Their fastest-growing line of business is their recently launched mobile product. This is, however, due to it starting at such a small base and still pales in comparison to their main 3 segments. Revenue from that segment grew 85% to $285 million.

Source: Q1 2020 Earnings Release

Ever since they launched their mobile offering, I was never quite sure what the value proposition was. They do not own the spectrum or maintain the network (other than some small experimental licenses), so are they just acting as customer acquirers for Verizon (NYSE:VZ) and maybe you might get lucky and benefit from a Spectrum WiFi hotspot somewhere?

It seems even more strange given that we are all at home which somewhat negates the selling point of connecting to Verizon network via WiFi technology while outside your house, which I am not sure is any better than 4G or 5G. I see the value here as one of cross selling and bundling which cable companies have loved doing for decades now with their triple plays. This might also be an interesting segment when 5G becomes more widespread in a few years.

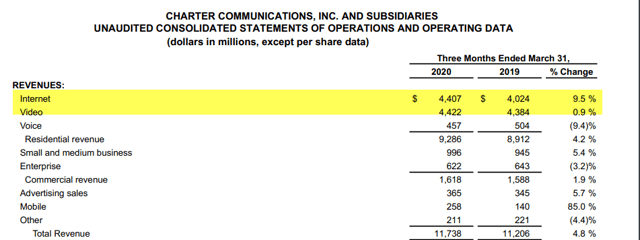

However, it is also unprofitable at the moment, with $374 million in identifiable operating costs related to the mobile division. It will be interesting to see in a year if this segment can start to break even or if it lacks operating leverage due to its structure. It is also hard to tell if the costs are understated due to the segment utilizing many of the larger companies accounting and other resources that maybe not included.

Source: Q1 2020 Earnings Release

Ultimately, the internet is the main course here. And the company continues to perform well in that segment. It is likely that it will overtake video as the top revenue driver in 2020, given that they are both about $4.4 billion per quarter and growing in opposite directions.

Source: Q1 2020 Earnings Release

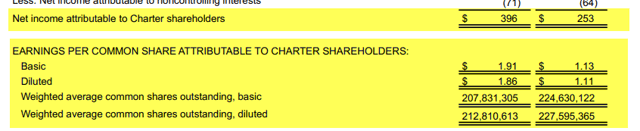

Going further down the income statement, operating income was $400m higher than Q1 2019. After a $300m loss on financial instruments and some other small items, net income was ~100m higher than Q1 2019.

Diluted EPS came in at $1.86 and the share count was well down this quarter, with over $2.3 billion spent on buybacks to make it happen.

Source: Q1 2020 Earnings Release

I really like the confidence to continue buybacks in the midst of a global pandemic. Or at least if they were earlier in the quarter, I didn't see an announcement that they would stop like a majority of the companies out there.

Almost any Q1 metric you look at is very strong for Charter. There are few sectors that are unaffected by the pandemic and the utility like cable operators appear to be doing just fine.

Looking Forward

Looking forward, I see a decline in Charter's business revenue for the rest of 2019. As small businesses struggle to reopen or don't reopen at all, they are likely to lose a lot of customers in their commercial segment.

The rest of the business seems to be relatively secure, though, but I would venture that video's slow decline would continue. While more customers may be at home which could lead to video ads, streaming continues to proliferate and is clearly the trend. Pandemic or not, I see video declining past internet in revenue sometime this year.

Mobile is a tough one. I am not sure if demand drops for this segment in this situation. With over a million customers already, maybe the easy cross-sells are gone and customer acquisition costs rise for this business in the short term.

The company does get a small "other revenue" boost from its various dabbling in LA sports such as the Dodgers and Lakers televised games. That should see some headwinds this year but are likely not material to their overall results.

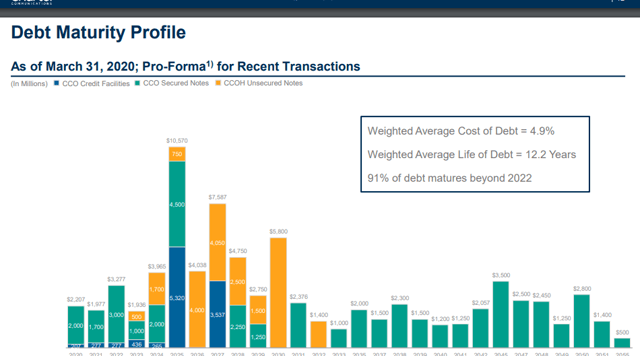

Liquidity and solvency wise, the company does not face any concerns. They do have a very large debt load in the absolute and also a capital structure heavily weighted towards debt. 75% of their capital structure is debt and only 25% equity.

This is one of those things that is not uncommon in the industry and doesn't matter until business performance starts to suffer. Since it is clear the pandemic has little effect so far, I think the balance sheet is OK, but not great. Increased shareholder returns are likely to come from FCF mainly go forward, without a boost from new debt issuance.

Debt maturities are being managed effectively with 91% of debt not due until 2022 or later.

Source: Q1 2020 Investor Presentation

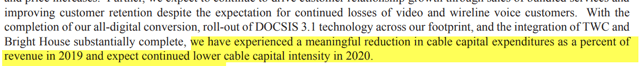

It has been almost 3 years since the company made two large acquisitions of Brighthouse and TWC, and the company now expects capital expenditures related to those acquisitions to fall from here on out.

Given that the company's network has clearly performed fine under added stress from a stay at home orders and no need to maintain a mobile network, this should be an almost direct benefit to free cash flow which can be redeployed for shareholder returns.

Source: 2019 Annual Report

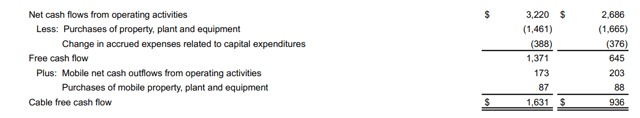

Free cash flow was up 100% in Q1 and 2019's full-year free cash flow was also up 100% to $4.6 billion and capex was down $2 billion versus 2018. I expect 2020's free cash flow to increase to over $5 billion as capex continues to drop.

Source: Q1 2020 Financial Addendum

Valuation

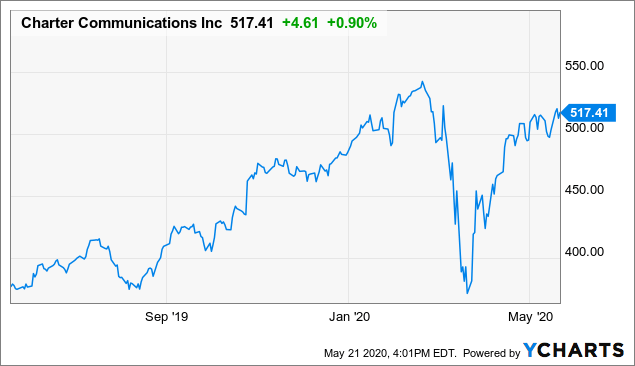

Extrapolating out Q1, we get an estimate of 2020 full-year EPS of $7.44. The stock trades at $517 or a forward P/E of 69. The stock price has recovered to just below where it was in February as investors have realized the company is largely unaffected and still posting stellar results.

Data by YCharts

One could argue that with over $2.5 billion in depreciation and amortization, the company's free cash flow and actual cash generation is far higher than its net income would let on. FCF per share divided by the current price would be somewhere around 27x, which is closer to reality but still pricey.

I think that given the company is growing faster than one might expect from a utility like company and considering the fact that it may deserve a solvency and stability premium, it is still too expensive anyway I look at the numbers at its current price.

At its March lows of $371, I could make that valuation work. That would only be a free cash flow yield of 20x, which sounds more reasonable.

Conclusion

Even with 2 of its 3 main business lines in a slow downward trend, it is clear that Charter is living its best post-acquisition integration life. The company is now beginning to gush cash flow at a record pace and its spending the majority of it on buybacks.

Its pandemic-related results are absolutely stellar and its mobile division is showing impressive early penetration even if it is not profitable yet or clear if it ever will be.

Valuation is the only thing holding me back at the moment, so I rate Charter as one to add to your watch list for a more attractive entry point but not a buy at this time.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.