B2W - Gain Exposure To The Brazilian Online Retail Sector

by James CherrySummary

- Brazilian e-commerce has been growing at 11.1% for the past two years and is projected to grow by 5.5% for the next three years without considering the effects of COVID.

- B2W's total GMV market share grew at an average of 1.6% over the past two years.

- My target price for BTOOY is $44.85 at a BRL rate of 5.5338 using B2W's 2024 projected net revenue.

I have been a shareholder of B2W - Companhia Digital (OTCPK:BTOOY) indirectly since 2018. When most people hear indirectly, they tend to think via an index investment. In this case, my stake in the company is through my investment in Lojas Americanas (LAME3.SA), which owns over sixty percent of the company. This way, I get exposure to B2W without the high volatility that comes with it. The parent company of B2W, LASA, has an operations strategy that is better known as the brick-and-mortar strategy. Unfortunately, my strategy is not possible for the average US-based investor.

Here is a quick overview of B2W and its operations in Brazil for those who have not been tracking the company. BTOOY's online sales platforms are Americanas.com, Submarino, shoptime, and Sou Barato (online outlet). B2W and Lojas Americanas own a fintech called AME, which is a payment app similar to Google Pay and PayPal. Recently, the company purchased an online supermarket that gives its members access to the products of several smaller supermarket chains in Sao Paulo.

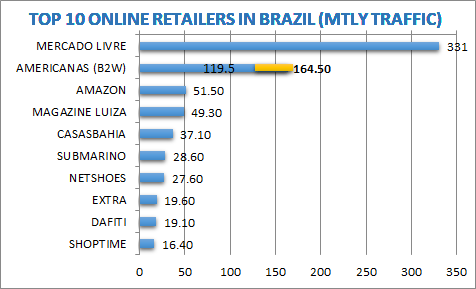

Source: Disfold Top e-commerce sites in Brazil and own estimates

As seen in the above chart, B2W's total monthly traffic (visits) is 164.5 million, which is the sum of Americanas, Submarino, and Shoptime. Mercado Livre (MercadoLibre (NASDAQ:MELI)) has almost double the number of visits as Americanas in Brazil. Amazon (NASDAQ:AMZN) and Magazine Luiza have less than half the traffic as Americanas.

E-Commerce Market Forecasts

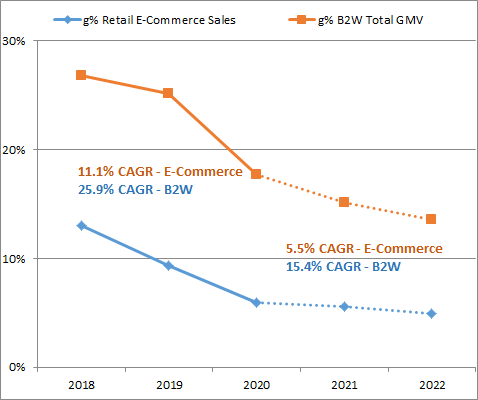

Source: Statista, B2W Company Financials, and own estimates

According to Statista, e-commerce in Brazil should reach $32.5 billion by 2022. During the past two years, e-commerce has grown by 11.1% on average per year, while B2W's growth was 25.9%. For the past two years, B2W's market share of the total Brazilian e-commerce has increased by 1.6%.

The issue with this study is that it was published on the 11th of March, which is before most countries started with the stay-at-home order. I do not believe that this means the Brazilian e-commerce market will be smaller than these estimates; on the contrary, I think it will be more substantial now. B2W's 1Q20 earnings stated that their operations were showing signs of growth demonstrated by a 32.3% increase in y-o-y net revenue.

B2W's SWOT

A full-blown SWOT analysis on B2W would take several days to produce, and its results would pollute this analysis with unnecessary information. I have reduced this SWOT to focus on a couple of main points.

Source: Reclame Aqui

You do not need to know Portuguese to understand the ratings in the above slide. Correios (the Brazilian postal service) has a 3.6 out of ten customer rating score. On MercadoLibre, I ordered a product from Sao Paulo, and it was delivered to me on the 21st of May. The retailer shipped it on the 5th of May, and I was informed by MELI's system that I would receive my package no later than the 18th of May, which I believe is still a long wait time. Either way, Mercado Livre was three days late on my delivery due to the postal service. Mercado Livre has a bad rating, in my opinion, because it relies almost exclusively on the Brazilian postal service.

In my opinion, the number of online purchases made every year is limited by the number of customers who are willing to wait a couple of weeks for a product to arrive at their home.

Strengths:

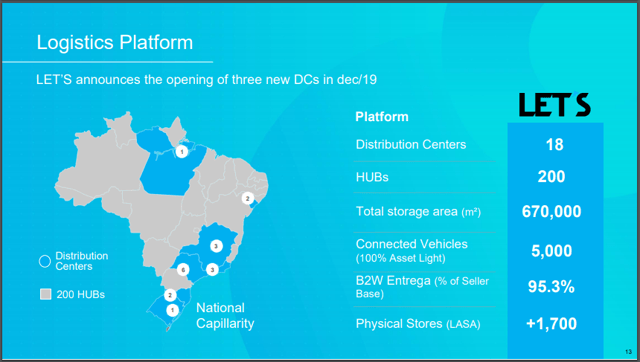

Source: B2W's 2018 Annual Report

- It has invested heavily on technology to improve the speed of deliveries in Brazil. Depending on the location, a bike messenger, a motorcycle messenger, or the company's logistics (including third parties) team could deliver the package to a customer. The company acquired a small company that created an app similar to Uber EATS but focuses on delivering retail sales.

- O2O - Over 8,000 connected points in Brazil (Americanas, sellers' stores, and partner points) with delivery time options, depending on the product and customer location, from 1 hour to 2 hours to 2 days.

- B2W acquired an online supermarket company based in Sao Paulo called Supermercado Now. This online supermarket is capable of getting food from its 3P sellers to its customers in less than 2 hours, according to its website.

Weaknesses:

- B2W is essentially Lojas Americanas' online selling platform. Small retail sellers may be unwilling to join its marketplace due to the difficulty of competing against a Lojas Americanas. Example: I bought my cellphone from Americanas.com, and during my search, I found several 3P sellers selling the same phone, but their price was higher than that of Lojas Americanas. Since Lojas Americanas is a larger store, they have more bargaining power with their suppliers than a smaller retailer would have.

Opportunities:

- Increase in online sales due to COVID-19 and a possible permanent change in consumer habits to prefer shopping online.E-commerce has been growing at 11.1% for the past two years and is projected to grow by 5.5% for the next three years without considering the effects of COVID-19.

- Competitors that rely on the Brazilian post office for their deliveries, I believe, will lose their market share due to perceived poor services. MercadoLibre has many complaints due to late deliveries and, in my opinion, a majority of these deliveries are delayed due to the post office. Amazon also utilizes the Brazilian postal services for its deliveries.

Threats:

- After the stay-at-home orders are lifted, consumers may flock to locations other than their homes to "spread their wings." This could reduce online sales demand in the short term.

- Partnerships with connection points are easily obtainable and can be lost as quickly as they were obtained. Competitors might partner with other connection points that are equally as large as BR Distribuidora, like Ipiranga, for example.

- The online sales market is highly competitive and has a very low barrier to entry. Two of the top ten online retailers in Brazil are international players with lots of cash available to invest. Opening a marketplace could be done in a garage as history has taught us.

B2W Forecasts

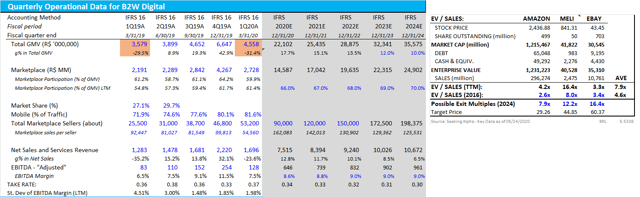

Source: Company's financials, Seeking Alpha Financial Data, and own estimates

B2W's total GMV market share grew at an average of 1.6% over the past two years. My forecasts consider that they will increase their market share by 1.6% again this year and by 1.5% in the next two years. In 2023, I project that the company will reach its goal of doubling total GMV to 32 million reais, which is a year later than the company's guidance.

B2W's take rate has been steadily decreasing every year. I project that their take rate will continue to fall until it reaches the right mix of around 0.30 in 2024. My approach to estimate their future take rate is based upon the average sales per active marketplace seller, which has been decreasing as the company adds new active sellers. By 2024, I believe that the average marketplace seller will sell R$125,531 per year.

Based upon the above assumption, in 2024, the company's net revenue should be R$10.7 billion.

I decided to use exit multiples to find the fair value of B2W. I picked Amazon, MercardoLibre (Mercado Livre in Brazil), and eBay (NASDAQ:EBAY) as its peers. B2W makes strategic moves similar to Amazon. Mercado Livre and eBay are both peers similar to where B2W was a couple of years ago. I used sales as the comparison factor because sales recognition methods are more comparable between US GAAP and IFRS than EBITDA (especially the very subjective adjusted EBITDA). FYI, the SEC and the CVM (Brazilian SEC) both have their own guidance on adjusted EBITDA, making it a less reliable comparison.

Conclusion

I have three exit multiple scenarios for BTOOY. The first is the current average peer EV/Sales multiple of 7.9x, and the second is MELI's EV/Sales multiple of 16.4x. In my opinion, MELI is currently overvalued and feel that a more appropriate exit multiple for B2W would be the average between the current and 2016 multiple. My target price for BTOOY is $44.85 at a BRL rate of 5.5338 using B2W's 2024 projected net revenue.

I believe the risks of this investment are covered well in the SWOT analysis. Besides those risks, investors in BTOOY are exposed to high FX risk, political risks, and liquidity risks (B2W's ADRs are only traded OTC).

Please follow me via Seeking Alpha for analysis of Brazilian and Food Industry Stocks.

Disclosure: I am/we are long BTOOY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.