Retail Opportunity Investments Is Stronger Than It Looks

by Dane BowlerSummary

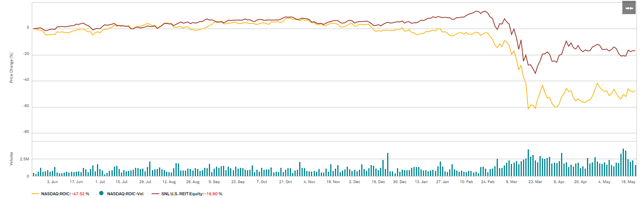

- ROIC has fallen dramatically on news of weak rent collection.

- Our analysis suggests the low percent of rent collected was more related to moratoriums in ROIC's areas rather than underlying weakness of the tenants.

- As such, we believe the recovery will be far stronger than indicated by the market price.

Retail Opportunity Investments (ROIC) has taken quite a beating in terms of market price, dropping 47% on the year compared to 16.9% for the REIT index.

Source: SNL Financial

This article will dig into fundamentals to see if such a drop is warranted or if it represents opportunity. We believe it is the latter.

Why it fell so hard

Retail REITs fell more than just about everything else, and in addition to being a retail REIT, ROIC had some ugly rent collection with just 67.5% of its April rent successfully collected. So, ROIC is in a troubled sector and its revenue drop was among the worst of the non-malls. Add on top of this ROIC’s dividend suspension and it is not hard to see why it fell so much. That seems like a cut and dry case for fundamental hardship.

However, there are some unique things going on that I think are being overlooked. We believe the awful April collection rate has little to do with fundamentals and is almost entirely the result of an interaction between ROIC’s geographic exposure and local political decisions.

Let us first discuss the political impact (note that we are explicitly non-partisan) and follow with a look at the fundamental outlook.

Rent Moratoriums

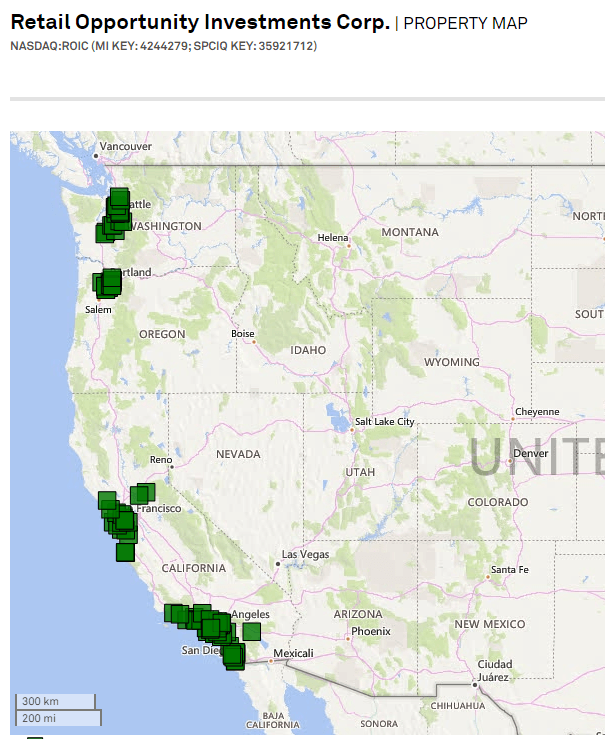

ROIC has a very concentrated geographic footprint in select west coast MSAs.

Source: SNL financial

These particular MSAs are generally great submarkets for commercial real estate as they offer both population density and relatively high household incomes. Historically, these areas have outperformed for most types of real estate, including shopping centers.

These areas also share a similar political viewpoint (generally speaking) which at this particular point in time favors tenants over landlords. I have no opinions on whether this is good or bad, but as a financial analyst, I must discuss the impact it has on real estate.

Most of the west coast has put in place moratoriums that restrict a landlord’s right to evict during this crisis, thereby giving tenants the green light to not pay rent. These moratoriums even allow financially healthy tenants who could easily pay rent to avoid paying during the crisis. The Oregon and California MSA moratoriums are disproportionately hurting ROIC’s rent collection relative to other REITs that are not as concentrated in this area.

Thus, I posit that the weak 67.5% rent collection by ROIC in April is mostly the result of moratoriums and only minimally the result of real fundamental issues. In looking under the hood, fundamentals actually look quite healthy which suggests the sell-off could be a buying opportunity.

Fundamentals

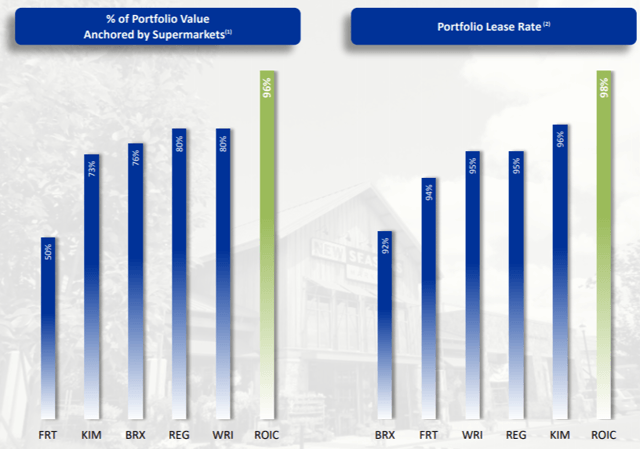

Recall that ROIC’s portfolio is almost entirely grocery anchored and high occupancy.

Source: ROIC

Grocery stores are one of few retailers that is actually benefitting from the crisis. With sit down restaurants largely shut down and QSR restaurants partially shut down, Americans are turning to grocery stores as the primary source of sustenance.

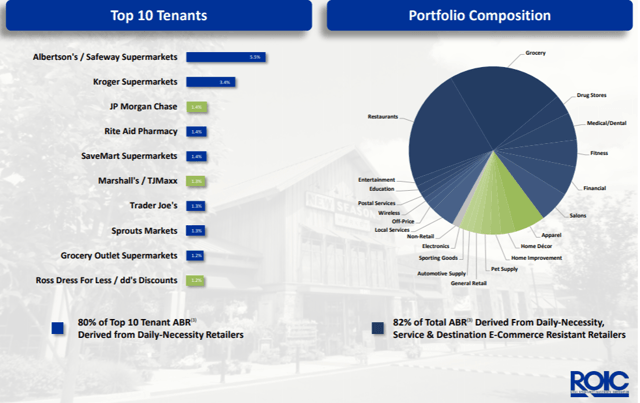

With 96% of shopping centers being anchored by grocers, ROIC’s anchors are doing quite well. The small shops are more of a case-by-case. The breakdown of tenants by industry is below.

There is a bit of an analytical conundrum as the types of tenants that are the best in the normal environment are the ones that are struggling right now.

Is a fitness center a good tenant? It depends on the time frame. Normally, they are a great tenant because fitness is e-commerce proof and the traffic does not compete with other tenants. In fact, fitness tends to bring business for other tenants as people will often grab some food after the gym. However, fitness centers are mostly shut down by COVID restrictions.

Salons and restaurants are in a similar boat - heavily impacted by COVID but otherwise great tenants. Most of ROIC’s tenant roster is well-positioned against e-commerce but not necessarily against COVID.

Grocery stores are the exception as they seem to be well-positioned both now and in a normal environment. So with ROIC being so heavily grocery anchored, I suspect their portfolio is better positioned than most other retail REITs.

Due to a combination of moratoriums and some COVID sensitive tenants, ROIC’s cash flows are likely to continue to be weak during the crisis. That said, they are also positioned to bounce back quite nicely. ROIC is a conservatively run company with 3 factors that should get it through the crisis.

- Prudent dividend

- Reasonable debt service coverage

- Minimal near-term debt

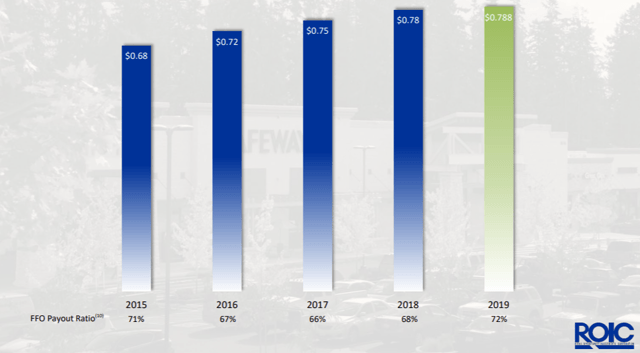

Over the past 5 years, ROIC has raised its dividend, but the payout ratio never exceeded 72%.

This conservatism remains in place today with the prudent suspension.

As of 3/31/20, ROIC had 3.3X recurring EBITDA coverage of interest expense. This is well within the normal range and coverage should remain in place even with the weak rent collection of the next few quarters.

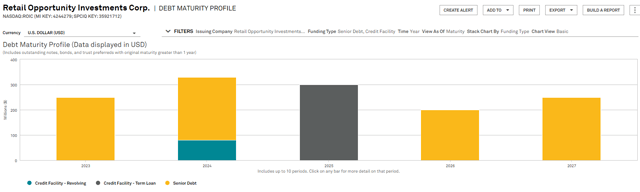

Finally, there is minimal chunky capital needs as the next big debt maturities are 2023 and beyond.

Source: SNL Financial

For these reasons, it seems likely that ROIC will make it through the crisis.

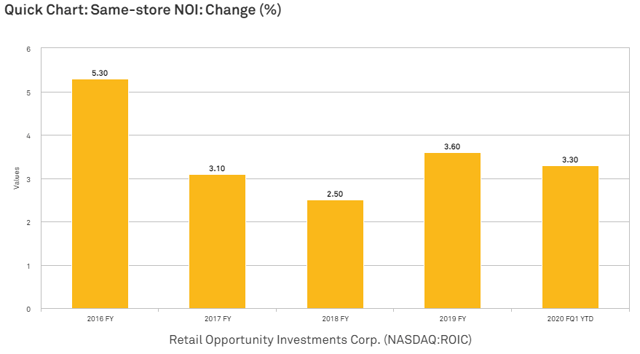

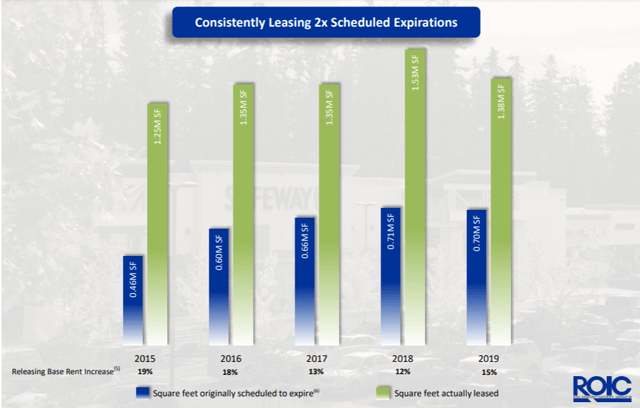

On the other side, the outlook is significantly brighter as ROIC has a track record of consistent rental rate growth and strong occupancy.

Source: SNL Financial

This same-store NOI delta came from both positive net absorption and releasing spreads in the high teens.

Moratorium outlook

I think it is important to note that the government imposed moratoriums do not grant rent forgiveness. That rent is still owed to ROIC and simply deferred. So, to the extent tenants survive and want to re-open after stay-at home orders are lifted, ROIC will eventually get the rent. Most of this rent is likely to be collected in an amortized fashion in late 2020 and 2021.

Valuation

ROIC is one of the stronger shopping center REITs and has historically traded as such. We have not owned ROIC in the past as we felt the valuation was a bit steep, but a 47% price drop changes things.

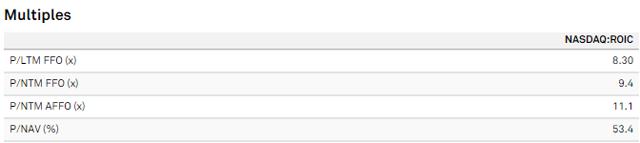

It now trades at a 9.4X forward FFO multiple, 11.1X forward AFFO multiple and just 53% of NAV.

Source: SNL Financial

This high-quality REIT has become a value REIT. Some level of discounting is warranted due to the challenges and risks it will face in the coming months, but the extent of the discount is too much. We view this as mispriced and opportunistic.

Risks

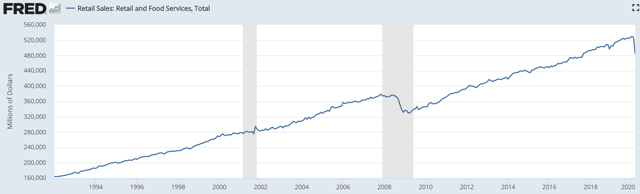

This is one of the most severe crashes of the modern era and the impact to retail is likely to greatly exceed that of the financial crisis. As seen below, the decline to retail sales is already about as large as in 2008-2009.

The million dollar question is what May and June will look like.

Putting it together

ROIC's severe price decline has priced in the weak rent collection as if it is indicative of struggling tenants that may never pay the rent owed. Tenants look reasonably healthy and rent is more likely to simply be deferred as a result of the moratoriums. We see closer to full rent collection on the other side of the crisis as well as a good amount of catch-up rent in 2021. This outlook means the sub-10X multiple is quite opportunistic.

For a full toolkit on building a growing stream of dividend income, please consider joining Retirement Income Solutions. As a member you will get:

- Access to Two Real Money REIT Portfolios

- Real-Time Trade Alerts

- Continuous market commentary

- Data sets on every REIT

You will benefit from our team’s decades of collective experience in REIT investing. On Retirement Income Solutions, we don’t only share our ideas, we also discuss best trading practices and offer members a chance to participate and grow.

We welcome you to test it out with a free 14-day trial. Lock in our founding member rate of $240 before it expires!

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in ROIC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: All articles are published and provided as an information source for investors capable of making their own investment decisions. None of the information offered should be construed to be advice or a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. The information offered is impersonal and not tailored to the investment needs of any specific person.

We cannot determine whether the content of any article or recommendation is appropriate for any specific person. Readers should contact their financial professional to discuss the suitability of any of the strategies or holdings before implementation in their portfolio. Research and information are provided for informational purposes only and are not intended for trading purposes. NEVER make an investment decision based solely on the information provided in our articles.

We may hold, purchase or sell positions in securities mentioned in our articles and will not disclose this information to subscribers, nor the time the positions in the securities were acquired. We may liquidate shares in profiled companies at any time without notice. We may also take positions inconsistent with the information and views expressed on our website.

We routinely own and trade the same securities purchased or sold for advisory clients of 2MCAC. This circumstance is communicated to our clients on an ongoing basis. As fiduciaries, we prioritize our clients’ interests above those of our corporate and personal accounts to avoid conflict and adverse selection in trading these commonly held interests.

Investing in publicly held securities is speculative and involves risk, including the possible loss of principal. Historical returns should not be used as the primary basis for investment decisions.

Commentary may contain forward looking statements which are by definition uncertain. Actual results may differ materially from our forecasts or estimations, and 2MCAC and its affiliates cannot be held liable for the use of and reliance upon the opinions, estimates, forecasts and findings in this article.

Any positive comments made by others should not be construed as an endorsement of the author's abilities to act as an investment advisor.