Beyond Meat: Earning A Meaty Profit

by Genuine ImpactSummary

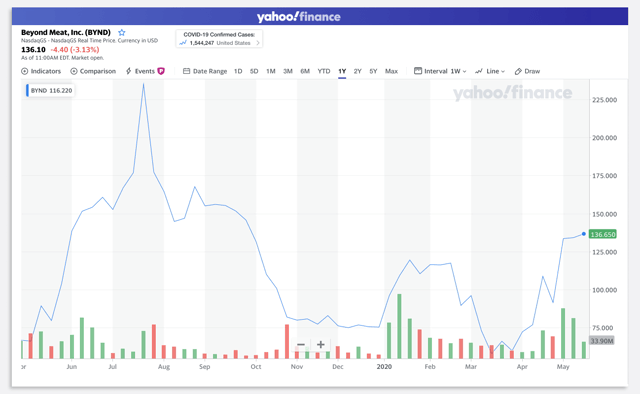

- The higher profit margin for artificial meat is the main catalyst behind BYND's recent rally as its stock price fully recovers from the recent sell-off in March 2020.

- BYND's gross profit margin of nearly 40%, gives the company plenty of room for a future price adjustment when facing growing competition from less profitable fresh meat producers.

- The shortages of fresh meat due to the disruption of supply chains from COVID-19 gives BYND an opportunity to gain shelf space in grocery chains and expand its consumer base.

High profit margins, growing brand, and the current supply shortages in fresh meat due to COVID-19 are all reasons to remain bullish on Beyond Meat (NASDAQ:BYND), as the plant-based meat producer continues to exceed market expectations on its growth progress. Its sky-high valuation relative to its fundamentals (such as revenue and cash generated), maybe a concern for investors seeking value stocks, but the continuous market volatility expected in the coming months should provide attractive entry points for long-term investors.

Source: Image created by author using data from Refinitiv

Since its IPO almost 12 months ago, investors in Beyond Meat have had a roller coaster year in terms of its price performance, as investors and media have chased the buzz caused by the new fashion for "artificial meat". Along with all of the attention and interest, the company's growth over the past year has been steady and frequently exceeds market expectations, as we see the company's market share expanding and losses gradually narrowing. However, despite the obvious progression, Beyond Meat's current valuation of $7.1bn may still seem extremely far-fetched for value investors.

Source: Yahoo Finance

As one of the leading brands in artificial meat production, Beyond Meat has certainly benefited from consumer demand increasingly gravitating towards plant-based protein options. Consumers are seeking to support companies and brands that make a difference towards environmental protection and preservation.

Beyond Meat's expansion strategy involves partnering with various restaurant operators, such as Starbucks (NASDAQ:SBUX), Dunkin Donuts (NASDAQ:DNKN), KFC (NYSE:YUM), and McDonald's (NYSE:MCD). It has quickly elevated its brand on an international scale, which has led to a significant boost for its sales in the grocery and restaurant channels.

Exceeding expectations, again

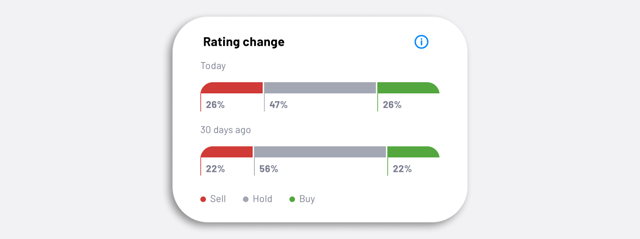

Prior to its Q1 2020 earnings release on 5 May, a number of institutions downgraded their rating for Beyond Meat, due to concerns about the potential adverse impact of COVID-19 on Beyond Meat's operations and strategy.

Source: Image created by author using data from Refinitiv

However, Beyond Meat managed to deliver a positive surprise as its first quarterly report showed that the company had fully turned its losses into profit. The stock price, subsequently, rose more than 26% in a single day.

The company's first-quarter revenue surged 141% year-on-year, with a net profit of $1.8 million, beating the market's expectations for a $4.5 million net loss. This also shows that Beyond Meat's growth has significantly improved, compared to the same period last year, when they generated a net loss of $6.6 million.

This increase in revenue is partly due to a shortage in the supply of fresh meat, caused by effects of the COVID-19 pandemic that engulfed the US and a large part of Europe. In the first quarter, Beyond Meat's revenue from the retail channel increased by 185%, and catering channel revenue rose by almost 100%.

But some people do not expect this disruption of the supply of fresh meat to result in any structural changes in the demand for fresh meat vs. artificial meat. This is because the effect of COVID-19 on the supply chain will be temporary and the traditional meat producers will introduce countermeasures soon, to bring the price of fresh meat back to normal.

More room for manoeuvre

Another fundamental statistic that investors must pay attention to is that when calculated in terms of units, Beyond Meat's profitability has far surpassed that of its major competitors in fresh meat production.

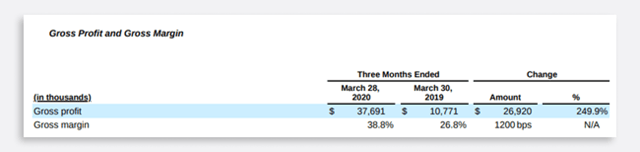

Source: BYND Q12020 report

Source: Image created by author using data from Refinitiv

Source: Tyson Q12020 report

According to their last quarterly report, Beyond Meat's gross profit margin in the first quarter was as high as 38.8%, while Tyson (NYSE:TSN) - the world's leading meat supplier - had a gross profit margin of only around 4.6%. This suggests that the current profitability of Beyond Meat products is almost on par with some large listed technology companies. That provides them with plenty of room for a future price adjustment if required, whereas the same cannot be said about the large fresh meat producers.

Before the COVID-19 outbreak, the average price of Beyond Meat products was higher than that of real meat across all channels. The current supply problems caused by the epidemic have caused the price of real meat to rise significantly and, therefore, narrowed the price gap between the two types of products.

Admittedly, this temporary pricing advantage may not be sustainable, but its superior profit margin means that Beyond Meat can afford to make any necessary pricing adjustments when traditional meat competitors start to become a more aggressive force in the plant-based meat market.

And that competition is coming for sure. Naturally, traditional meat producers will not ignore the lucrative profit margins of artificial meat products and watch their own market share being swallowed. In fact, the likes of Tyson, Kellogg (NYSE:K), and Nestlé (OTCPK:NSRGY) have already set foot in plant-based meat markets, and more competitors are likely to enter this arena in the future.

Final thoughts

Its current valuation will obviously put off many investors, but there is no doubt that there will be more volatility to come over the next few quarters, which will provide good entry points for this stock. Having very little debt and a strong balance sheet also mean that the company faces little solvency risk, which is particularly important in the current economic environment.

Their increasingly ubiquitous brand and a structurally strong business model will serve Beyond Meat well in a post-virus world. They will have to fight for shelf space in the grocery channels such as supermarket chains. While the long-term success of their partnerships with fast food and restaurant chains will, ultimately, depend on whether economies of scale reduce their unit pricing. But it's looking promising so far.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Our comments above only consider historical data and don't take any current daily news and company press releases into consideration. We do not make recommendations or provide investment advice. Individual investors should make their own decisions or seek independent advice.