NewsBTC

Ethereum is Ready For Heavy Volatility, And Analysts Predict a Big Rally

by Nick ChongIt’s been a quiet past few days for Ethereum and the rest of the crypto market.

After last week’s correction, prices have settled. ETH is trading about 10% lower than its May highs, which is about the same performance assets like Bitcoin.

Analysts have begun to bet that second-largest cryptocurrency is primed to see some upside as the technical and fundamental case for the asset has improved.

Related Reading: Crypto Tidbits: Satoshi Isn’t Dumping His BTC, China ‘Bans’ Cryptocurrency Mining

Ethereum Market Volatility Is Coming

The past few days have seen Ethereum contract around $200 to trade within an extremely tight range of 5% to the upside and downside.

One prominent crypto trader illustrated the stagnation in the ETH market with the chart below. The chart shows ETH’s price action tightening to form a textbook symmetrical triangle.

The asset is nearing the triangle formation’s apex, indicating the presence of low volatility.

Further corroborating the presence of low volatility is the Bollinger Band Width indicator, seen at the bottom of the chart above. It shows that the width of the Bollinger Bands is at 0.16 — about 90% lower than that seen after March’s crash and the lowest level since early-February.

The trader who shared the chart above said that these two signs indicate that a “big decision” is to be made by investors soon.

Related Reading: The $90 Million Bitcoin Pizza Story Has an Unexpected Silver Lining

Analysts Bet on ETH Upside

That raises the pressing question: in which way will Ethereum breakout? What “decision” will ETH investors make?

Analysts are currently expecting upside as opposed to downside.

Mythos Capital founder Ryan Sean Adams indicated in a recent edition of his newsletter called “Bankless” that Ethereum is “doubly” undervalued.

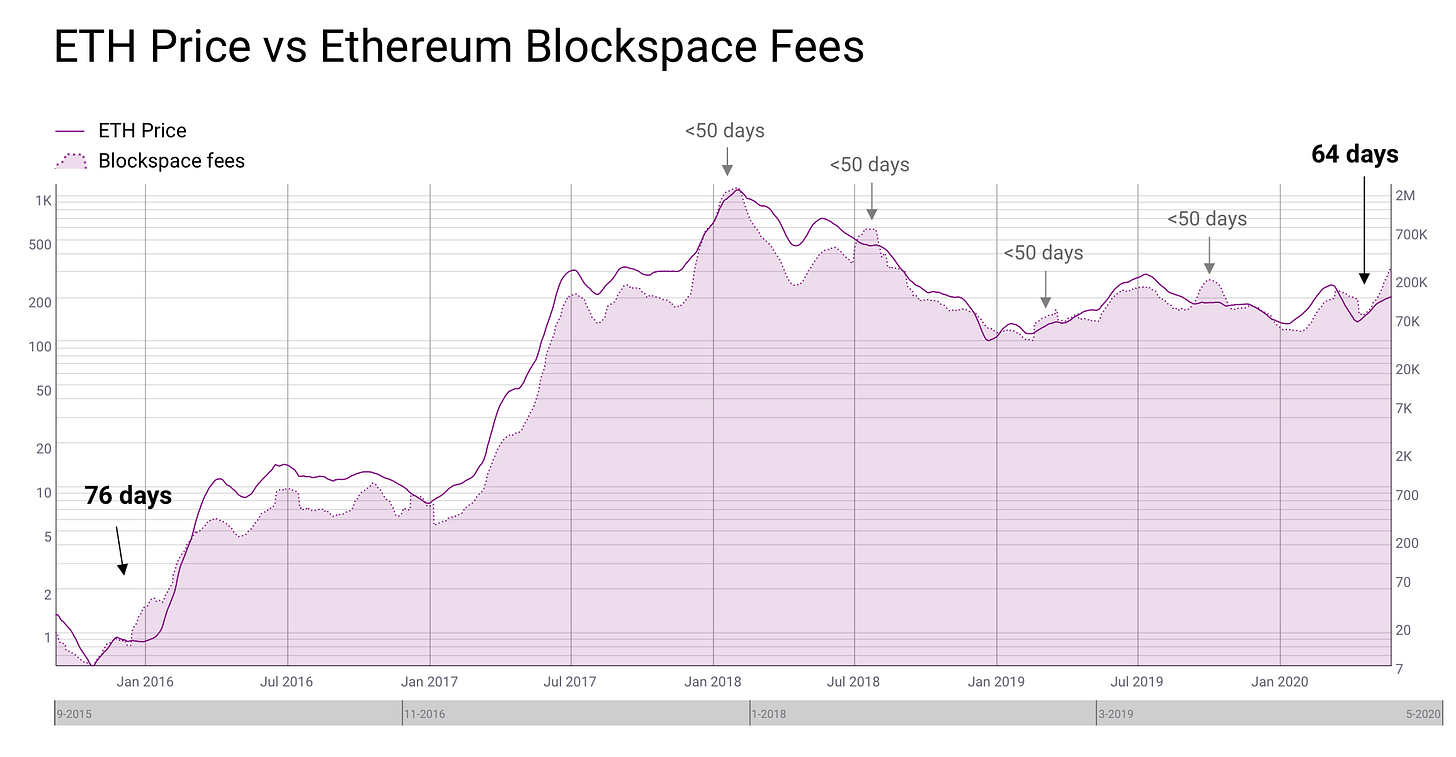

Adams cited the fundamentals of the cryptocurrency, showing that the demand for ETH transactions has skyrocketed over reason weeks. The increase in transaction demand has increased transaction fees, which is suggestive of a higher Ethereum price as can be seen in the image below.

Bitcoin, too, is leaning bullish, boosting the chances Ethereum experiences upside.

As reported by NewsBTC previously, the geopolitical tensions between the U.S. and China have worsened. The U.S. is purportedly considering sanctions as Hong Kong continues to see growing protests over a proposed security law.

Due to the potential sanctions, the Chinese yuan has sunk. The foreign currency is currently trading at its lowest level since September 2019, the peak of the 2019 trade war.

Bitcoin stands to benefit as it can act as a safe-haven.

Chris Burniske, a partner at Placeholder Capital, explained:

“If China’s CNY continues to weaken against USD, then we could have a 2015 and 2016 repeat, where BTC strength coincided with yuan weakness.”

Featured Image from Shutterstock