Nikola Motor: Investing In The Truck Of The Future

by Somint ResearchSummary

- Nikola Motor will compete with the biggest names in trucking, but it won't make a dent to market share until 2024.

- A very strong product line-up means it can compete and potentially take 5-8% share of new truck sales.

- Nikola trucks are expected to be competitive to diesel trucks mainly because they are more productive for truck operators.

- Manufacturing capacity and mass producing the vehicles is the biggest risk to this story.

- At 3.7x 2024 expected revenues, the stock is not cheap, but still presents strong upside.

Before I begin, I would like to thank my friend SE for bringing this stock to my radar.

VectoIQ Acquisition Corporation (VTIQ) will be merging with Nikola Motor sometime within the next couple months. After the merger closes, the ticker symbol will change to NKLA. 1 share of VTIQ stock will convert into 1 share of NKLA stock. Because the merger is highly likely to close, I will refer to the stock as NKLA throughout the article.

This article will discuss Nikola Motor, its business prospects, and whether the stock offers a good investment opportunity. The article will review the trucking industry, Nikola’s product competitiveness, manufacturing challenges, and revenue potential. Lastly, stock valuation will be discussed.

The main point is that at 3.7x expected 2024 revenues, NKLA appears somewhat overpriced as it will take about four years for NKLA to justify its valuation. Nikola has an outstanding product line that will be bring strong competition to the largest truck manufacturers. However, Nikola’s manufacturing capacity is yet to be developed, and there is a high degree of uncertainty regarding Nikola’s truck price. That makes NKLA a high-risk investment.

But if all goes well, my analysis suggests that there is upside as NKLA could be the next $50B company.

Source: Nikola Motor

Nikola is attempting to disrupt the trucking industry by designing and manufacturing fully electric vehicles that are both battery powered and fuel cell powered. Nikola expects to sell and deliver 12,000 class-8 trucks by 2024 (more than 14,000 have been pre-ordered). To put Nikola’s ambitions in perspective, let’s see where Nikola stands within the broader trucking industry.

Trucking Industry Review

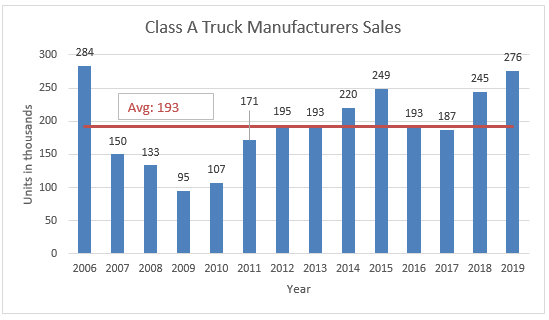

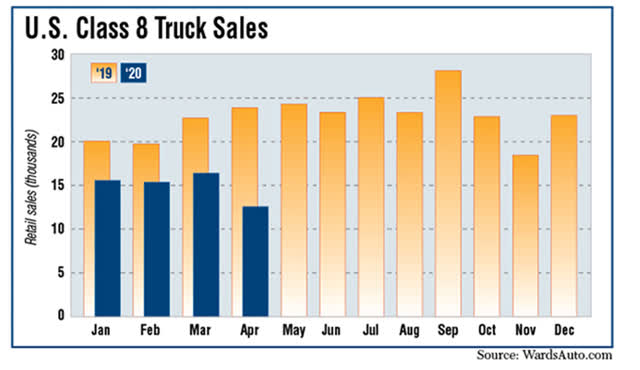

Since 2006, sales of class 8 trucks in the U.S. have ranged from 95,000 to 284,000 per year. On average, manufacturers have sold about 193,000 trucks per year. Last year was a strong year, but this year sales started soft and worsened due to the coronavirus pandemic.

I expect sales will normalize in the 150,000 to 250,000 range after the pandemic ends and economies recover. I estimate that replacement rates for class 8 trucks are probably about 200,000 per year. The following two charts should help visualize the data.

Source: Author with data from TTNews

Source: TT news, WardsAuto.com

In the U.S., market share of class 8 sales is concentrated among 7 brands and 4 companies, which is split approximately as follows:

- Daimler AG (OTCPK:DDAIF) has 36% market share with its dominant Freightliner brand (34% share) and the smaller Western Star (2% share)

- PACCAR (PCAR) has 30% market share with an even split between Peterbilt (15% share) and Kenworth (15% share)

- Volvo (OTCPK:VOLVY) has 18% market share with its flagship Volvo trucks (11% share) and its Mack brand (7% share)

- Navistar (NAV) has 14% market share, which is entirely driven by its International brand

Nikola is attempting to compete with these companies, which are the largest and most recognized manufacturers in the U.S.

By projecting 12,000 unit sales in 2024, Nikola is expecting to grab approximately 5% to 8% share of new truck sales, assuming a normalized market. I find that to be a realistic target because it means Nikola will become a new player in the field. Expecting Nikola to grab this market share seems reasonable.

Of course, a lot has to go right for this to become reality. Nikola trucks will need to prove better than the competition. Can Nikola trucks compete with diesel trucks?

Nikola Trucks vs. Diesel Trucks

Nikola expects to break through the trucking industry and grab market share from the big boys with three main products (pictured below).

Source: Nikola Motor

Counterintuitively, the Nikola TRE will be first to market. The Nikola Two and Nikola One will follow. The Nikola TRE will be a BEV (Battery Electric Vehicle), and the Nikola Two and Nikola One will be FCEV (Fuel Cell Electric Vehicles).

Nikola One, Nikola Two and Nikola TRE are class 8 trucks with 1,000 HP and an expected maximum weight of 20,000 lbs. The weight is important because it eats into hauling capacity, so the more the truck weighs, the lower its hauling capacity, which could impact revenue per truck. Although Nikola trucks appear to be heavier than the typical diesel truck, it is expected to be lighter than battery powered trucks such as the Tesla (TSLA) Semi.

Despite being heavier, it seems the Nikola truck will be a fair competitor to the typical diesel truck because the weight difference is manageable. A typical diesel truck weighs approximately 17,000 to 19,000 lbs. If Nikola manages to produce their trucks at a weight of 20,000 lbs., then its hauling will only be reduced by approximately 1,000 to 3,000 lbs. My industry contact tells me that’s not too much. Such weight differential will not meaningfully change the economics of operating the truck for an owner operator. That’s good for Nikola trucks.

Other key characteristics are expected to favor Nikola trucks, such as 100% fuel cost savings, approximately 60% savings on repair and maintenance, better torque and acceleration, equal refueling/recharging time, and most importantly, zero emissions!

I need to emphasize the last point because it is extremely important. The Nikola trucks are expected to generate zero emission, unlike the diesel trucks which are emission heavy.

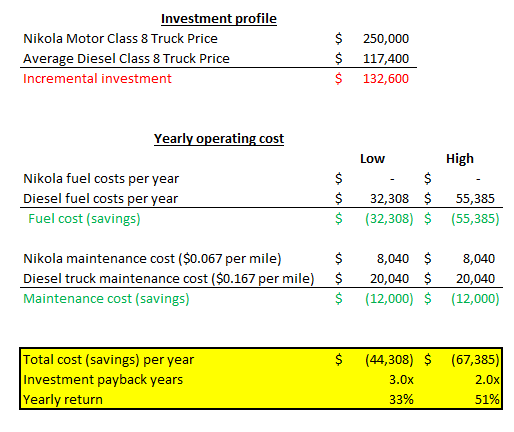

Where Nikola trucks fall far behind traditional diesel trucks (and the Tesla Semi) is pricing. With an expected price tag of $235K to $250K, the Nikola trucks will be much more expensive than the competition. The National Automobile Dealers Association reports that an average new class 8 truck sells for ~$117K. The Tesla Semi is expected to price at $150K to $180K. Both are cheaper than Nikola’s trucks.

However, because the operating costs of Nikola trucks are expected to be meaningfully lower than diesel trucks, it could make sense for operators to pay the hefty price tag. My analysis tells me that an owner operator would probably recoup his incremental investment of ~$133K in as little as 2-3 years. My industry contact tells me that truck operators typically hold their trucks for 6-8 years, which means Nikola could turn out to be a good investment. That’s a strong point in favor of the Nikola truck.

The payback analysis below illustrates the point. It assumes 6.5 MPG (miles per gallon) diesel consumption, a price range of $1.75 to $3.0 per gallon of diesel, truck is driven 10,000 miles monthly, and maintenance cost per mile at $0.167 for diesel vs. $0.067 for Nikola.

Source: Author’s calculations

A rational owner operator of class 8 trucks is justified to buy from Nikola Motor after performing a rather simple cost-benefit analysis. Owner operators will get a cleaner and more powerful truck with better acceleration, comparable hauling capacity, and long-term cost savings that will improve their productivity and cash flows. That’s a strong point for NKLA.

If Nikola Motor can actually deliver the weight and truck operating costs discussed, I believe Nikola Motor will have a strong and competitive product to challenge the dominance of diesel trucks. However, as of today, all Nikola trucks are prototypes.

Nikola’s biggest challenge is to be capable of manufacturing its trucks at low enough costs in order to convert pre-orders into actual deliveries. This is the most critical factor for the stock to work. With that in mind, let’s discuss manufacturing.

Manufacturing and the IVECO Joint Venture

If Nikola delivers what it’s promising to customers, revenues will explode, and the NKLA stock will likely skyrocket. Nikola expects to deliver 12,000 trucks by 2024, but still has to ramp up manufacturing capacity. There is little room for error as the characteristics discussed above must be achieved in order for the product to be competitive. Plenty of risks exist and there is no guarantee Nikola will be able to do it. If they don’t do it, look down as NKLA stock is likely to plummet.

Nikola has an ace up its sleeve in manufacturing. Nikola formed a JV with CNH Industrial (CNHI), the parent company of leading heavy truck manufacturer IVECO and FPT Industrial. The JV secured IVECO’s manufacturing facility in Ulm, Germany, for production of the Nikola TRE. This means Nikola will leverage IVECO’s manufacturing capacity and expertise, which is an important strategic move that reduces manufacturing risk. This is good for NKLA. For those who don’t know, IVECO is a leading truck manufacturer in Europe.

However, plenty of manufacturing risk still exist. The Nikola TRE is currently under development so that it can be manufactured in Germany. The manufacturing facility needs an estimated EUR 40 million investment in upgrades. Meanwhile, the world is still under heavy travel restrictions due to the coronavirus. The Nikola TRE is expected to hit the market in 2021, but no one knows if it will be on schedule. Chances are it will be delayed.

The Nikola One and Nikola Two are expected to hit the market in 2023. These trucks are expected to be manufactured in Coolidge, AZ, where Nikola will build a shiny new manufacturing facility.

This is where most of the manufacturing risk lies as Nikola needs to not only manufacture highly complex hydrogen trucks but also needs to build an entire factory that can mass produce these trucks. All that without cost overruns, mind you, as those will likely be severely punished by Mr. Market. This is a huge uncertainty and the reason to treat this stock as high-risk investment.

Nikola has a strong product and has solved part of the manufacturing puzzle. So, what is the revenue potential of Nikola? That’s next.

Nikola's Revenue Potential

Before jumping in, it is important to clarify that my revenue analysis is specific to truck sales. The analysis excludes other revenues, which I believe is the appropriate course of action at this stage.

Nikola is a vertically integrated energy technology company with ambitions to run its own hydrogen refueling stations (pictured below) and sell other types of vehicles (such as power sports vehicles).

Source: Ars Technica

However, the prospects for generating revenue with these activities is remote. For one thing, the economics of how the hydrogen stations will generate revenue remain dark.

Additionally, Nikola is not expecting to generate revenue with power sports vehicles before 2024, so I don’t see why investors should expect that either. This is why I’m only focused on truck sales revenue.

In its most recent investor presentation, Nikola projects it will sell 12,000 trucks in 2024. Revenues should begin to flow in 2021 with sales of the Nikola TRE, followed by rapid growth from sales of the Nikola One and Nikola Two.

The chart below illustrates revenue potential.

Source: Author, Company presentation

If all goes well, Nikola Motor has potential to generate just a little under $3B in truck sales revenue by 2024, which, as discussed above, would mean it takes approximately 5% to 8% market share in new US truck sales.

Nikola Motor is unlikely to be profitable by 2024 due to heavy investment needed to ramp up manufacturing capacity. So, this revenue potential is critical to framing up company valuation, which comes next.

Enterprise Valuation

After the merger closes and Nikola Motors begins to trade under NKLA ticker, the capital structure will be as follows (share count and dollars in millions).

Source: Author's calculations

With an EV (enterprise value) of roughly $10.7B and expected revenues of $150M in 2021, the stock appears very expensive at 72x EV/Sales. As discussed before, once manufacturing capacity is built, revenues are expected to grow fast. By 2024, Nikola targets $2.9B in revenue, which equates to 3.7x EV/Sales ratio, a more reasonable multiple.

At 3.7x EV/Sales ratio, the stock could turn out to be a wonderful investment. If Nikola is able to realize its revenue targets for 2023 and 2024 (or at least come close to it) without much cost overruns, the stock is likely to experience a meteoric rise due to multiple expansion. Imagine it is time to report Q4 and full year 2023 results, and Nikola appears on track to convert pre-orders into deliveries. Nikola's EV/Sales multiple will likely expand to much higher than 3.7x.

For example, Tesla EV/Sales ratio ranged from 4.5x to over 30x over the past 10 years. Investor enthusiasm for environmentally friendly companies is likely at the highest it’s ever been. That’s a strong reason for investors to bid up NKLA stock to much higher EV/Sales ratio.

The question I’m wondering is how high the stock price of NKLA could go, assuming absolutely everything goes as expected and according to plan. The table below summarizes the results under different EV/Sales assumptions:

Source: Author’s calculation

My calculations point me to a stock price that could be as high as $70, assuming 10x EV/Sales ratio. The caveat to this analysis is that it is difficult to know what the EV and capital structure will look like by 2024. It is not guaranteed that a $29B enterprise value will translate into a $70 stock price because of future capital raising activities.

Nikola is expected to have approximately $709M of cash when the merger closes, but still has a manufacturing facility to build. My best guess is the manufacturing facility will cost more than that, so more capital will need to be raised. Nonetheless, the analysis shows that NKLA does indeed have potential to become the next $50B company.

Investor conclusion

Nikola Motor is still in the very early stages as a company with most of the growth ahead of it. That is the appeal of the stock because with all the growth ahead of it, the upside potential is large. I believe NKLA could be one of the most appealing stories in the stock market that will not only cater to environmentally conscious investors but also to individual and growth investors.

Investors’ demand for environmentally friendly companies is probably the highest it’s ever been. Investors want companies with environmentally friendly products. Nikola's products are zero emission vehicles with sustainable sources of fuel. It fits exactly what investors are looking for.

However, Nikola only has a few prototypes and is yet to convert 14,000 pre-orders into actual revenues. Their prototypes are looking very good, and should provide truck operators with a competitive product that will be appealing. Manufacturing capacity has been secured for the time being, but a whole factory needs to be built, on time and on budget.

With four years of lead time before revenues begin to seriously move the needle, investors have plenty of time to wait and see, if they wish. An investment in NKLA today is highly speculative, but if all goes well, NKLA has strong upside potential.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.