Walgreens Boots Alliance: The Case For Buying In At Near 5-Year Lows

by Edmund InghamSummary

- Walgreens Boots Alliance is the largest retail pharmacy, health and daily living destination across the United States and Europe, employing 440k staff globally across 18,750 stores.

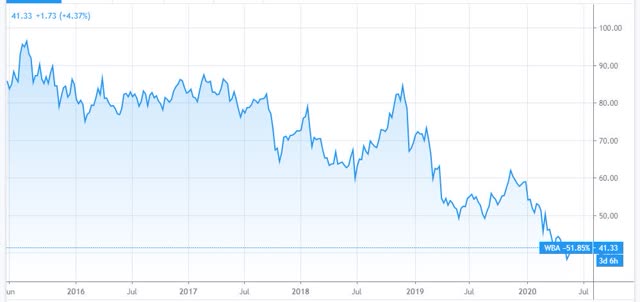

- WBA shares are trading at their lowest price since 2013, having declined 53% from a price of $85 in Nov '19. In 2020 the share price has declined 33%.

- Sales in Q220 were up 3.7% vs. Q219. Operating income was down 19% and EPS down 7.3% to $1.07. Net cash from operating activities was up $1.3bn to $2.5bn.

- The company has withdrawn its broadly flat 2020 guidance in light of COVID-19, saying it cannot predict what effect the pandemic will have on business performance at this time.

- For a company that has grown revenues and been profitable in each of the past 5 years, WBA looks undervalued. Hence, a good time to buy this dividend paying blue-chip.

Investment Thesis

Walgreens Boots Alliance 5-year share price performance. Source: TradingView

Walgreens Boots Alliance (WBA) may not represent the most glamorous of investment opportunities but there is no escaping the fact that this could be a good time to acquire a position in this pharmacy retail giant.

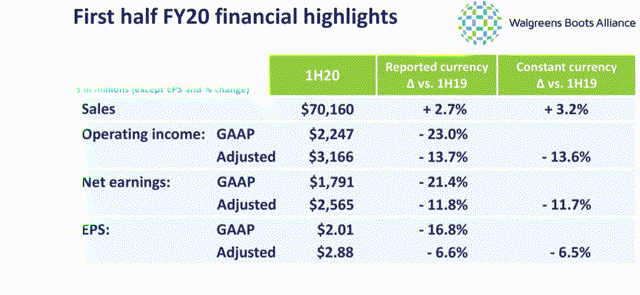

That may sound like an odd statement given that the company hit a 5-year price low in mid-May, reported first half FY20 net earnings down 21.4% to $1.8bn, and faces significant uncertainty in the second half of the year owing to the headwinds created by the coronavirus pandemic.

A more thorough analysis of the company, however, suggests that the market - which has a tendency to undervalue the retail pharmacy sector - has punished Walgreens stock more heavily than it might have done given the company's lengthy history - which goes back to 2015 - of growing revenues, delivering bottom-line profitability, offering a dividend yield of ~$4.5% and a return on invested capital ("ROIC") that is typically above 7% per annum.

Further evidence that Walgreens' stock is undervalued is offered by the company's current Price to Earnings ratio of 10x, which has drifted slightly from 9x at YE19 but is still low enough to make the company a bargain, given that the average P/E ratio for the Healthcare Services sector as a whole is estimated in some quarters to be as high as at 21.8x.

Walgreens Boots Alliance vs. S&P, CVS Health and Healthcare Services ETF 1-year share price performance. Source: TradingView.

As we can see from the chart above, whilst the Healthcare Services sector, S&P 500 and major sector rival CVS Health (CVS) have all staged a recovery from early mid-May price-lows caused by the coronavirus induced market sell-off, hitting 3-month price highs, Walgreens experienced a more prolonged downturn and is still trading at 24% below its mid-March price of $52.

Although the company's second quarter 2020 results were underwhelming compared to the corresponding period in 2019, with EPS of $1.52 representing a 7% year-on-year decline, owing, management says, to headwinds created by a year-on-year bonus impact and the true-up of a reimbursement contract, the company still managed to generate a free cash flow of >$1.8bn which is $1bn more than for the same period last year.

Whilst it's true that Walgreens management has taken the decision to withdraw its financial guidance for 2020 - which had suggested that 2020 performance would be broadly flat compared to 2019 - and that the full force of the COVID-19 lockdown period will most likely impact on Q3 results - I do not believe there is any reason to panic. Walgreens is a juggernaut of a company that provides an irreplaceable service given that its customers rely upon it to fill their prescriptions and provide a range of essential and non-essential products that are in no real danger of experiencing falling demand.

When we throw in a generous dividend payment, a company-wide cost-savings drive forecast to generate $1.8bn in savings by FY22, and the resumption of full trading at its stores, I believe the case for Walgreens growing its share price in the latter half of 2020 is persuasive.

The market's traditional wariness of the retail pharmacy sector remains a caveat. Arguably, both CVS and Walgreens trade at a near-constant discount to their fundamental fair value price. Even without near-term share price accretion, however, investors who buy at current price can still benefit from the dividend payment, share buyback program, and huge sales volumes, with little downside risk. I therefore make Walgreens a buy with a price target of $70, based on my DCF analysis which subscribers to Haggerston BioHealth can find in my model portfolio.

Company Overview - headwinds and tailwinds

To describe Walgreens as "too big to fail" may be tempting fate, but with a market cap of $34.7bn, sales of $140bn in 2019, 18,750 stores in 11 different countries, a workforce of 440,000, and ownership of globally recognized chains such as Rite Aid, Boots pharmacies in the UK, plus cosmetics brands No7, Soap & Glory, Liz Earle, Botanics and others, Walgreens ought to be a company that sets the agenda rather than follows it.

Market trends also play into the company's hands. In its last 10K submission Walgreens lists an aging population, heightened life expectancy, wider availability of generic drugs, baby-boomers' increased usage of Medicare Part D, and newer and better medical treatments as long-term tailwinds, and it is hard to disagree.

Now that Joe Biden has won the race to take on Donald Trump in the Presidential elections, the once significant threat of an overhaul of the pharmaceutical industry by the left wing of the Democrat party has dissipated, which is important to Walgreens since retail pharmacies are heavily dependent upon government support to sustain their operating models. The prospect of long-term stability appears to have been restored.

Walgreens Boots Alliance First Half FY20 results. Source: Walgreens Q220 earnings presentation.

In the first half of 2020 Walgreens was able to grow top line sales. Although net earnings declined by 21% to $2.57bn, attributed by management to 2 one-off factors - a reimbursement contract true-up of -10% and year-on-year bonus impact of -6% - the company still generated a quite reasonable EPS of $2.01 on a GAAP basis.

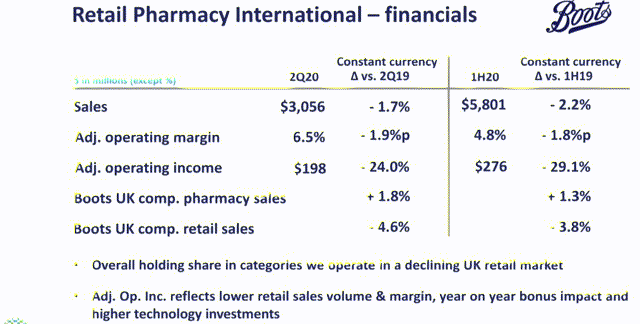

Boots a concern

One long-term headwind that Walgreens faces is the fact that its $9bn acquisition of UK-based Boots pharmacies in 2014 has not really worked out as planned. The United Kingdom (where Boots operates) has suffered from a long-term trend of dwindling high-street sales which has been exacerbated by the COVID-19 pandemic. Although Walgreens reported that front-of-store sales at Boots had been strong at the beginning of March, the lockdown period has reversed those gains and planned growth initiatives have had to be abandoned, whilst Walgreens has had to work closely with the UK government on staff furloughing plans, business rates etc.

Boots 2Q20 and 1H20 performance. Source: Walgreens Q220 earnings presentation.

The long-term decline of the UK high-street poses a problem for Walgreens, and the company has turned to online to try to address it. The company plans to introduce telemedicine services providing access to GPs and Boots pharmacies, and has launched an app which has already attracted 3m active users, as well as a digital loyalty card which is likely to prove popular in a country that increasingly favors "clicks" over "bricks".

Retail Pharmacy USA remains robust

Of Walgreens 3 major reporting segments: Retail Pharmacy USA, Retail Pharmacy International, and Pharmaceutical Wholesale, Retail Pharmacy USA accounts for 75% of all revenues.

Top line sales in the division increased by 3.8% in the second quarter and although store optimization costs provided a 70 basis point impact, the decision ought to pay off over the longer term - investors are rarely disappointed when profits are being reinvested back into improving the business.

On the pharmacy side, sales in Q220 increased by 5.3% year-on-year, with central specialty sales particularly impressive, growing by 18% year-on-year. A favorable cold and flu season, improved Medicare Part D performance, and increase in comp scripts also contributed to a successful quarter, Walgreens' CFO James Kehoe informed analysts on the earnings call. The company commands a 21% share of the market, a small 50 bps year-on-year decrease.

On the retail side, sales declined by 0.3% in the quarter, but Walgreens Health and Wellness continued to flourish, gaining 6.7%, with personal care also up by 2.3% and beauty up over the first half of the reporting year, by 0.9%.

International business suffers but Pharmaceutical Wholesale continues to thrive

Pharmacy International sales declined 2.2% in 1H20 to $5.8bn delivering a meager operating income of $276m (down 29% year-on-year) with headwinds including civil unrest in Chile and a decline in Chinese tourists to Thailand, according to CFO Kehoe. An alternative explanation may be that the company is simply struggling to execute in quite the same way overseas as it does in the US - this appears to be the biggest weakness in the company's overall business model, but it could also be that overseas business is more susceptible to head and tailwinds, and could pick up rapidly when the global retail markets are not under exceptional strain.

The Pharmaceutical Wholesale business, however, delivered 1H20 sales >$12bn (up 8.1%) and adjusted operating income of $464m (up 5%). Walgreens has a 10-year pharmaceutical distribution agreement in place with AmerisourceBergen (NYSE:ABC) (in which it holds a significant equity position of around 27% thanks to a >$2bn investment) which was recently extended by 3 more years (to 2026), and allows Walgreens to source generic pharmaceutical products from AmerisourceBergen.

After announcing these results on April 3rd Walgreens was rewarded with a slight jump in its share price from $40 to $46, but the gains did not last and the stock had fallen to a low of $38 - its lowest ebb since Feb 2013 - by May 15th. It is hard to find justification for such a slump but my personal opinion is that analysts did not react well to the retraction of FY20 forecasts.

Still, the consensus 1-year price target for Walgreens is currently $48 with a high of $56 and a low of $42, implying share price accretion ought to be expected - even by an investment community that is rarely optimistic about retail pharmacy.

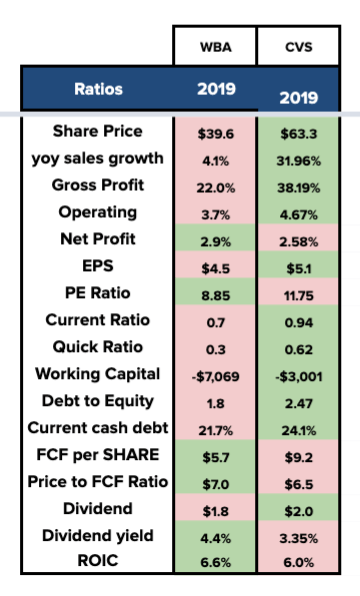

Fair comparison to sector rival CVS supports the case for growth

Walgreens vs. CVS Health investment ratio comparison. Source: my table using historical financial from both companies.

To illustrate the favorable investment opportunity provided by Walgreens, I have compared the company to its sector rival, CVS Health. CVS stock is currently priced at a 60% premium to Walgreens and its market cap of $83bn is more than twice that of Walgreens' $35bn. CVS annual sales growth of 32% is exceptional as it includes revenue from Aetna Healthcare, the company CVS acquired in November 2018. In FY2018, CVS grew revenues by 5% on an annual basis.

Walgreens' net profit margin of 2.9% in FY19 is superior to CVS', as is its P/E ratio of 8.9x. Its free cash flow per share is also superior to CVS, and it is Walgreens that currently provides the better dividend yield - by more than 100bps (if, as expected, Walgreens' share price increases this will reduce - but that is what I would call a win-win situation). Walgreens also provides the better return on invested capital (6.6% compared to 6.0% by my calculations).

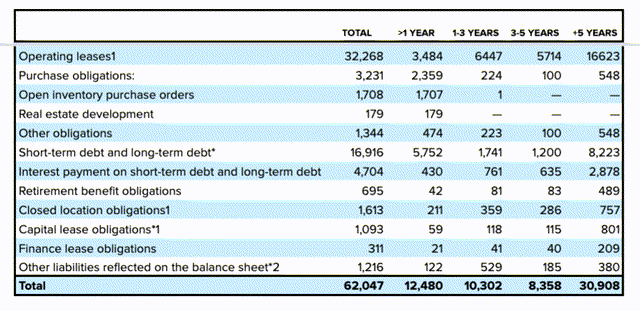

Walgreens debt schedule as at YE19. Source: company 10K 2019.

Walgreens scores less well is where debt is concerned. At YE19 its current liabilities were greater than its current assets and this continues to be the case at end of Q220 (the ratio is currently 66%).

Walgreens also has significant debt of $62bn, and as we can see from the table above, the debt schedule is onerous, with the company having only $1bn of short-term cash and 18.7bn of current assets overall. This is likely to put a strain on the company's resources given that net cash from operating activities in 2019 was $5.6bn, preventing it from investing money back into the business to the extent management would wish, or indeed, to the extent required to run a global business with >13,000 physical retail stores in its direct portfolio.

This is probably the biggest concern I have identified relating to Walgreens and its ability to grow sufficiently to shrug off headwinds such as coronavirus, intensifying competition, and its overseas issues. Still, the company traded at a price of $62 as recently as November '19 with the same (or very similar) levels of leverage and it is not unusual for a large company to find itself indebted - CVS itself has taken on an enormous debt pile ($64bn of long-term debt as Q120) as a result of its Aetna acquisition, for example.

Conclusion - buying now to balance a portfolio could prove a wise decision

Admittedly, Walgreens Boots Alliance is ailing in some departments. The company is very unlikely to grow top line sales revenues this year (although I wouldn't bet against it springing a surprise come YE results), must decide how to combat falling high street sales at its Boots chain of pharmacies, does not have significant capital reserves to invest into its physical stores and R&D, and, given that its Executive Chairman is aged 74 and its CEO aged 78, presumably needs to implement a workable succession plan within the next few years.

I believe, however, that these issues are more than reflected in the current depressed share price. The company's debt is not so bad as to make a suspension of the generous dividend payment likely, or affect the current share buyback program ($3.8bn of shares repurchased in 2019, likely to be $1.7bn in 2020), and to counteract the issues at Boots, I believe the company is pursuing the right strategy in exploring digital and online opportunities - in this respect Boots could become a very useful bellwether for the inevitable migration towards telemedicine-style services and virtual healthcare.

As such, I believe that - for those that want to invest in a solid dividend-paying blue-chip at a very cheap price, and to hold for the medium-to-long-term perhaps as a hedge against riskier assets to create a more balanced portfolio, within the healthcare sector, Walgreens fits the bill.

The case for further downside is thin, in my view. A company that has delivered 5 straight years of top line revenue and made a profit >$4bn in each of the last 3 years, trading at a 34% discount to its price just 6 months ago is, in my view, emitting buy signals, notwithstanding the issues created by COVID-19. Provided they dissipate, as seems to be expected, significantly within the next 3-6 months, and in the absence of other major headwinds, this is an opportune time to buy Walgreens stock, in my view.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in WBA over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.