Target - On Target, Fairly Valued

by The Value InvestorSummary

- Target is enjoying real momentum in sales, driven by digital and essential categories.

- The store base and specific headwinds in certain categories, including the combination of safety measures, extra worker payments and greater online fulfillment, do pressure margins.

- Target seems more than fully valued here, despite strong sales momentum and flexibility in its operations.

Target (TGT) has seen some interesting moves in its share price as of late. Shares started the year around the $130 mark as real accelerating organic sales growth as a result of a more focused strategy (not just categories, but also geographies) has boosted the company’s performance over the past few years, making investors generally upbeat in recent years.

Shares did fall to levels in the low $90s in March and early April for obvious reasons but have regained half of the lost ground, trading at $125 per share at some point last week ahead of the first-quarter earnings report. Investors clearly see Target as somewhat of an essential business which will not only survive these current times but might also benefit from it directly, or indirectly through further weakening of competition in some areas.

The Business, The Thesis

Early March, the company reported its 2019 results with comparable sales growth of 3.4% being largely driven by a 29% increase in digital comparable sales growth. That said, it should be noted that 1.5% comparable sales growth in the final quarter was significantly weaker, with digital sales up just 20%.

The company has grown to a revenue base of $78 billion for the year on which it reported steep operating profits of $4.7 billion, for margins equal just a few basis points short of 6%. Some modest gains on this front in combination with sales growth drove a 12% increase in net earnings to nearly $3.3 billion. Thanks to a 3% reduction in the share count, reported earnings per share were up 15% to $6.42 per share.

Despite the start of the COVID-19 outbreak, the company did provide a guidance for 2020 early March. With a low single-digit increase in comparable sales seen in 2020, the company saw potential for earnings per share to advance to $6.75-$7.00 per share, as no mentioning was made on the COVID-19 crisis in the press release.

Net debt of $8.9 billion looks relatively modest with EBITDA coming in at $7.0 billion in 2019, for a leverage ratio of a modest 1.3 times. Trading at $125 at the start of the year, shares traded at 19-20 times earnings, more or less in line with the market.

COVID-19, A Mixed Quarter

As it now became apparent, the impact of the COVID-19 crisis consists of two tails in the first quarter. Important to realize is that the quarter ended early May, which means that the real impact was seen in both March and April.

Reported sales were up 11.3% to nearly $19.4 billion. This was driven by comparable sales growth which was up 10.8% as the number of transactions was down 150 basis points, yet the average transaction amount was up 12.5%, similar directions as seen by other retailers.

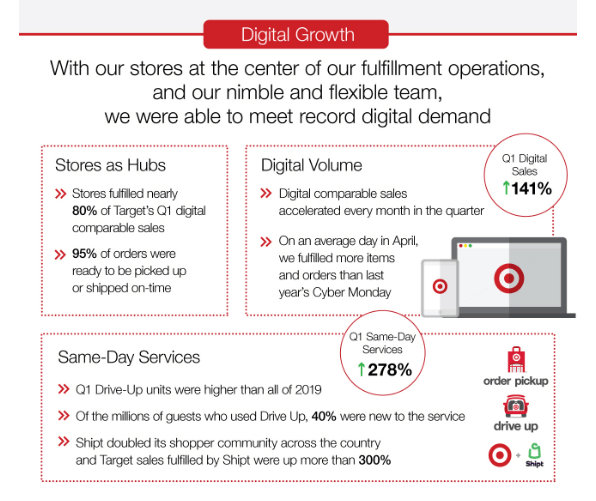

Note that store comparable sales were up just 90 basis points, as digital comparable sales were up by 141%, thereby contributing 990 basis points to reported sales growth. With the surge even being twice that growth rate in April, the stores played a major role in actually fulfilling these orders during the quarter. Total digital sales came in at 15% for the quarter, but probably far higher towards the end of the quarter.

While the sale trajectory was certainly impressive, the margin picture was a bit different. Operating margins for the quarter came in at just 2.4% for the quarter, down a full four points compared to the year before. This was driven by gross margin compression, with gross margins down 450 basis points.

This was driven by actions taken by the team, including inventory impairments on troubled categories such as apparel, as sales of lower-margin segments were strong, including food & beverage. SG&A was down 10 basis points, marking very modest leverage given the growth, yet included in here are higher compensation costs and investments, not just in higher payouts, but precautionary measures taken as well.

Some Further Thoughts

The good thing is that Target has come a long way in advancing its digital channels, as this past quarter certainly was a stress test. Of course, the company has seen real deleverage, but the reasons for this are quite explanatory, relating to additional demand and one-time investments in staff, but mostly a change in the basket composition to lower margin products and big clearance sales.

All in all, the picture is a bit mixed as earnings are essentially down two-thirds, fallen from $1.53 per share to $0.56 per share. However, a great deal of the margin compression is driven by a one-time inventory write down, although not quantified exactly on the conference call.

The results displayed by peers, including Walmart (NYSE:WMT), indicate that most retailers, even if they see specular comparable sales growth, will see dome deleverage as a result of the combination of protective measures taken and additional wages/overtime paid to employees, but mostly because some categories will excel and others will lag seriously in this environment.

The $7 per share number seen originally this year will not likely be attained. Adjusting for inventory write-downs, earnings are likely flattish or down a little, also because the strong e-commerce growth typically does not bode well for retailers, as it further results in some deleveraging of the store base.

Thus, now trading around $117 per share, shares trade at a multiple near 20 times earnings, assuming they come in around $6 per share, or about 17 times if the original guidance will be attained as the entire situation is of course still highly fluid and uncertain. Additionally, anticipated economic headwinds will pressure the results as well of course in the medium term.

When shares of Target plunged in November 2018 to $69, I concluded that sales performance continued, with appeal luring. I recognized that like many retailers, the company was betting on growing its commerce capabilities at the expenses of margins. That left me to conclude that I was initiating small position in Target with potential aim to lock in a "pair trade" with Walmart, which was in the same boat yet traded at a higher valuation.

Certainly, as I never locked in the short side of the trade, it has been very beneficial with Target up about 70% in a time frame of about just around one and a half years, while Walmart's capital gains were stuck around 25% for the same period of time.

At these levels, I am no longer holding a position (sold already in the summer of 2019) as I feel that Target here is more than fully valued, so not seeing imminent appeal here.

If you like to see more ideas, please subscribe to the premium service "Value in Corporate Events" here and try the free trial. In this service we cover major earnings events, M&A, IPOs and other significant corporate events with actionable ideas. Furthermore, we provide coverage of situations and names on request!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.