Apple Looking For Growth Return

by Bill MaurerSummary

- Analysts see green again in December 2020 quarter.

- October iPhone launch may change the narrative.

- Another trade war could pressure shares.

When technology giant Apple (AAPL) reported fiscal Q2 earnings back in April, the company's revenue figure came in almost $3.7 billion ahead of street estimates. Apple needed almost all of that beat to show year over year growth for the top line, coming in at a 0.51% increase. While the coronavirus wasn't able to turn things into the red for that period, the next few quarters aren't projected to be so lucky. Today, I want to look at when investors can hope to see some green again, and what the key drivers of that will be.

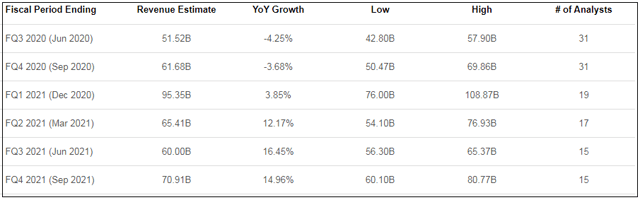

In the graphic below, you can see where street estimates currently stand. As a reminder, Apple management did not provide quarterly guidance, following what most companies have done in this environment. The company has started to reopen a number of its stores, but many have been closed for a good chunk of this quarter, and certain retail partners that may have stayed open might have seen reduced hours. As a point of reference, that low estimate implies a year over year revenue decline of 20.4%, which seems a bit dramatic, but this pandemic environment means extreme uncertainty.

(Source: Seeking Alpha Apple estimates page, seen here)

Most analysts see a return to growth in the December 2020 period, but that's still a dart throw at this point. A second wave of the coronavirus in the US could easily put that in jeopardy, or increased trade tensions with China could cause a repeat of what we saw in recent years. Also, how much money global governments pump into their economies over the next few months will play a major role in how willing consumers are to spend, especially around the holidays.

However, the biggest question may be the launch date of this year's new iPhones. While these devices normally come to market in the back half of September, a number of analysts believe we'll see a delay of about a month this year due to production issues thanks to the coronavirus. If that delay approaches two months, it might be very hard for Apple to show any growth in overall revenues for the December period.

In the second half of calendar 2019, Apple averaged over $3.4 billion in iPhone revenues per week. In the final three months of the year, that number was over $4.3 billion. An October or November launch would obviously push some iPhone revenue out of the September quarter, but it also means some time in the holiday quarter with no new iPhone. I would think a one month delay pushes roughly $3 billion into the March 2021 period based on the above numbers, which itself pushes the revenue figure close to the flat line. The loss of services revenue based on slower ecosystem user growth then pushes us into the red.

Delays in launching other new products would also push the return to growth timeline into 2021. There is an expectation of a new entry level iPad coming at some point later this year, but a key Apple watcher says that a new iPad mini planned for this year is going to slip into 2021. Updates to the Apple Watch, TV, and HomePod also remain in limbo. Remember, wearables and services accounted for more than $22.7 billion in last year's holiday period, so they do play a decent sized part in the revenue picture.

A potential delay in the iPhone could result in this year's iPhone launch cycle mirroring that of 2018. As the chart below shows, there was a big run into that year's launch. However, holiday period guidance was weaker than expected, and when combined with the US/China trade war, shares tanked into year's end. With President Trump blaming China for the virus in an effort to shift blame away from his administration as he looks to be re-elected, a similar situation this year is not out of the question. Any retaliation from the Chinese government on the Huawei saga could definitely hurt Apple.

(Source: Yahoo! Finance)

In the end, Apple's expected return to growth is coming, but how long it takes to get there remains the big question. Delays to the launch of this year's iPhones and other products could easily push billions of revenue into 2021, meaning a subdued time for Apple's most important quarter of the year. Increased trade tensions with China could also play a part, which would seem to mirror the situation seen in late 2018. Getting the top line growing again will likely be a key part of the investor bull case for the next few months, which will help to determine if Apple shares can hit a new high and look for a breakout towards $400.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.