The Hertz Bankruptcy And Used Vehicle Values

by Tim WorstallSummary

- Hertz has gone bust and that's that - but the interesting thing is why? For the answer to that tells us a lot about what happens next.

- For example, there are worries that 500k cars might be about to hit the used market, thereby collapsing prices. But that's to get this the wrong way around.

- Hertz went because the used car market fell, it's not Hertz failing that will lower the used market.

Car rental companies

So, we all think they make their money by, well, renting out cars to us all at airports and the like, right? And that may well be true but here's a different and true story. It's old, from the 1990s, and it's in the UK. But involving one of those major global car rental companies.

The car rental part lost money and was always expected to. However, they bought a large enough fleet each year that they could gain very, very, good prices from the manufacturers. They had to agree to hold them for a certain period (4 months and or 8,000 mile to memory) and then they could sell them as slightly used, or second hand. Their discounts from the manufacturers were sufficiently large that they made a profit doing this. They were, in economic terms, really a very large second hand car dealer - the rental was just the bit that got them the good prices in the first place.

No, I do not say that the major US companies are like this, not exactly. But they do buy substantial parts of their fleets directly (other parts are on a deal where the manufacturer takes them back) and this is one reason why they tend to prefer one or other of the majors for their purchases - Hertz (NYSE:HTZ) (and this isn't about Hertz this piece, it's using it as an example) bought about 45% GM, for example. Big purchases get better discounts.

The point of this though is that the car hire companies are hugely reliant upon the state of the used car market. They hold a car on average for 13 months or so - some faster, some slower - and the true determinant of the company's profit over time is not what it can be rented out for, it's the difference between purchase and sale price. Sure, the rental fees are nice but they're not what determines disaster or not.

The used car market

Given the above this explains neatly why Hertz just went bust. Sure, it has problems and all that anyway but this is the killer blow:

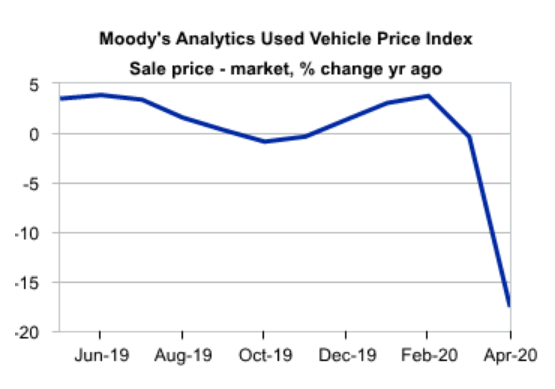

Used-vehicle prices were down 17.6% on a year-over-year basis in April, marking the largest decline in the series, which began in 1996. Light-truck and SUV prices decreased 18.3%, whereas car prices moved down 16.8%. Vehicle retention value, measured as price/MSRP, fell 19.3%. In the light-truck/SUV component, retention value was down 20%, and in the car component it declined 18.6%.

(Used car prices from Moody's Analytics)

Used cars are, near enough, down 20% or so. And if your business depends upon the resale value of those cars you've been renting out, well, then:

(Hertz stock price from Seeking Alpha)

Well, it's fallen again from there so look through the link to see what it is when you're reading this.

In more detail

In more detail, Hertz used special purpose vehicles (no, not cars vehicles, company formation vehicles) which borrowed money by issuing bonds to buy the cars. Then leased them to Hertz. And Hertz had to do a certain amount of guaranteeing the resale value of those cars to the bond holders. Rather like a covenant on a bank loan, in fact exactly like a covenant on a bond issue. And then the used car price fell:

Given the value of the Company's leased Non-Program Vehicle fleet, a 1% drop in vehicle values translates to an approximately $75 million depreciation "true-up" requirement to remain in compliance.

The used car market's dropped 20% - that's gonna hurt. And it did and they're bust.

Two points about this

The first is that the Hertz that emerges from the bankruptcy might well be a useful thing to buy into. It had, I agree, its problems. But it really has been killed by that collapse in the used car market. And however they finance a fleet in the future they're not going to agree to a covenant like that.

However, the actual point of this is that just isn't going to ripple through the whole used car market. Not the Hertz collapse isn't, no. Hertz just isn't large enough to make that happen.

At the top of any estimate possible Hertz might - if liquidated - put 500,000 cars into that used market. Sure, the market doesn't really exist right now but usually it's some 40 million transactions a year. And near all of those Hertz vehicles would have hit that market over the next year anyway.

That is, even a Hertz fleet liquidation isn't large enough to affect that used car market to any great extent.

The point here

The used car market is in the doldrums, there's little trade going on and prices are well down. Anyone looking for a used car well, now's the time to go out and go looking - as long as you've the cash to do so. But other than that, the point here is that Hertz isn't going to make it much worse, not to the extent that we'll really note it that much.

So, think collapse isn't going to affect used car dealers, or the other players in that market. We don't need to flee the sector. Well, OK, perhaps we do, given the state it's in, but we don't because of Hertz.

My view

It's important to get cause and effect the right way around. Hertz was done in by the collapse in used vehicle values rather than Hertz is about to cause such a collapse. We don't as a result of Hertz, need to worry more than we already were about the sector.

The investor view

Don't allow yourself to be stampeded into hasty decisions about investments in the sector. Hertz is a symptom, not a cause. Whatever was true of the used car market last week is still true this. Do not, therefore, change strategy or investments as a result of this corporate failure. It was about covenants on bonds and it's not large enough to significantly change that used car market overall.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.