Zillow: The Stock Is A Zell

by Gary J. GordonSummary

- Zillow has built a tremendous following for its residential real estate website.

- But the business has only just moved into the black and has limited further upside potential. I value this business at $20 per share.

- Zillow Offers, a buy-and-flip home business, has lost a lot of money to date. I fail to see a profitable niche. I value it at $0.

- Zillow Home Loans is in the perennially unprofitable mortgage banking business. Another $0.

- With the stock at $61, Zillow is significantly overvalued.

What is a Zillow?

Zillow has three business units. The historic and still main one is Internet, Media and Technology, or "IMT", which is a residential real estate-focused media company. In 2018 the company started Zillow Offers, which buys and sells homes. Then it bought a mortgage banker and formed Zillow Home Loans.

My path to my Zell. OK, Sell

This report reviews the history and outlook for Zillow's (NASDAQ:Z) three business units and then values them. Note that I analyze the businesses using net income, not the EBITDA measure that Zillow favors and many Wall Street analysts employ. EBITDA is "earnings before interest, taxes, depreciation and amortization". But we investors have to pay for Zillow's interest expense, taxes, and capital expenditures. To add insult to injury, Zillow also excludes stock compensation expenses in its EBITDA calculation as well. Giving away part of investors' ownership to employees sure seems like an expense to those investors. While fantasies sustain us as humans, reality is generally a better strategy for investors.

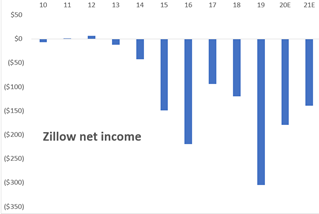

Speaking of losses, that is all that Zillow has produced over the past seven years and is expected to produce this year and next year:

Source: Zillow financial statements

Despite these facts, Zillow's stock price more than doubled over the past two months and is not far off of its all-time high. The rally was big enough for Zillow to raise more capital a few weeks ago. It sold stock at $48 a share and a convertible note at a 2.75% yield and a $67.20 conversion price.

Is Mr. Market onto something? Or is this another "hope and a prayer" online stock run? I'm in the latter camp. So, to repeat my silly headline, I think Zillow is a Zell.

The media business (IMT)

Zillow began life in 2004 as a residential real estate website. It evolved, as many service-related websites did, into a New Age media company, free to readers/viewers and sustained by ad revenues. Zillow's main media attraction is "Zestimates", which is a database-generated estimate of essentially all of the homes in the U.S. The company claims that, for listed homes, the degree of error for its price estimate is only 2%, and 8% for unlisted homes. Pretty darn good. I assume a material percentage of Zillow's visits are from various real estate professionals - realtors, mortgage lenders, appraisers, etc. - but current and would-be homeowners clearly have a recurring interest as well.

Zillow's primary source of ad revenues is realtors, both for home sales and to a far lesser extent for rentals. IMT also gets some revenue from banner ads bought by other real estate entities. Zillow charges realtors fees for viewership and for actual leads.

The realtor advertising market - about $4 billion

How much do realtors spend on marketing? My estimate is about $4 billion a year, using the following math:

- 6.2 million existing and new home sales per year. This is the sales pace that existed before the pandemic.

- About a $300,000 average home price.

- That means $1.9 trillion in the dollar value of home sales.

- The average real estate commission charged is about 4½%. So, total industry commissions earned is about $80 billion. (Note that I've seen a $70 billion estimate somewhere.)

- Industry leader Realogy has a marketing budget of about 5% of revenues. Competitor Redfin spends 13%, which has created big share gains but also big losses. I therefore assume that Realogy is more representative of the industry.

- $80 billion of commissions times a 5% marketing budget equals $4 billion.

How much more share of that $4 billion can Zillow take?

IMT's revenues are currently running at $1.2 billion annualized. That suggests Zillow's current market share is about 30%. That's a lot; good for them. Let's look at the ways Zillow could grow share.

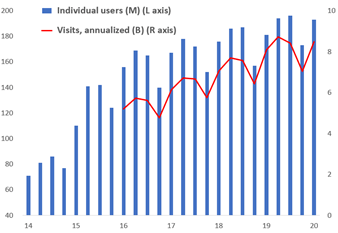

Increase its viewership? If Zillow grows its audience, realtors should happily pay Zillow more to access them, right? Zillow's outstanding success has been building viewership. Nearly 200 million unique users visit its website each quarter. That is an astounding 60% of the U.S. population! And they visit a remarkable 8 billion times a year, or nearly once a week for the average user. Here's a history of users and views:

Source: Zillow financial statements

The viewer base is leveling out! Which makes sense - as I said above, 60% of Americans already use Zillow. While grade schoolers remain largely untapped, I'm guessing that realtor/advertisers don't see them as a profitable demographic. So, materially growing viewership is quite unlikely to help them grow advertising market share.

New technology? Zillow is counting on its technology advances to help take more share. For example, from its Q1 '20 earnings conference call:

"The virtual tools home shopper's need for safety today will become their expectations for convenience tomorrow. Our focus now is not just on managing our way through this crisis. We are also moving faster to the future. Our vision of Zillow 2.0 is becoming a reality even sooner than we have had planned."

But, of course, Zillow isn't the only company to figure out that technology can simplify the real estate process. Here are two very recent (May 21, 2020) headlines from real estate trade journal Housing Wire:

"Spruce raises $29 million in Series B funding. Real estate tech company focused on empowering scalable, efficient transactions." "States Title raises $123 million to digitize real estate closings."

It seems unlikely that Zillow can gain more than a temporary technological competitive advantage.

Competitors heading for the hills? Could competitors for realtor ad spending share give up before Zillow's might? I couldn't find market share data, so I went online. I asked Google "Where can I find a realtor?" Here is what I learned:

- Zillow doesn't even bother to advertise on Google. That's a good sign - viewers know Zillow well enough to head right there.

- Realtor.com is all over Google. Realtor.com is certainly Zillow's main competitor. It has two strengths. One is that it has ties to the realtors' trade group, the National Association of Realtors. Second, it is owned by media giant News Corp., so it has plenty of investment capital available if needed.

- There are many small competitors, like Dave Ramsey, fastexpert, 3best, homelight and upnest.

- Then, there are the cross-sellers who have a different core product but see real estate advisory as an easy add-on product - Bankrate, nerdwallet and creditkarma.

- Finally, Google (NASDAQ:GOOG) (NASDAQ:GOOGL) itself is also a competitor - some realtors advertise directly on Google. Facebook (NASDAQ:FB) does the same.

On the flip side, could current ad customers get upset with Zillow? As I'll explain, both Zillow Offers and Zillow Home Mortgage put the company in competition with its advertisers. Will some get annoyed and shift to other advertising outlets? Hard to forecast, but it is certainly a real risk.

So, yes, Zillow is the 800-pound gorilla in realtor advertising. But it is far from the only ape in the jungle.

How much can IMT earn when it matures? $1.50 per share is possible

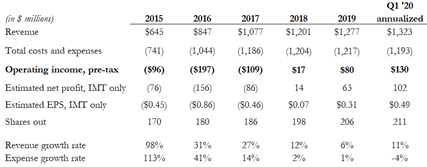

With some minor adjustments made by me to account for Offers and Home Mortgage, here's how much IMT earned in recent years:

Sources: Zillow financial statements

Here are the highlights as I see them:

- Revenue growth is clearly slowing. Share gains are getting more challenging, as I described above.

- IMT is getting operating leverage. Its expenses have been flat now for over three years, and it appears that it is working on cost savings.

- As a result of the two points above, IMT is now clearly profitable, and profits should rise quickly for at least a few years. But those profits will level out.

The table above showed that IMT earned $0.49 per share annualized during Q1. Q2 results will start reflecting the pandemic, so of course, they will be weaker; almost certainly a loss. For example, Zillow cut its ad rates up to 50% to keep volume up (so New Age!). And I assume results will be subpar through at least 2021 because of economic turmoil.

But let's dream a little. Things get back to normal. IMT creates more cost efficiencies. Could today's $100 million profit run rate triple? Could IMT earn $1.50 in EPS for Zillow? I say yes.

Finally, what is IMT worth? $20 a share

Two key factors influence my valuation:

- The bad news. IMT is fundamentally not a growth business. Ultimately, its growth depends upon the increase in real estate brokerage commissions, which in turn is a function of dollar home sales and commission rates. Home sales are a mature business, and commission rates will almost certainly decline as technology makes the real estate sale process more efficient.

- The good news. Pretty much all of IMT's earnings should be free cash flow available for payout to shareholders through dividends and share buybacks. More likely for at least the next few years is that IMT's earnings will go towards covering Zillow's other losses, but I'll ignore that for this purpose.

The bad news suggests a P/E in the single digits. The good news should take the P/E into the 12-15 range. Combining the $1.50 EPS target and the 12-15 P/E ratio produces a roughly $20 per share value for IMT.

So, here's Zillow's problem. A $20 per share stock price just doesn't cut it. Not when your actual stock price is running in the $40s and $50s, as it largely has for the past four years. So, what's a management to do? Pivot!

The questionable pivot into new "addressable markets"

If your kingdom is too small, imagine a larger kingdom. In modern tech-speak, that means a larger "addressable market". Check out Zillow's potential addressable markets, quoting from its 2019 annual report:

"We are in the midst of a significant, multi-year business model expansion…" "This strategic expansion has dramatically increased our total addressable market from $19 billion in real-estate related advertising according to a 2019 Borrell Associates report to $1.9 trillion in annual U.S. real estate transactions." "…Mortgages through Zillow Home Loans and title and escrow closing services through Zillow Closing Services in select markets. According to a 2019 Macquarie Research report, U.S. mortgage origination represents a $44 billion annual opportunity…" With nearly half of all people looking to buy also considering renting…our strategically complementary rentals marketplace also participates in a nearly $45 billion annual property management services industry…"

I'll stop there, but Zillow added five other "addressable markets".

The addressable market shift began in 2018, when Zillow launched started Zillow Offers. Then, it bought a mortgage banker to create Zillow Home Loans. Let's assess the value creation of these two moves.

Zillow Offers. Huh?

Again, Zillow Offers buys and flips homes, providing sellers and buyers with an alternative to a transaction with the realtor in the middle. I compare the economics of the two types of transactions this way:

- The traditional home sale has the seller and the buyer swapping at the same price, and the seller paying the sales transaction costs in the form of a realtor's commission.

- The Zillow home sale has the seller receiving the bid price and the buyer paying the offer price. Zillow receives the spread and covers the transaction costs.

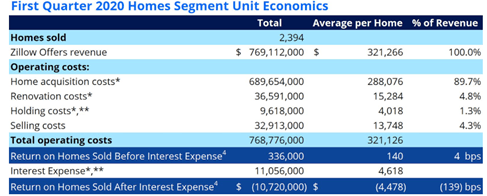

Zillow's Q1 earnings presentation gives a good snapshot of the economics of the business from its viewpoint:

Source: Zillow Q1 '20 presentation

Zillow buys knowing it usually has renovation costs, so adding up the purchase price and renovations left it with a gross profit of 5.5% of its sale price. That gross profit did not cover Zillow's cost to maintain the property while it owned it (holding costs plus interest expenses), plus its selling costs. So, the operating profit per home sold was ($4,478) and for all the sales was ($11) million. And that is before overhead expenses of somewhere north of $50 million, for a total $89 million quarterly loss for Zillow Offers as a business. Total losses for the past five quarters were $401 million! Not good.

What is Zillow thinking? I can think of three possibilities:

1. Its Zestimates home price estimator is so good that it can consistently find underpriced homes in large quantities. Not likely. While the housing market is not as efficient and stocks and bonds, it does a good job of finding the appropriate potential buyers of each home. And there is a large cottage industry of contractors and other individuals constantly on the hunt for bargains, especially for fixer-uppers. Finally, the introduction of buy-to-rent institutional buyers (Invitation Homes (NYSE:INVH) and BlackRock (NYSE:BLK) e.g.) has increased efficiency further.

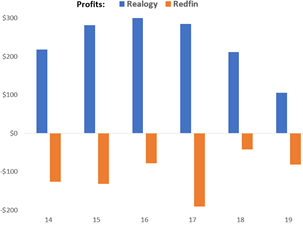

2. It can grab the large profit that realtors make on their commissions. Very unlikely - the realtor business stinks. Zillow noted that there are 86,000 real estate brokerage entities in the U.S. The biggest is Realogy (RLGY). Its market share is about 15%. That's a pretty small market share for an industry leader. Redfin (RDFN), another market leader, has a mere 1% share. Let's check out their earnings:

Sources: Realogy and Redfin company reports

Depressing. Here is what Realogy said about the competitiveness of its business (2019 annual report, page 21):

"The real estate brokerage industry has minimal barriers to entry for new participants…The significant size of the U.S. real estate market…has continued to attract outside capital investment in traditional and disruptive competitors that seek to access a portion of this market. There are also market participants who differentiate themselves by offering consumers flat fees, rebates or lower commission rates on transactions (often coupled with fewer services). Although such competitors have yet to have a material impact on overall brokerage commission rates, this could change in the future if they use greater discounts as a means to increase their market share..."

3. It can use proprietary technology to far more cheaply complete the purchase/sale transaction. Once again, not likely, except for perhaps a short period of time, as I noted above.

Three strikes, Zillow Offers is out. I value it at zero. Less than zero is a real possibility.

Zillow Home Mortgage. Tell me it ain't so

When I was a professional stock analyst, mortgage lenders were a big part of my coverage. It was a dispiriting group to follow. Lomas & Nettleton was the major independent mortgage banker when I started out in the mid-'80s. It went bust. Then a big mortgage refinance boom in the early '90s brought a bunch of mortgage bankers public. Within a few years, when the refi boom ended, they went bust, or got bought out by dumb banks which then had to shut them down after a big write-off. Then subprime mortgage lending took off, bringing a different group of mortgage bankers public. Guess what? They ended up going bust. Several times. There was one constant throughout these years, one shining star - Countrywide Credit. It survived and thrived. Then came the '07-'09 Financial Crisis. Countrywide went bust. Seeing a trend?

Today's environment is no better for mortgage bankers. The problem has always been too much competition. Largely because of Fannie Mae and Freddie Mac, pretty much all home mortgage lenders have the same lending standards and prices. It is very easy to enter and leave the business. As a result:

- There are over 45,000 home mortgage lenders in the U.S., according to Zillow.

- The largest lender, Quicken Loans, has only a 7% market share. In prior periods, Countrywide and Wells Fargo achieved 20%+ shares. So, the business has fragmented.

- Major banks like Wells (NYSE:WFC), Bank of America (NYSE:BAC), Citibank (NYSE:C) and JPMorgan (NYSE:JPM) have all de-emphasized mortgage lending because of weak profits.

- Loads of companies view mortgage lending as a natural cross-sell. Nearly all banks, of course. But so do stock brokerages. And Costco! (NASDAQ:COST) Etc., etc. So, Zillow joins a long list with the same business model.

Today, there are very few public mortgage banking companies. PennyMac (PFSI) is the star of the group, at $29 and with real earnings. But Impac Mortgage (IMH) is at $1.57, and it cumulatively lost money over the past three years. Ocwen Financial (OCN) is at $0.64 and lost money for at least the past seven years.

The import of this sad story for Zillow is clear. It will never cover the cost of its capital allocated to this business. I value Zillow Home Mortgage at $0. As with Zillow Offers, a negative value is very possible.

One last risk - the capital structure

Zillow's equity financing adds two risks to shareholders. The first risk is concentrated voting power. Zillow has three classes of common stock. Class A shares (59 million outstanding) have one vote per share. Class B shares (6.2 million outstanding) have 10 votes per share. Class C shares (157 million outstanding) have no vote. All of the B shares are held by two founders, so together they have voting control of the company while owning only 3% of the shares. They seem to like it that way, since only C shares were issued in the recent stock offering. Hopefully, Messrs. Barton and Frink will act in the other shareholders' interests, but you never know.

The other risk is share dilution, which means that more shares will be issued to dilute the investors' percentage ownership of the company. One source of dilution is stock option grants to employees. I believe that about 30 million employee stock options are outstanding (about 14% of shares outstanding). Second, Zillow has five convertible notes outstanding, including one recently issued. The dilution risk is just about impossible to analyze, at least by me, because Zillow had paid substantial amounts to reduce dilution risk. But to the best of my ability, I guess that something over 30 million shares could be issued under these securities. This amount of potential ownership dilution is very high compared to most companies.

Summing up

I actually will sum up:

$20 per share for IMT

+$0 for Zillow Offers

+$0 for Zillow Home Mortgage

$20 per share fair value. The stock is currently $61. Zell, don't Buy.

Disclosure: I am/we are short Z. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.