I've Changed My Mind About Norwegian Air - The Future Is Brighter

by Tim WorstallSummary

- Norwegian Air Shuttle was, effectively, bust, but it has managed to get the creditor takeover, the rights issue, and the government aid all through.

- It's thus a very much smaller but darn near debt-free operator. Which I said wasn't all that exciting but that's changed.

- Other airlines have been changing their strategy and there's now a space for Norwegian to - potentially - do rather well.

Norwegian Air Shuttle was bust

An extremely enthusiastic expansion left Norwegian Air (OTCPK:NWARF) very fragile indeed as an economic organisation. The coronavirus then entirely finished it off. As I said before, they needed a Hail Mary pass to get out of this. They managed to complete that unlikely feat.

The creditors ended up with nearly all the equity. For the second time - there was a rights issue. Given that the company had a capital base again, the promised Norwegian state aid kicked in. The airline now has one of the most modern fleets on the block, near no debt, and is going to at least start operating as a Nordic local airline.

This is not terribly exciting as I said that three weeks back.

My view then

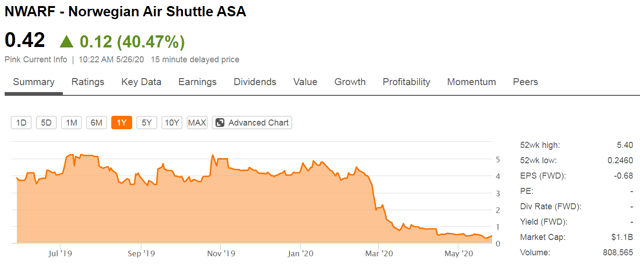

I said that if they managed to get the re-capitalization through, then there would be a bounce even if only one from relief. They did and there has been:

(Norwegian Air Shuttle stock price from Seeking Alpha)

I then went on to say that as a small regional carrier, there wasn't all that exciting a future. Certainly, nothing to get it back up to the sort of stock price there was.

However, that's changed quite a bit in this short period of time. Not so much because of Norwegian but because of what everyone else is currently doing.

The big story

The growth story for Norwegian isn't in trying to compete directly with easyJet (OTCPK:EJTTF), Wizz Air (OTCPK:WZZAF), and Ryanair (NASDAQ:RYAAY) on the short-haul European routes. It's obviously possible to do that, but charging in where the competition is heavy isn't obviously the manner to generate good profits.

The trick being, if you can, to find an area where you have a specific advantage and are thus able to beat any competition that comes along. For Norwegian, that's low cost long-haul. And they're being very much aided by other airlines and their decisions about Gatwick Airport.

As here:

However, sources in the industry are claiming that a recapitalised Norwegian is planning an audacious return to Gatwick during the winter and that it will be ready to start flying its most successful and lucrative routes to New York and Los Angeles next April.

It was the third biggest airline there; of the other two, easyJet is short-haul and BA has quit the airport:

With BA signalling that it is to retrench its operations back to Heathrow and with Virgin Atlantic quitting Gatwick, Norwegian believes that it will have a unique opportunity to become the airport's largest and potentially only long-haul operator for some time. It also hopes to use its relationship with easyJet, in which the carriers feed passengers into each other's networks.

It's also true that the transatlantic operations were distinctly profitable when they were running. It was the long-haul routes out to Asia that weren't.

This changes things

It's now possible to see the beginning of a profitable strategy. One where the competition is distinctly limited given the choices other people have been making. And no, I don't think people are going to lose their taste for trips to the US. Not given the shared culture and language and all that.

So, I've changed my opinion. Yes, there was going to be and there has been that relief bounce as a result of the refinancing. But, now, there's that longer term and believable plan as well. So, the change of opinion is that there's an incentive for a long-term holding in the stock, not just a gamble upon the refinancing.

My view

I was dismissive of the long-term story at Norwegian, thinking they'd retreat to being a very boring - if they got refinanced at all - regional airline with not stirring future. That has now changed and largely as a result of those decisions by other airlines to close down their Gatwick operations.

Sure, there's still the proof of execution of the plan required, but it does mean that there could be a bright future here.

The investor view

Anyone who was holding from before the recapitalization is so diluted down that there's little point in doing anything but hang on. Anyone who bought into the rights issue, as I recommended, should hold. And anyone entirely outside the company should be thinking hard about buying in small measures.

Note, a large position isn't justified. But the plan to do long-haul again from Gatwick probably would work given the lack of competition now. Worth parking some money there for the medium term.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.