Sandstorm Gold: This Gold Miner Is About To Get Much Bigger

by SomaBullSummary

- Sandstorm's stock outperformance should continue as there are many bullish growth catalysts.

- There is incremental growth over the next few years thanks to newly contributing royalties and streams, and more impressive longer-term growth when Hod Maden and Agua Rica enter production.

- It's likely that SAND will bridge this gap with its $400+ million of liquidity.

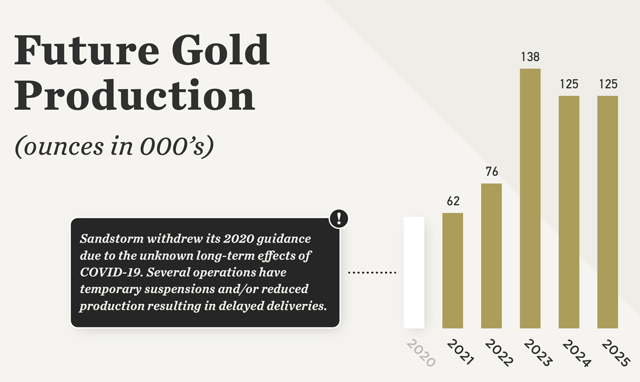

- By 2024-2025, the company's gold production total could be closer to the 175,000-ounce mark — almost triple the current output.

- If SAND can deliver on this growth, then it takes a major step forward and starts to emulate an earlier version (circa 2010) of FNV.

The bull market occurring in physical gold and the gold mining stocks is no longer stealthily advancing. It has entered the next phase, as momentum builds thanks to significantly increased interest. I believe this phase will last for many more years before eventually morphing into a bubble. I'm always discussing with my subscribers the stocks in the sector that I feel offer the best risk/reward, ones that have catalysts to propel them much higher and lead to outperformance during this bull market. Case in point: Sandstorm Gold (SAND).

In an article I posted last September (Sandstorm Gold: An Excellent Opportunity To Buy The Stock At A Discount), I stated the following on SAND:

The current pullback is a great buying opportunity as the fundamentals remain strong and there are many bullish catalysts in place. The relative valuation is also quite compelling compared to its peers.

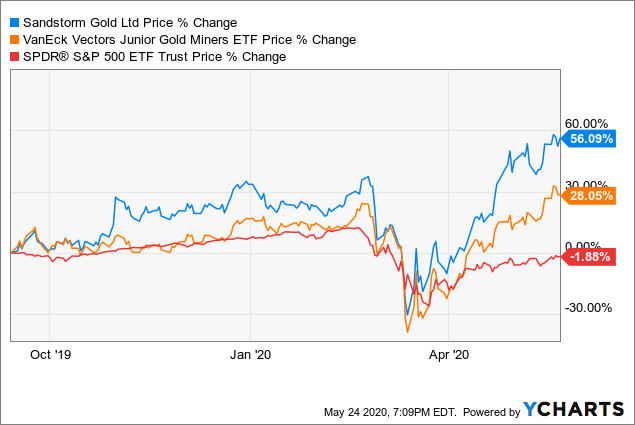

Since then, the stock has increased by 56% — double the performance of the VanEck Vectors Junior Gold Miners ETF (GDXJ). I also threw in the performance of the S&P during this time to show investors that they must start participating in this gold bull market, or they will be missing out on many stellar gains over the next several years. Non-gold related assets will likely show lackluster (at best) performances during this time.

Data by YCharts

Back on point, Sandstorm's stock outperformance should continue as there are many bullish growth catalysts. The company also has $400+ million of liquidity available to make sizable stream/royalty deals. In this article, I will discuss how Sandstorm is about to get much bigger. Mega growth + rising gold prices = outsized returns.

The Current Growth Trajectory

Sandstorm is not your typical gold miner — their business model centers around purchasing streams or royalties on mines, not operating the assets directly. Franco-Nevada (FNV) is the pioneer of this highly successful model in the sector.

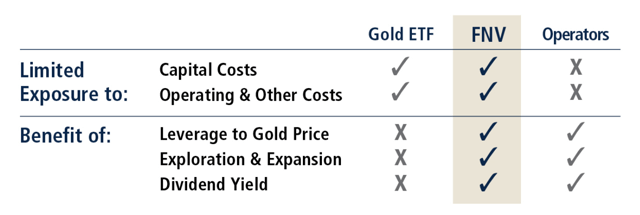

The table below shows why this model works so effectively. Mine operators are exposed to capital costs, operating costs, and other costs (exploration, etc.). Budget overruns on projects and/or higher than expected cash operating costs are detrimental to a gold miners' stock performance. For a company like Sandstorm, they are immune to these typical stock deflating events, as:

1) They aren't responsible project Capex (that's at the operator level).

2) Their cash costs are fixed on streams that they purchase, as the price they pay to the operator has already been agreed upon as part of the deal.

Often this cash cost is somewhere in the $300-$400 per ounce range if it's on a gold asset, or sometimes it will be 25-30% of the gold price if the operator wants some cost inflation protection. Margins are typically similar if the stream is on a silver or base metal mine. If it's a royalty, costs are negligible (practically $0). Margins for royalty and streaming companies are enormous, which is why this is such a high cash flowing business model. But there are many other benefits to this model. Companies like Sandstorm don't have to fund exploration, yet they receive all of the upside of any successful exploratory drilling. This is zero-risk, zero-cost growth; pure optionality. Also, Sandstorm has just as much leverage to the price of gold as operators do.

(Source: Franco-Nevada)

While not listed above, I have always said that this model allows for enough diversification that a gold miner like SAND can become almost bulletproof. An operator might own 2-3 producing mines, or for the larger companies, possibly 10-15. For a streaming/royalty company, they could have dozens and dozens of cash flowing assets. It's this diversification that dramatically lowers the risk, as trouble at one mine won't be detrimental to a streamer/royalty company, which it could be for the operator of the asset.

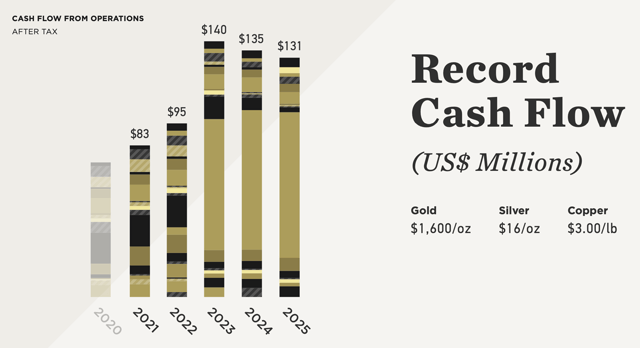

Sandstorm is only a small-cap, yet its cash flow is spread out amongst 24 producing mines, and that figure is growing. Each shaded section of the cash flow bars below represents the contribution from an individual asset or grouping of assets (e.g., smaller royalties). Sandstorm has a diverse revenue/cash flow stream, one that is about to expand significantly over the next several years. Cash flowing assets coming online or ramping up include a 0.9% royalty on the Fruta del Norte mine (~3,000 Au ounces per year), a 3-5% NSR on the Aurizona mine (~5,500 Au ounces per year), and a gold stream on the Relief Canyon mine (~4,500 Au ounces per year). There is incremental growth over the next few years thanks to newly contributing royalties and streams. Then in 2023, Hod Maden (located in Turkey) is expected to enter production, which will catapult Sandstorm's growth rate and cash flow as SAND owns a 30% NPI (net profit interest) and 2% royalty on the project.

(Source: Sandstorm Gold)

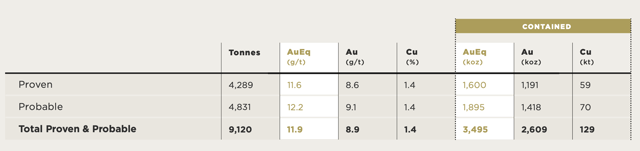

Hod Maden will be one of the highest margin gold/copper mines in the world thanks to the ultra-rich ore grade. There are currently 2.6 million ounces of gold reserves at a grade of 8.9 g/t, and 129,000 tons of copper at a stunning grade of 1.4%. On a gold equivalent basis, the mine's all-in sustaining costs will average $374 per ounce, and this is on a co-product basis (i.e., there are no by-product copper credits being used to lower costs).

(Source: Sandstorm Gold)

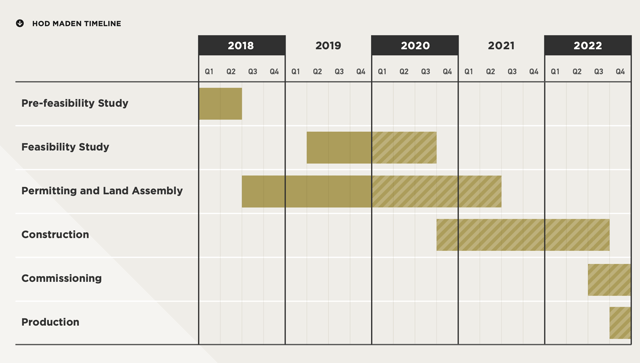

It can be argued that little value is being given to Hod Maden and the cash flow the asset will generate for Sandstorm. Part of this could be because of the delay in the mine reaching production.

When Sandstorm first acquired the royalty on Hod Maden in 2016, the mine was expected to enter production by 2021. That timeline has been pushed back twice over the last few years, and now the operation is expected to come online in late 2022. Although with COVID-19, there could be a quarter or two delay.

(Source: Sandstorm Gold)

An asset like Hod Maden — in production — will supercharge the cash flow generated by the company. But Sandstorm's current growth potential extends far beyond Hod Maden.

There are many layers to this story, some of which are hidden (i.e., they aren't contributing to operating cash flow, but they could be soon, or they are just starting to come to fruition).

For example, the NSR on the Aurizona mine is a 3-5% sliding scale royalty:

- Under $1,500 gold = 3% royalty

- $1,500-$2,000 gold = 4% royalty

- Above $2,000 gold = 5% royalty.

For the longest time, the assumption was Aurizona would be a 3% NSR, but gold blasted through $1,500, and now the royalty has increased to 4%. Given gold's exceptionally bullish fundamentals and technical outlook, it's likely to be above $2,000 soon, which would increase this royalty to 5%. This is zero-cost growth for Sandstorm simply because of higher gold prices.

That's only half the story, as Equinox Gold (OTC:EQX), the owner of the mine, is also looking at an underground project that would increase output by an additional ~75,000 ounces of gold per year. Sandstorm would receive 4% of that production at current metal prices, or 3,000 ounces of gold. This is also zero-cost growth for the company.

I believe that Equinox will push hard to boost output at Aurizona and develop the underground mine.

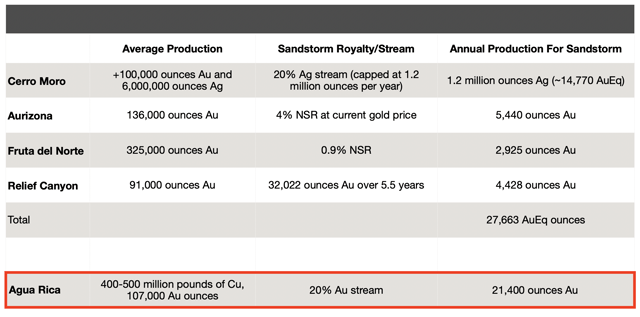

Something of more significant impact is Sandstorm's option on the Agua Rica project, which they have the right to turn into a 20% gold stream for the life-of-mine.

Up until last year, it seemed unlikely that Sandstorm would ever recognize cash flow from Agua Rica, at least anytime in the next 5-10 years. But in 2019, Yamana Gold (AUY), Glencore (OTCPK:GLCNF), and Goldcorp signed an agreement in which the Agua Rica project would be developed and operated using the existing infrastructure at the nearby Alumbrera mine. This changed the entire outlook for the project, and most importantly, greatly fast-tracked the timeline to production.

The pre-feasibility study released last year envisioned a mine life of 28 years, with average annual production over the first ten years of approximately 553 million pounds of copper equivalent — including 107,000 ounces of gold.

To put this in context, if Agua Rica was in production today, it would be by far, the highest cash flowing asset for Sandstorm. Even Cerro Moro — which is currently Yamana's largest contributor to OCF — doesn't match up. Just like with Hod Maden, I don't believe shares of SAND are pricing in Agua Rica.

(Source: SomaBull)

Given that three major producers own a piece of Agua Rica, and it's a significant asset that can be fast-tracked to production at a much lower capital cost than initially envisioned, this mine will likely be developed. Glencore could end up buying a larger percentage of the project.

Both Hod Maden and Agua Rica are part of the longer-term picture, but their value shouldn't be minimized — or excluded — just because their impact isn't felt yet. Unfortunately, it's unlikely that these assets will boost Sandstorm's stock price in the near-term.

While the cash flow from these mines is still off in the distance, I don't believe SAND investors will have to wait long to see a step-change in growth like Hod Maden and Agua Rica will eventually deliver.

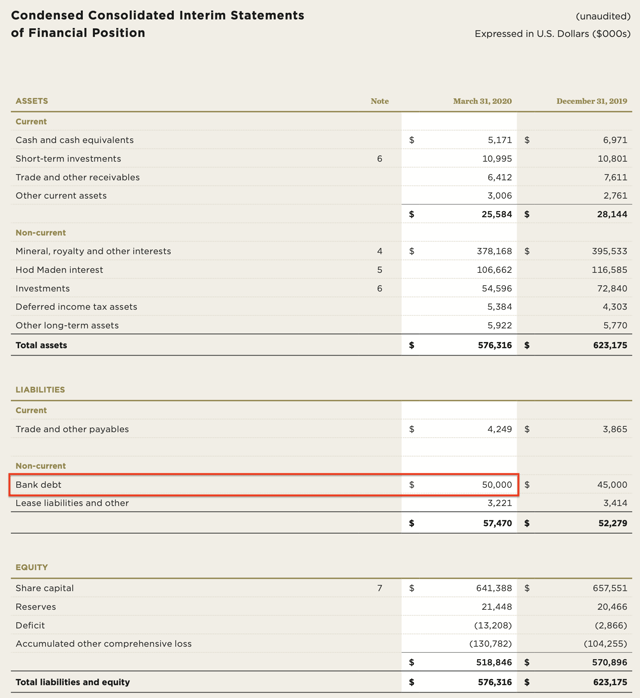

Bridging the Gap With $400+ Million Of Current Liquidity

Sandstorm's balance sheet continues to remain exceptional. While there was US$50 million of debt last quarter, the recent early warrant exercise incentive program raised US$50.25 million, which SAND used to repay the full amount borrowed on its credit facility. The company currently has no bank debt, and the entire US$225 million revolving credit facility is available. There is also an additional US$75 million accordion feature on this credit facility, which can be used for future acquisitions. Plus, they just initiated an at-the-market equity program that would allow them to issue up to US$140 million of stock. The company is also generating free cash flow each quarter. In total, the company has well over US$400 million of available liquidity.

(Source: Sandstorm Gold)

All of this liquidity could be used for new stream and royalty acquisitions. If Sandstorm wanted to, they could complete a $300-$400 million deal right now. Speaking of which, a quote by the company from the Q1 2020 conference call:

Sandstorm is actively pursuing a number of different transactions, any one of which would be a record in size for our company.

Sandstorm is clearly looking to go big. The Hod Maden acquisition cost the company $175 million, so it seems that a deal north of $200+ million is a possibility.

Given that the base metal prices have collapsed over the last several months because of weakening industrial demand due to COVID-19, the base metal producers are in a more dire need for liquidity injections. Base metal mines will typically produce by-product metals such as gold and silver. There could be opportunities in this segment for SAND to grab some gold by-product.

Sandstorm has also been clear that they are looking for deals that will offer immediate, or at the very least, near-term growth.

To spread out the risk, a handful of high quality, $40-$50 million royalty/stream agreements would be preferred over one large $200+ million acquisition — although easier said than done. But any of those two outcomes would be a boon to the stock and overall outlook.

More growth, more diversification. This will only enhance the already bullish thesis.

If Sandstorm can add 20,000-30,000 AuEq ounces to its production profile via high-quality, immediately accretive streams/royalties, yet still have that mega growth from Hod Maden and Agua Rica off in the distance, I would expect the stock to react very favorably.

Sandstorm's 2020-2025 production guidance already shows impressive growth, but it only takes into account Hod Maden. It doesn't include Agua Rica, the 75,000 Au ounces of likely production growth at Aurizona, or a 5% NSR on Aurizona. If you add those into the mix, along with additional ounces from future stream/royalty deals that are currently in the process of due diligence, then by 2024-2025, the company's gold production total could be closer to the 175,000-ounce mark — almost triple the current output.

(Source: Sandstorm Gold)

To give a higher level of confidence that this amount of production can be attained within the stated time frame, I would like to see construction begin on Hod Maden. To me, that will be the green light to Sandstorm reaching this achievement.

Why SAND Over FNV?

FNV is the leader amongst the royalty and streaming companies, as it has the most diverse portfolio of assets, most of which are of exceptional quality.

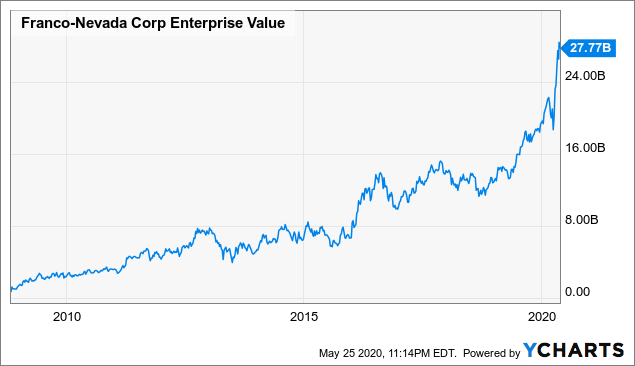

The growth in Franco-Nevada's enterprise value over the last 10+ years has been astounding, as it's gone from an EV of $800 million in 2008 to a $27.8 billion behemoth today.

Data by YCharts

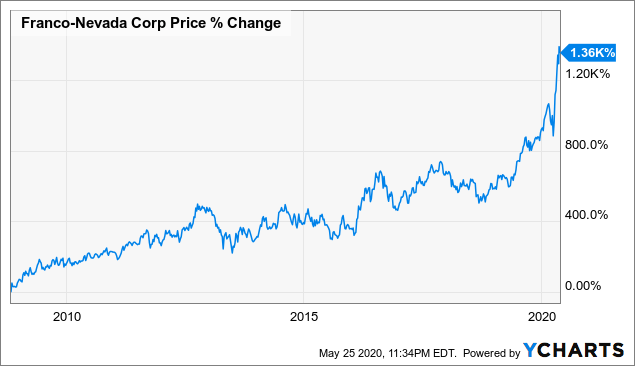

In terms of stock price appreciation, FNV has returned over 1,300%, and that doesn't include dividends.

Data by YCharts

In this gold bull market, I think it's important for investors to have some exposure to a royalty/streaming play.

Why SAND then instead of FNV? Because SAND is trading at a much lower relative value, it is earlier stage (which equals more upside potential), has far more growth in the pipeline, and is following FNV's model of success.

If Sandstorm can deliver on the growth talked about above, then it takes a major step forward and starts to emulate an earlier version (circa 2010) of Franco-Nevada. That means the future share price appreciation potential for SAND is just as promising as it was for FNV 10+ years ago. I believe Sandstorm can deliver, as this is just about time and money, both of which the company has.

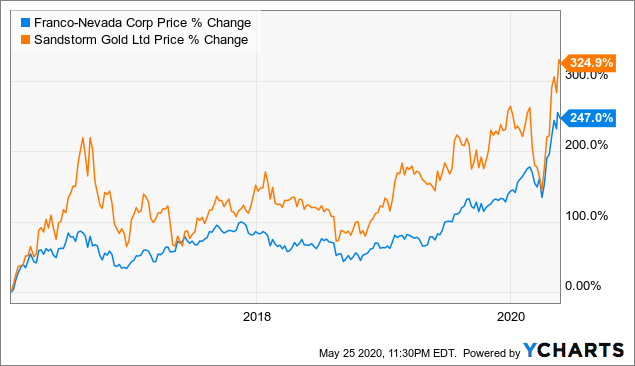

Besides, since the bear market lows in January 2016, SAND has drastically outperformed FNV. This is a trend that I expect will continue, for all of the reasons noted.

Data by YCharts

Subscribe To The Gold Edge

If you would like additional in-depth analysis of the sector, including all of my top picks, subscribe to The Gold Edge. The Gold Edge offers what I believe to be the most comprehensive coverage you will find on the precious metals sector. Click here for details and to become a member of the most popular gold-focused service on Seeking Alpha.

Disclosure: I am/we are long SAND. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.