Dumpster Diving: (Kirkland's Edition)

by Courage & Conviction InvestingSummary

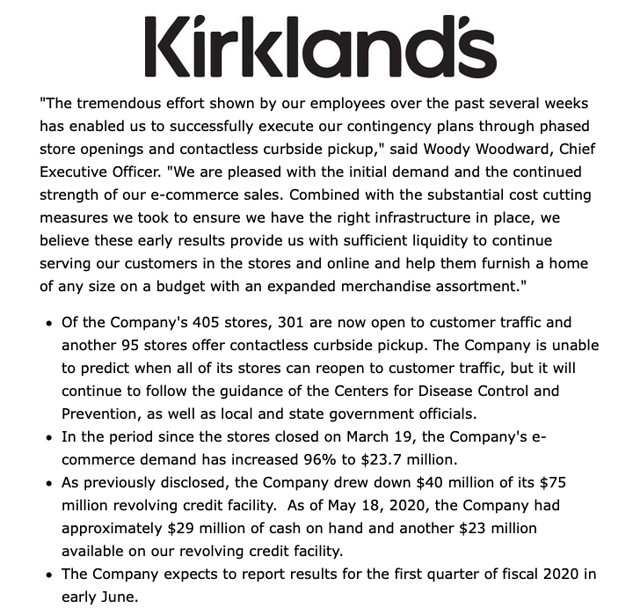

- On May 18, 2020, Kirkland's reported a business update. The big highlight was 96% e-commerce growth.

- Despite the costly two month forced shutdown due to COVID-19, KIRK has the wherewithal and liquidity to bounce back from this terrible event.

- CEO, Steve "Woody" Woodward has a great pedigree, as he was formerly Chief Merchant of Crate and Barrel. His entire reputation is on the line.

As my last public site article was on the topic of 'Dumpster Diving' (reference Whether To Give Up Dumpster Diving), given the reader interest on the topic, I write to discuss a good dumpster diving candidate. Today's candidate is Kirkland's Inc. (KIRK).

If we take a peek at Kirkland's five year chart, it clearly fits the criteria of down at least 90%. Also, the stock is trading well below its economic replacement cost (think of the amount of capital required to build out the store network, inventory, and e-commerce platform). Before Amazon (AMZN) became so ubiquitous, Wall Street decided to finance Wayfair Inc.'s (W) rapid growth and seemingly infinite losses, and The TJX Companies, Inc. (TJX) made its hard push for growth with its popular HomeGoods stores, Kirkland's once consistently had some net income power (note that I said net income and not Adjusted EBITDA power). However, after a poor Holiday 2019 campaign, KIRK's business momentum and stock price have been on life support.

Source: Fidelity

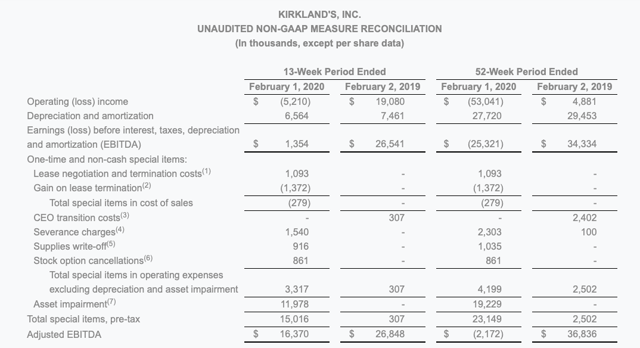

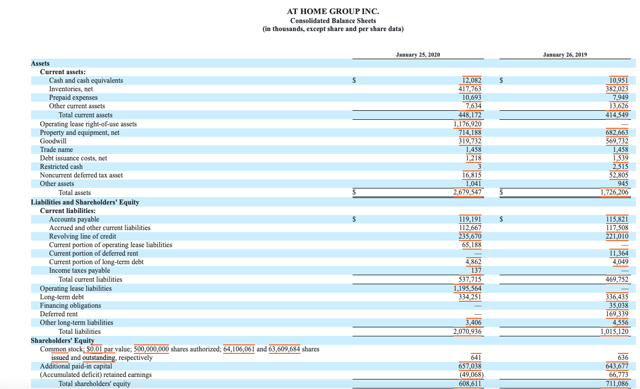

In the fifty two week period ending February 1, 2020, KIRK generated negative $2.2 million of Adjusted EBITDA and posted comparable same store sales of -7.1%. This marked a sharp decline from the prior year, when KIRK posted Adjusted EBITDA of $36.8 million and comparable same store sales of -1.3%.

TTM Results

- Q4 FY 2019: Adjusted EBITDA: $16.4 million vs. $26.8 million and comps down 2.7%

- Q3 FY 2019: Adjusted EBITDA: -$3.8 million vs. $4.8 million and comps down 6.4%

- Q2 FY 2019: Adjusted EBITDA: -$11.5 million vs. -$1.3 million and comps down 11.2%

- Q1 FY 2019: Adjusted EBITDA: - $3.6 million vs. $5.4 million and comps down 10.7%

May 22, 2020 (after-hours)

On May 18th, after the bell, Kirkland's provided a shareholder update.

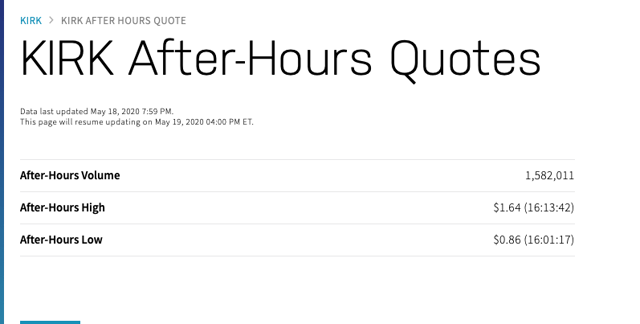

In after hours trading, on May 18th, shares of KIRK nearly doubled at one point and volume was robust at 1.58 million shares. For perspective, KIRK only has 14 million shares outstanding, as of its 10-K filing in mid March 2020.

Source: Nasdaq.com

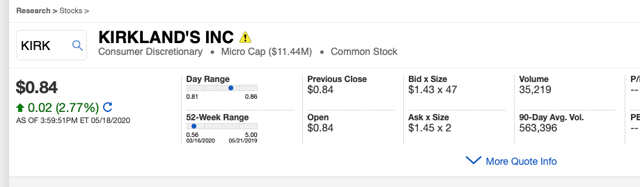

As I was tracking it, in early pre-market action, around 5am on May 19th, shares of KIRK were changing hands in the low $1.40s.

Source: Fidelity

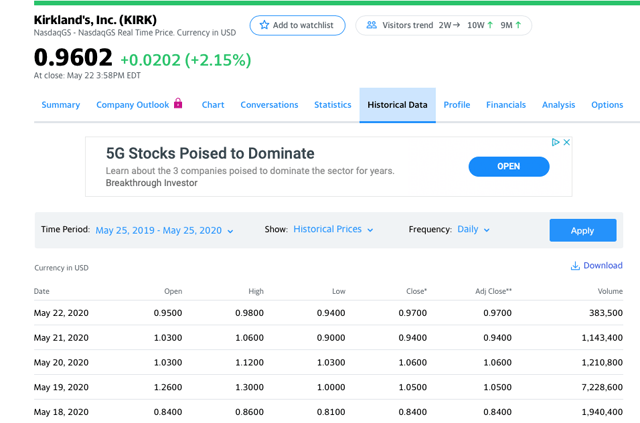

Incidentally, during the regular trading session, on May 18th, before the business update, shares of Kirkland's traded 1.94 million shares, more than 3X its 90 Day average volume. Moreover, the next day, the stock opened at $1.26 per share, and briefly hit $1.30, only to end the day on a weak note.

Source: Yahoo Finance

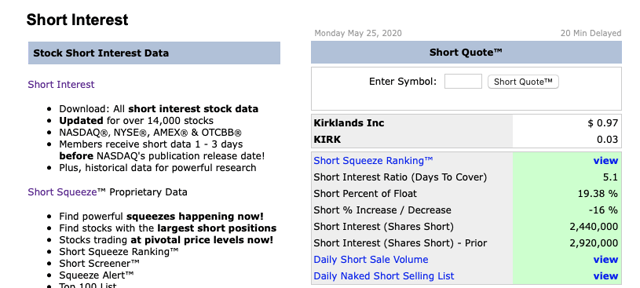

As I periodically check Stocktwits to gauge sentiment, it is clear that this stock is a day trader's delight. Notwithstanding the mysterious 3X trading volume ahead of the May 18th update, the fast (smart) money clearly sold on the news. Moreover, what makes this stock super volatile is its small market capitalization and relatively elevated short interest. As of April 30, 2020, there were 2.44 million shares of Kirkland's sold short (17.4% of its entire share count).

CEO, Steve "Woody" Woodward (former Chief Merchant of Crate and Barrel)

Given the poor trajectory of comps and Adjusted EBITDA, the only reason I am remotely interested trading shares of Kirkland's is because of CEO, Steve Woodward.

In September 2018, Kirkland's hired away Crate and Barrel's Chief Merchant, Steve Woodward. In retail, and in case some readers are unaware, the CEO, CFO, and Chief Merchant are the top three roles.

As I learned the hard way, even bringing on the best manager and/or team, turnaround takes 12 to 24 months (if they ever even happen).

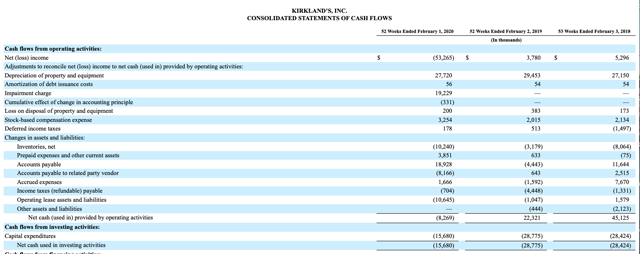

FY 2019 cash flow from operations was negative $8.3 million compared to positive $22.3 million. And if you include the $15.7 million of CAPEX, KIRK burned $24 million of cash.

Source: Kirkland's FY 2019 10-K

That said, Q4 FY 2020 did indicate there were some chances of an inflection point. Kirkland's ended its fiscal year 2020 with $30 million in cash and nothing drawn on its $75 million revolving credit facility.

As of the May 18th update, Kirkland's said the following: 75% of its stores are open, e-commerce sales were up 96% to $23.7 million, and the company had $29 million of cash and $52 million drawn on its revolver (see below).

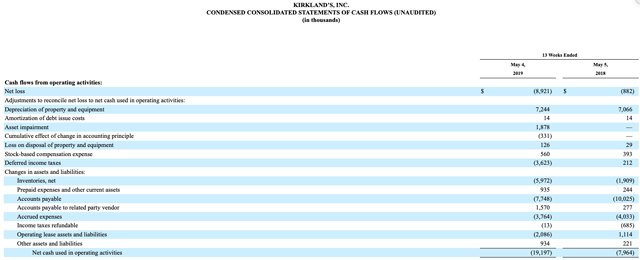

For perspective, and I am trying to isolate the seasonally higher working capital demands of the business from the end of Q4 to end of Q1. It looks like $10 million is a good number (as you have to net out the Q1 FY 2020 loss) as remember, for this exercise, we are only after working capital movements.

Per the May 18th update, with $29 million of cash and $52 million drawn on the revolver, that marks a $54 million swing from February 1, 2020 to May 17, 2020. Recall on February 1, 2020, they had $30 million of cash and no debt and now net debt is $24 million. Again, though, there are seasonal working capital fluctuations.

So on a pro-forma basis, KIRK's market capitalization (based $1.03 per share) is $14 million plus net debt of $24 million. So we are looking at an enterprise value of call it $38 million.

Now although KIRK's e-commerce sales were up 96% over a 8.5 week period, if KIRK's could maintain that torrid growth rate (and I doubt it as the stores are now reopened) that would translate into just shy of 25% of FY 2021 total sales.

That said, this is impressive growth and highlights Kirkland's has built a good e-commerce platform and there is inherent customer demand for its brand and shopping experience.

Here is the math (52 weeks / 8.5 weeks = a multiplier of 6.12). So 6.12 X $23.7 million equals $145 million. $145 million divided by $603 million (FY 2020 total revenue).

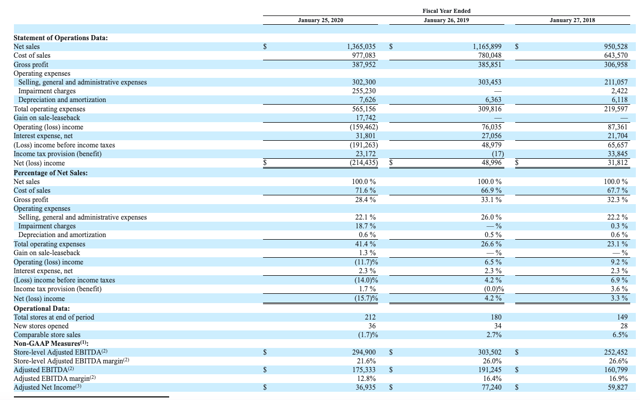

Although a bit apples to pineapples, look at how the market is valuing shares of At Home Group Inc. (HOME). In the fiscal year ending January 25, 2020, HOME generated $175 million of Adjusted EBITDA.

However, as of January 25, 2020, the company had negative working capital of negative $90 million, $235.7 million drawn on its revolver, and long-term debt of $334 million. Yesterday, shares of At Home closed at $5.10 per share x 64.2 million shares outstanding or a market capitalization of $327 million. Add in the debt of $660 million and we're talking about an EV of $987 million. At face value an EV/Adjusted EBITDA of 5.64X FY 2019 is fine. However, given the two month shutdown of most of the U.S., furloughs, and inherent losses, there is a very good chance HOME's debt waistline has expanded and we know its Adjusted EBITDA has shrunk. So given the debt load, why is Wall Street pricing in a sharp rebound and recovery in HOME shares, but not for KIRK?

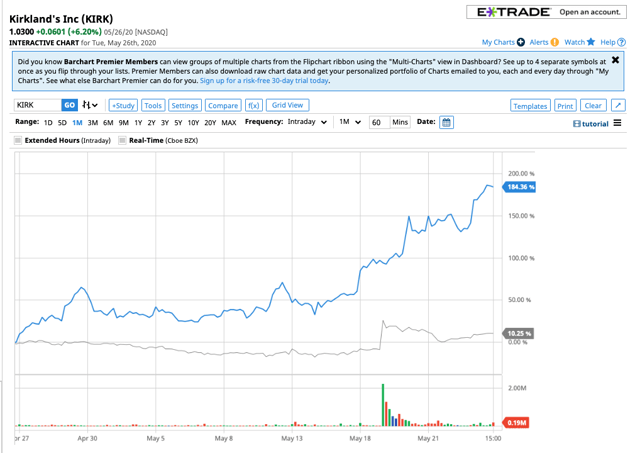

For example, over the past month, shares of HOME are up 184% whereas KIRK shares are up 10%.

Source: Barchart.com

Takeaway

As cathartic as it would be to 'quit' dumpster diving, as a deep value investor, this is in my DNA. That said, and going forward, I am refining my 'dumpster diving' process and dialing down my sizing on the more binary bets.

I would argue that Kirkland's is an excellent dumpster diving candidate, at least at $1.03 per share. With the U.S. economy opening back up, there seems to be some pent up demand for U.S. shoppers (as working hard and playing hard is in many American's DNA) to get back out there. Being confined to our residences has made many of us stir crazy. Given the fact that Steve Woodward's entire business reputation is on the line, I'm sure he is leaving it all on the field.

Second Wind Capital is a catalyst driven/ trading oriented service with an underpinning tied to value and out of favor sectors. The hold period can range from a few days to up to six months (sometimes longer if my conviction level for a particular thesis is elevated and fundamentally and tangibly intact). Risk management perimeters will be set based on position sizing and/or stop losses. No one bats a thousand, so if you can get it right 51% of the time and you manage your risk, you will generate out-sized returns. Join now with a 2 week free trial and follow my real-time porfolio.

Disclosure: I am/we are long KIRK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.