Sea Limited: Skeletons In The Closet

by Karol HochschornerSummary

- SE is inflating revenue.

- SE is selling goods for a negative gross margin.

- The maximum potential value is $59.8/share.

Investment thesis

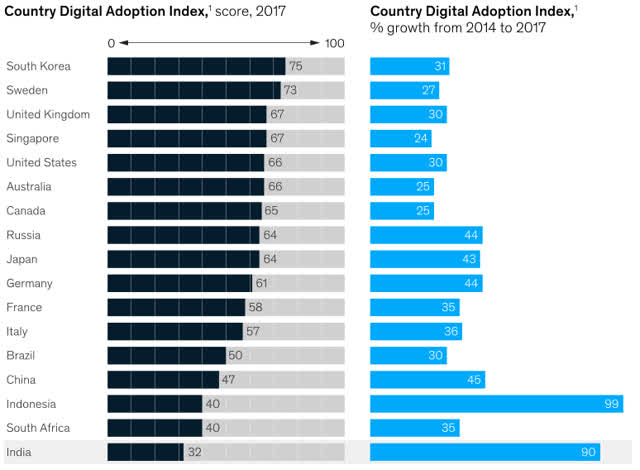

Sea Limited (SE) is a high growth company selling for a fair P/S multiple but with many risks. The company is operating in fast-growing emerging markets (mostly in south-east Asia and Latin America) with many tailwinds behind its back. GDP is growing more than 4% p.a. and growing internet adoption. Indonesia and India are on the bottom of the Digital Adoption Index but both countries are among the fastest growers.

Source: McKinsey

In this report, I will write about the SE business model and about the risks.

Business model

SE has four segments:

- Digital Entertainment: SE is the market leader in PC and mobile games in its markets. The company makes own games (e.g. Free Fire) and licenses games from other producers (E.g. League of Legends).

- E-commerce marketplace: like Alibaba (NYSE:BABA) marketplace. SE monetizes it by charging commission out of GMV, selling advertising and other value-added services.

- Sales of goods: SE is also selling some goods directly to customers competing with other sellers on its platform.

- Digital Financial Services: payment processing services and offers other financial products to its customers.

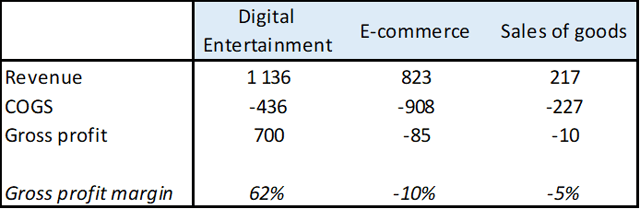

SE strategy is to grow market share, gain a dominant position, and start monetizing later. Revenue is growing 100%+ but at a high cost. SE is operating the E-commerce marketplace and is selling goods directly to customers at a negative gross profit margin. No wonder that customers are buying goods from SE when it is cheaper to buy from SE than from the producer.

Source: 20-F report

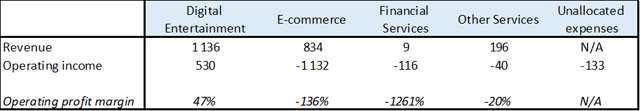

The next table has more segments in it because SE discloses more information. Financial services generate just $9M in revenue (and it is declining yoy), so I will not mention this segment anymore. The main segments are mentioned in Table 1.

SE operates E-commerce at a negative 136% operating profit margin.

Source: 20-F report

SE is operating its E-commerce marketplace in many countries basically for free to gain market share. The plan is to monetize it later. SE can to this for the foreseeable future because it has a lot of cash from its very profitable Digital Entertainment division and because it generates a lot of deferred revenue. Customers pay in front, but because of accounting rules, SE cannot book the revenue immediately. E.g. SE books revenue from a player buying an item in a game proportionally based on the useful life of the item.

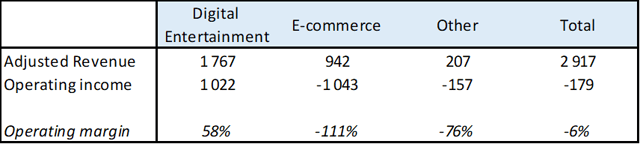

After adjusting for the deferred revenue, the total cash burn does not look that scary. SE had an operating income of negative $179 million in 2019.

Source: company's presentation

The big question is how marketplace users will react when SE starts charging commissions. If SE can monetize the users, the same way as Alibaba or Pinduoduo (PDD), then it has a very valuable business. BABA has a take rate of 3.6% and PDD has 3% with an 80% gross profit margin.

SE had LTM GMV from the marketplace of $19.999B which would mean gross profit from e-commerce of $480-576 million. SE claims it has a 4.8% take rate, but I think the number is inflated, and I will talk about that in the risk section.

Risks

Concentrated revenue: Top five games contributed 94.5% of the digital entertainment revenue and probably all of the company's gross profit.

Financial services segment: SE claims it has three segments and one of them is the payment processing business. But revenue from payment processing is declining, and in 2018, SE even stopped disclosing gross transaction value.

Inflated revenue from e-commerce: SE claims it has 4.8% take rate (LTM e-commerce revenue of $959M/LTM marketplace GMV of $19,999M) but with a negative gross margin. This does not make sense because platform e-commerce companies have a high gross margin. The only explanation is that SE also counts transportation costs as revenue. SE does not directly disclose this. It claims that it monetizes e-commerce "by offering sellers paid advertisement services, charging transaction based-fees, and charging sellers for certain value-added services." But, in costs of revenue, SE states:

Our cost of revenue for e-commerce services primarily consists of bank transaction fees for transactions conducted through our Shopee platform, service fees paid to third party logistics service providers, server and hosting costs, staff compensation and welfare costs, which include share-based compensation, and other miscellaneous costs."

The transportation costs are passed through to third-party logistics service providers and should be deducted from revenue. E.g. PDD does not count transportation costs which are passed through to third party logistic companies as revenue. Another example is Farfetch (FTCH) which counts transportation costs in revenue and also discloses net revenue just from its marketplace.

I have adjusted the 2019 income statement for transportation costs. This calculation is not based on any confirmed information and is entirely made up by me.

*I have decreased revenue to $200M because I believe SE is monetizing the segment to some degree, so not all revenue should be deducted. I have no idea what the right revenue should be, so this is just my wild guess.

**Marketplace platforms have high fixed costs; so, for the first $200M revenue, I guess SE has a 0% margin. Later when revenue grows, SE can achieve the economy of scale and an 80% gross margin.

Valuation

I used sum of the part valuation method.

Digital Entertainment: The gaming companies are valued between 5 and 10 sales multiple. I have used multiple of 10 because SE has above-average revenue growth. Value is $13.3B.

E-commerce marketplace: It is difficult to value the marketplace because SE is not fully monetizing this segment. If SE could monetize the marketplace the same way as PDD or BABA, then SE would have $600-720M in revenue. The maximum sales multiple I would value it is 20 which would give us a value of $12-14.4B

Sales of goods: SE is selling goods for negative gross margin, so I have put $0 value on this segment.

Financial services: revenue from this segment is declining and SE stopped disclosing GTV. This segment has also low valuation. I have put $0 value for this segment.

SE combined value is between $25.3B and $27.7B which is $54.7-59.8 per share. I would like to add that this calculation is based on the SE potential to monetize the e-commerce segment. It is not clear if SE would lose customers after it will fully monetize the platform. The goal of this calculation was to give maximum potential value to SE based on the most optimistic scenario.

Conclusion

SE is run for the long term. Management, clearly, wants to gain market share and monetize it later. I believe they are doing a good job. SE is not aggressively burning cash. On the other hand, the shares are overvalued for $79/share. I would certainly not short this company because one day it might dominate the south-east Asia region and be very profitable. But I would also not go long as I believe the risk-reward ratio is not in my favor.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.