GBP/USD bears seeking a close below 50-D EMA, Brexit talks loom

by Ross J Burland- GBP/USD is holding in short term bullish territory above a 500-D EMA.

- Brexit, Hong Kong and Boe are all bearish fundamentals.

GBP/USD is currently trading at 1.2247 and lower on the day so far. The US dollar has picked up a safe-haven bid as geopolitics heats up. Cable has travelled from a high of 1.2354 to a low of 1.2204 and this trend, from both a technical and fundamental standpoint, could just be getting started.

In yesterday's news, (GBP/USD: Bulls rocket to critical resistance area, pause for thought), it was explained that Brexit is back to the fore ahead of talks getting underway at the start of June, next week. The pound rallied hard on signs that the EU might just be caving on their hard stance which could equate to concessions from the bloc on its "maximalist" fisheries demands. One of Mr Barnier's senior aides welcomed the possibility that a halfway house could be found between the UK and EU’s positions.

Markets are of the mind that this is a sign of things to come and how the UK and EU could well find some middle ground, even on the larger and more important negotiations. This, coupled with an opinion in markets that negative rates may not realise had helped to lift sterling out of the doldrums withing a broadly risk positive market environment.

However, we are some time away from the next Bank of England policy meeting on the 18th June and there is still plenty of time between now and then to see another splash of 'negative' Brexit headlines from the last remaining round of talks scheduled to take place on June 1.

A bearish case for GBP

Despite the recent optimism, one can't get away from the point that the last talks were referred to by EU Chief negotiator Barnier as ‘disappointing, very disappointing’. Moreover, we should note how the UK government is maintaining its threat to walk away from negotiations if the EU does not concede more ground. Given that the UK also continues to refuse to contemplate a request to extend the transition phase beyond the end of this year, a hard Brexit is still very much a higher probability at this juncture.

When you couple the domestic politics with global geopolitics and the wider macro picture, it is a recipe for a strong USD, even if just one risk factor crystalises, set to rick the foundations of global financial markets. It is, therefore, no wonder then that cable, especially when chatted up and analysed on a technical basis, was unable to exceed the highs of yesterday in the face of the Hong Kong risks, trade wars as well as the Brexit talks next week.

The big news today has been with the Secretary of State Mike Pompeo saying that he has certified to Congress that Hong Kong is no longer autonomous from China and does not warrant special treatment under US law.

GBP/USD levels

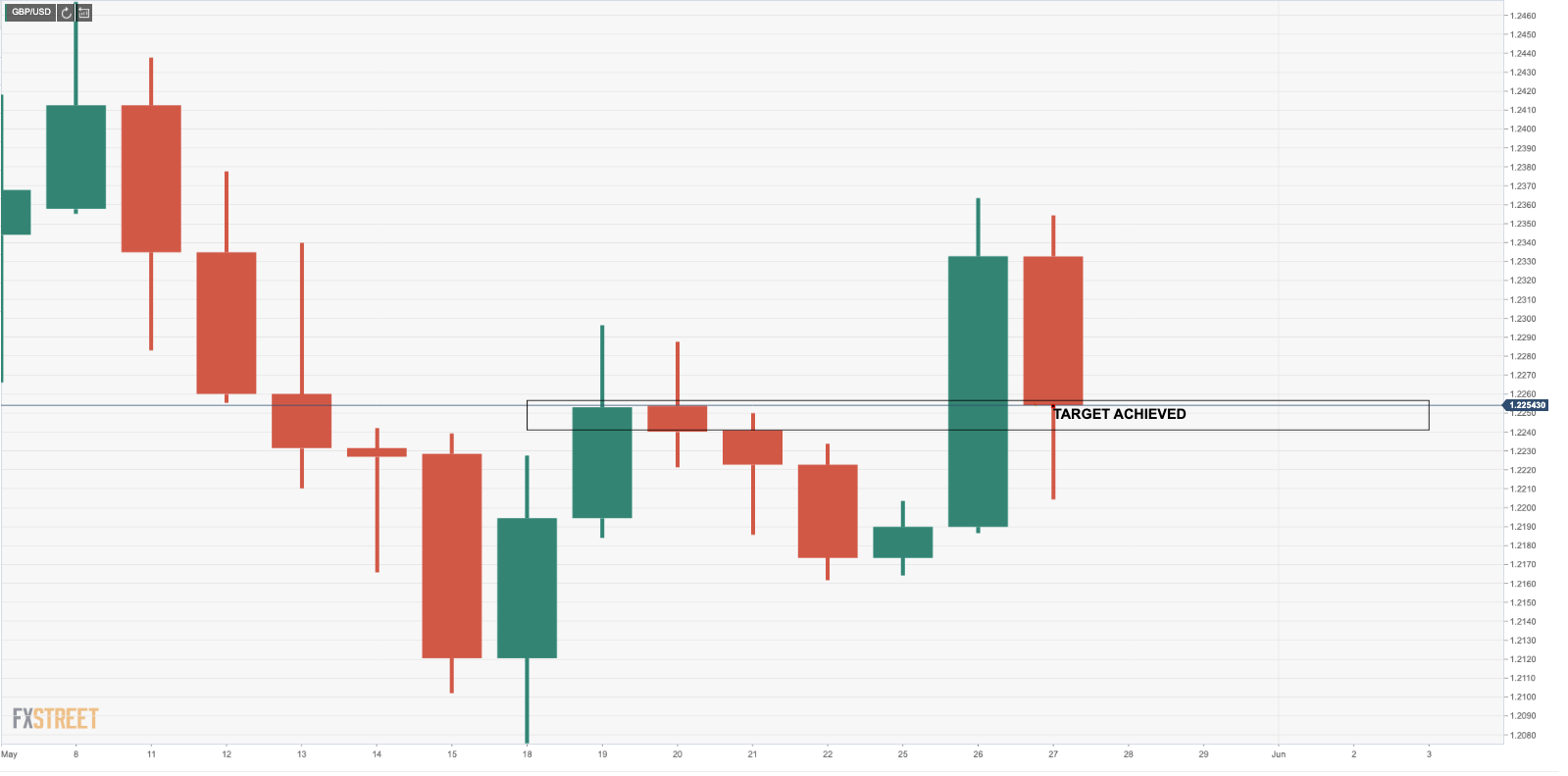

As per yesterday analysis:

GBP/USD: Bulls rocket to critical resistance area, pause for thought

We have seen that trade plan out precisely:

At this juncture, with the looming BoE meeting mid-June, further support in the form of additional quantitative easing over coming weeks should help to keep a lid on the pair. But it will be all about Brexit before then. Unless something extraordinarily positive comes of the talks and subsequent headlines, rallies are seen as selling opportunity with downside risk towards a GBP/USD 1.19 target.

"A drop below 1.1935 is needed to refocus attention on 1.1491, 2016 low, and also on the March low at 1.1409. Fibonacci support en route is found at 1.1883 and at 1.1675," analysts at Commerzbank argued. -On the flip side, however, should bulls hold above the lows printed today, (a 50-D EMA confluence) and subsequently maintain form above the 50% retracement of the March-to-April advance at 1.2030, then there remains a short-term technical bias to the upside.