US Dollar Index Asia Price Forecast: DXY is bouncing from monthly lows

by Flavio Tosti- US Dollar Index (DXY) rebounds from the May’s lows.

- Strong support is seen in the 99.00/98.80 price zone.

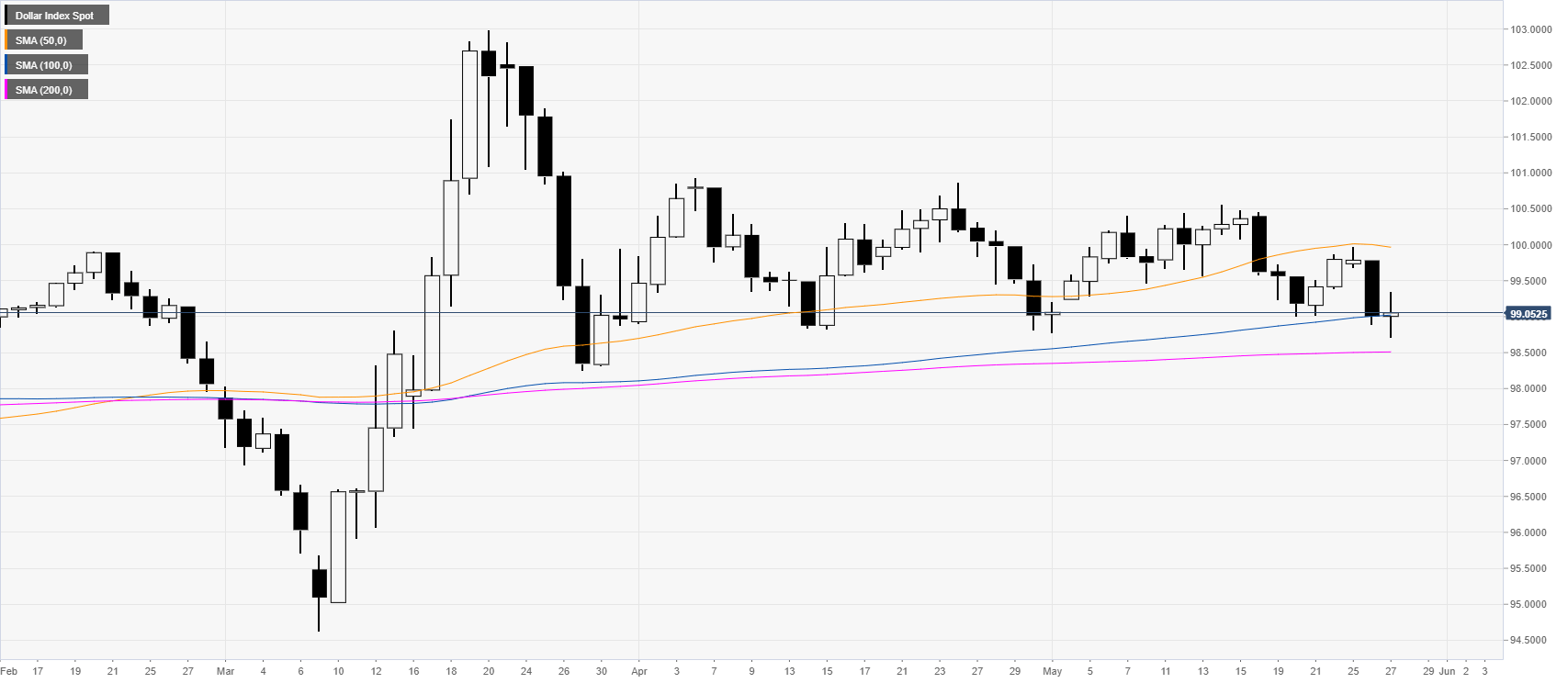

DXY daily chart

The US Dollar Index (DXY) is finding some solid support near the monthly lows close to the 99.00 level and the 100 SMA on the daily chart. However, the risk appetite mood on Wall Street is diminishing the demand for the greenback.

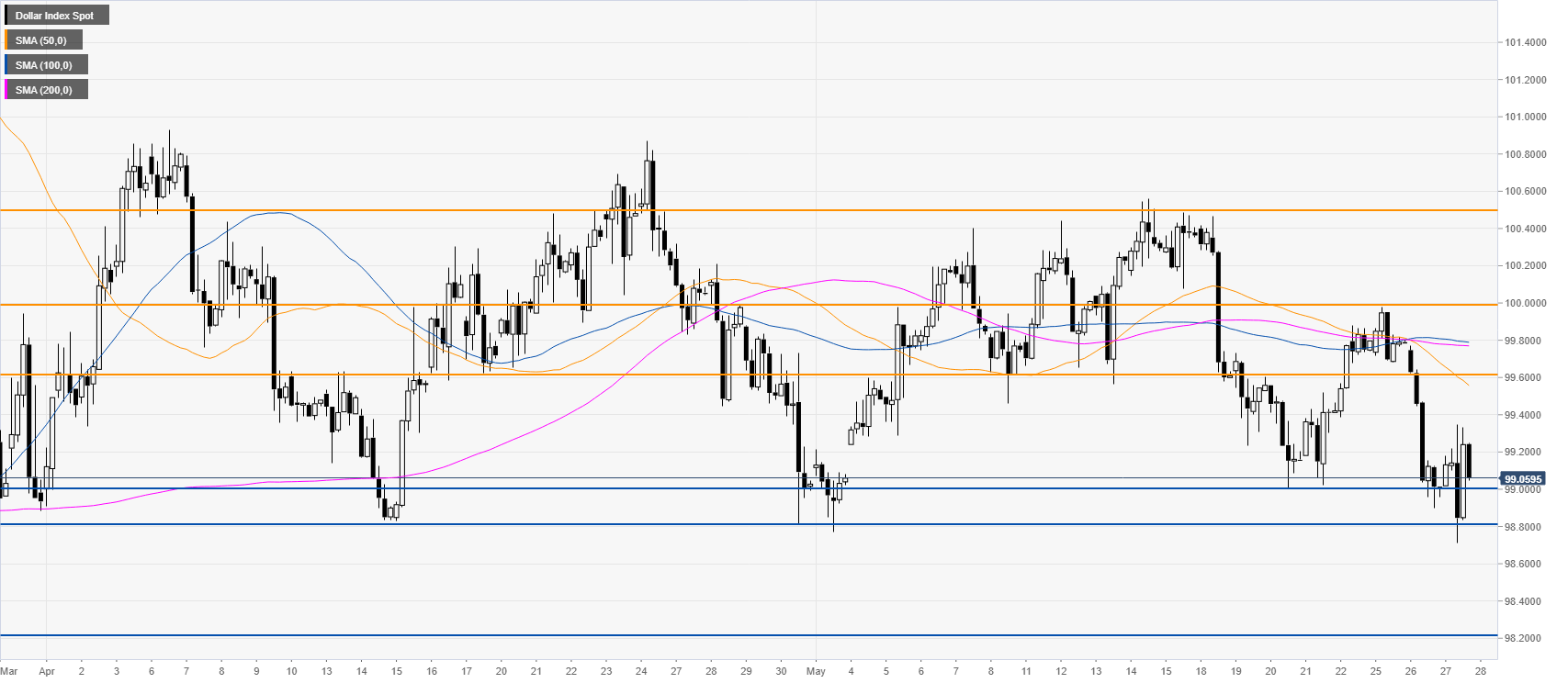

DXY four-hour chart

DXY is rebounding from the May’s lows while trading below the main SMAs on the four-hour chart. Buyers are attempting to support the market in the 99.00/98.80 price zone as it has been solid support in the last few months. On the flip side, a convincing break below the mentioned levels can yield an extension down to the 98.20/98.00 support zone.

Additional key levels

Dollar Index Spot

| Overview | |

|---|---|

| Today last price | 99.05 |

| Today Daily Change | 0.05 |

| Today Daily Change % | 0.05 |

| Today daily open | 99 |

| Trends | |

|---|---|

| Daily SMA20 | 99.71 |

| Daily SMA50 | 100 |

| Daily SMA100 | 99 |

| Daily SMA200 | 98.51 |

| Levels | |

|---|---|

| Previous Daily High | 99.78 |

| Previous Daily Low | 98.9 |

| Previous Weekly High | 100.47 |

| Previous Weekly Low | 99 |

| Previous Monthly High | 100.93 |

| Previous Monthly Low | 98.81 |

| Daily Fibonacci 38.2% | 99.24 |

| Daily Fibonacci 61.8% | 99.45 |

| Daily Pivot Point S1 | 98.67 |

| Daily Pivot Point S2 | 98.34 |

| Daily Pivot Point S3 | 97.78 |

| Daily Pivot Point R1 | 99.56 |

| Daily Pivot Point R2 | 100.12 |

| Daily Pivot Point R3 | 100.45 |