Ackman dumps stake in Buffett’s Berkshire Hathaway

Hedge fund manager says he can be ‘more nimble’ than his mentor’s conglomerate

by Ortenca AliajBill Ackman has sold his stake in Berkshire Hathaway, he disclosed on Wednesday, saying his hedge fund can seize on opportunities in the market faster than Warren Buffett’s sprawling conglomerate.

“The one advantage we have versus Berkshire is relative scale,” Mr Ackman said on a quarterly call with investors in his hedge fund, Pershing Square. “We can be much more nimble.”

The holding was worth $1bn at the end of March, out of Pershing’s nearly $10bn in assets under management.

The Berkshire sale comes less than a year after Pershing first bought the stake and just weeks after Mr Ackman increased it, declaring that the company was “built by Warren Buffett to withstand a global economic shock like this one”.

Mr Ackman has long considered the 89-year-old Mr Buffett a mentor, adding particular interest to Pershing Square’s decisions to buy and sell.

Many investors, including Mr Ackman, had expected Berkshire to seize on the market rout to make bold investments at depressed prices — much like it did in the 2008 financial crisis — after years in which Mr Buffett has complained about high valuations.

Instead, Berkshire’s cash pile swelled to a record $137bn at the end of March and Mr Buffett has not made any large acquisitions.

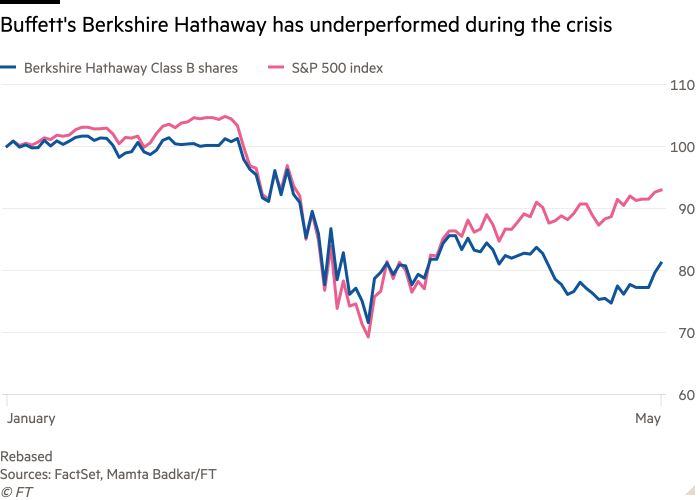

Berkshire’s investment portfolio has also been hammered by the sharp sell-off in global stock markets, causing the company to report a $49.7bn loss in the first three months of the year.

The stock market rout in March provided Mr Ackman a $2.6bn gain from hedges he took out earlier in the year, when he bet that the creditworthiness of companies would be severely hit by the pandemic.

While Mr Buffett has stood mainly on the sidelines, Mr Ackman has ploughed his funds back into the stock market.

This included adding to stakes in hotel group Hilton Worldwide Holdings and property group Howard Hughes Corporation, as well as initially increasing the Berkshire stake by 40 per cent. Pershing Square also bought back into Starbucks.

Recommended

Bill Ackman

Inside Bill Ackman’s $2.6bn big short

Mr Ackman said on Wednesday that he had reduced some of his exposure since then, also exiting small investments in the private equity firm Blackstone and Parks Hotels & Resorts.

Largely thanks to its successful hedge, Pershing Square is up 22 per cent so far this year, net of fees, while the S&P 500 index is down 7 per cent.

In the call with investors, Mr Ackman added that the recent rebound in the S&P 500 did not reflect what was occurring under the surface. Big technology firms such as Amazon and Facebook, which are heavily weighted in the index, have buoyed its levels but the majority of stocks remained still substantially down, he noted.