Buy Realty Income Now, Or Regret It Later

by Robert & Sam KovacsSummary

- Realty Income is by far one of the best managed REITs that exist.

- They are the dividend investors dream company. They also now yield 5.36%.

- The market has unjustly punished Realty Income, dividend investors should capitalize on the current opportunity.

Written by Robert Kovacs

Introduction

Let me break this down for you: there is no reason a stock like Realty Income (O) should yield 5.36%. O is one of the best-managed REITs ever. If they go bust, most likely all retail REITs will have gone bust before them.

Source: Open Domain

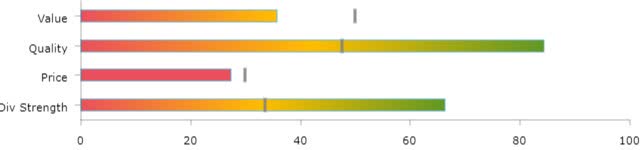

Our MAD Scores give O a Dividend Strength score of 66 and a Stock Strength score of 71. As you can imagine from the sentences above, I believe buying O around its current price of $52 makes perfect sense.

Source: mad-dividends.com

Keep in mind that we are committed to being net purchasers of stocks throughout all markets, as our belief in top companies to continue generating value for their shareholders and clients throughout the upcoming decades is unshakeable. That is, we are net buyers, provided we can find good purchasing opportunities. In my experience, there is always at least one good opportunity for dividend investors.

In this article, I will walk you through O's dividend profile before considering its potential for market-beating potential in upcoming quarters.

Dividend Strength

Our concept of dividend strength encapsulates both dividend safety and dividend potential - defined as the combination of dividend yield and dividend growth potential - to identify stocks that are likely good picks for dividend investors. The Dividend Strength score - the details of which can be found here - is used primarily for screening purposes. We then look in detail at the underlying ratios which make up the score.

Dividend Safety

Realty Income Corporation has an earnings payout ratio of 188%. This makes O's payout ratio better than 10% of dividend stocks.

O pays 70% of its operating cash flow as a dividend, which is better than 15% of dividend stocks.

However, as all REIT investors know, earnings payout ratio doesn't make much sense for the sector. It is better to look at funds from operations or adjusted funds from operation. We believe operating cash flow is also a good measure.

O's AFFO payout ratio is 80%, a reasonable amount by all accounts.

| 31/03/2016 | 31/03/2017 | 31/03/2018 | 31/03/2019 | 31/03/2020 | |

| Dividends | $2.3100 | $2.44 | $2.56 | $2.66 | $2.74 |

| Net Income | $1.07 | $1.15 | $1.12 | $1.34 | $1.45 |

| Payout Ratio | 216% | 212% | 228% | 198% | 188% |

| Cash From Operations | $2.83 | $3.33 | $3.01 | $3.09 | $3.88 |

| Payout Ratio | 82% | 73% | 85% | 86% | 70% |

| AFFO per share | $2.76 | $2.94 | $3.08 | $3.22 | $3.39 |

| Payout Ratio | 83% | 82% | 83% | 82% | 80% |

Source: mad-dividends.com

Looking at CFO and AFFO payout ratios for O tells us that the dividend is well covered. If anything, this shows prudent management, as both CFO and AFFO have been growing at the same rate as the dividend over the past 5 years.

O has an interest coverage ratio of 2.62x which is better than 38% of stocks. This level of coverage while not excessively high is above the industry median and, as such, should be considered satisfactory.

Realty Income's management is super committed to paying its dividends, and I don't believe the payment is going anywhere. Like management said in the latest earnings call:

In summary, our balance sheet is in great shape. And we continue to have low leverage, strong coverage metrics and ample liquidity. In March we increased the dividend for the 106th time in our company's history. We have increased our dividend every year since the company's listing in 1994, growing the dividends at a compound average annual rate of approximately 4.5%. And we are proud to be one of only three REITs in the S&P 500 Dividend Aristocrats Index for having increased our dividend every year for the last 26 consecutive years.

When pressed by analysts in the Q&A, the answer was very convincing:

We have 20%off of room within our business model to help support the dividends that we have in place. Yes, it is our brand. We are the monthly dividend company. It is very much part and parcel of how we operate our business. It is our mission. And so, this is one of those tools that we certainly have available to us, we manage liquidity.

Rest assured, O's dividends aren't going anywhere. Their mission is to deliver growing dividends, they define themselves that way and will go the stretch to ensure it gets paid.

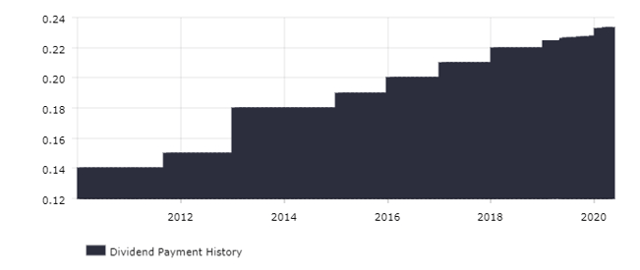

Dividend Potential

Realty Income Corporation has a dividend yield of 5.36% which is higher than 74% of dividend stocks. It is also considerably higher than O's historical dividend yield. During the past 10 years, the stock has had a median yield of 4.69%. In fact, at the end of 90% of trading days in the last decade, O closed with a yield below its current yield.

Source: mad-dividends.com

The dividend grew 3.1% during the last 12 months which is slightly lower than the company's 5-year average dividend growth of 4%.

With a yield as high as 5.36%, you only need the dividend to grow around inflation to get a satisfactory return. I believe Realty Income definitely has the long-term potential to increase by 2%.

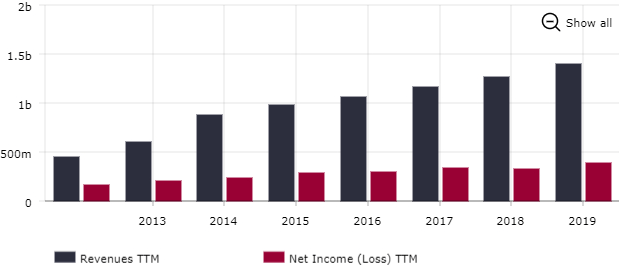

Source: mad-dividends.com

After all, during the last 3 years, the company's revenues have grown at an 11% CAGR, while net income has grown at a 12% CAGR.

Source: mad-dividends.com

Sure business is under pressure now, but O has a big enough buffer to maintain its dividend, and when it comes to it, there aren't many businesses that are run this well. Fellow SA authors William Equity Research wrote a fantastic article (hats off guys) looking at the potential shortfall of revenue from O's customers.

The article claims that "Under the pessimistic scenario detailed above, Realty Income generates 86.6% of 2019's rent."

This would be enough to continue paying the dividend this year. Without a doubt, management will squeeze in a token increase to be able to keep the streak alive. If you still believe retail will exist 20 years from now, you can only believe that Realty Income will still be paying a growing dividend.

Dividend Summary

O has a dividend strength score of 66/100. Sectors that inherently have a lot of operational or financial leverage get penalized in our scoring system. This is the case for utilities as it is for REITs. We are considering adjustments that we can make without introducing bias.

O has great dividend potential. The current price is super attractive. If you're a dividend investor, you'll regret not buying Realty Income at the current prices.

Stock Strength

Realty Income is the dividend stock that all dividend investors want in their portfolio. At the current prices, you get to own it at an amazing price. But what do our fundamental factors - value, momentum, and quality - tell us about the stock price's prospects in upcoming quarters? To understand how our Stock Strength score is calculated you can read this blog post.

Value

- O has a P/E of 35.97x (15x AFFO)

- P/S of 11.54x

- P/CFO of 13.42x

- Dividend yield of 5.36%

- Buyback yield of -13.03%

- Shareholder yield of -7.66%.

According to these values, O is more undervalued than 36% of stocks, which doesn't look great on the surface, but it might not be as bad as it seems.

The PE ratio is a bad metric to use for REITs. Looking at the multiple of AFFO gives a much more reasonable ratio of 15x. The Price to CFO is also reasonable given the stability and quality of this triple net REIT's tenants.

The negative buyback yield suggests a large stock offering happened in the past few months. This is the case: in February, O floated an extra 9mn shares, to refund debt with any leftover to go towards funding new projects.

While the market initially reacted negatively then, the timing of the shares emission couldn't be better. What is the first lesson of investing? Buy low and sell high. Stocks were being applauded for buying back shares when the prices were high and being scolded for issuing more equity? While diluting existing shareholders is never appreciated when you look at purely cash flow management and the way O runs its business, we are starting to appreciate that the move was extremely timely.

Source: mad-dividends.com

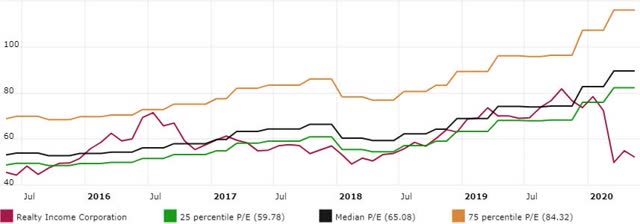

Now, PE isn't a good metric for REITs, but if we use the median multiple at which the stock trades as a proxy for valuation, we can see that the current PE of 35x is way below the 10-year median PE of 65.

Although the valuation metrics might make you believe that O is expensive, this is a classic case of where the numbers can be misleading.

I believe O shouldn't have declined 40%. The scare which infected all retail REITs brought it down with the rest. They say the way up is an escalator and the way down is an elevator.

On the other hand, I would never have bought O when it yielded 3%. Below 4.5% I would have never considered it because I wouldn't have been comfortable forgiving the potential income for the perceived safety. Of course, this will change depending on your situation and wealth. If you are wealthier, you can afford to be in safe lower yield positions.

If you're opportunistic, you wait for the safe stocks to be mispriced. I believe this is the case currently. Think about it, 9/10 times in the past decade, O yielded more than it currently does.

Value Score: 36/100

Momentum

Realty Income Corporation trades at $52.15 and is down -36.74% these last 3 months, -31.58% these last 6 months, and -25.20% these last 12 months.

Source: mad-dividends.com

This gives it better momentum than 27% of stocks, which places it among market laggards. The REIT sector has a median momentum score of 29/100, which means that O's momentum is actually worse than its sector. Can you believe it? Sure O will be hit, but it will weather the hit. The market is dead wrong about O, and I'm putting my money where my mouth is.

The yield spiked above 6% in the spur of the moment, before the price stabilized. The market has left O out to hang dry.

We live at a time where I'm disagreeing with the market a lot more than often. Many stocks which should have dropped a lot more haven't. Those which are strong and should have held up better haven't.

There is a disconnect between the economy and stock market prices. There is no doubt about this. We might be in for equities going down at a devastating rate. I really do not know. What I do know is that some companies will continue to make enough money to pay their dividends and prosper. Some of those are offered at fantastic prices, and investors should pay attention and make the most of those opportunities. Realty Income is such an opportunity.

Momentum score: 27/100

Quality

Subpar momentum, and a low value score. But O has one more factor on which it can do well: quality. And this is where O really shines. O has a gearing ratio of 0.8, which is better than 71% of stocks. The company's liabilities have increased by 8% over the course of the last 12 months. The company's operating cash flow can cover 15.9% of liabilities, nearly double the sector median. Each dollar of assets generates $0.08 in revenue, but this translates into a 4.55% return on equity. O has a Total Accruals to Assets ratio of -25.1%, which is better than 91% of companies. Its interest coverage ratio of 2.6x, while not breathtaking is also much better than the sector. This makes O's quality better than 84% of stocks. REITs usually have a hard time scoring well on the quality score. Not O. O has superior quality, a pristine balance sheet, which makes it perfectly equipped to deal with the downturn.

Quality Score: 84/100

Stock Strength Summary

When combining the different factors of the stocks profile, we get a stock strength score of 71 / 100 which is pulled up and above by its fantastic quality score. The momentum suggests it will take the market a while to turn around. The valuation numbers need to be unpacked for the average investor to clearly see the picture. These will likely hold the stock back during upcoming months. However, I believe most downside has now been priced. A worst-case scenario would be an extra decrease of 15-20% if the sector tanks even more than it already has. However, O will prevail, the business will survive, as will the dividend. In a few years, we'll look back at this, and I believe dividend investors who didn't buy when it yielded more than 5% will regret it.

Conclusion

With a dividend strength score of 66 & a stock strength of 71, Realty Income Corporation is a great addition for dividend investors. We've been adding shares to our portfolios, and will likely increase its position in our model "All Weather Dividend Portfolio".

Want more dividend articles like these? Then hit the orange "follow" button at the top of the page, so that we can let you know when we publish our next article on Seeking Alpha.

Disclosure: I am/we are long O. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.