Elbit Systems Firing On All Cylinders

by Harold GoldmeierSummary

- The military defense industry is one of the essential industries during crises but Elbit's sentiment and fundamentals are strong offering a safe investment especially at a little lower price.

- Elbit's sales are inextricably linked to the US and Israel markets but despite the skyrocketing national deficits, the military budgets appear sacrosanct.

- Elbit missing analysts' estimates might cause the share price to drop but that will be a buying opportunity for retail value investors.

I previously recommended the military defense industry to retail value investors when I delineated my rules for crisis management investing. The need for food and military defense is a constant and there are opportunities for making money and safeguarding cash on hand buying into these essential industries.

Elbit Is A Feisty Player In A War-Worried World

Israel-based Elbit Systems Ltd. (NASDAQ: ESLT) is not a market influencer comparable to General Dynamics (NYSE: GD) about which I have previously written. But Elbit is a feisty, scrappy, and sustainable company with strong fundamentals. GD has a market cap 6x larger than ESLT, though ESLT shares are selling for at about the same price (~$138).

I believe ESLT's share price in the immediate future will drop because earnings and revenues reportedly miss Q1’20 analysts' estimates despite actual increases. The positive sentiment for Elbit is not misplaced and the shares will recoup in the near term. In the meantime, any drop in share price presents a buying opportunity.

One extrinsic concern is that the US and Israel will nibble at their military budgets to stem skyrocketing national deficits from the costs of the pandemic. The novel coronavirus continues to rampage. No vaccine. No cure. Legal and social pressures on politicians to end lockdowns. Too many knuckleheads refusing to comply with CDC guidelines to wear masks and maintain social distancing, avoid bars, social gatherings, and recreational venues, all combine to suggest to anyone with common sense we are closer to February 2020 conditions than to those in February 2019. There are only two humongous sources of money in national budgets: the social safety net and the military. Countervailing is the economic and political pressures on both the US and Israel are the sabers are rattling in the Middle East and the Far East.

Tensions between the US and Iran are flaring. War looms again with talk of Israel’s annexation of the West Bank. Iran, Turkey, Syria, and Israel are jockeying for that sweet-spot military edge. Cyberwarfare is already underway. The pressure is on all players for hi-tech tactical weaponry dominance. These tensions make increased military spending more likely and better buying opportunities for investors in companies like Elbit.

Elbit's commercial, military defense, and homeland security systems are sold worldwide including:

• military aircraft and helicopter systems• commercial aviation systems and aerostructures• unmanned aircraft systems and unmanned surface vessels• electro-optic, night vision, and countermeasures systems• land vehicle systems• munitions• command, control, communications, computer, intelligence, surveillance and reconnaissance (C4ISR) and cyber systems• electronic warfare and signal intelligence systems• other commercial activities.

Source Elbit Systems

Elbit Offers Stability And Sustainability

Elbit’s stability and sustainability are reflected in the lengthy service of most managers and board members including Chairman Michael Federmann. He is in service for almost two decades. Since 2002, Federmann is Chair and CEO of Federmann Enterprises Ltd. (FEL), a privately-owned Israeli company. FEL, directly and through subsidiaries, holds a diversified portfolio of investments, including ownership of approximately 45% of Elbit’s outstanding shares. The CEO is in office for more than six years overseeing more than 17,000 employees. The average management tenure touches nearly a decade showing stability and experience in a competitive and rapidly-changing business.

In recent news, Charlesbank Capital Partners announced an investment of $70M in the Elbit subsidiary Cyberbit Ltd. Cyberbit trains cybersecurity teams in commercial training systems. Other subsidiaries are IMI Systems, a weapons manufacturer; EFW focuses on military electronics; Elsira builds advanced electronic defense systems; Kollsman manufactures semi-conductors, avionics, and electric-optic systems; and Opgal is in optronics.

An example of their hands-on management, the company responded in April to C-19 by fast-tracking production of LifeCan Medical smart, automatic ventilation machines, ventilators, drones, or aerospace products, Israel tries to make it at home. Elbit personifies this mission: "To reach a fully independent (Israel-based) production capability supplying thousands of ventilators to Israel’s health system” by leveraging the defense industry into quantity production in record time. Of course, a (ret.) Brig. General is in charge of the project.

By May 15, enough LifeCan ventilators were being produced for a trade deal announcement between Elbit Systems Land and Medigus Ltd. (NASDAQ: MDGS). MDGS was to distribute LifeCan in Mexico where C-19 cases are raging.

Real Numbers Say More Than Analysts’ Estimates

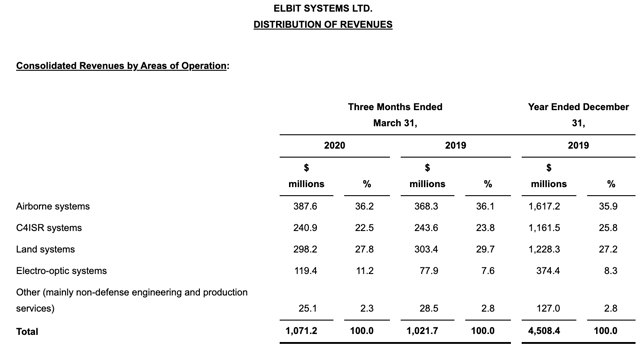

The company's Q1’20 financial report released May 26th justifies my enthusiasm for ESLT. Earnings grew 10.2% over the past year. Elbit’s order backlog stands at $10.8 billion, revenues at $1,071 million, non-GAAP net income is $72 million, GAAP net income is $64 million, non-GAAP net EPS is $1.63, and GAAP net EPS is $1.44.

Elbit received in the first quarter $1.8B in new orders (+$50M) with nearly $11B in orders now waiting to be completed; that is an 8% increase Y/Y. Elbit continues spending about 7.5% of revenues on R&D. GSA net was slightly higher in Q1’20, 5.4% of revenues compared to 5.2% in Q1’19. Some of this is attributable to extra costs incurred by the imposition of government worker safety measures due to the novel coronavirus. Nevertheless, cash and equivalents at the end of March totaled +$684M compared to $221M at the end of last December.

Source Elbit Systems

On the downside, the company cut the dividend from 44 cents to 35 cents per share for the shareholders of record on June 8, 2020. Another caveat is in the reported sources of revenues. Sales to Israel’s government and companies fell in 2020 to $246M (23%) from $262M (25.6%) in 2019. Likewise, for sales in Europe, Asia-Pacific, and other countries. Meantime, sales in North America rose dramatically in 2020 (34.2%) from 2019 (27%), i.e., to $366.8M from $275.6M. Sales in Latin America were flat.

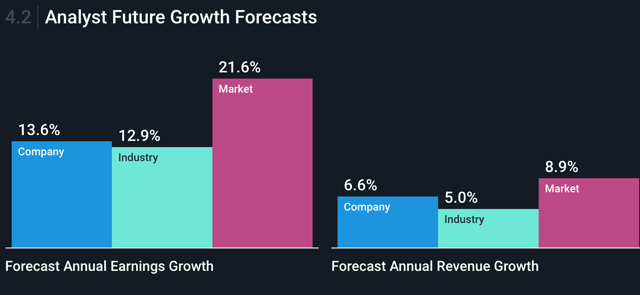

Finally, the current share price is at the high-end of value but there is nothing on the horizon to warrant concern for the price to fall significantly. On the contrary, the military defense industry is anticipating strong growth and Elbit will be a part of that annual earnings and revenue growth in my estimation.

Source: Simply Wall Street

Final Thoughts

While military defense spending is expected to decrease in many countries because of budget stresses from the pandemic, American military spending is unlikely to be the wellspring for balancing the US budget deficit while the current administration is in office. Mr. Trump’s positions on military spending and saber-rattling are well-known. This bodes well for Elbit already doing more and more business with the US military. The current share price is on the high side of my preference but the share price drop I expect makes Elbit a better buy over the near term.

The pressure on defense budgets from the pandemic spending, the dividend cut, and the company missing analysts’ normative estimates are going to be a short-term drag on share price despite respectable actual increases in revenues, backorders, cash, etc. This is an opportunity for retail value investors to make money.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.