Radical Transparency: A (Positive) Spin On Despegar's Q1 Earnings Call

by Eric Jensen CFASummary

- Despegar reported disappointing Q1 results on May 4th, 2020.

- The company outlined cost-cutting measures and liquidity sufficient to survive an extraordinarily deep and prolonged demand downturn.

- Despegar remains the dominant online travel agency in South America, and I remain bullish on the shares.

On May 4th, 2020, Despegar (NYSE:DESP) reported a Q1 loss of $0.22 per share ($0.08 better than the consensus expectation for a -$0.30 loss) on revenues of $76M ($2M below the Street’s wild guess of $78M). Weak results were anticipated due to the coronavirus pandemic lockdown measures and international travel restrictions, rendering the headline earnings number irrelevant. Management chose to devote their time on the earnings call to a discussion of DESP’s liquidity and financial wherewithal to weather the ongoing pandemic and lockdown. Management’s refreshingly honest, though starkly bleak, commentary reinforced my belief that Despegar remains well-capitalized and poised to emerge from the international lockdown as a high quality, high-margin growth asset.

The Bull Thesis

Those of you that have found and followed my previous work will know that I maintain a cautious outlook for the broad market indices, and I continue to believe that the market may not have fully discounted the full, dramatic impact of the havoc that the coronavirus pandemic has wreaked on the global economy. It might seem paradoxical, then, that I’m recommending investors to purchase shares of Despegar, so I will endeavor to outline the bull case as simply and briefly as I can.

- Despegar shares are underfollowed, underappreciated, and underperforming.

- In normal times, DESP is a fast-growing, high margin, high ROIC online travel agency with a leading market share position in the emerging South and Latin American markets.

- The company maintains a net cash position sufficient to survive over a year of pandemic-related travel restriction and demand destruction and will require little-to-no capital investment to restart their business when the time comes.

- To the extent that the pandemic will drive weaker competitors out of business, DESP is poised to emerge from the coronavirus crisis in the best competitive position the company has ever enjoyed (they’re already the dominant player in a winner-take-most emerging e-Commerce market).

- At all times, Despegar is, and will remain, a strategically relevant asset to business partner and minority owner Expedia (Nasdaq:EXPE).

Further, a more detailed discussion of the bull case for DESP can be found in my previous article on Seeking Alpha or in the newsletter I sent to subscribers on April 1st of this year.

The Zero Revenue Experiment

In my previous article, I outlined a scenario whereby Despegar would continue to operate during the coronavirus-induced lockdown with zero revenue, in an attempt to calculate the company’s cash burn rate and runway longevity during the (hypothetical) worst-case scenario. Due to the severity of the crisis we are currently facing, the worst-case scenario is basically unfolding. To quote management commentary during DESP’s Q1 conference call:

The largest impact to our business occurred in the second half of March at the time most global economies shutdown. In turn, we saw a 95% decrease in gross bookings in this period compared to the second half of March of the prior year. Unfortunately, we expect that trend to continue throughout the second quarter. – Damian Scokin, CEO

I reiterate this, not to pat myself on the back for stating the obvious one month ago, but to point out that Despegar is presenting equity research analysts a unique opportunity to hone their craft. By virtue of the mere fact that they are operating an actual business for which demand will disappear entirely for at least one entire quarter before restarting, Despegar is forced to offer analysts radical transparency into the inner workings of their financial model.

While Q1 results (in the past) are irrelevant to investors in the context of the global pandemic and lockdown, and Q2 results (forward-looking) are still irrelevant because revenue will be zero (or close enough to it), the releases and earnings calls for these quarters may well become the best tools for the analysts seeking to understand Despegar’s income statement for years and years to come.

So let’s dive in and summarize what we learned:

Despegar Has Little/No Near-Term Cash Flow Requirement

We already knew that Despegar had no debt. In my April article, I surmised that Despegar might have need for up to $195M in working capital immediately to refund customer purchases where government restrictions had explicitly cancelled travel plans. That proved to be conservative, as the actual working capital investment in the quarter totalled $134.6M:

…In the quarter, we canceled a significant portion of the tourist payables position we had at year-end 2019, which explains the $134.6 million investment in working capital in the quarter. – Alberto Lopez Gaffney, CFO

Despite an extreme reduction in gross bookings during the quarter, accounts receivable actually increased by $80M, which leaves only $52.9M in net payables left on the DESP balance sheet, with regard to which, I’ll quote Mr. Gaffney again:

We believe our cash position, together with expected cash flows from operations are sufficient to meet our currently anticipated cash needs beyond the next 12 months.

The only other cash outlay for which Despegar may have potentially been liable was the agreed-upon upfront payment for the acquisition of Mexican travel agency, Best Day. Management was quite clear on the conference call that the force majeure provisions of their merger agreement have been invoked, and that they are in the process of renegotiating the agreement terms in order to postpone any cash outlays to 2022 at the earliest. They were clear that should they be unable to reach an agreement with Best Day, the transaction will not go through at all.

Despegar ended the quarter with $226M of cash on hand.

Despegar Has Cut Costs In Anticipation Of Prolonged Demand Destruction

By the end of 2019, Despegar management had recognized a need to find cost savings and productivity improvement in order that the company might return to 2017 levels of profitability in the current currency regime and South and Latin American interest rate environment. Those cost reductions were sufficient, in my estimation, to bring DESP down to a quarterly run rate in the ball park of $55M in structural operating expense. In addition to those improvements, management instituted temporary salary reductions of 50% for senior management, 25% for middle management, and eliminated inflation adjustments to salaries company-wide, along with first half bonuses. As a result of these actions, Despegar estimates that structural costs in Q2 will be even lower, at roughly $34M. By Q3, they believe the company will have only $28M per quarter of fixed, structural expense. These figures can be found on slide 6 of the company’s Q1 earnings presentation.

Of course, it will be incumbent on management and shareholders to monitor talent retention and management turnover on a go-forward basis. For now, I’m satisfied that these measures are temporary, and they are appropriate in direct response to an unprecedented economic crisis. As a DESP shareholder, I’m convinced of management’s intent to be a conscientious steward of shareholders' capital.

This leaves us in the position to calculate Despegar’s cash runway with simple arithmetic. The company ended Q1 with $226M in cash and $53M in net payables. They expect to burn through $34M in structural expense in Q2, and $28M per quarter thereafter, implying that the company can survive with no further cost reduction, no revenue, and no capital raise until the end of Q3, 2021. That’s almost nearly 6 quarters away. If your outlook for coronavirus-related travel demand destruction incorporates a total lockdown through and beyond Q3 2021, it’s more conservative even than mine.

If we are reasonably reassured, then, that Despegar will survive, the only remaining question relates to revenue. When will transaction volumes come back, and at what transaction volume might we expect Despegar to stop burning, and start generating cash flow?

Revenue Equals Price x Quantity, Profit Equals Revenue Minus Costs

When transaction volumes are zero, so too will revenues be naught. Investors might reasonably anticipate, though, that Despegar’s transaction volumes will not be zero, indefinitely. They are almost certain to rebound from the nadir of travel activity associated with a total lockdown on travel demand and international travel restrictions that we are currently experiencing. But, they are unlikely to fully recover to where they were, for some time. So we anticipate that things will get better than they are now, but that they will be structurally worse than they had been, then, for some time.

If you want a precise estimate for exactly what travel demand will look like in 2022, you’ll have to get it somewhere else, because I don’t have one, and if I did, I wouldn’t give it to you for free. But I have looked at DESP Q1 results with a view towards determining arithmetically what level of demand might get us back to break-even.

In order to “break-even,” Despegar will have to generate gross profit in excess of their quarterly structural cost run rate, which is $28M, at least initially. Since gross profit equals (Transaction Volume x Price) – Variable Cost per Transaction, we can calculate the required break-even transaction volumes using known inputs, and compare those volumes to prior periods to assess how reasonable they might be.

On slide 9 of their earnings presentation, Despegar indicates that variable cost per transaction was $16 in Q1. Since COGS was $33.5M in the quarter, we know that there were 2.09M transactions in the quarter, and that the average customer ticket was $36.35. (If that strikes you as low for a travel agency that sells airfare and hotel accommodations, it should serve as a reminder that Latin and South America remains an emerging market for travel – as I’m typing this a one-way fare from Lima, Peru to Cusco popular with tourists headed to Machu Picchu costs $43, one month out.)

If we make the extremely conservative assumption that Q1 fares will be pretty sticky for the next few years, and hold that $16 per transaction is a good number for variable costs, then DESP will need to see 1.36M in transactions to break-even at $28M in quarterly structural costs. In Q1 of 2019, DESP saw 2.64M transactions. Despegar needs travel demand to get back to merely half of what it was in early 2019 in order to break even. No matter how conservative your outlook for travel in post-coronavirus South America, it must conclude that we are likely to return to at least half of the travel that we used to see. Keep in mind, Despegar is an OTA, and therefore heavily exposed to leisure travel, as opposed to corporate, which might be further exposed to productivity enhancements associated with the new normal, “work from home” culture.

Underfollowed, Underappreciated

The last datapoint of note to me on the Despegar conference call was its length. The call was only 47 minutes long, and DESP management fielded only 4 questions from sell-side analysts representing, Itau, Keybanc, UBS, and Cowen. It is with the utmost respect to those institutions that I'll point out: that's not exactly a roster of bulge bracket banks. Imagine a Booking Holdings (NASDAQ:BKNG) call with only 4 questions. It's a literal impossibility.

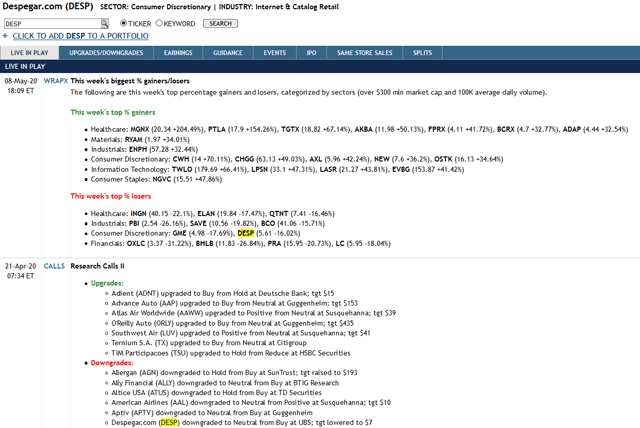

What's more, Briefing.com seems unaware that DESP even reported earnings, as the following screenshot can attest:

DESP news doesn't even make the news. As a value investor, I have to admit that this is the kind of neglect that can get me excited. Undervalued and neglected stocks with catalysts for change are typically good investments. In Despegar's case - we're only waiting on a catalyst.

Despegar Remains A Strategically Relevant Asset

If you’re sufficiently convinced that Despegar has enough cash on the balance sheet to meet near-term working capital needs, and a sufficiently lean structural cost structure to return to positive cash flow in a relatively short period of time, then the company’s survival is beyond question. The only remaining inquiry relates to Despegar’s ultimate value as a strategic asset, keeping in mind that they are the dominant online travel agency in South America (and have been for some time), and that they maintain a partnership with Expedia (EXPE), who owns 14% of the company today.

I found the following table compelling, as it regards the value of Despegar as a strategic asset:

| Company | Market Cap |

| Booking Holdings | $65.45B |

| Expedia | $11.22B |

| Trip.com Group (TCOM) | $15.25B |

| Despegar | $0.4B |

In lieu of summary, I’ll allow my readers to derive their own DESP price targets. The risks are self-evident: revenues are temporarily non-existent; value is another story.

Going Forward

At current prices, Despegar's small market capitalization does not reflect its leading market share of an attractive, and growing, Latin American travel market. While near-term demand has been decimated by the coronavirus pandemic and associated travel restrictions, Despegar has outlined appropriate cost-cutting measures and a sufficient liquidity position to allow the company to outlast the crisis, and emerge from it in a strong competitive position. While the shares will likely continue to be volatile in the near term, due to the market's sentiment fluctuations surrounding the longevity and impact of the pandemic, the long-term outlook remains bright, and in my opinion, DESP shares remain a "Buy" for investors with a long-term investment horizon and the ability and inclination to withstand elevated near-term volatility.

Disclosure: I am/we are long DESP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.