Oil - It's A Terrible Time To Be A Refinery, But There Might Be Light At The End Of The Tunnel

by HFIRSummary

- Refining margins remain in the dumps as crude rally outpaces product prices.

- Global refining margins indicate if crude doesn't pullback soon, we could see throughput remaining low.

- So in order to keep crude rally going past the current level, we would need to see margins improve.

- But as global demand rebounds, refineries should be able to benefit.

Welcome to the horrible margin edition of Oil Markets Daily!

As crude prices rally on the shut-ins and OPEC+ production cut, global refining margins have never been so terrible.

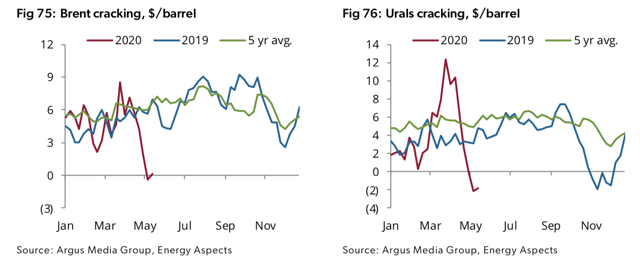

Take the Brent and Urals cracking for example as both dips into the negatives. The sharp drop in global refining margins is the result of a double whammy effect we are seeing in the oil market.

As global demand is hit, refined product prices remain low, while inventories remain bloated. This puts refineries in a precarious position. Most refineries can't go to 0% utilization. There are physical limitations and why refineries usually do rolling maintenance as opposed to shutting down the entire refinery. Another reason is that refineries are fixed cost beasts, so there's a certain threshold the refineries have to operate in order to not incur massive cash losses from a prolonged shut-down.

Unlike oil producers, refineries can't just stop throughput on a dime when margins go negative. For oil producers that are seeing negative operating cost production, they will shut-in production. For refineries, the more they reduce throughput, the faster the cash burn is (higher fixed cost structure).

Now combine this with a supply squeeze where US oil producers have contributed a massive 2.5 to 3 mb/d of production cut so far alongside OPEC+'s 10 mb/d, and we are seeing refineries get absolutely squeezed from both ends.

This means that refineries globally have to wait for demand to rebound. As refinery throughput has bottomed out currently, there's nothing they can do about the lower crude supplies. Time spreads have already materially compressed thanks to the supply cuts in the front end. But in order for crude to keep rallying, we would need to see refining margins rebound, which means that refineries would see improving economics.

Summary

Refining margins are bad today as global demand hit and global supply cut squeeze refineries on both end. But with the recent crude rally causing the curve to flatten, further price rallies would require refining margins to rebound thus incentivizing higher throughput. In addition, as global demand rebounds, refineries will benefit as higher demand will drain product storage. All of this means that while things are bad for refineries today, better days are ahead.

We are now entering one of the craziest periods in the energy sector. Valuations have gotten so out of hand that we believe this is the final washout. We are now offering a 2-week free trial and if you wish to read our WCTWs this week, please see here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.