NZD/USD: I Retain My Long-Term Bullish View

by Discount FountainSummary

- The NZD/USD has remained quite resistant during COVID-19.

- Export data for New Zealand came in better than expected.

- In spite of the potential for negative rates, I continue to take a long-term bullish view on the currency.

Last month, I made the argument that a short-term drop in the NZD/USD is probable going forward. My reason for making this argument was that markets had quite possibly overvalued the NZD as a result of New Zealand’s resistance to COVID-19 and the currency could be set for a correction.

With that being said, I also argued that the currency could be set for longer-term upside, with normal economic activity potentially resuming in New Zealand earlier than in other countries – and this would be reflected by a rising Kiwi dollar.

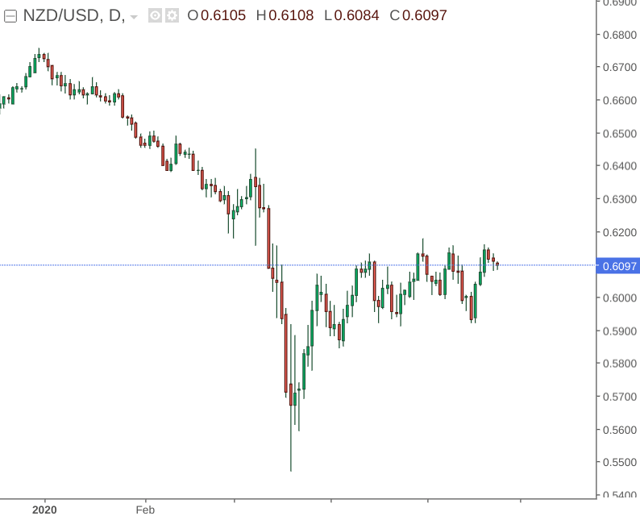

In the past month, the NZD/USD has not declined per se – but has been trading in a rather stationary manner:

Source: investing.com

In this regard, the NZD/USD has been proving resistant. The Reserve Bank of New Zealand kept the official cash rate at 0.25 percent on 13 May, after having substantially lowered the rate from 1 percent on 16 March.

With that being said, what is particularly noteworthy is that the NZD/USD has not seen an excessive move to the downside – given that the Reserve Bank stands ready to introduce negative rates if necessary to combat low growth – the first time in the country’s history that such an eventuality would take place. This course of action may be deemed necessary by the central bank if – as predicted – growth falls by a large 21.8% in June, before being expected to bounce back by 23.8% in the subsequent quarter.

The Federal Reserve in the United States is in large part ruling out negative interest rates as a policy option for the foreseeable future.

However, the fact that the Kiwi dollar is standing its ground against the dollar in light of rates potentially turning negative is a welcoming sign for the currency.

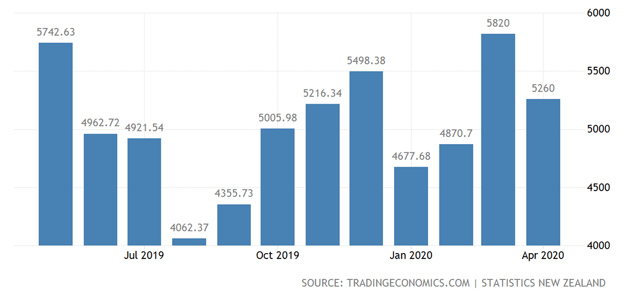

Moreover, with equity markets having recently seen a boost, the NZD/USD has been rising of late with data showing that export levels during the lockdown still remained encouraging.

We see that while April export levels had fallen from that of the previous quarter, they still remained well within the range of that seen in the past year:

Source: tradingeconomics.com

In this regard, should we see New Zealand prove more economically resilient to the crisis going forward – then it is quite possible that the NZD/USD could stand to rise further. Even if negative rates were to materialise, rates in many developed countries around the world are trading near or at zero in any case. The market may well expect a quick recovery from the fallout of COVID-19 and this could push the NZD/USD higher.

I retain my long-term bullish view on the Kiwi dollar and expect that the currency may well see further upside from here.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.