Lam Research: Strong Cost And Pricing Advantages Improve Outlook

by Stefan OngSummary

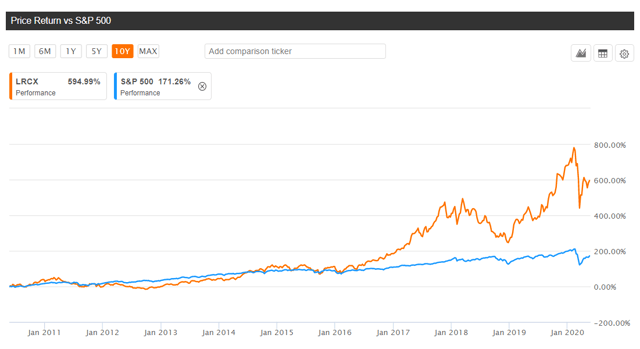

- Lam Research has outperformed the S&P 500 over the past 10 years due to its scale advantages.

- The company has a strong liquidity position and cash flow generation ability.

- Lam Research appears to be undervalued due to weaker consensus estimates.

Lam Research Corporation's (NASDAQ:LRCX) stock has outperformed the S&P 500 over a 10 year period, returning 595% compared to S&P's 171%. This is mainly due to its market leadership in its wafer fabrication equipment segment, which enables the company to enjoy cost advantages and pricing power. Lam Research has been earning high returns on capital that are well above its cost of capital and creating value for shareholders. The company appears to be undervalued due to weaker financial estimates relative to peers.

(Source: Seeking Alpha Data)

Lam Research has room to grow through innovation

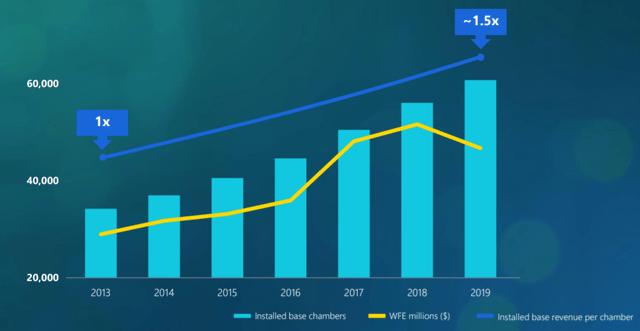

Lam Research is a global supplier of innovative wafer fabrication equipment and services to the semiconductor industry, which is a critical step in the chipmaking process. Demand from cloud computing and the digital economy is driving the need for more powerful and lower-cost semiconductors. Lam Research's leadership in deposition, etch, and clean will help facilitate some of the challenges of traditional two-dimensional scaling. This has led to steady revenue growth from $2.1B in 2010 to $9.6B in 2019 at an annual rate of 16% in a cyclical industry. The company has been able to grow its installed base from 40,000 in 2015 to 60,000 in 2019. This large base helps Lam Research maintain its leadership position through a strong reputation and provides feedback for future solutions.

(Source: Investor Presentation)

Lam Research also has room to grow. With the growth catalyst arising from the introduction of 5G wireless communication technology, significant advances in semiconductor-based computing power and storage will be required. With its strong product portfolio and innovative culture, it is likely that Lam Research will be able to capture a large portion of this growing market.

(Source: Investor Presentation)

Lam Research enjoys cost advantages from scale

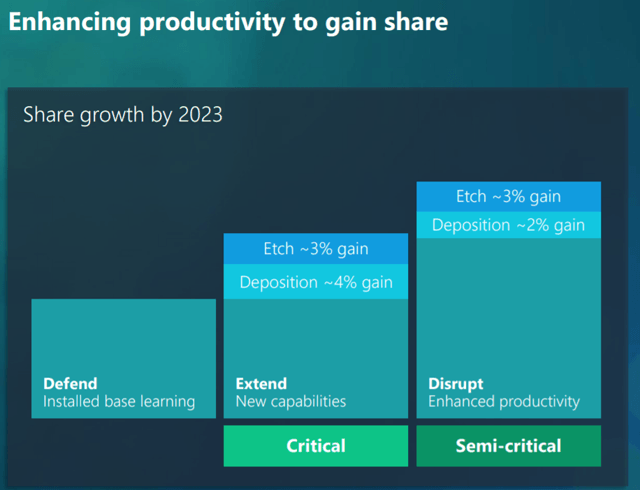

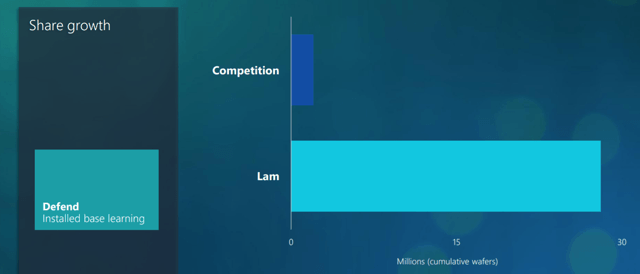

The company is a market leader in its segment, which helps provide Lam Research with scale advantages. Lam Research is able to invest more in research & development compared to its peers as it can spread these costs to cover a large base of customers. As such, it provides some barriers of entry to smaller competitors who are unable to innovate on a similar scale as Lam Research.

Lam Research has also built up a large customer base with some degree of collaboration in manufacturing processes. This has created brand loyalty for Lam Research that allows the company to enjoy some pricing power. This is reflected in the growth of the company's installed base. As such, Lam Research's operating margin has remained above 20% in the past three years.

(Source: Investor Presentation)

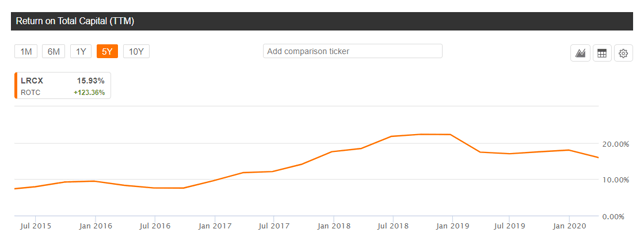

Growth also delivers more value if Lam Research's return on invested capital is higher than its cost of capital. Given that the company's return on invested capital has been higher than 15% in recent years, which exceeds its average cost of capital of roughly 7.55%, growth has been creating value for Lam Research.

(Source: Seeking Alpha)

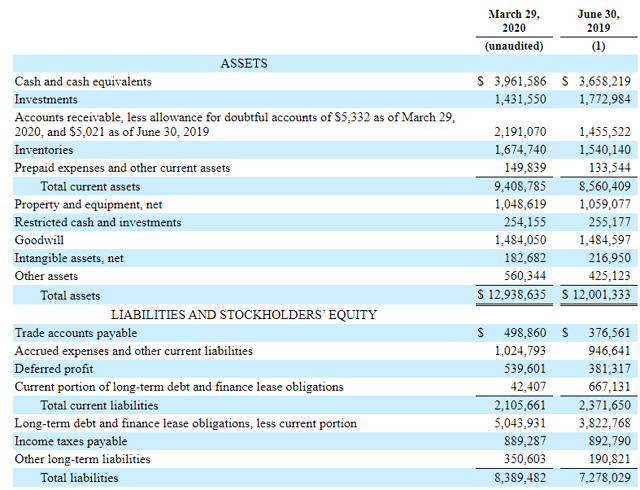

Balance Sheet

Lam Research has about $3.9B of cash and $1.4B of short-term investments. The company also has $42M of short-term debt and $5B of long-term debt, which helps to bring down its cost of capital. With free cash flow of $1.2B in the most recent fiscal year, Lam Research has sufficient liquidity to pay down its debt when it comes due. The company also has the ability to raise capital to fund the growth of 5G if necessary. Given its strong liquidity position and free cash flow generation capabilities, however, we do not expect the company to raise more capital in the near term.

(Source: 10Q)

Investment Risks

Depending on the severity of the economic downturn, there may be some negative impact for Lam Research. It is impossible to predict how Lam Research's customers will react to a prolonged downturn. However, the company seems optimistic in the long run:

Extraordinary efforts by Lam's global teams helped to mitigate the operational impact of the COVID-19 pandemic, resulting in solid financial performance in the March quarter," said Tim Archer, Lam Research's President and Chief Executive Officer. "While there is limited visibility to near-term macroeconomic conditions and industry supply chain recovery, customer demand for our equipment remains strong. We believe in the long-term resiliency of the semiconductor industry and are focused on providing innovative technology to our customers and positioning Lam for outperformance as industry conditions normalize

(Source: Press Release)

The industry also faces cycles and a few customers make up a big portion of Lam Research's sales. In order to keep up with innovation, Lam Research has to continue spending on R&D despite any economic downturns. This could put some strain on its cash flows in difficult times. If Lam Research fails to keep up with technological trends, it might lose some market share to other competitors.

Valuation

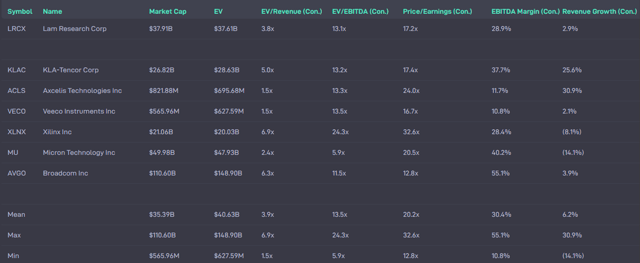

Based on relative valuation, Lam Research's stock appears to be fairly priced. The company's consensus EV/Revenue and EV/EBITDA ratios are roughly in line with the average. But its consensus P/E ratio of 17.2x is lower than the average of 20.2x. This could be explained by its lower financial estimates. The company's EBITDA margin of 28.9% is lower than the mean of 30.4% and its consensus revenue growth of 2.9% is lower than the average of 6.2%. As such, poorer financials in the short run is contributing to the relatively less expensive stock. If the company outperforms these estimates, the company could have some decent upside.

(Source: Atom Finance)

Takeaways

For Lam Research to continue outperforming, it has to continue to invest in R&D so that it stays on top of any technological trends. The company has the advantage of a large customer base so it has to fully utilize their feedback and innovate based on their needs. Despite the cyclical nature of the industry, the company cannot fall behind during downturns that would allow well-funded competitors to catch up. Potential investors have to decide if the company is able to perform better than the consensus estimates. If so, the current stock price appears to be cheap now.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.