Autohome Inc.: 3 Reasons Why Stock Price Could Increase By 30% In 12 Months

by Stella MwendeSummary

- Weak macro conditions in China from November 2019 (when the first COVID-19 case was diagnosed) made sales of Autohome passenger vehicles to drop by 10% YoY.

- The average market awareness for vehicle listing increased by 70% after these automakers signed up for Autohome's "New Car Launch" features under the "Intelligent Car Launch."

- The Chinese government extended its subsidies and tax breaks targeting NEVs to 2022. These subsidies were scheduled to expire in 2020, but the transition was hampered by COVID-19.

- Approximately 65% of the Chinese youth - the highest in a sample of 11 countries desire to buy cars in the period ending 2020-2021.

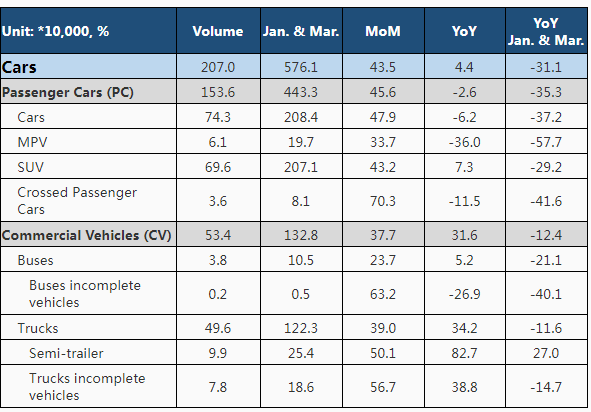

The Chinese Association of Automobile Manufacturers (CAAM) reported that the enterprise inventory for commercial vehicles in April 2020 had decreased by 4.6%. This decrease was against an increase of 6.8% for passenger cars in the same month. Automobile demand, translated in sales YoY for January and March, indicated a decline of 41.6% for crossed passenger cars, 29.2% for MPV and 35.3% for passenger cars.

Source: CAAM

The decline in sales for both passenger cars and commercial vehicles (-12.4%) has in turn made Chinese automakers to be cautious in spending. Demand destruction has adversely affected Autohome, Inc.'s (ATHM) stock that closed at $74.50 on 22nd May 2020 (a decline of 7.77%). With its next earnings date set for August 2020, investors will be hoping for higher revenues. This optimism is a result of easing lockdowns that have derailed business ventures not just in China but in the entire world.

Thesis

Despite the current decrease in car sales as a result of COVID-19 leading to adverse Q1 results, Autohome's investors and managers will rely on the company's intelligent R&D program, innovations of new data solutions and the ease of restrictions hampering purchase policies in China. These factors will contribute in raising Autohome's stock by at least 30% in the next 12 months.

Strong Revenue

In Q4 of 2019, Autohome closed off with a revenue base of RMB 8.42 billion or $1.18 billion. Weak macro conditions in China from November 2019 (when the first COVID-19 case was diagnosed) made the total sales of passenger vehicles to drop by 10% YoY. Of special note is the fact that new initiatives have contributed to the increase in revenue for the company from 12% in 2018 to 18% in 2019. The company prides itself as a leader in product innovations and digital transforms that have come in handy in the wake of the coronavirus. The company's future depends on how it taps into automotive value chain from manufacturing to ownership.

Intelligent R&D program

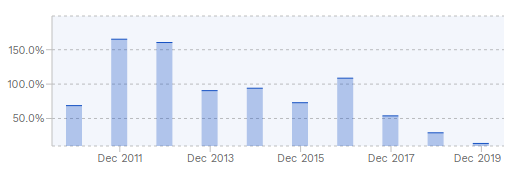

Autohome's R&D growth moved from a peak of 165.3% in 2011 to 13% in December 2019. It hit a five-year low at the time.

Source: Finbox

The growth from 2015 to 2019 stood at an average of 55.6%. Through R&D, revenue has risen from $68.7 million in 2011 to $1.209 billion in December 2019. CEO Min Lu confirmed that Autohome's intelligent data offerings were purchased by 36 automakers in 2019. The intelligent R&D not only lowers the auto cycle for R&D but also acts as an interface for interacting with users. These users then turn into customers or partners.

The R&D program helped Autohome to integrate its "Intelligent New Car Launch" system that has attracted 13 automakers since 2019. The average market awareness for vehicle listing increased by 70% after these automakers signed up for Autohome's "New Car Launch" features. Among the companies inspired by Autohome's R&D is China's EV heavyweight - Xpeng Motors.

Xpeng Motors, a leading electric vehicle (EV) manufacturer in China supported by Alibaba (BABA), launched the P7 super-long-range Sports Sedan on April 27, 2020. This EV signaled a milestone in the company's 5-year history as it uses intelligent R&D. What sets apart the P7 Sports Sedan is its voice-interactive system, the first in the world to use a full-scenario program, integrating apps and a duel ecosystem. Deliveries for the P7 are expected to start in June 2020, with prices set at RMB 229,900 to RMB 349,900 or $32,462 to $49,404.

Baidu (BIDU), a Chinese technology company, has stepped up its artificial intelligence mark while also focusing on intelligent manufacturing. In Changsha, Baidu has developed the Apollo Robotaxi, a convenient self-driving cab operated through the "Dutaxi" application. The Robotaxi was unveiled in the end of April 2020 as a way to promote social distancing and prevent the spread of the coronavirus. Baidu will be way ahead of its competitors if it goes ahead to implement the "intelligent connected vehicle" (ICV) automotive industry, proposed in Changsha.

The rapid advancement of intelligence R&D in China will help Autohome's stock rise by more 30% in the next 12-month period. Canada, for instance, launched the Pan-Canadian AI 5-year strategy in 2017 that is expected to have delivered in 2022. The government allocated $125 billion of its federal budget into research and talent development on AI to ensure it meets all prospects of this strategy. Companies like Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Uber (NYSE:UBER), and Nvidia (NASDAQ:NVDA) have supported this initiative by making massive investments to prepare for AI transition.

Innovations of new data solutions

More than 17,000 car dealers bought Autohome's data solutions in 2019. The company has pledged to support the innovation of data solutions into the year 2020. This move is key in helping the dealers embrace digital transformation in the automotive industry.

It will be easy for dealers using Autohome's innovative solutions to subscribe and market their car inventories and automotive-related services in the apps or websites especially on new-energy vehicles (NEVs). The solutions are meant to update articles and offer professional reviews of cars. Using the data, dealers will analyze car-pricing trends across various markets in order to offer suitable prices to their vehicles. The database should comprise of videos and photo categories.

In its Q4 2019 earnings, Autohome reported that the number of Daily Active Users (DAUs) increased by 25% YoY. The company boasts of more than 36 million DAUs that access the company's mobile websites, primary and mini-applications. Such an increase means that users are impressed by the promotional listings in the company's digital platforms. We expect more users to subscribe as the economic tensions subside across the globe.

Subsidy Extension and ease of restrictions

According to the CNBC, the Chinese government extended its subsidies and tax breaks targeting NEVs to 2022. These subsidies were scheduled to expire in 2020, but the transition was hampered by COVID-19. The government pumped in 2.7 billion Yuan to the infrastructure supporting NEV battery-charging. This allocation was a result of most car dealers citing battery-charging systems as their main reason for buying electric vehicles (EVs). The government's support for the NEV market is on a long-term strategy. The Chinese auto sector rakes in 10% of the retail country's sales, with a sixth of the jobs related to this industry.

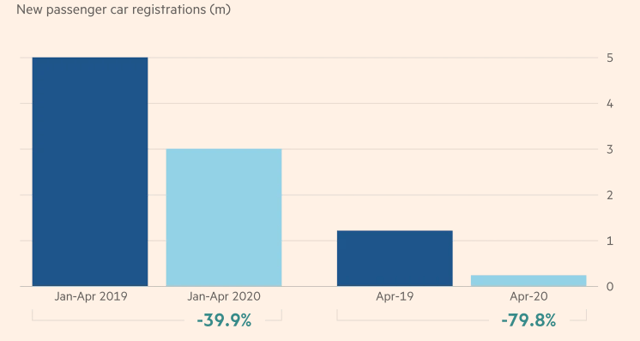

In Western Europe, the purchase of novel passenger car has slid year-over-year since the beginning of the year as a result of the outbreak.

Source: Financial Times

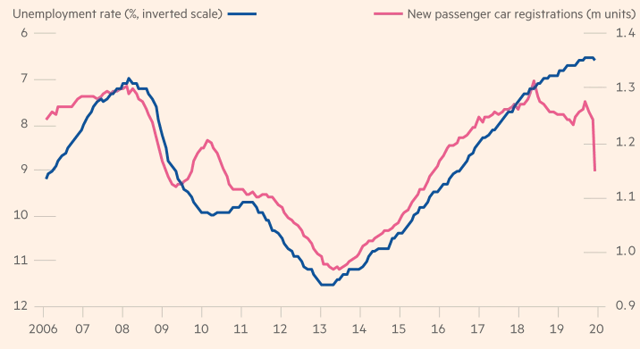

General Motors (GM) and Daimler (OTCPK:DDAIF) have invested billions of dollars into car sharing services, cabs and other options that will not necessarily involve car purchases. In Europe, automotive business is yet to pick up as seen in the graph below.

Source: Financial Times

Car sales in Europe have significantly dropped with the registration of new passenger car units decreasing by more than 10% since the beginning of the year. The unemployment rate has hit a 15-year high in the scale.

However, in China, the need for private car ownership has risen due to the desire to maintain social distancing. Volvo has reported a 20% increase in sales in the month of April in the Chinese market as compared to 2019.

Close to a billion people in China (approximately 904 million) can access the internet. The rate of internet penetration in rural areas was 46.2% while that of urban areas stood at 76.5%. Analysis of Chinese youth sampled by the China Internet Network Information Center (CNNIC) in April 2020 indicated that most young people (about 94%) preferred to access to the internet via the smartphones. This situation means that most tech companies will need to invest more in mobile apps to reach the desired youthful targets.

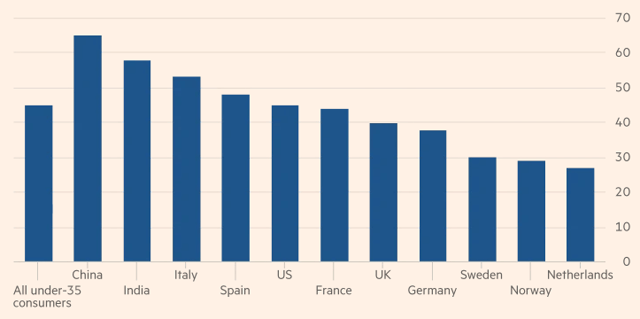

Out of an analysis of 11 countries, the Chinese youth expressed the highest desire to purchase vehicles.

Source: Financial Times

Approximately 65% of the Chinese youth desire to buy cars in the period ending 2020-2021. At the height of the pandemic, in mid-March 2020, US search engines recorded a 7-fold increase in the keywords "Is it a good time to buy a car." These incidences mean that health concerns are forcing an increase in car subscription services that will increase as the year progresses.

Conclusion

At the moment, ATHM's buy rating is a considerable prospect. We foresee an increase of 30% to the stock price in the next 12 months. The company's cash flow is expected to increase as more people desire to own private cars due to the health concerns occasioned by COVID-19. The intelligent R&D program will attract more dealers as the world diversifies in artificial intelligence. The implementation of the company's data solutions has also seen a rise in subscriptions. More DAUs are expected in the FY 2020-2021. Extension of subsidies and tax breaks by the Chinese government will also help consumers own NEVs that have hit a milestone in the Asian country.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.