Weekly Closed-End Fund Roundup: 2 Upcoming Mergers (May 17, 2020)

by Stanford ChemistSummary

- 1 out of 23 CEF sectors positive on price and 8 out of 23 sectors positive on NAV last week.

- A little bit of alpha available from MNE and SRF/SRV mergers.

- GER/GMZ cut their distributions by over -80%.

Author's note: This article was initially published on May 17, 2020, and data are from that date. Please check latest data before investing.

The Weekly Closed-End Fund Roundup will be put out at the start of each week to summarize recent price movements in closed-end fund [CEF] sectors in the last week, as well as to highlight recently concluded or upcoming corporate actions on CEFs, such as tender offers. Most of the information has been sourced from CEFInsight or the Closed-End Fund Center. I will also link to some articles from Seeking Alpha that I have found for useful reading over the past week. The searchable tag for this feature is "cildoc". Data is taken from the close of Friday, May 15th, 2019.

Weekly performance roundup

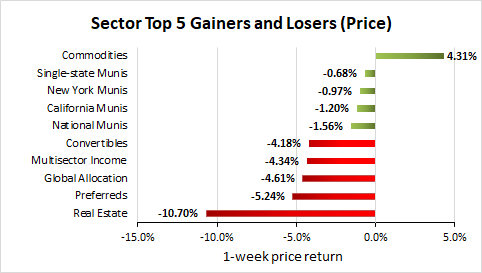

1 out of 31 sectors were positive on price (down from 24 last week), and the average price return was -3.03% (down from +2.10% last week). The lead gainer Commodities (+4.31%), followed by Single-state Munis (-0.68%) and New York Munis (-0.97%), while the weakest sectors by Price were Real Estate (-10.70%), Preferreds (-5.24%), and Global Allocation (-4.61%).

(Source: Stanford Chemist, CEFConnect)

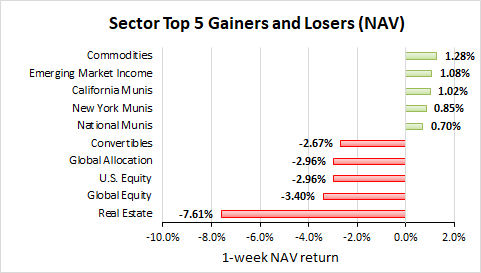

8 out of 31 sectors were positive on NAV (up from 21 last week), while the average NAV return was -1.09% (up from +4.68% last week). The top sectors by NAV were Commodities (+1.28%), Emerging Market Income (+1.08%), and California Munis (+1.02%). The weakest sectors by NAV were Real Estate (-7.61%), Global Equity (-3.40%), and U.S. Equity (-2.96%).

(Source: Stanford Chemist, CEFConnect)

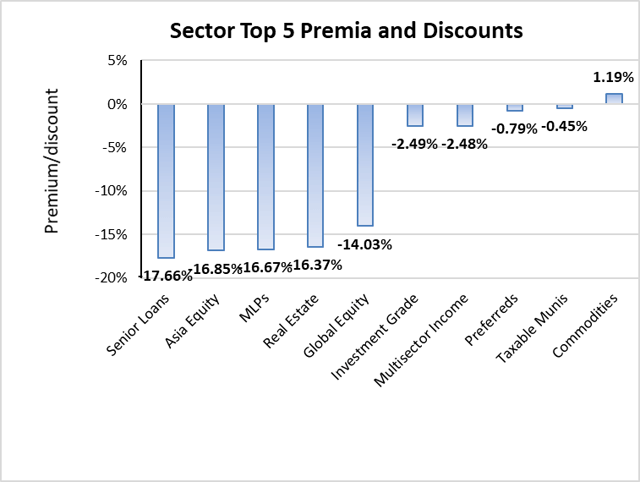

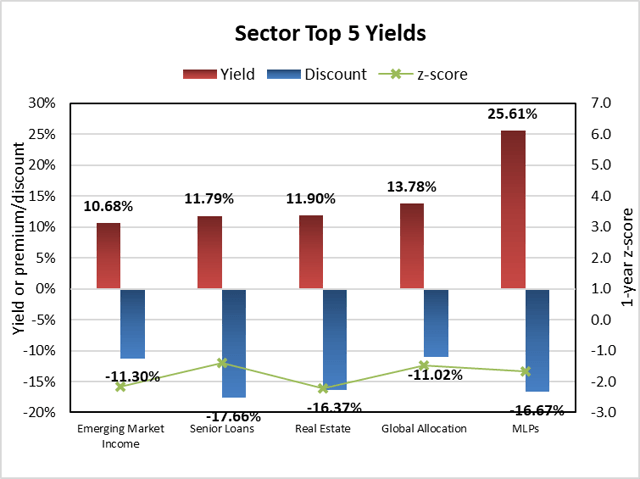

Only one sector had an average premium this week, which was Commodities (+1.19%), while the sector with the highest discount was Senior Loans (-17.66%). The average sector discount is -9.13% (down from -7.40% last week).

(Source: Stanford Chemist, CEFConnect)

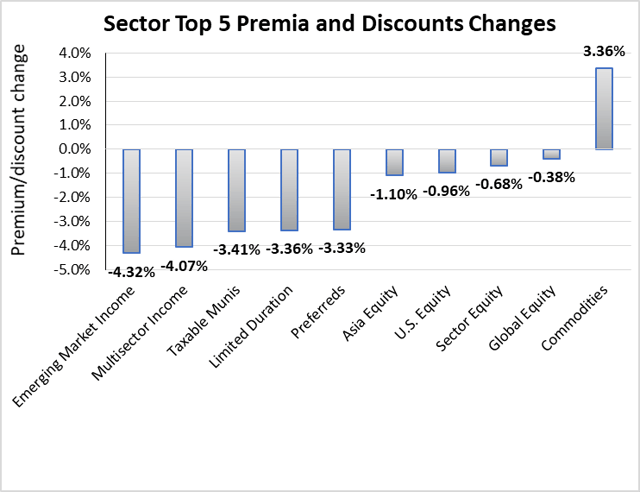

Commodities (+3.36%) showed the largest increase in premium/discount, while Emerging Market Income (-4.32%) showed the lowest premium/discount decline. The average change in premium/discount was -1.83% (up from -2.51% last week).

(Source: Stanford Chemist, CEFConnect)

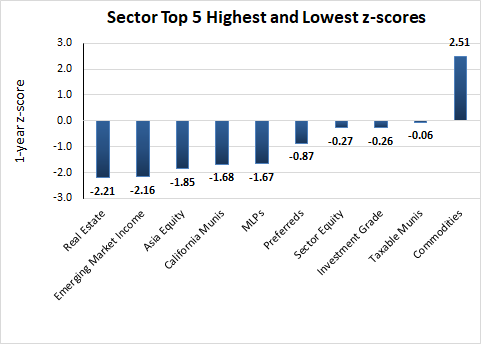

The only sector with a positive average 1-year z-score is Commodities (+1.28). The sector with the lowest average 1-year z-score was Real Estate (-2.21), followed by Emerging Market Income (-2.16). The average z-score is -1.10 (down from -0.59 last week).

(Source: Stanford Chemist, CEFConnect)

The sectors with the highest yields are MLPs (25.61%), Global Allocation (13.78%), Real Estate (11.90%), Senior Loans (11.79%) and Emerging Market Income (10.68%). Discounts and z-scores for the sectors are included for comparison. The average sector yield is +9.16% (up from +9.10% last week).

(Source: Stanford Chemist, CEFConnect)

Individual CEFs that have undergone a significant decrease in premium/discount value over the past week, coupled optionally with an increasing NAV trend, a negative z-score, and/or are trading at a discount, are potential buy candidates.

| Fund | Ticker | P/D decrease | Yield | P/D | Z-Score | Price change | NAV change |

| PIMCO Global StocksPLUS & Income | (PGP) | -16.05% | 15.23% | 9.96% | -2.6 | -14.15% | -1.61% |

| Stone Harbor Emg Mkts Total Income Fund | (EDI) | -10.60% | 15.05% | -1.39% | -2.5 | -7.13% | 2.86% |

| Stone Harbor Emg Mkts Income Fund | (EDF) | -9.89% | 16.27% | 3.87% | -3.2 | -6.05% | 2.90% |

| DoubleLine Income Solutions Fund | (DSL) | -9.66% | 14.53% | -6.07% | -1.9 | -8.43% | 1.54% |

| Cohen & Steers Select Preferred and Inc | (PSF) | -9.38% | 8.97% | 0.92% | -1.9 | -10.33% | -1.98% |

| Center Coast Brookfield MLP & NRG Inf Fd | (CEN) | -9.07% | 29.27% | 2.50% | 0.4 | -8.89% | -0.83% |

| Oxford Lane Capital Corp. | (OXLC) | -8.77% | 59.56% | -55.66% | -2.9 | -19.29% | 0.00% |

| Cohen & Steers Total Return | (RFI) | -8.00% | 9.26% | -4.07% | -1.5 | -14.58% | -7.45% |

| Eagle Point Credit Company Inc. | (ECC) | -7.89% | 18.08% | -44.05% | -2.3 | -15.71% | 0.00% |

| Putnam Master Intermediate Income | (PIM) | -7.63% | 8.80% | -1.68% | 0.7 | -8.09% | -0.95% |

(Source: Stanford Chemist, CEFConnect)

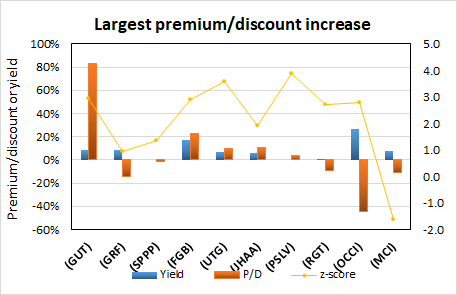

Conversely, individual CEFs that have undergone a significant increase in premium/discount value in the past week, coupled optionally with a decreasing NAV trend, a positive z-score, and/or are trading at a premium, are potential sell candidates.

| Fund | Ticker | P/D increase | Yield | P/D | z-score | Price change | NAV change |

| Gabelli Utility Trust | (GUT) | 7.75% | 8.96% | 83.06% | 2.9 | -1.76% | -5.91% |

| Eagle Capital Growth | (GRF) | 5.83% | 8.36% | -14.16% | 0.9 | 3.11% | -2.59% |

| Sprott Physical Platinum & Palladium Tr | (SPPP) | 5.25% | % | -0.96% | 1.4 | 4.82% | -0.73% |

| First Trust Spec Finance & Fincl Opp | (FGB) | 5.25% | 17.48% | 22.62% | 2.9 | 1.64% | -2.70% |

| Reaves Utility Income | (UTG) | 5.24% | 7.06% | 9.52% | 3.6 | 1.16% | -3.66% |

| Nuveen High Income 2023 Target Term Fund | (JHAA) | 5.24% | 5.97% | 10.54% | 1.9 | 3.54% | -1.36% |

| Sprott Physical Silver Trust Unit | (PSLV) | 4.98% | % | 4.09% | 3.9 | 6.82% | 3.53% |

| Royce Global Value Trust Fund | (RGT) | 4.17% | 0.59% | -8.81% | 2.7 | 1.50% | -3.13% |

| OFS Credit Company Inc. | (OCCI) | 4.17% | 26.75% | -44.23% | 2.8 | 8.06% | 0.00% |

| Barings Corporate Investors | (MCI) | 4.05% | 7.65% | -11.24% | -1.6 | 4.76% | 0.00% |

(Source: Stanford Chemist, CEFConnect)

Recent corporate actions

These are from the past month. Any new news in the past week has a bolded date:

| Number of Shares Tendered | Number of Tendered Shares to be Purchased | Pro-Ration Factor | Purchase Price* |

| 17,034,684 | 2,470,791 | 0.14507726 | $10.2018 |

April 17, 2020 | BlackRock Debt Strategies Fund, Inc. Announces Final Results of Tender Offer. BlackRock Debt Strategies Fund, Inc. (NYSE:DSU) announced today the final results of the Fund's tender offer (the "Tender Offer") for up to 5% of its outstanding shares of common stock (the "Shares"). The Tender Offer, which expired at 5:00 p.m. Eastern time on April 16, 2020, was oversubscribed. Therefore, in accordance with the terms and conditions of the Tender Offer, the Fund will purchase Shares from all tendering stockholders on a pro rata basis, after disregarding fractions, based on the number of Shares properly tendered ("Pro-Ration Factor"). The final results of the Tender Offer are provided in the table below.

Upcoming corporate actions

These are from the past month. Any new news in the past week has a bolded date:

May 8, 2020 | Cushing® Announces Shareholder Approval of Closed-End Fund Merger. Cushing Asset Management, LP ("Cushing") announces today that at a reconvened special meeting of shareholders of The Cushing® MLP & Infrastructure Total Return Fund (SRV) shareholders voted to approve the merger of The Cushing® Energy Income Fund (SRF) with and into SRV (the "Merger"). Shareholders of SRF approved the Merger at the special meeting of shareholders held on May 1, 2020. It is currently expected that the Merger will be effective after the close of trading on the New York Stock Exchange on May 29, 2020, subject to the satisfaction of customary closing conditions. May 1, 2020 | BlackRock Announces Shareholder Approval of Municipal Closed-End Fund Merger. BlackRock Advisors, LLC announced today that at a special meeting of shareholders of BlackRock Muni New York Intermediate Duration Fund, Inc. (MNE), the requisite shareholders of MNE approved the merger of MNE into BlackRock New York Municipal Opportunities Fund ("NYMO" and together with MNE, the "Funds"), an open-end mutual fund and a series of BlackRock Multi-State Municipal Series Trust, with NYMO being the surviving Fund (the "Merger"). Common shareholders of MNE who become shareholders of NYMO will be permitted to redeem, purchase or exchange shares of NYMO received in the Merger at the then-current net asset value. It is currently expected that the Merger will be effective with the open for business of the New York Stock Exchange on June 22, 2020, subject to the satisfaction of customary closing conditions and the prior redemption of all of MNE's outstanding variable rate demand preferred shares. The aggregate net asset value of NYMO shares received by MNE common shareholders will be equal to the aggregate net asset value of the common shares of MNE held by its common shareholders, in each case as of the close of business on the business day immediately prior to the closing date of the Merger. April 28, 2020 | Nuveen MLP Closed-End Funds Provide Update on Liquidation. Nuveen Energy MLP Total Return Fund (JMF) and the Nuveen All Cap Energy MLP Opportunities Fund (JMLP) previously announced that both funds intend to liquidate and distribute their net assets to shareholders. The funds now anticipate making a single liquidating distribution to shareholders in cash on or about May 8, 2020. As planned, the funds will continue trading on the New York Stock Exchange through May 4, 2020 and will be suspended from trading before the open of trading on May 5, 2020, after which time there will be no secondary market for the funds' shares. The Board of Trustees have approved the liquidation and termination of both funds on or about May 8, 2020. April 20, 2020 | Nuveen MLP Closed-End Funds Announce Plan to Liquidate. Nuveen Energy MLP Total Return Fund (JMF) and the Nuveen All Cap Energy MLP Opportunities Fund (JMLP) announced that both funds intend to liquidate and distribute their net assets to shareholders. Upon completing a review of potential actions in response to the unprecedented downturn in the midstream MLP sector, each fund's Board of Trustees concluded that liquidation and closure was in the best interest of shareholders. The funds will begin the orderly liquidation of their assets, determine and pay, or set aside an amount at least equal to, all known or reasonably ascertainable liabilities and obligations. As the funds' portfolio securities continue to be sold, the funds may deviate from their investment objectives and policies. The funds will make one or more liquidating distributions. It is anticipated that liquidating distributions will begin being paid on May 8, 2020. The funds have fixed the close of business on May 8, 2020, as the effective date for determining the common shareholders of the funds entitled to receive liquidating distributions. The funds will continue trading on the New York Stock Exchange through May 4, 2020 and will be suspended from trading before the open of trading on May 5, 2020, after which time there will be no secondary market for the funds' shares. April 20, 2020 | Tortoise Announces Reverse Stock Splits for Certain Closed-End Funds. Tortoise announced that the funds' Board of Directors has approved reverse stock splits for TYG, NTG, TTP and NDP as outlined below. The funds anticipate completing the reverse stock splits prior to the open of trading on the New York Stock Exchange (the "NYSE") on May 1, 2020 for common stockholders of record as of the close of business on April 30, 2020. The funds' common shares are expected to begin trading on a split-adjusted basis when the market opens on May 1, 2020. Common shares of TYG, NTG, TTP and NDP will continue to trade on the NYSE under their current symbol, but will trade under new CUSIP numbers, as listed below. As a result of the reverse stock splits, every four outstanding common shares of TYG will be converted into one common share, every ten outstanding common shares of NTG will be converted into one common share, every four outstanding common shares of TTP will be converted into one common share, and every eight outstanding common shares of NDP will be converted into one common share. The reverse stock splits will decrease the number of the funds' shares of common stock outstanding and potentially increase the market price per share by a proportional amount. Neither the funds' portfolio holdings nor the total value of stockholders investments in the funds will be affected as a result of the reverse stock splits. The reverse stock splits are intended to increase the market price per share of the funds and broaden the range of potential investors in shares of the funds' common stock, thereby potentially improving the market for, and liquidity of, shares of the funds' common stock. March 30, 2020 | Duff & Phelps Select MLP and Midstream Energy Fund Inc. Announces Liquidation and Dissolution Proposal. The Duff & Phelps Select MLP and Midstream Energy Fund Inc. (DSE), a closed-end fund subadvised by Duff & Phelps Investment Management Co., announced today that its Board of Directors has approved fund management's recommendation to seek shareholder approval for the liquidation and dissolution of the fund. The determination to seek the liquidation and dissolution of the fund was based on an assessment of a variety of factors, including the significant and unprecedented downturn in the MLP and midstream energy sector, in which the fund invests, the current level of assets, as well as a review of potential alternatives. Ultimately it was determined that it was advisable and in the best interest of shareholders to liquidate the fund. The proposal to liquidate and dissolve the fund, which requires the approval of shareholders, will be submitted for approval at the fund's annual shareholder meeting, scheduled for May 21, 2020. Given the liquidation proposal, the Board decided that the fund should not declare or pay a dividend for the second quarter. February 6, 2020 | Angel Oak Capital Advisors Announces Board Approval of Merger of Angel Oak and Vivaldi Closed-End Funds. Angel Oak Capital Advisors, LLC (Angel Oak), an investment management firm that specializes in value-driven fixed income investment solutions, announces that the Board of Trustees of Angel Oak Financial Strategies Income Term Trust (FINS) approved the merger of the Vivaldi Opportunities Fund (VAM) with and into FINS, subject to approval of the reorganization by VAM's shareholders and of the issuance of additional FINS common shares by FINS's shareholders. The proposed merger showcases Angel Oak's continued growth efforts and commitment to seeking to provide value for FINS shareholders. The proposed merger, which is expected to be completed in the second quarter of 2020, subject to required shareholder approvals and the satisfaction of applicable regulatory requirements and other customary closing conditions, includes the transfer of all the assets of VAM to FINS in exchange solely for newly issued common shares of beneficial interest of FINS at a ratio of the net asset value of each fund. There will be no change to the investment objectives, investment strategies or investment policies of FINS as a result of the proposed merger, and the entire management team for FINS will remain the same.

Recent activist or other CEF news

These are from the past month. Any new news in the past week has a bolded date:

April 25, 2020 | Credit Suisse Gets $314 Million Highland Verdict Cut by 91%. Credit Suisse has to pay Highland Capital Management only $26 million of a nearly $314 million award stemming from fraud claims over a failed Las Vegas real estate deal, the Texas Supreme Court ruled Friday. The state high court tossed $287.5 million in damages a trial judge imposed on Credit Suisse on top of the $26 million awarded by a jury that found the bank inflated the appraisal used to finance a golf development ahead of the 2008 housing crash. The court said the judge should not have allowed Highland to argue in a separate proceeding that its damages were... (subscription required). April 24, 2020 | Highland Income Fund Announces Repurchase Program. Highland Capital Management Fund Advisors, L.P. ("HCMFA") announced today that the Board of Trustees (the "Board") of the Highland Income Fund (HFRO) ("HFRO" or the "Fund") approved a repurchase program pursuant to which the Fund may repurchase up to 10% of its stock in open-market transactions over a one-year period. The program allows for the Fund to repurchase shares, if trading at a discount, in open-market transactions until the conclusion of the repurchase period on April 24, 2021. By purchasing Fund shares, which are currently trading at a discount to the Fund's net asset value ("NAV"), HCMFA seeks to enhance value for HFRO shareholders. The total repurchase amount and the timing of repurchases will be subject to the Fund's available cash, after consideration of reserves necessary for anticipated fund expenses and contingencies, and compliance with all applicable laws and regulations. The Fund may sell portfolio securities in order to generate cash. There is no assurance that the Fund will repurchase shares in any amount. April 24, 2020 | NexPoint Strategic Opportunities Fund Announces Repurchase Program. NexPoint Advisors, L.P. ("NexPoint") announced today that the Board of Trustees (the "Board") of the NexPoint Strategic Opportunities Fund (NHF) ("NHF" or the "Fund") approved a repurchase program pursuant to which the Fund may repurchase up to 10% of its stock in open-market transactions over a one-year period. The program allows for the Fund to repurchase shares, if trading at a discount, in open-market transactions until the conclusion of the repurchase period on April 24, 2021. By purchasing Fund shares, which are currently trading at a discount to the Fund's net asset value ("NAV"), NexPoint seeks to enhance value for NHF shareholders. The total repurchase amount and the timing of repurchases will be subject to the Fund's available cash, after consideration of reserves necessary for anticipated fund expenses and contingencies, and compliance with all applicable laws and regulations. The Fund may sell portfolio securities in order to generate cash. There is no assurance that the Fund will repurchase shares in any amount.

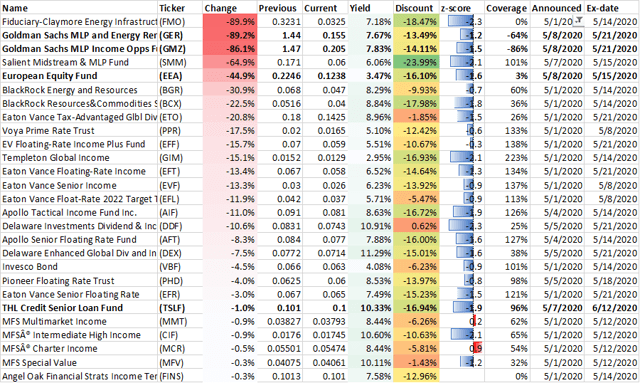

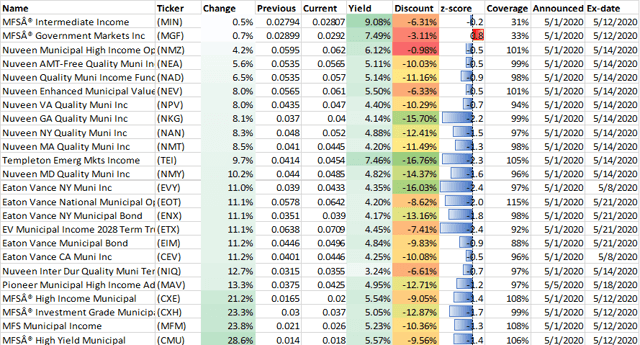

Distribution changes announced this month

These are sorted in ascending order of distribution change percentage. Funds with distribution changes announced this month are included. Any distribution declarations made this week are in bold. I've also added monthly/quarterly information as well as yield, coverage (after the boost/cut), discount and 1-year z-score information. I've separated the funds into two sub-categories, cutters, and boosters.

Cutters

| Name | Ticker | Change | Previous | Current | Yield | Discount | z-score | Coverage | Announced | Ex-date |

| Fiduciary/Claymore Energy Infrastructure | (FMO) | -89.9% | 0.3231 | 0.0325 | 7.18% | -18.47% | -2.3 | 0% | 5/1/2020 | 5/14/2020 |

| Goldman Sachs MLP and Energy Rena. Fund | (GER) | -89.2% | 1.44 | 0.155 | 7.67% | -13.49% | -1.2 | -64% | 5/8/2020 | 5/21/2020 |

| Goldman Sachs MLP Income Opps Fund | (GMZ) | -86.1% | 1.47 | 0.205 | 7.83% | -14.11% | -1.5 | -86% | 5/8/2020 | 5/21/2020 |

| Salient Midstream & MLP Fund | (SMM) | -64.9% | 0.171 | 0.06 | 6.06% | -23.99% | -2.1 | 101% | 5/7/2020 | 5/15/2020 |

| BlackRock Energy and Resources | (BGR) | -30.9% | 0.068 | 0.047 | 8.29% | -9.93% | -0.7 | 60% | 5/1/2020 | 5/14/2020 |

| BlackRock Resources&Commodities Strategy | (BCX) | -22.5% | 0.0516 | 0.04 | 8.84% | -17.98% | -1.8 | 36% | 5/1/2020 | 5/14/2020 |

| Eaton Vance Tax-Advantaged Glbl Div Opp | (ETO) | -20.8% | 0.18 | 0.1425 | 8.96% | -1.85% | -1.5 | 26% | 5/1/2020 | 5/21/2020 |

| Voya Prime Rate Trust | (PPR) | -17.5% | 0.02 | 0.0165 | 5.10% | -12.42% | -0.6 | 133% | 5/1/2020 | 5/8/2020 |

| EV Floating-Rate Income Plus Fund | (EFF) | -15.7% | 0.07 | 0.059 | 5.51% | -10.67% | -0.3 | 138% | 5/1/2020 | 5/21/2020 |

| Templeton Global Income | (GIM) | -15.1% | 0.0152 | 0.0129 | 2.95% | -16.93% | -2.1 | 223% | 5/1/2020 | 5/14/2020 |

| Eaton Vance Floating-Rate Income | (EFT) | -13.4% | 0.067 | 0.058 | 6.52% | -14.64% | -1.3 | 134% | 5/1/2020 | 5/21/2020 |

| Eaton Vance Senior Income | (EVF) | -13.3% | 0.03 | 0.026 | 6.23% | -13.92% | -0.9 | 137% | 5/1/2020 | 5/8/2020 |

| Eaton Vance Float-Rate 2022 Target Term | (EFL) | -11.9% | 0.042 | 0.037 | 5.71% | -5.47% | -0.9 | 113% | 5/1/2020 | 5/8/2020 |

| Apollo Tactical Income Fund Inc. | (AIF) | -11.0% | 0.091 | 0.081 | 8.63% | -16.72% | -1.9 | 126% | 5/4/2020 | 5/14/2020 |

| Delaware Investments Dividend & Income | (DDF) | -10.6% | 0.0831 | 0.0743 | 10.91% | 0.62% | -2.3 | 25% | 5/5/2020 | 5/21/2020 |

| Apollo Senior Floating Rate Fund | (AFT) | -8.3% | 0.084 | 0.077 | 7.88% | -16.00% | -1.6 | 127% | 5/4/2020 | 5/14/2020 |

| Delaware Enhanced Global Div and Inc | (DEX) | -7.5% | 0.0772 | 0.0714 | 11.29% | -15.01% | -1.6 | 38% | 5/5/2020 | 5/21/2020 |

| Invesco Bond | (VBF) | -4.5% | 0.066 | 0.063 | 4.08% | -6.23% | -0.9 | 101% | 5/1/2020 | 5/14/2020 |

| Pioneer Floating Rate Trust | (PHD) | -4.0% | 0.0625 | 0.06 | 8.53% | -13.97% | -0.8 | 98% | 5/5/2020 | 5/18/2020 |

| Eaton Vance Senior Floating Rate | (EFR) | -3.0% | 0.067 | 0.065 | 7.49% | -15.23% | -1.5 | 121% | 5/1/2020 | 5/21/2020 |

| THL Credit Senior Loan Fund | (TSLF) | -1.0% | 0.101 | 0.1 | 10.33% | -16.94% | -1.9 | 96% | 5/7/2020 | 6/12/2020 |

| MFS Multimarket Income | (MMT) | -0.9% | 0.03827 | 0.03793 | 8.44% | -6.26% | 0.2 | 62% | 5/1/2020 | 5/12/2020 |

| MFS® Intermediate High Income | (CIF) | -0.9% | 0.0176 | 0.01745 | 10.60% | -10.63% | -2.1 | 65% | 5/1/2020 | 5/12/2020 |

| MFS® Charter Income | (MCR) | -0.5% | 0.05501 | 0.05474 | 8.44% | -5.81% | 0.9 | 54% | 5/1/2020 | 5/12/2020 |

| MFS Special Value | (MFV) | -0.3% | 0.04075 | 0.04061 | 10.11% | -1.43% | -1.2 | 32% | 5/1/2020 | 5/12/2020 |

| Angel Oak Financial Strats Income Term | (FINS) | -0.3% | 0.1013 | 0.101 | 7.58% | -12.96% | 0% | 5/1/2020 | 5/14/2020 |

Boosters

| Name | Ticker | Change | Previous | Current | Yield | Discount | z-score | Coverage | Announced | Ex-date |

| MFS® Intermediate Income | (MIN) | 0.5% | 0.02794 | 0.02807 | 9.08% | -6.31% | -0.2 | 31% | 5/1/2020 | 5/12/2020 |

| MFS® Government Markets Inc | (MGF) | 0.7% | 0.02899 | 0.0292 | 7.49% | -3.11% | 0.8 | 33% | 5/1/2020 | 5/12/2020 |

| Nuveen Municipal High Income Opp Fd | (NMZ) | 4.2% | 0.0595 | 0.062 | 6.12% | -0.98% | -0.5 | 101% | 5/1/2020 | 5/14/2020 |

| Nuveen AMT-Free Quality Muni Inc | (NEA) | 5.6% | 0.0535 | 0.0565 | 5.11% | -10.03% | -0.5 | 99% | 5/1/2020 | 5/14/2020 |

| Nuveen Quality Muni Income Fund | (NAD) | 6.5% | 0.0535 | 0.057 | 5.14% | -11.16% | -0.9 | 98% | 5/1/2020 | 5/14/2020 |

| Nuveen Enhanced Municipal Value | (NEV) | 8.0% | 0.0565 | 0.061 | 5.50% | -6.33% | -0.5 | 101% | 5/1/2020 | 5/14/2020 |

| Nuveen VA Quality Muni Inc | (NPV) | 8.0% | 0.0435 | 0.047 | 4.40% | -10.29% | -0.7 | 94% | 5/1/2020 | 5/14/2020 |

| Nuveen GA Quality Muni Inc | (NKG) | 8.1% | 0.037 | 0.04 | 4.14% | -15.70% | -2.2 | 99% | 5/1/2020 | 5/14/2020 |

| Nuveen NY Quality Muni Inc | (NAN) | 8.3% | 0.048 | 0.052 | 4.88% | -12.41% | -1.5 | 97% | 5/1/2020 | 5/14/2020 |

| Nuveen MA Quality Muni Inc | (NMT) | 8.5% | 0.041 | 0.0445 | 4.20% | -11.49% | -1.3 | 98% | 5/1/2020 | 5/14/2020 |

| Templeton Emerg Mkts Income | (TEI) | 9.7% | 0.0414 | 0.0454 | 7.46% | -16.76% | -2.3 | 105% | 5/1/2020 | 5/14/2020 |

| Nuveen MD Quality Muni Inc | (NMY) | 10.2% | 0.044 | 0.0485 | 4.82% | -14.37% | -1.6 | 96% | 5/1/2020 | 5/14/2020 |

| Eaton Vance NY Muni Inc | (EVY) | 11.0% | 0.039 | 0.0433 | 4.35% | -16.03% | -2.4 | 97% | 5/1/2020 | 5/8/2020 |

| Eaton Vance National Municipal Opprs Tr | (EOT) | 11.1% | 0.0578 | 0.0642 | 4.20% | -8.62% | -2.0 | 115% | 5/1/2020 | 5/21/2020 |

| Eaton Vance NY Municipal Bond | (ENX) | 11.1% | 0.0351 | 0.039 | 4.17% | -13.16% | -1.8 | 98% | 5/1/2020 | 5/21/2020 |

| EV Municipal Income 2028 Term Trust | (ETX) | 11.1% | 0.0638 | 0.0709 | 4.45% | -7.41% | -2.4 | 92% | 5/1/2020 | 5/21/2020 |

| Eaton Vance Municipal Bond | (EIM) | 11.2% | 0.0446 | 0.0496 | 4.84% | -9.83% | -0.9 | 88% | 5/1/2020 | 5/21/2020 |

| Eaton Vance CA Muni Inc | (CEV) | 11.2% | 0.0401 | 0.0446 | 4.25% | -10.08% | -0.5 | 96% | 5/1/2020 | 5/8/2020 |

| Nuveen Inter Dur Quality Muni Term Fund | (NIQ) | 12.7% | 0.0315 | 0.0355 | 3.24% | -6.61% | -0.7 | 97% | 5/1/2020 | 5/14/2020 |

| Pioneer Municipal High Income Advantage | (MAV) | 13.3% | 0.0375 | 0.0425 | 4.95% | -12.71% | -1.2 | 97% | 5/5/2020 | 5/18/2020 |

| MFS® High Income Municipal | (CXE) | 21.2% | 0.0165 | 0.02 | 5.54% | -9.05% | -1.4 | 108% | 5/1/2020 | 5/12/2020 |

| MFS® Investment Grade Municipal | (CXH) | 23.3% | 0.03 | 0.037 | 5.05% | -12.87% | -1.7 | 99% | 5/1/2020 | 5/12/2020 |

| MFS Municipal Income | (MFM) | 23.8% | 0.021 | 0.026 | 5.23% | -10.36% | -1.3 | 108% | 5/1/2020 | 5/12/2020 |

| MFS® High Yield Municipal | (CMU) | 28.6% | 0.014 | 0.018 | 5.57% | -9.56% | -1.4 | 106% | 5/1/2020 | 5/12/2020 |

CEF analysis from around Seeking Alpha...

ADS Analytics presents Leaning To CEF Sectors With Stronger Distribution Profiles (May 12), Further Deleveraging Across PIMCO Taxable CEFs (May 13), Uses And Abuses Of CEF Distribution Coverage (May 14)

Alpha Gen Capital presents CEF Report May 2020: Definitely Better Than Feared (May 11), PCI And PDI: What To Make Of The NAVs Of The PIMCO Twins (May 13), CEF Weekly Commentary: May 3, 2020 (May 15)

Bridger Research presents HIX: Franklin Templeton On Board Should Enhance Shareholder Value Creation (May 12)

Douglas Albo presents Equity CEFs: A Big Fat Opportunity In The BSTZ Technology CEF (May 15)

Jeremy S Chen presents EOS: Approach The Volatile Market With This Covered Call CEF From Eaton Vance (May 14)

*Juan de la Hoz presents BHK: Strong Leveraged Fixed Income CEF With Lower Risk And Lower Return Compared To PIMCO Funds (May 13), GUT: This Will Not End Well (May 15)

*Nick Ackerman presents BMEZ: BlackRock's Second Offering In The Healthcare Space (May 10), BTO: An Interesting Financial Play (May 13), TEAF: Discount Widens Significantly (May 15)

Rida Morwa presents PCI: Rare Double-Digit Yields From An Elite Fund (May 15)

*Stanford Chemist presents When Full Coverage Doesn't Guarantee Against CEF Distribution Cuts (May 10), Weekly Closed-End Fund Roundup: May 1, 2020 (May 11), The Chemist's 'High-High-Low' Closed-End Fund Report, April 2020 (May 12), HIE: Near-4% Annual Alpha From This High Dividend Equity Closed-End Term Fund (May 14)

*To subscribers: these link to the public version of the article, which you will already have seen in the members section.

Macro/market section

Fear & Greed Trader presents S&P 500 Weekly Update: The Market Gets A Reality Check (May. 16)

Jeff Miller presents Weighing The Week Ahead: There Are No Shortcuts (May. 17)

Lance Roberts presents Stuck In The Middle As Seasonal Sell Signals Trigger (May. 17)

Commentary

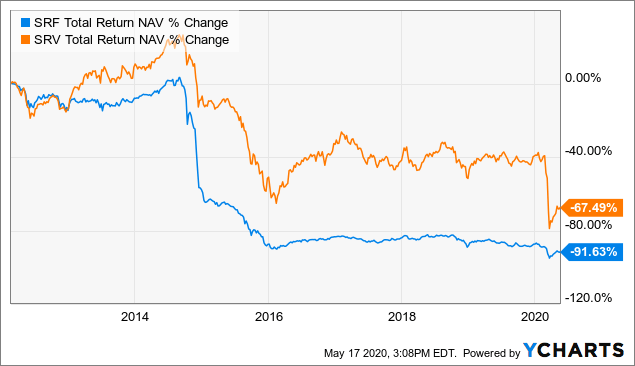

We have two upcoming mergers taking place over the next month. The first is the merger of Cushing Energy Income Fund (SRF) into Cushing MLP & Infrastructure Total Return Fund (SRV), which was approved by shareholders. As might be expected, the better-performing fund (SRV in this case) becomes the accounting survivor, while the records of the abysmal SRF conveniently disappear. The reason that SRF has performed relatively poorly could be because it isn't as focused on MLP/midstream as SRV is, and so SRF includes many upstream companies that have performed even worse than MLP/midstream entities.

Data by YCharts

Since SRV (-19.13% discount) is trading at a relatively narrower discount than SRF (-21.71%), there could be a few percentage points of alpha in play here by buying SRF and selling SRV now until the merger closes on May 29, 2020, only 10 days away. For example, if one currently owns SRV and originally intended to hold after the merger, they could swap to SRF now and hopefully receive back a few more shares of SRV than they initially had 10 days later. For active trades, the annualized valuation difference of around 65% comfortably exceeds the current borrow rate of 14% shown for SRV on Interactive Brokers. However, given that the two portfolios have some differences (such as upstream exposure for SRF), this is a risk to this swap.

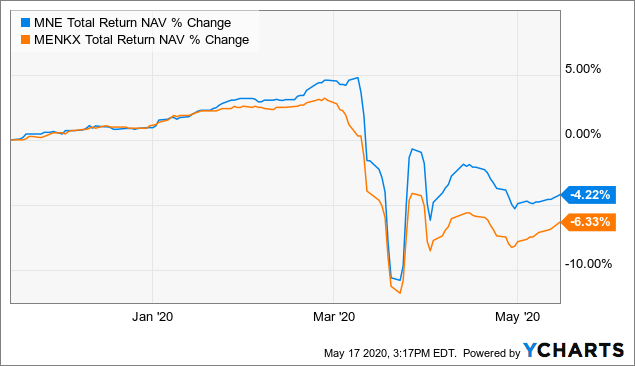

The second merger is of BlackRock Muni New York Intermediate Duration Fund, Inc. (MNE) into the open-ended BlackRock New York Municipal Opportunities Fund (of which MENKX is one share class), which was also approved by shareholders. The merger is expected to close on June 22, 2020. MNE currently has a -1.57% discount, giving an annualized alpha of around +18% from discount contraction should one desire NY muni exposure.

Data by YCharts

Goldman Sachs MLP and Energy Renaissance Fund (GER) and Goldman Sachs MLP Income Opportunities Fund (GMZ) announce massive distribution cuts of -89.2% and -86.1%, respectively. This shouldn't have been much of a surprise, given how much their NAVs have fallen, plus the fact that they have deleveraged their funds completely. At first glance, GER's new quarterly distribution of $0.155 seems only marginally lower than their February distribution of $0.16 per share, but that is because the fund underwent a 9-for-1 reverse split in the meantime! The similar applies to GMZ too, which underwent a 7-for-1 reverse split last month.

Our Memorial Day sale is limited to this week only, or until the first 50 members have signed up, whichever comes first.

Get 20% Off + 26% Off on Annual Plan + 2-Week Free Trial

At the CEF/ETF Income Laboratory, we manage market-beating closed-end fund (CEF) and exchange-traded fund (ETF) portfolios targeting safe and reliable ~8% yields to make income investing easy for you. Check out what our members have to say about our service.

Disclosure: I am/we are long ECC, ECCB, ECCX, ECCY, MAV, OCCI, OCCIP, OXLCM, OXLCO, OXCLP, TYG. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.