Looks Like adidas Has Found Its Bottom Now

by The European ViewSummary

- Urgently needs liquidity.

- What was unusual, however, was that the company was unable/unwilling to issue bonds due to a lack of credit ratings.

- This has extremely adverse effects on investors, as adidas is not allowed to pay a dividend, for example.

- From a fundamental point of view, however, an entry for long-term investors could still be worthwhile, even if the stock is already quite expensive again.

Introduction

For a long time, adidas (OTCQX:ADDYY; ADDDF) only knew rising share prices. Anyone who bought shares in the company during the Great Recession of 2008 was able to increase his or her investment tenfold since then.

But then came COVID-19 and hit the company hard. It also revealed some weaknesses that I did not think were possible. Some mistakes in the past have now cost investors the dividend. However, for the time being, the share price seems to be bottoming out. It is quite possible that a sustained upward movement could start from here. Nevertheless, the share remains quite expensive. adidas remains an interesting opportunity for long-term investors to diversify their portfolio.

adidas might have found a bottom

adidas suffered from COVID-19 like many other companies. The business has already taken a severe hit in the first quarter of 2020:

- Coronavirus causes standstill of the majority of business in March and April

- More than 70 percent of the company's global store base still closed by the end of April

- First-quarter revenues down 19 percent currency-neutral and in euro terms

- Operating margin down to 1.4 percent due to revenue shortfall

- Net income from continuing operations declines 97 percent to €20 million

Numbers were taken from adidas press release and edited by the author.

In addition, the company indicated that the second quarter could be even worse:

Consequently, both top- and bottom-line declines in the second quarter of 2020 are currently expected to be more pronounced than those recorded in the first quarter, with currency-neutral sales projected to come in more than 40% below the prior year level and the operating result to be negative.

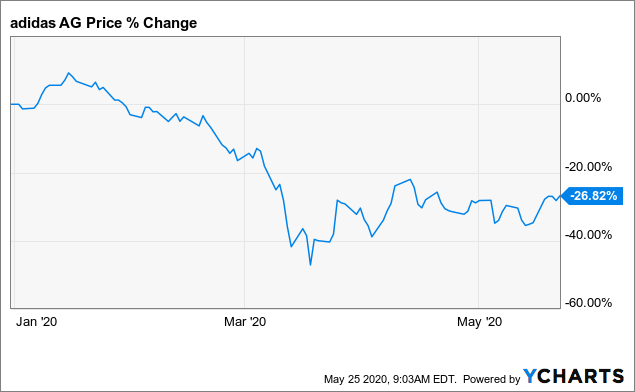

This comes as little surprise since the first month of the quarter in Western countries remained largely unaffected by COVID-19 and were only hit at the end of the first quarter. In this respect, the cards are all on the table. And how's the stock price? It almost looks as if the stock has found a bottom here and is gradually leveling off after the crash.

Data by YCharts

As I will show you in a moment, investors have made massive use of a favorable time window that could close soon.

Time window of good fundamental chance/risk ratio closes

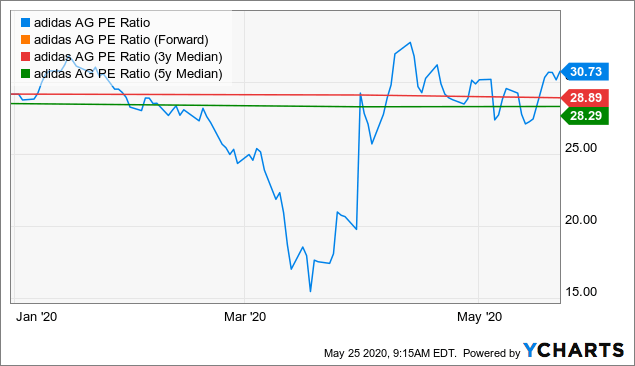

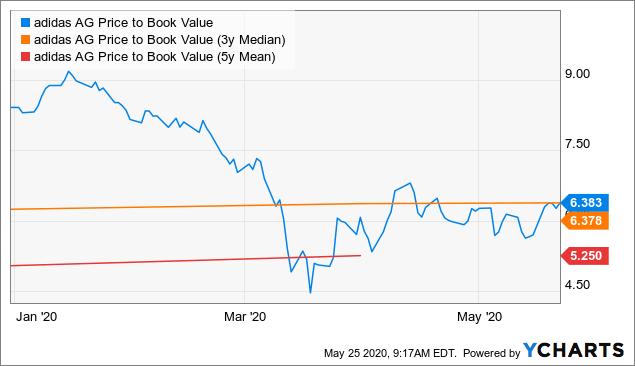

For a short period of time, adidas was relatively cheap and almost a bargain compared to its own historical multiples. In the meantime, however, the P/E ratio and the Price/Book value ratio have again come close to their historical medians.

Data by YChartsData by YCharts

There are, of course, reasons for this, as investors assume that business will pick up again after COVID-19. Things went quite well in the first quarter before COVID-19 where revenue outside the Asia-Pacific region was up 8 percent. In addition, the beginning of the second quarter has already provided initial indications of this:

The company's top line continued to sequentially recover in Greater China in the first three weeks of April, and global e-commerce revenues showed another significant acceleration from 55% currency-neutral growth recorded in March.

The many major events postponed until the next year, such as the European Football Championship and the Summer Olympics, could also give the business another big boost. In this context, it is perhaps also a good thing that adidas must now inevitably place an even stronger focus on online retail. Here too, adidas has been quite successful. In the first quarter, adidas online retail sales were up 35 percent. In March, online retail even grew 55 percent.

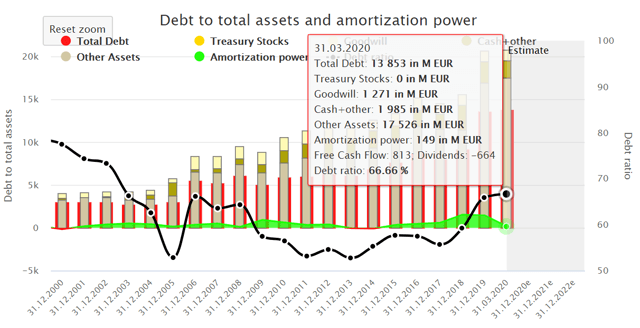

With a debt ratio of 66 percent, the company also has a relatively stable foundation. The average amortization power of EUR 1.5 billion shows furthermore that adidas has enough resources to address debt and liabilities in normal times.

(Source: Debt ratio adidas)

No dividend due to lack of credit ratings

Like many other companies, adidas had some liquidity problems due to store closures.

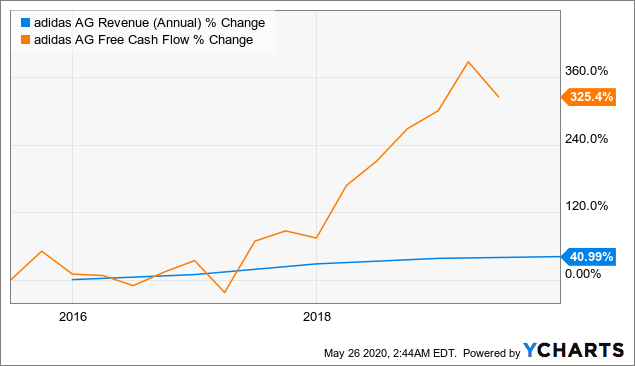

So far, the usual events were still affected here. However, from an investor's point of view, I think it is much more problematic that adidas was not able to raise new money on the capital market. adidas could not issue bonds because the company does not have a credit rating. The management simply did not care about it. On the one hand, this can be seen as a self-confident statement. And, of course, if you look at the development of cash flow and revenue, the company doesn't really have any liquidity problems.

Data by YCharts

The other side is, however, that this approach has caused immense damage for investors. adidas was now dependent on obtaining a syndicated loan, in which KfW Bank, Germany's state-owned development bank, covered 80 percent of the credit risk. Since it is a state-owned bank, the conditions are correspondingly strict. For example, adidas is not allowed to pay a dividend until the loan is repaid. So, while competitors like Nike (NKE) simply obtained capital through bonds, adidas was forced into a state dependency.

This means that the adidas story as a potential dividend gem is also gone. adidas has, in fact, increased its distributions in the last 10 years, in some cases massively. A distribution of EUR 3.90 per share was planned for 2019. Compared to the payouts in 2010, this would have been almost five times as much. Loyal investors who would have bought adidas shares 10 years ago would now have had a yield on cost of over 7 percent; a juicy cash flow in difficult COVID-19 times.

(Source: Dividend history and planned but canceled proposal for 2019)

Conclusion

After every analysis of a company, I will use a three-grade rating. Its purpose is to ensure that readers recognize at first glance whether a company might or might not be worth investing in. The three steps rating at a glance:

Buy the jewel now rather than tomorrow if:

- There are no downsides, and the company has growth potential.*

- The upsides outweigh the downsides, and the company has enormous growth potential.

Worth an investment (maybe later after a second look) if:

- The upsides outweigh the downsides.

- The upsides are equal to downsides, but the company has growth potential.

No thanks if:

- No growth potential in the long term.

- The downsides outweigh the upsides.

*Of course, the growth potential is a part of the upsides, but it is also crucial in my final considerations.

Conclusion: The grade for adidas

Because of the dividend increases, adidas used to be a potential gem. But that's over now. As far as dividends are expected again in the future, the company remains an interesting investment for long-term investors. However, the time window in which the company was a bargain has almost closed again. Meanwhile, the company is only available at prices that are within the historical median.

If you enjoyed this article and wish to receive other long-term investment proposals or updates on my latest portfolio research, click "Follow" next to my name at the top of this article.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.