RealNetworks Could Have A Winner

by Shareholders UniteSummary

- The company's video codecs, Napster and other assorted businesses have lingered, not producing any profits.

- However, they have a growing gaming business that looks interesting.

- But we think the winner could be their computer vision platform which enables face recognition even those wearing masks, and looks like turning to remote thermal sensing capabilities.

- Given the shares are very cheap, any uptick in their business is likely to quickly change the trajectory of its shares.

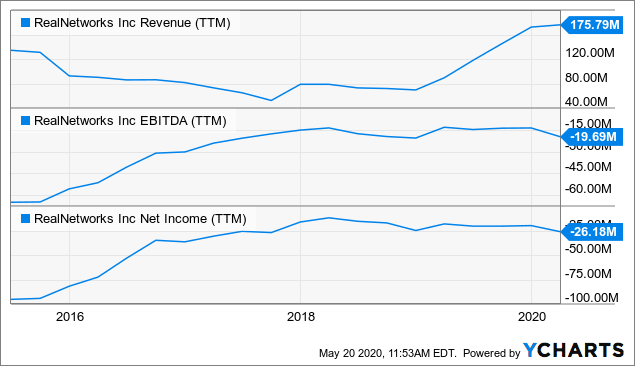

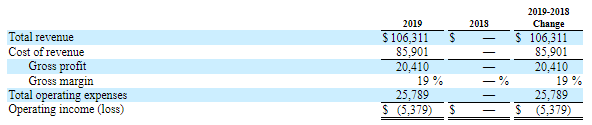

At first sight RealNetworks (RNWK) might not seem like a stellar investment choice. The company has a history of losses and while there is a jump in revenues after it doubled its stake in Rhapsody (Napster), these losses have continued unabated:

Data by YCharts

But we see an opportunity here as a result of:

- SAFR, the company's computer vision business, more especially in its AI powered facial recognition platform

- Cheap valuation

Management made an interesting pivot towards "the intersection of public health and safety" in their SAFR business in relation to the COVID-19 pandemic. Apart from recognizing faces even when people are wearing masks, we think it's likely this will also include remote thermal sensing.

While this is speculative, it's not unreasonable to expect as we will argue below and if we're right the stock price could receive quite a jolt.

Products

Since nobody here on SA has written anything on the company for years, a short introduction is perhaps warranted. The company reports in four segments:

- Consumer Media (video codecs, RealPlayer, SuperPass)

- Mobile Services (Kontxt, other SaaS services, SAFR, RealTimes platform)

- Games

- Napster

These are all described in detail in the 10-K so we refer you to that for details.

Growth

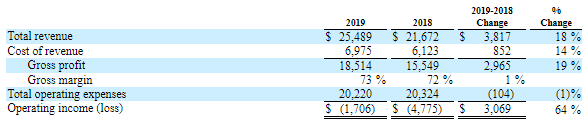

At first sight, there doesn't seem to be much reason for optimism here as only their games segment is growing. From the 10-K:

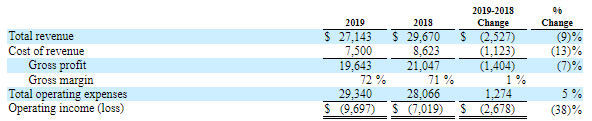

Their mobile services isn't. (10-K):

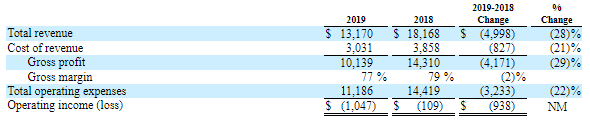

And neither is their smaller consumer media. (10-K):

And these three divisions are much smaller compared to the 84% stake in Napster. (10-K):

Unfortunately, Napster generates a much lower gross margin. Apart from the lack of growth, neither of these segments is actually profitable.

Q1 results

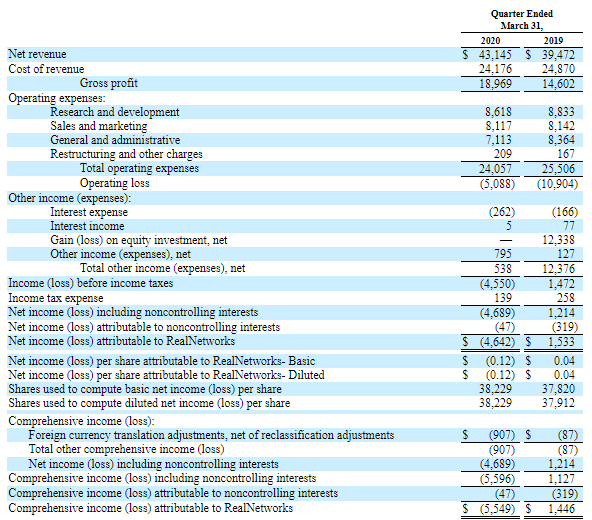

At first sight, Q1 looks like the company returned to growth. From the 10-Q:

But one has to keep in mind that the company bought 42% of Napster in Q1 2019 and this was included in the figure from January 18 onward, so there are almost three weeks in Q1 2019 where Napster revenue (its largest segment) wasn't included in the figures:

- Napster Q1 2019 revenue: $24.3M

- Napster Q4 2019 revenue: $26.1M

- Napster Q1 2020 revenue: $26.3M

So even taking this into account, overall company revenue is still growing and indeed (Q1CC):

When not including revenue from Napster, the first quarter marked our third consecutive quarter of year-over-year revenue growth.

Napster doesn't seem all that promising though, despite the $200K sequential revenue increase (Q1CC, our emphasis):

The sequential increase was mainly due to an early termination fee of a customer contract and an increase in platform services revenue, partially offset by declining subscribers.

While it might have invented it, the company has a lot of competition in the streaming music business and unless something significant changes, it's difficult to see this going anywhere anytime soon, even if margins are somewhat improving (see below).

Their consumer media segment also doesn't look like it's going to take off anytime soon. While revenues were up $1M compared to Q1 2019, this doesn't seem to be too promising (Q1CC):

Year-over-year, the increase was primarily driven by the timing of renewals and shipments of our IP codec business which were partially offset by continuing declines in our legacy PC products.

We think there are potentially three parts of their business which can provide growth. One of these already is, of course and that's the gaming segment (Q1CC):

Games revenue for the first quarter was up $100,000 sequentially and up $900,000 year-over-year. On a sequential and year-over-year basis, the increase was driven by continued strong performance of free-to-play mobile games, partially offset by fewer premium game launches and a decline in our legacy PC subscription business.

And then there is this (Q1CC, our emphasis):

Mobile services revenue was up $400,000 on a sequential basis and down $200,000 on a year-over-year basis. The sequential improvement was primarily driven by higher sales in SAFR and Kontxt and was partially offset by declines in our legacy Ringback Tones product.

SAFR

This is their computer vision platform, which hasn't yet generated significant revenue streams but we see at least some potential (it has quite a number of significant partners, for starters). So does management, as they are pivoting towards the intersection of public health and public safety, with enhanced products arriving in H1 2020.

They didn't say much on the Q1CC about these, but our interest was piqued by this from biometricupdate:

Performance accuracy of SAFR biometric facial recognition technology from RealNetworks is not affected by people wearing masks to protect themselves against the spread of COVID-19, explains Eric Hess, senior director of product management for Face Recognition & Security Solutions in a company blog post. Hess says the algorithm can easily adapt to the situation thanks to the occlusion detection feature which is included in the SAFR platform. The company is now focusing on improving occlusion logic to enable high performance and accuracy even in the toughest scenarios. The technology could then be easily deployed for healthcare workers moving from one area to another, and essential service providers and potential security threats can still be identified.

Indeed, mask wearing can be a problem for facial recognition platforms. But RealNetworks is hardly the only company working on this:

In the UK, for example, biometrics company Facewatch, which provides retailers and venues with facial recognition systems, announced on 11 May it had developed a "periocular" algorithm which allows its cameras to make identifications by scanning the area between a person's cheekbones and eyebrows... One of the first companies to deploy a system it claimed could identify individuals with hidden faces was Chinese artificial intelligence (AI) firm SenseTime, which reportedly deployed the technology as early as 11 February to control building access to the headquarters of South Korean IT company LG CNS. While other Chinese firms, including Alibaba, Hanwang Technology, Telpo and Wisesoft, quickly followed suit with similar solutions throughout February and March, facial recognition developers in the rest of the world were not far behind.

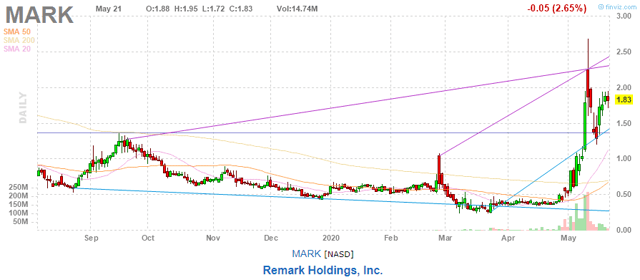

So this looks like a bit of a crowded field already although the US is unlikely to use any Chinese technology, and might not even use the technology from RealNetworks competitor Remark Holdings (MARK) which has seen its shares spike recently on similar positioning, on March 3 this year:

KanKan AI improved its already-robust Smart Monitor technology by adding thermal detection, including body temperature detection, and improved its facial recognition capability to include compliance with public sanitary regulations such as the wearing of protective masks. This builds upon the successful technology platform that has already been deployed among students within the Hangzhou school systems for early flu detection.

The stock did nothing on that news, but on April 30 it followed up with:

today announced that it began shipping and deploying products from its family of AI thermal solutions, including Thermal Kits, Thermal Pads, and Thermal Helmets, in the United States and Japan. "We are proud that customers such as casinos, entertainment venues, government agencies, hospitality organizations, industrial operations, law enforcement, and retail establishments have placed their trust in our AI-based thermal products to function as part of the solution for reopening the U.S. economy," stated Kai-Shing Tao, CEO of Remark Holdings. "Our solutions provide touch-free access control and monitoring, as well as accurate temperature measurement and the ability to scan as many as 120 people per minute, a rate that is approximately 10 times faster than manual checks. Our solutions also filter out non-human heat sources and provide security personnel with real-time alerts with photo identification."

And there we go:

We have to admit that we have distinct mixed feelings about this company, a couple of years ago we were struck by the grandiose AI claims of the company and we think that our strong reservations have been quite vindicated since.

Also, the company presents itself as:

Early stage leader in China's burgeoning AI market - establishing niche with accessible and customizable AI products at reasonable price points

It also comes with a host of Chinese partnerships so this is likely to be off limits in the US as well. But RealNetworks could benefit here. We have heard rumors that they are working on remote temperature sensing capabilities, but can't confirm that. In any case their technology is really capable. From Security Informed:

In the April 2019 NIST results, SAFR tested as the fastest and most compact solution among algorithms with less than 0.022 False Non-Match Rate - 62 percent faster than the average speed, according to the company. SAFR now provides capabilities such as live video overlays alerting security professionals to events in real time, automatic bookmarks with rich metadata for investigative work, and alerts that can be customized to create security responses.

And in a very recent interview, the CEO said this:

What distinguishes SAFR is we are, by far, the fastest. What matters in live video is the combination of your accuracy and your speed. Because of SAFR's speed we actually complete multiple recognitions in the time that it takes our competitors to finish one in some cases. As a result of that, we reach a higher level of accuracy, 99.9% accuracy, faster than anyone else in the world.The second thing that sets us apart is our remarkably low level of bias.

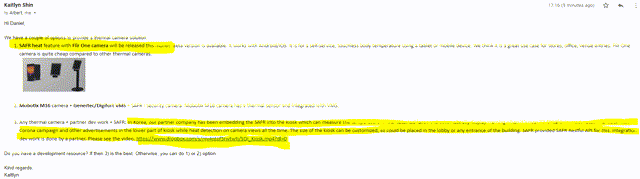

But what about remote temperature sensing? There are some indirect pointers though:

- The public health and safety pivot, brought on by the COVID-19 pandemic. Remote thermal sensing seems a very obvious fit, as it's the main public health and safety concern.

- The company's partnership with Brazilian surveillance camera maker Digifort.

- Digifort's thermal camera platform.

On their cooperation:

The SAFR platform supports flexible deployment - including on-premise, cloud, or hybrid - and can also characterize gender, age, and sentiment. This enables security professionals to not only identify people on watchlists, but also build greater awareness of demographics and traffic patterns in facilities across retail, health, telecom, education, government, and other commercial markets. Digifort and RealNetworks are committed to making SAFR available to current and new customers around the world in 2019. Current Digifort customers can contact their Digifort sales representative or authorized reseller to learn how to purchase and install SAFR.

On remote thermal sensing. From Digifort:

Due to the rapid spread of coronavirus, there are no independent tests of thermal camera performance/accuracy to date. We urge caution and work closely with manufacturers and their recommendations. Digifort is doing our best in making sure these cameras are natively integrated with Digifort, so a centralised solution can be achieved whether manned or un-manned scenarios. If any of the chosen models for a project is not yet integrated, rest assured we will prioritise the integration for you.

This does sound like a platform to us, and since they're partnering with RealNetworks' SAFR platform, this is an interesting possibility. And then there is this, which comes from the Twitter feed of a certain MrJakePeralta99:

It seems to be the sales force of SAFR, confirming an upcoming Flir One camera with SAFR software with heatseeking capabilities, release end of May. There is even a video where it is demonstrated in Korea.

We also know of at least one other person to whom this has been confirmed in writing, so it seems to be a bit more than just a rumor.

COVID-19 pandemic impact

The company is taking pro-active measures (Q1CC):

Specifically, we've reduced internal expenses, frozen employee salaries, laid off about 20 staff members worldwide, furloughed about half a dozen more and modified our 2020 executive bonus program.

The CEO also reneged on his bonus. They did suffer a bit from the pandemic though. From the 10-K:

For our software license revenues, the $0.3 million increase was primarily the result of revenue from sales of our recently introduced SAFR product, which recognized negligible revenue in the prior year. At this time, we believe that there is risk that the effects of the recent outbreak of coronavirus COVID-19 on global mobility and corporate investment could negatively impact growth expectations and sales prospects for our SAFR business.

Funny enough it's their SAFR business that has been (marginally) affected, perhaps that induced the pivot towards public health and safety.

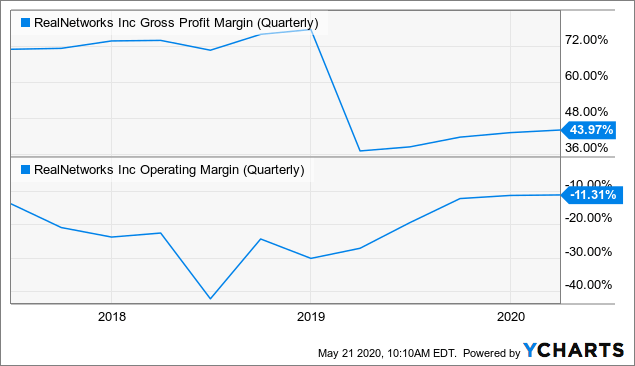

Margins

Data by YCharts

Gross margins crashed with the January 2019 purchase of another 42% of Napster, but they have been recovering a bit since, which is encouraging. From the Q1CC:

gross margin was 44% compared to 43% in the prior quarter and 37% in the prior year period. RealNetworks' gross margin without Napster was 76%, consistent with the prior quarter and an increase from 70% in the prior year period.

That 600bp improvement in gross margin ex-Napster is something to hold onto, as is the generally high level of these gross margins. But even Napster's margins seem to improve (Q1CC):

Napster's contribution margin was $1.1 million compared to $200,000 in the prior quarter and a loss of $500,000 in the prior year period. The sequential and year-over-year improvements were primarily due to higher revenue.

The y/y comparison isn't viable as Napster wasn't part of the company's accounts for nearly three weeks of Q1 2019, but the sequential increase is promising, albeit just that, one quarter data. It remains to be seen whether there is any kind of trend here.

Operating costs are decreasing to $24.1M from $24.6M in Q4 and $25.5M in Q1 2019, although $600K of this is lower cost from the Napster acquisition. Unallocated overhead also decreased, by $400K versus the previous quarter and by $1.6M versus Q1 2019.

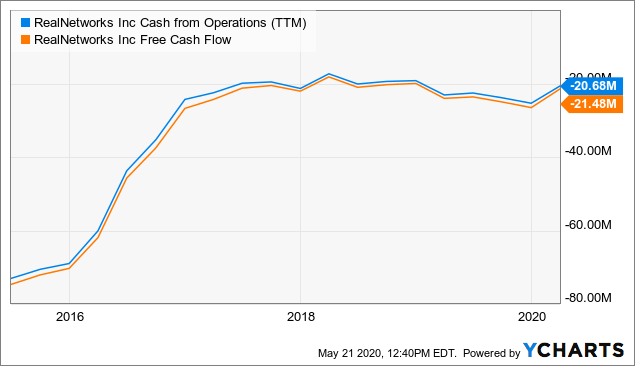

Cash

This isn't an encouraging graph for investors:

Data by YCharts

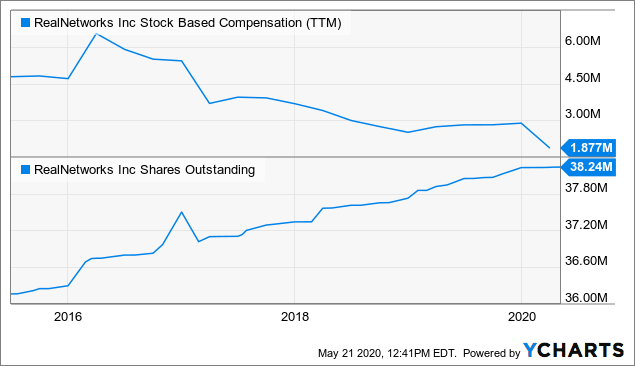

Although surprisingly, this hasn't led to much dilution and stock based compensation is declining quite fast:

Data by YCharts

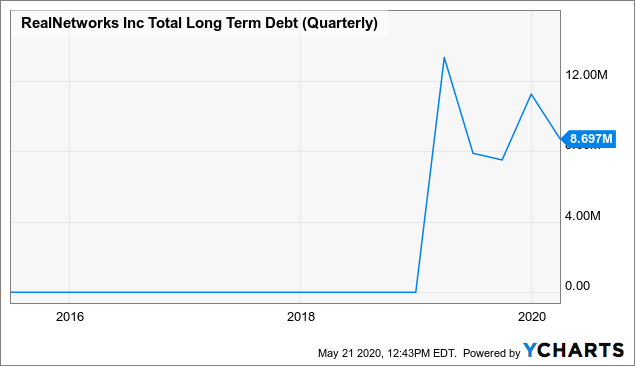

And even debt has been quite moderate:

Data by YCharts

But the company does issue preferred stock, for which it received $10M in Q1 from no less a figure than the CEO himself (10-Q):

In February 2020, Mr. Glaser invested approximately $10.0 million in RealNetworks in exchange for the issuance to him of 8,064,516 shares of Series B Preferred Stock. The Series B Preferred Stock is convertible into common stock on a one-to-one basis subject to the limitation described in Note 13 Related Party Transactions.

With respect to these conditions (10-Q):

no conversion is permitted in the event that such conversion would cause Mr. Glaser's beneficial ownership of our common stock to exceed the 38.5% threshold set forth in our Second Amended and Restated Shareholder Rights Plan dated November 30, 2018. The Series B Preferred Stock has no liquidation preference and no preferred dividend.

And it has a revolving credit facility and it has received a $2.9M loan from the government PPP program (and Napster received an $1.7M loan as well).

The company has $19M in cash and equivalents, so it has time to turn things around before it needs new financing.

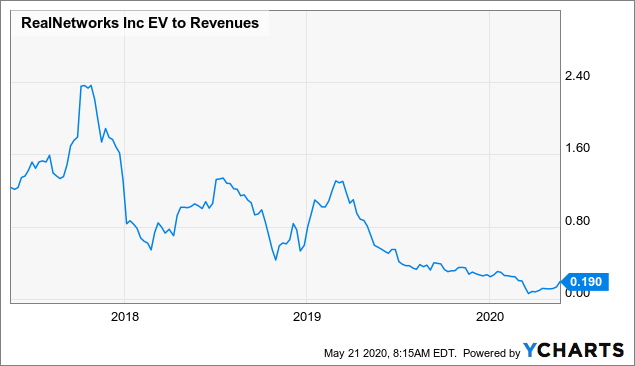

Valuation

Data by YCharts

A 0.2x EV/S ratio offers a lot of upside when the company's fortunes turn.

Conclusion

The shares are dirt cheap, which isn't surprising given the history of losses and cash bleed. Yet the CEO recently invested $10M in the company.

On top of that it has a growing games business and its computer vision platform seems to offer interesting opportunities. Given the low valuation, not much has to happen for the shares to move materially higher, in our view.

What could the spark be? Well, that interesting public safety and health pivot of their computer vision business SAFR could be that spark. SAFR is a capable face recognition platform, can recognize people wearing masks but while we don't have hard evidence, the obvious public safety and health concern here is remote temperature sensing.

If the share price explosion of Remark Holdings is any guide, this could be fun. This is of course speculative and might not materialize, but for investors who like the odds, it offers an interesting opportunity.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in RNWK over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.