Teekay Tankers: A Story Of Very Rapid Deleveraging

by Marel.Summary

- Teekay Tankers generated over $240M of free cash flow in the last two quarters (the current market cap is below $575M).

- Strong free cash flow is also expected in Q2 2020, in part due to recent chartering activity fixing 10 Suezmaxes and 3 Aframaxes for 6-to-24-month periods at attractive rates.

- The key highlight is the company's rapid deleveraging results; Q1 2020 net debt was reduced by ~$200M, or over 20%, from Q4 2019.

- Net debt to total capitalization was reduced to 40.0% versus 48.4% in Q4 2019. In normal times, this aggressive debt reduction would have taken years.

- The tanker orderbook is currently 8% of the existing fleet size, the lowest level since 1997.

Teekay Tankers (TNK) is the oil tanker segment of the Teekay Group and one of the world's largest owners and operators of mid-sized crude tankers. The vast majority of my exposure in the Teekay Group is via Teekay Corporation (TK). TK owns approximately 30% of TNK, making it the largest shareholder. Therefore, I have direct exposure to TNK by owning shares of TNK outright and indirect exposure via my stake in TK.

Earlier this year, we experienced one of the strongest tanker markets on record. Mid-size tanker spot rates in Q1 2020 were the highest since Q3 2008. Q1 2020 spot tanker rates were boosted by:

- elevated supply in March and April due to Russia-Saudi price war

- collapse in oil prices

- rise in floating storage

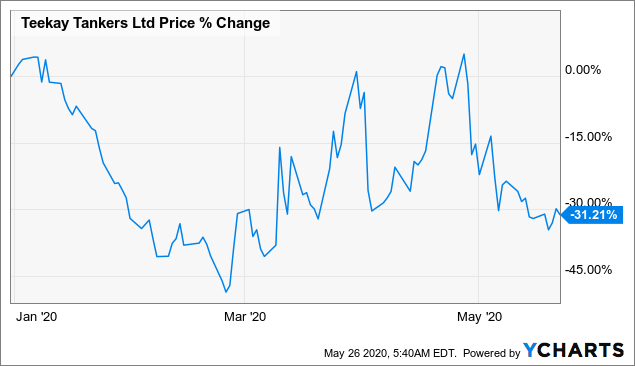

Despite this, TNK is down ~30% YTD. One would have expected the opposite.

Data by YCharts

As a result of the strong market, Q1 2020 results were the best in more than a decade. Specifically:

- Total adjusted EBITDA of $155.4M, up $22.6M from Q4 2019

- Adjusted net income of $110.0M (or $3.27 per share), up from adjusted net income of $83.0M (or $2.47 per share) in Q4 2019

- Quarterly EPS yield of 20.0% (annualized yield of 80.0%)

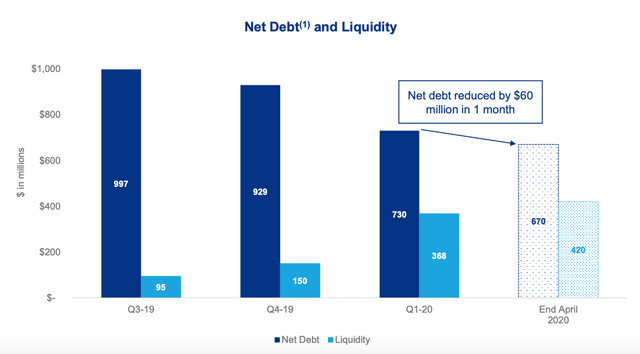

All in all, TNK was a cash machine generating over $140M of free cash flow. In addition, the company completed ~$60M of vessel sales at firm prices. Most importantly, this led to a massive reduction in debt, perhaps the key highlight of the quarter.

- Q1 2020 net debt was reduced by ~$200M, or over 20%, from Q4 2019.

- Net debt to total capitalization was reduced to 40.0% versus 48.4% in Q4 2019.

In normal times, this aggressive debt reduction would have taken years.

The strong free cash flow generation will substantially boost TNK's NAV. This applies to many other tanker companies as well. In the past, investors have been accustomed to tanker companies just covering OPEX and finance costs. Now, they are generating tremendous amounts of free cash flow. This may lead to a massive transformation for tanker equities, potentially with long-lasting effects. This was also echoed by leading shipping analysts who see significantly increased valuations with tanker NAVs potentially doubling by the end of 2020.

Source: TradeWinds

It goes without saying that the impact on NAVs will, ultimately, depend on how long the strong market lasts. At the time of writing this article, the market is not that hot, but one needs to bear in mind that several companies have locked in attractive period rates, as opposed to being solely exposed on the spot market. This also applies to TNK which capitalized on the strong market by entering into 9 six-month to two-year time charter-out contracts for six Suezmaxes and three Aframax-sized vessels at attractive rates. More specifically:

- five one-year Suezmax chartered out at an average rate of $45,600/day

- one six-month charter out at $52,500/day

- three Aframax-sized vessels chartered out for 12 to 24-month periods at an average rate of $26,750/day

These are very strong rates and Q2 2020 looks set to be another strong quarter.

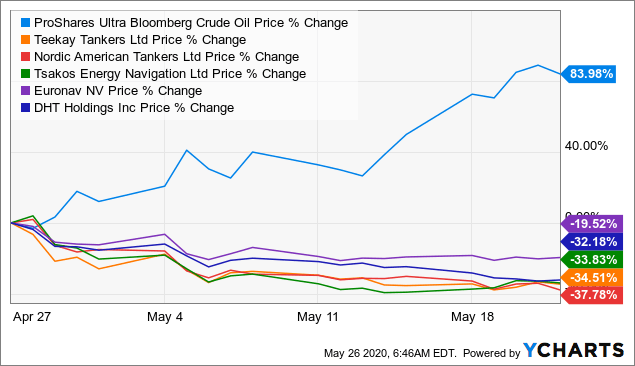

The floating storage play has created the perception that oil tanker stocks are an oil hedge. As the price of oil has gone up, tanker stocks have fallen substantially.

Data by YCharts

There will eventually be a divergence and we will experience a tanker rally even if oil prices continue to climb, as tankers become 'transportation assets' again. The floating storage mania will eventually fade away as the world economy reopens and the demand for oil will inevitably pick up. It is important to note that a strong oil market is required for oil supply to start increasing again, which will, ultimately, benefit tankers due to increased demand for transportation.

In closing, TNK is poised to benefit via rapid deleveraging which will, in turn, boost NAV per share. In addition, lower net debt will lower the company's cash breakeven due to lower interest payments and potentially favorable refinancing terms. The graph below summarizes the tremendously positive impact the strong tanker market has had this year on TNK's financial position.

Source: TNK Q1 2020 Earnings Presentation, slide 9

While it is unrealistic to expect the same level of free cash flow as in Q1 2020, which on an annualized basis represented a free cash flow yield of ~100% based on the current share price, strong free cash flow is still expected in Q2 2020 and beyond. This will occur even at significantly lower spot tanker rates, in part due to the aforementioned attractive period term-charter deals, which have boosted the company's backlog by $170M.

I fully appreciate the uncertainty in the tanker space as oil markets start to normalize. However, the tanker orderbook is currently 8% of the existing fleet size, the lowest level since 1997. Fleet growth is expected to remain very low for the next couple of years and, in the meantime, the global fleet is aging, with a large number of potential scrap candidates. Not all cycles are the same and, this time round, tankers are far better positioned to weather a period of weaker demand compared to previous cycles. While many think this is the end of a nice tanker bubble, the opposite might be the case i.e. the beginning of a nice super tanker cycle, like in the 2000s. In any event, I am buying TNK today, at levels attractive relative to NAV, while NAV is expanding due to strong cash accumulation.

Disclosure: I am/we are long TNK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am also long the parent company TK