3 Nasdaq-100 Stocks to Buy On the Dip For Bullish Investors

In a market made up of stocks, these leading NASDAQ stocks remain constructive

Individual stocks rally and fall every day. But inside today’s bull market, the Nasdaq-100 and its component stocks have demonstrated the kind of leadership critical to sustaining the wider market rally. And right now, three Nasdaq-100 stocks are ‘still’ working hard to ensure that friendly trend continues.

Delta Airlines (NYSE:DAL), Boeing (NYSE:BA), Caterpillar (NYSE:CAT), Las Vegas Sands (NYSE:LVS) and more are just a few of the big names supporting NASDAQ gains. By Tuesday’s closing bell, these large-cap stocks had advanced strongly.

This is especially important considering that those names have been a veritable who’s who of stocks that have lagged the broader averages since late March’s coronavirus-induced bottom.

Of course, there’s nothing wrong with that, and it would be a mistake to be dismissive. On the session, S&P 500 added 1.27% and for the first time since the bear market bottom, moved convincingly above its 62% to new relative highs, turning bullish.

Reports of a new vaccine trial from biotech Novavax (NASDAQ:NVAX) and renewed economic optimism following a mostly successful test of new social hygiene standards during the Memorial Day holiday helped with those gains. But elsewhere in the market, Tuesday’s early optimism faded fast.

The tech-heavy Nasdaq-100 and many of its top constituent stocks, which led U.S. equity markets higher over the past two months, has stumbled.

The index closed fractionally lower as influential leadership from Microsoft (NASDAQ:MSFT), Netflix (NASDAQ:NFLX) and other heavyweights was absent, even counterproductive, with many of those stocks closing firmly underwater.

The good news is that a single day does not a trend make. It’s quite normal for leadership within a bull market to take a break. It is after all, a market made up of stocks. And even the best of the best are prone to profit-taking. Having said that and as long as the pause we’re seeing right now doesn’t turn overtly symptomatic of a bearish top, it’s time to have a watch list of Nasdaq-100 stocks to buy.

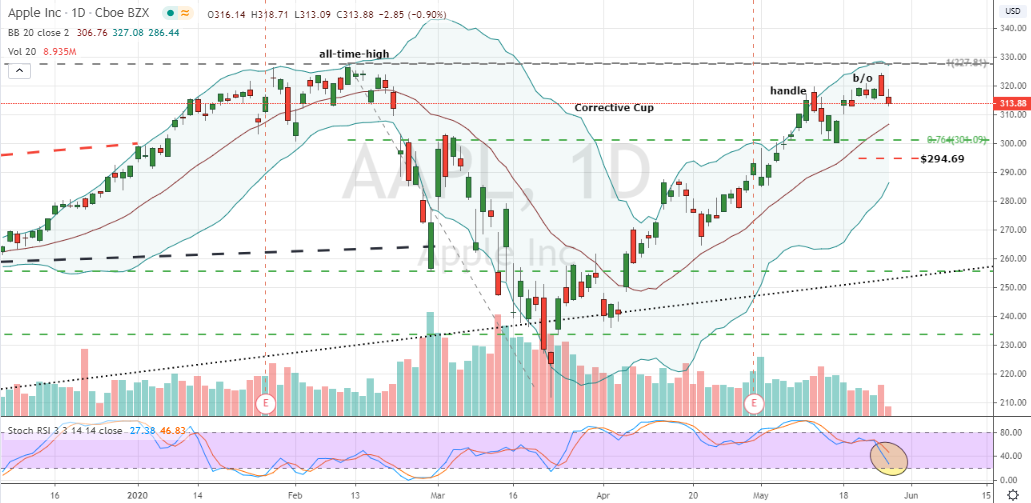

Nasdaq-100 Stocks to Buy: Apple (AAPL)

Source: Charts by TradingView

The first of our Nasdaq-100 stocks to buy is Apple. Shares of the diversified consumer technology giant have narrowed the market cap gap against Microsoft in recent days. And three new upwardly-revised, above-market-rate price target hikes from Wall Street could be what’s needed to put shares back atop the valuation food chain.

Technically, shares of Apple have attempted to break out of a tight handle congestion pattern formed off the 76% retracement level of its cup shaped corrective base. However, the initial reaction has faltered, so shares are modestly trading back inside the handle formation.

My advice for this Nasdaq-100 stock to buy is wait on a flattening of stochastics, then watch for price action to confirm a daily chart pullback entry. The observation is the current handle could fall victim to a bear raid. But as long as shares remain above $294.69, any additional price weakness could be viewed as a healthy opportunity to buy shares within the larger cup base.

T-Mobile (TMUS)

Source: Charts by TradingView

T-Mobile is the next of our NASDAQ stocks to buy, as shares of the industry-disrupting telecom giant could offer investors big profits.

You won’t find any defensive dividends for TMUS shareholders. But what you will find is a company leading the wireless services market in subscriber and sales growth. And that’s not all.

Following T-Mobile’s takeover of Sprint, the combined company boasts more radio spectrum than larger competitors AT&T (NYSE:T) and Verizon (NYSE:VZ). That could prove an important advantage as the 5G network grows.

Technically, another thing this Nasdaq-100 stock has that’s also more attractive than its peers is a bonafide uptrend, developed as part of a well-formed corrective cup. Shares recently attempted to breakout, but after establishing marginal new all-time-highs, settled back into the base.

Similar to Apple, T-Mobile is a stock to buy on healthy pattern weakness, if the purchase is backed by an improving stochastics indicator. For this Nasdaq-100 stock though, the line in the sand for a purchase also requires that shares remain above the 76% retracement level.

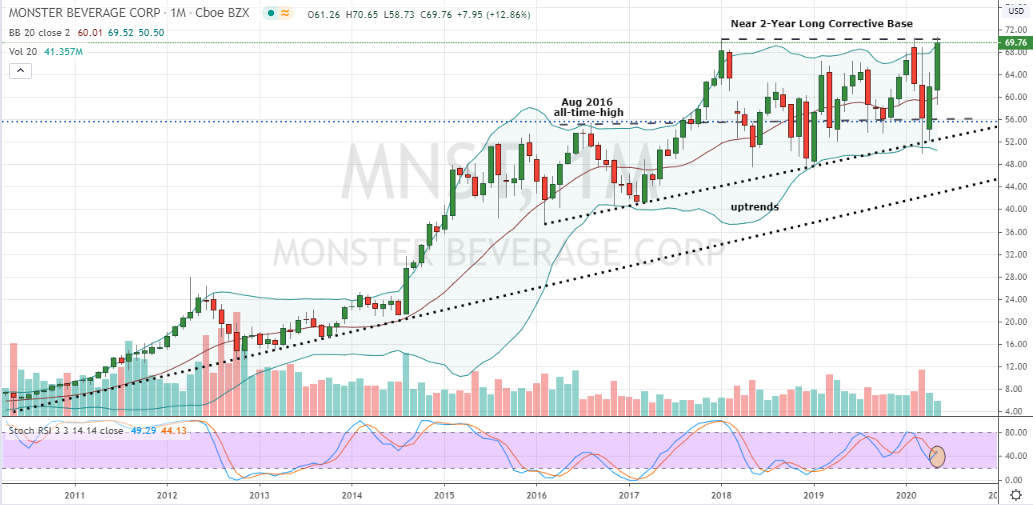

Monster Beverage (MNST)

Source: Charts by TradingView

Monster Beverage is the last of our Nasdaq-100 stocks to buy and we may have saved the best for last. A recent profit and sales beat by the company’s namesake energy drink saw investors thirsting for more as shares bubbled higher by nearly 6%.

Moreover, the monthly price chart strongly suggests there’s more of that fizzy action in the works. Technically, shares are positioned within 1% of breaking out of a near two-year long basing pattern that’s formed around Monster’s former 2016 all-time-high.

A failed base breakout occurred in February just as the novel coronavirus’ began to upend risk assets. But a second monthly attempt and new narrow all-time-high was secured Tuesday before shares dipped back into the base to close out the session.

Bottom-line, with second attempt’s often yielding big-time profits and Monster’s stochastics confirming the possibility for a more sustainable rally, unlike peer Coca-Cola (NYSE:KO), this Nasdaq-100 stock is a hot commodity for investors right now.

Disclosure: Investment accounts under Christopher Tyler’s management does not own any securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.