Iron Mountain: Strong Operating Results Despite COVID-19

by Kody's DividendsSummary

- Iron Mountain recently declared its dividend in line with the previous, which is excellent news in a difficult economic environment such as the one we are currently in.

- Despite the tailend of Q1 2020 being a difficult operating environment, Iron Mountain managed to deliver 1.4% YoY reported revenue growth, 11.9% YoY adjusted EBITDA growth, and 19.6% AFFO growth.

- In addition, shares of Iron Mountain are undervalued by 26% based on my interpretation of data sourced from I Prefer Income, as well as the dividend discount model.

- Between its 10.2% yield, 2.0-3.0% annual AFFO growth potential, and 3.1% annual valuation multiple expansion, shares of Iron Mountain are positioned to exceed my annual total return requirement of 10% over the next decade.

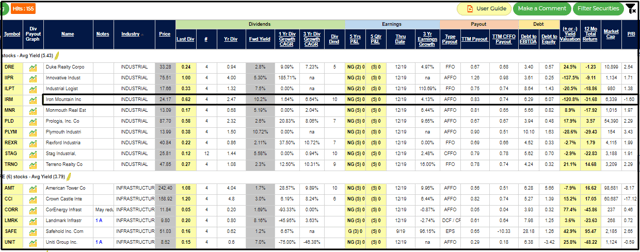

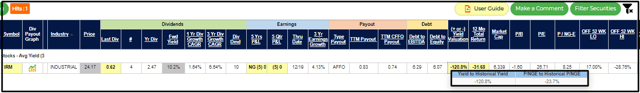

Image Source: I Prefer Income & I Prefer Income Filter

In a business operating environment fraught with as much uncertainty as the current one, it is important to seek out dividend stocks that are holding up well despite the uncertainty.

To that end, I filtered I Prefer Income's REIT database for stocks that offer a yield of greater than 10%, as well as 3-year earnings growth and dividend growth greater than 2%.

In doing so, I was able to narrow the database of REIT stocks from 155 down to 3.

Today, I'll be revisiting Iron Mountain's (IRM) dividend safety and growth profile since I last covered the stock in April, discussing recent operating results and pertinent risks to consider, as well as examining Iron Mountain from a valuation standpoint to gain an overall understanding of Iron Mountain's total return potential and investment appeal at the current price.

Dividend Sustainability Continues To Improve

Although I hold the opinion that it is wise to examine the sustainability of all dividend stocks, it is especially important to scrutinize the payout ratios on a stock that is yielding 5 times the S&P 500 as is the case with Iron Mountain, which is why I'll be checking in on Iron Mountain's AFFO payout ratio for the most recent quarter.

In the first quarter of the current fiscal year, Iron Mountain generated AFFO of $231.2 million according to Iron Mountain's Q1 2020 earnings press release against $181.3 million in dividends paid during that time, according to page 7 of Iron Mountain's Q1 2020 10-Q, for an AFFO payout ratio of 78.4%.

The financial benefits of Iron Mountain's Project Summit transformation program are beginning to be realized as Iron Mountain's payout ratio for the first quarter of this fiscal year has notably improved from the 82.3% AFFO payout ratio of last fiscal year as discussed in my previous article on the company and the 92.0% AFFO payout ratio in Q1 2019 (based on data sourced from Iron Mountain's Q1 2019 earnings press release and Iron Mountain's Q1 2019 10-Q).

As a result of Iron Mountain's AFFO growth outpacing dividend growth in the near future, Iron Mountain is well on its way to reaching the mid-60 to low-70% AFFO payout ratio that CEO William Meaney discussed in the company's Q3 2019 earnings call in order to bring its dividend obligation in line with other data center REITs.

Given that Iron Mountain's dividend growth will be relatively light over the next couple of years to accomplish the aforementioned AFFO payout ratio before approximating AFFO growth, I believe it is reasonable to expect a 2-3% annual long-term dividend growth rate in line with my forecasted annual AFFO growth for Iron Mountain.

Strong Operating Results In Spite Of COVID-19

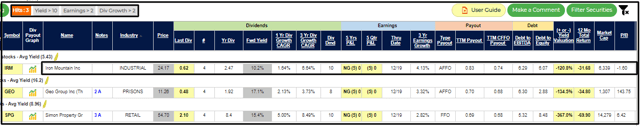

Image Source: Iron Mountain Q2 2020 Investor Presentation

Iron Mountain delivered strong operating results in spite of the operational challenges that manifested in the tail end of Q1 as a result of the COVID-19 pandemic.

Starting with the top line, Iron Mountain managed to grow its reported revenue by 1.4% from $1.054 billion in Q1 2019 to $1.069 billion in Q1 2020.

Adjusting for the impact of business acquisitions and divestitures, Iron Mountain's organic YoY revenue growth was 1.0%, and excluding the unfavorable currency translation, Iron Mountain's revenues advanced 3.2% YoY in the first quarter on a constant currency basis.

Delving a bit deeper into Iron Mountain's solid operating results during the first quarter, the global RIM segment produced organic revenue growth of 60 basis points for the quarter, which was a reflection of revenue management and volume growth in faster-growing markets that more than offset lower YoY paper prices, according to opening remarks from Iron Mountain's CFO Barry Hytinen in Iron Mountain's Q1 2020 earnings call.

What's more, Iron Mountain reaped the rewards of its Project Summit and continuous improvement initiatives as the segment's EBITDA margin of 41% represented a YoY 230 basis-point increase, as indicated by Mr. Hytinen in his opening remarks during Iron Mountain's Q1 2020 earnings call.

Moving to Iron Mountain's data center business, organic YoY revenue growth of 9.9% was achieved in the first quarter, which benefited from relatively low churn of 50 basis points and strong leasing, per Mr. Hytinen's opening remarks in Iron Mountain's Q1 2020 earnings call.

The thesis that surging data center demand will be able to drive Iron Mountain's financial results going forward continued to play out as supported by the above data, as well as the fact that Iron Mountain's data center business was able to expand its EBITDA margin by 360 basis points YoY to 45.9% in Q1 2020, according to Mr. Hytinen's opening remarks in Iron Mountain's Q1 2020 earnings call.

As a result of Iron Mountain's top-line growth and continuous improvement initiatives, Iron Mountain reported $363 million in adjusted EBITDA in Q1 2019 against the $325 million reported in Q1 2019, for a robust reported YoY growth rate of 11.9% in adjusted EBITDA.

Accounting for unfavorable currency translation, Iron Mountain's adjusted EBITDA increased 13.7% on a constant currency basis.

Furthermore, Iron Mountain's AFFO surged by 19.6% from $193 million in Q1 2019 to $231 million in Q1 2020.

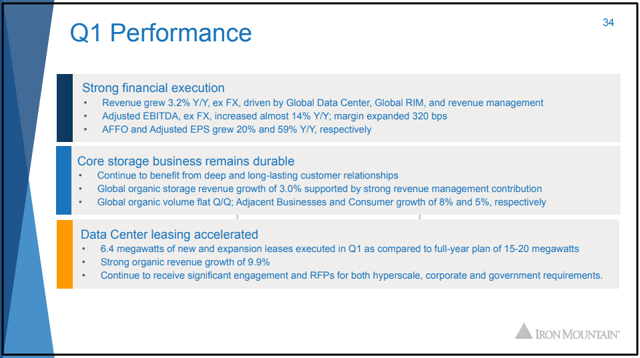

Image Source: Iron Mountain Q2 2020 Investor Presentation

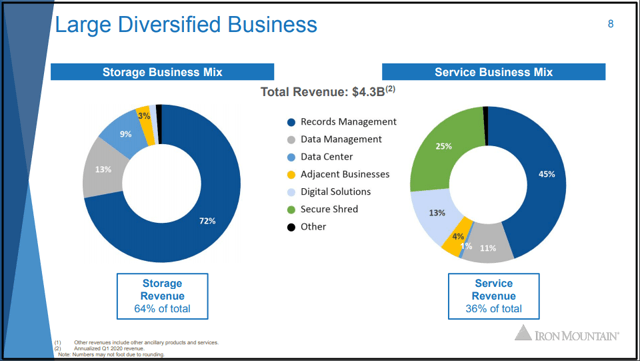

As illustrated above, Iron Mountain's diversified revenue streams allow for the company to deliver consistent financial results.

This is because 64% of Iron Mountain's revenue is generated by the more predictable storage business mix, as opposed to the less predictable service business mix.

Given that Iron Mountain's customer retention rate within its records management business is 98% and that over 50% of boxes remain in Iron Mountain's facilities for an average of 15 years, as indicated by slide 9 of Iron Mountain's Q2 2020 Investor Presentation, it isn't surprising that Iron Mountain has held up relatively well in spite of the COVID-19 pandemic and its disruptions to many businesses throughout the economy.

Image Source: Iron Mountain Q2 2020 Investor Presentation

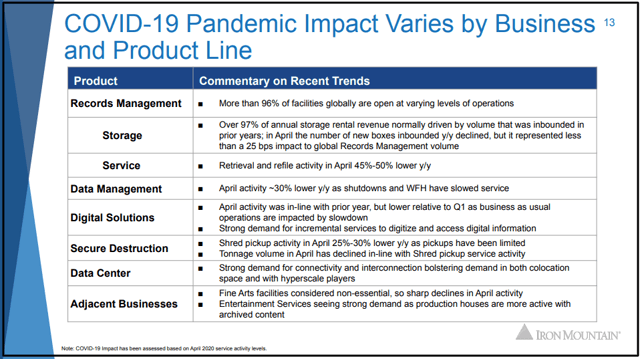

Fortunately, Iron Mountain's operations in the Records Management segment have held up relatively well as more than 96% of facilities are open in some capacity around the globe due to the company's operations being deemed an essential service in most locations, as indicated by CEO William Meaney's opening remarks in Iron Mountain's Q1 2020 earnings call.

Iron Mountain's data center business has also held up well due to the demand for services to enable workers around the world to work remotely.

While the storage portion of Iron Mountain's Records Management segment and the data center business have held up quite well due to the low customer turnover and strong demand, respectively, much of the company's service revenue has encountered obstacles.

Boxes in bounded plummeted 58% YOY in North America, while retrievals and re-files declined 49% YoY, according to Mr. Hytinen.

What's more, data management activity was roughly 30% lower YoY in April and secure destruction pickup activity declined 25-30%.

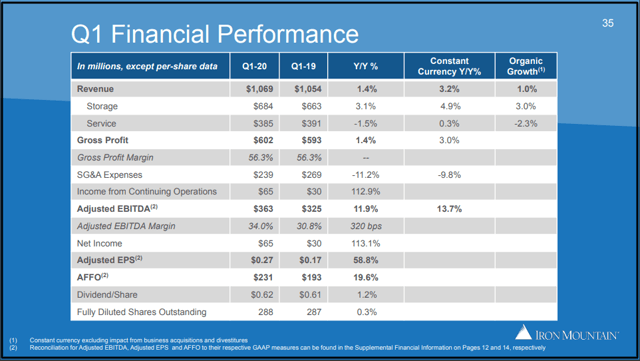

Image Source: Iron Mountain Q2 2020 Investor Presentation

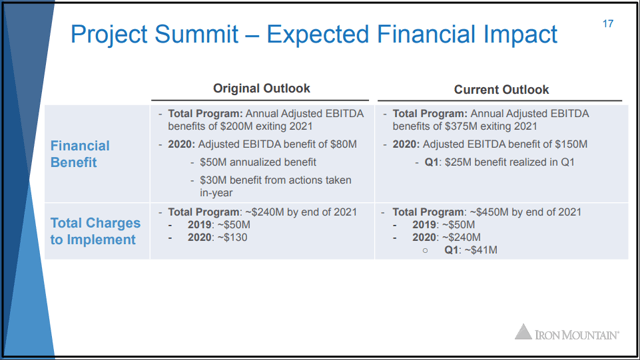

Although Iron Mountain will undoubtedly face a challenging Q2 this year, another encouraging sign is just how much progress has been made with respect to Iron Mountain's Project Summit transformation program.

As a result of the speed with which Wave One of Project Summit was executed, Iron Mountain has "identified additional opportunities to accelerate strategies to streamline our business and operations," as indicated by Mr. Meaney in his opening remarks during Iron Mountain's Q1 2020 earnings call.

While the expected charges to implement Project Summit meaningfully increased from $240 million through next year to $450 million through next year, Mr. Meaney anticipates that Iron Mountain will be able to save $375 million annually exiting next year as opposed to the initial expectation of $200 million.

As operations at Iron Mountain gradually resume across the business and capital spending allocated to executing Project Summit is reassigned elsewhere, the company will benefit from a significant uptick in adjusted EBITDA.

Image Source: Iron Mountain Q2 2020 Investor Presentation

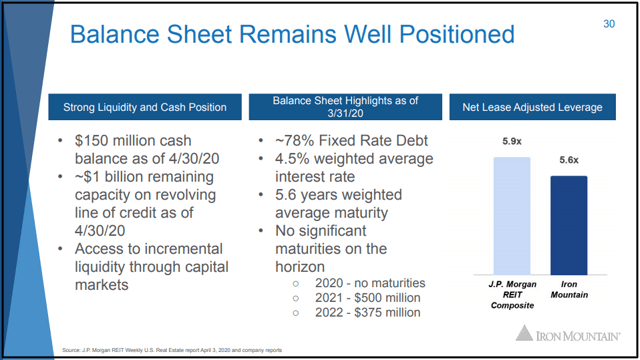

Aside from Iron Mountain's solid operating results in an uncertain business environment and significant progress in the execution of Project Summit, Iron Mountain's balance sheet has also improved since I last covered the company.

As was the case at the end of last fiscal year and in my previous article on the company, Iron Mountain faces no notable maturities until 2023 and the debt profile remains similar, with ~78% of the company's outstanding debt being fixed rate as opposed to ~80% at the end of last fiscal year.

Given that Iron Mountain is a REIT and carries more debt than most other companies, it is also beneficial that the company has been able to lower its weighted average interest rate from 4.8% at the end of last fiscal year to 4.5% at the end of Q1 2020.

From a liquidity standpoint, Iron Mountain's $150 million in cash as of last month and $1 billion in remaining capacity on its revolving line of credit positions the company to respond proactively to any further COVID-19 developments.

Iron Mountain's net lease-adjusted leverage ratio has also improved from 5.7 at the end of last fiscal year to 5.6 as of last month, while the J.P. Morgan REIT Composite's net lease-adjusted leverage ratio has deteriorated a bit from 5.6 to 5.9, which suggests that despite the significant leverage, Iron Mountain is less leveraged than the average REIT in JP Morgan's Composite.

When I take into consideration Iron Mountain's strong Q1 2020 operating results, Project Summit's progress to date, and Iron Mountain's slightly above average balance sheet relative to its REIT peers, I believe the company is capable of being a great long-term investment if shares are acquired at or below fair value.

Risks To Consider

Despite Iron Mountain's strong Q1 operating results, the company faces several key risks in the near future and over the long term, which I'll discuss below.

Since I have already discussed many of the key risks as per Iron Mountain's most recent 10-K in my previous article, I'll be reiterating most of those risks, as well as discussing the risks posed by COVID-19.

Starting with the COVID-19 pandemic, Iron Mountain faces several risks on this front as indicated in the company's most recent 10-Q.

Although the COVID-19-induced recession we find ourselves in has had a limited impact on Iron Mountain's ability to collect revenue from customers to this point, it is important to note that a continuation or deterioration of this recession late into this year or into next year could materially impact the liquidity of Iron Mountain's customers (page 63 of Iron Mountain's most recent 10-Q).

If more of a U-shaped recovery occurs rather than a V-shaped recovery, the financial impact of the recession could be more severe for Iron Mountain's customers, which would result in difficulty collecting revenue from customers, leading to uncharacteristically disappointing financial results from Iron Mountain.

A prolonged period of operational and economic uncertainty for Iron Mountain and its customers could also have the deleterious impact of a potential credit downgrade for Iron Mountain and limited access to liquidity, which would increase the company's cost of capital and possibly interfere with its growth strategy (page 64 of Iron Mountain's most recent 10-Q).

Iron Mountain is exposed to the reality that the COVID-19 pandemic will have a materially adverse impact on the company's operations and financial results in at least the short term, which is due to the fact that Iron Mountain's service revenue will be negatively impacted by the sharp declines in both demand for shred pickup due to limited pickups and data management as a result of COVID-19 shutdowns (page 63 of Iron Mountain's most recent 10-Q and slide 13 of Iron Mountain's Q2 2020 Investor Presentation).

Another longer-term outcome of the COVID-19 pandemic that may play out and be unfavorable to Iron Mountain, is the risk that Iron Mountain's customers may accelerate their shift from paper and tape storage to alternative technologies, such as cloud-based document storage (page 63 of Iron Mountain's 10-Q).

Should the above occur and Iron Mountain prove to be unsuccessful in diversifying its revenue stream away from paper and tape storage into other growth avenues, such as data centers, Iron Mountain's financial condition and operating results could be materially compromised (page 7 of Iron Mountain's most recent 10-K).

A shift from paper and tape storage to alternative storage technologies would also result in a shift in Iron Mountain's revenue mix from more stable storage revenues to more volatile service revenues, which would decrease Iron Mountain's earnings quality and predictability, making it a higher risk company.

Yet another risk to Iron Mountain is from a reputation and regulatory standpoint given the sensitive nature of the data Iron Mountain stores for its customers (pages 8-9 of Iron Mountain's most recent 10-K).

In order to comply with the various laws and governmental regulations pertaining to data privacy and cybersecurity while meeting the demands of its customers, Iron Mountain will need to continue to dedicate significant resources to compliance and cybersecurity spending.

Even though Iron Mountain will continue to allocate considerable resources to compliance and cybersecurity spending, there is no guarantee that the company will be able to safeguard its customers' records indefinitely as data breaches continue to become more ubiquitous with each day that passes.

Should a major data breach occur or Iron Mountain unintentionally compromise the security of its customers' data, the company may face significant financial penalties and fines in the short term. The longer-term implications of a massive data breach would be a serious blow to Iron Mountain's reputation, which the company may be unable to restore, permanently impairing the company's earnings power.

It's important to also note that as a part of Iron Mountain's growth strategy, the company may expand the use of joint ventures to build upon its data center presence, which is accompanied by risks of its own (page 13 of Iron Mountain's most recent 10-K).

Even if Iron Mountain remains diligent in protecting its wholly-owned operations from the risk of litigation, fines/penalties, and damage to the company's reputation, the involvement of outside parties in Iron Mountain's joint ventures could subject the company to litigation, fines/penalties, and damage to its reputation if its JV partners act negligently or unethically, which could result in negative operating and financial results for Iron Mountain.

While I have discussed several key risks associated with an investment in Iron Mountain, the above isn't to be interpreted as a complete discussion of Iron Mountain's risk profile. For a more comprehensive discussion of the risks facing Iron Mountain, I would refer interested readers to pages 7-21 of Iron Mountain's most recent 10-K, pages 63-64 of Iron Mountain's most recent 10-Q, and my previous articles on the company.

A Wonderful Business Trading At A Deep Discount

Even though I believe Iron Mountain is an above-average company, that doesn't mean an investor can expect to do well over the long term simply by acquiring shares at any price.

It is for this very reason that I'll be using two valuation metrics and a valuation model to determine the fair value of Iron Mountain's shares.

Image Source: I Prefer Income

The first valuation metric that I'll be examining to arrive at a fair value for shares of Iron Mountain is yield to historical yield.

According to I Prefer Income, Iron Mountain's current yield of 10.24% is well above its historical yield of 4.64%.

Factoring in a reversion to a yield of 7.5% and a fair value of $32.99 a share (which I believe appropriately accounts for Iron Mountain's risk profile), Iron Mountain is trading at a 26.7% discount to fair value and offers 36.5% upside from the current price of $24.17 a share (as of May 24, 2020).

The next valuation metric that I will utilize to approximate the fair value of Iron Mountain's shares is the TTM price to non-GAAP earnings to historical price to non-GAAP earnings ratio.

Iron Mountain's TTM price to AFFO of 7.09 is well below its historical price to AFFO of 10.21.

Assuming a reversion in Iron Mountain's TTM price to AFFO of 9.50 and a fair value of $32.39 a share, Iron Mountain is priced at a 25.4% discount to fair value and offers 34.0% of capital appreciation from the current price.

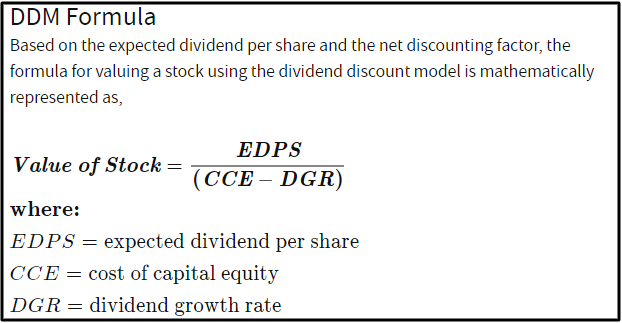

Image Source: Investopedia

The valuation model that I'll be using to assign a fair value to shares of Iron Mountain is the dividend discount model or DDM.

The first input into the DDM is the expected dividend per share, which is the annualized dividend per share. In the case of Iron Mountain, that amount is currently $2.474.

The next input into the DDM is the cost of capital equity, which is the rate of return that an investor requires on their investment. While this varies from one investor to another, I require a 10% average annual total return on my investments because I believe that is a satisfactory result for the amount of time and effort that I dedicate to researching investment opportunities and occasionally monitoring my investments.

The third and final input into the DDM is the long-term dividend growth rate or DGR.

Unlike the first two inputs into the DDM that only require an investor to retrieve the annualized dividend per share and set a required rate of return, accurately forecasting the long-term DGR requires an investor to consider numerous factors, including a stock's payout ratios (and whether the payout ratios are positioned to remain the same, expand, or contract over the long term), future AFFO growth, industry fundamentals, and the strength of a stock's balance sheet.

Given that Iron Mountain's dividend growth will likely be around 1% annually over the next couple of years as the company works to reduce its AFFO payout ratio from the high-70% range to its target AFFO payout range of the mid-60s to low-70s, I believe that Iron Mountain's dividend growth will lag AFFO growth in the short term, but that it will mirror long-term AFFO growth of 2-3%.

Using this logic, I believe a long-term DGR of 2.5% is reasonable, which again gives a fair value of $32.99 a share, indicating that shares of Iron Mountain are trading at a 26.7% discount to fair value and offer 36.5% upside from the current price.

Upon averaging the three fair values together, I compute a fair value of $32.79 a share, which implies that shares of Iron Mountain are priced at a 26.3% discount to fair value and offer 35.7% of capital appreciation from the current price.

Summary: Iron Mountain Offers An Attractive Yield With Modest Growth Potential

While Iron Mountain's dividend growth will be relatively minimal over the next couple of years, it's important to note that Iron Mountain is taking the necessary steps to secure its dividend for the long term, and continue its consecutive dividend increase streak well beyond the existing 10-year streak.

Iron Mountain's commitment to reducing its AFFO payout ratio from the high-70 to low-80% range to a mid-60 to low-70% range will allow it to be more competitive with its data center REIT peers and continue to invest capital in its primary growth avenue of data centers, while also helping to strengthen its BB- balance sheet, which will eventually lower its cost of capital.

Despite the immediate risk of the COVID-19-induced recession and the longer-term concerns surrounding the viability of Iron Mountain's data center REIT growth strategy, the company's recent quarterly results have shown that the company is trending in the right direction.

Adding to the case for an investment in Iron Mountain, is the fact that shares of the company are trading at what I estimate to be a 26% discount to fair value based on my interpretation of data sourced from I Prefer Income, as well as the dividend discount model.

When I factor in Iron Mountain's 10.2% yield, 2.0-3.0% annual AFFO growth potential, and 3.1% annual valuation multiple expansion potential, I believe shares of Iron Mountain are positioned to exceed my average annual total return requirement of 10% over the next decade.

Disclosure: I am/we are long IRM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.