Kohl's Is In Trouble

by Josh ArnoldSummary

- KSS saw sales plummet more than 40% in Q1, with Q2 shaping up to be even worse.

- Looking further out, Kohl's is relying upon its digital business, but I don't think that is the answer.

- With normalized earnings years away, the stock isn't cheap enough.

I’ve been bullish on apparel and home goods retailer Kohl’s (KSS) at various times in the past. The company is an old-line retailer in the department store style that has gone out of fashion in a variety of ways, but Kohl’s has had an ability to generate strong cash flows in the past, which afforded it the ability to pay an ample dividend and buy back stock. However, COVID-19-related closures around the country have exposed Kohl’s weaknesses, and even I am not bullish at this point in time, despite an ~$18 share price.

COVID-19 causing additional costs and reduced demand

Kohl’s has taken the necessary steps to protect its customers and employees the best that it can from COVID-19. Many retailers closed their stores entirely back in March – Kohl’s was on the 20th – and additional steps were taken for the eventual reopening of stores.

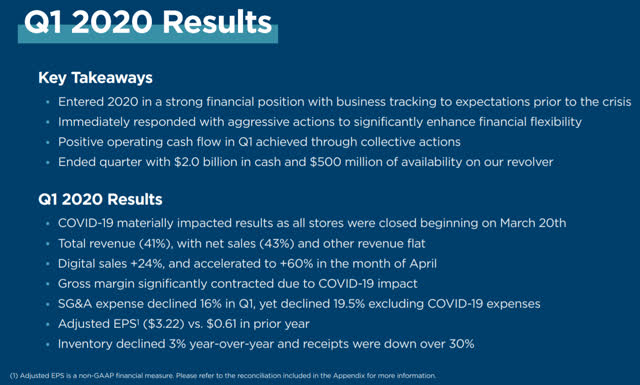

Source: Q1 earnings presentation

Kohl’s reopened half of its stores by early May, guided by local health officials’ guidance. That’s fine, but the costs of doing so may be too much for Kohl’s to recover from. Kohl’s is doing what it should, including additional cleaning procedures, reduced store hours, PPE for employees, and social distancing. The problem is that all of these things either reduce capacity, or cost Kohl’s additional money to operate its stores. To be clear, Kohl’s is doing what it must, but for a retailer that was operating on thin margins before the crisis, these measures are things the company will struggle to overcome in my view.

Because of closing its stores in March, Kohl’s decided not to provide comparable sales for Q1. However, it gave us enough to know that Q1 was a complete disaster, with clues about how Q2 will likely look when those results are reported in a couple of months.

Source: Q1 earnings presentation

Kohl’s was understandably focused on cash preservation given the environment it is operating in, but in order to generate more cash in the future, it has to figure out a way to stoke demand from consumers. It is apparent that demand fell off a cliff at the end of Q1 as social distancing orders made the company’s stores much less productive, and then as they were shut altogether.

Revenue plummeted 41% in Q1 while gross margins were more than cut in half from 37% to 17%. Most of the decline was due to a reserve for excess seasonal inventory, but the company will now have to unload that inventory at fire-sale prices, if it can find buyers at all. With receipts of inventory down more than 30%, one has to wonder what Kohl’s actually has in stock that people may want to buy from an apparel perspective, which is where it drives margin from. This sort of inventory problem - Kohl's has seasonal apparel it doesn't want, but is receiving less of the apparel it does want from vendors - is a big issue that will likely take months to work through.

To be fair, I think Kohl’s has done enough to remain liquid during this crisis, which is more than one can say for many retailers and restaurants in this climate.

Source: Q1 earnings presentation

The company ceased all capital returns, including its formerly enormous dividend, it lowered capex by $500 million, and boosted available liquidity. In short, Kohl’s will survive this period, but I’m concerned about what will be left when it is over.

Digital won’t save Kohl’s

Kohl’s touted its digital strategy as the savior of the business during this very rough time, but I’m not so sure it is.

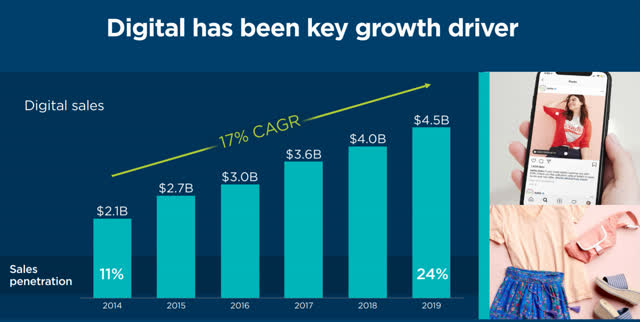

Source: Q1 earnings presentation

The company has invested heavily in its digital capabilities in recent years because, like other retailers, it had to in order to stay relevant in a changing marketplace. It has done so to an extent, but as we can see above, digital revenue was $4.5 billion out of $18.9 billion in total revenue last year, or about a quarter. Kohl’s said digital revenue was up 24% in March and 60% in April, which are impressive totals. However, even if digital revenue doubled or tripled, Kohl’s would still be in some level of trouble.

Kohl’s also notes that 35% of digital orders are fulfilled by stores, which I have to think will come down due to at least some consumers not feeling comfortable going to the store, even for curbside pickup. Either way, the fact is that Kohl’s has built its business on having stores close to its consumers, and at this point, that seems more of a liability than an asset. This is not a problem unique to Kohl’s, of course, but it is a problem in my view.

The fact is we simply don’t know when stores will be allowed to operate at some level of normalcy – without reduced hours, distancing protocols, additional sanitizing, etc. – and that these are all additional costs Kohl’s couldn’t really afford in the first place.

Digital fulfillment could be part of the answer, but keep in mind that digital orders tend to cost more than someone walking into a store to buy something. The company either has to pay for shipping to get the product to a customer’s residence, or it has to ship a single item to a store and then have the order fulfilled by an employee. These options all cost more than having bulk goods moved from warehouse to store, where the customer then does the work. Even if Kohl’s can see some level of demand recovery, one has to wonder what its margin profile will look like if/when that occurs.

The bottom line

While I want to like Kohl’s at this price, I can’t bring myself to do so. The main reason I liked Kohl’s in the past was its ample capital returns, but those have ceased indefinitely. That just leaves the company’s earnings potential, which isn’t all that great at this point for the reasons I cited above.

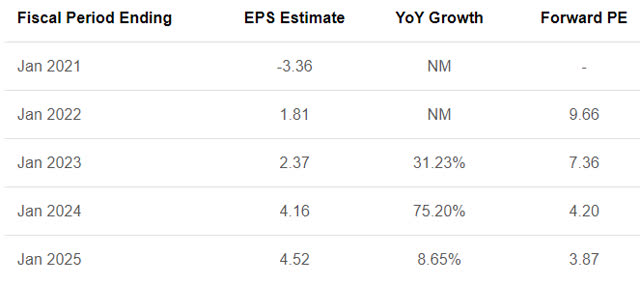

Source: Seeking Alpha

Analysts reckon Kohl’s will lose a lot of money this year, which totally makes sense. What’s interesting, however, is that the recovery looks to be quite slow. Next year is slated to see just $1.81 in EPS, which was nearly $5 at the beginning of the year. In other words, it appears Kohl’s is at least three or four years off from getting back to normalized earnings levels, if ever.

That’s my problem with Kohl’s; the idea that the company may never return to previous earnings levels is too great for me to want to jump in. If the company can get back to $5 in EPS at some point, the stock looks pretty cheap today. However, there is a lot that can go wrong between now and 2024 or 2025 to derail that, and for that reason, I think Kohl’s should be avoided.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.