Briggs & Stratton: The Equity Is Out Of Money

by Double S CapitalSummary

- The recently stock rally doesn't make any sense.

- There are a few restructuring scenarios but none of them are good for the existing equityholders.

- Chapter 11 might be required to deal with the unfunded pension liabilities.

Misvaluation

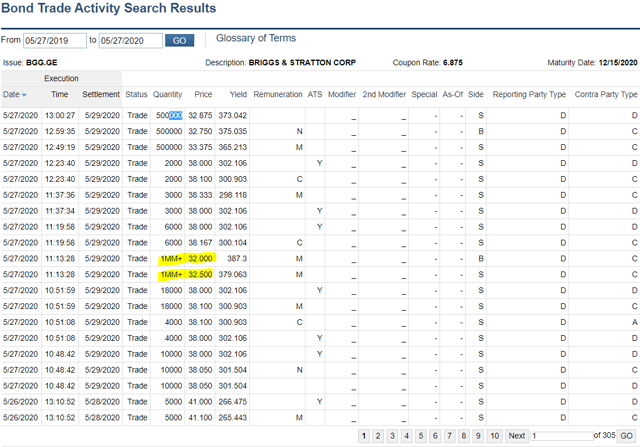

The relative valuation between the senior notes and the Briggs & Stratton (BGG) equity doesn't make sense. The senior notes most recently traded around 32-32.5 cents on the dollar. Let's use the mid price of 32.25, and given the ~$195 million face value, indicates a market value of ~$63 million (195 x 0.3225). While junior to the senior notes, BGG has an equity market cap of ~$81 million. This seems like a misvaluation as an result of silo-ed investors not looking at the entire capital structure.

Time is Running Out

While I believe BGG should exist as a business, its liquidity position combined with an aggressive ABL lenders timetable means that in my opinion a restructuring is imminent and this will not end well for the existing equity investors. From the recent 10-Q:

The April 27, 2020 ABL amendment added events of default relating to, among other things, (A) the Company’s failure to deliver on or before May 15, 2020 one or more term sheets in respect of a permitted junior debt financing, equity issuance and/or real property sale-leaseback transaction to be consummated after the effective date of the Amendment No. 4 and from which the Company would receive aggregate net proceeds of at least $100 million, or (B) the failure of such a transaction to have its proposed terms and conditions approved by the required lenders and the Agent on or before June 12, 2020 or to be closed, effective and fully funded, on such approved terms, on or before June 15, 2020.

It's reported that BGG has hired Houlihan, a restructuring investment banker, as the financial advisor to rework their debt - another indication that the existing equity holders are at risk of getting wiped out or severely diluted.

Restructuring Scenario

Assuming the $100 million junior capital financing is somehow satisfied, or more likely waived if the senior notes can be successfully restructured, one/a combination of the below scenarios can take place, and none of the scenario leave much (if any) residual value for the existing equity.

New Money - you can solve the problem by throwing money at it, however it's difficult to make an investment case when the company is still burning cash on a full-year basis and the existing management and board are still in place.

Amend & Extend - extending the maturity date of the bond to provide runway for the business operation to stabilize. However, a successful amend & extend transaction require a high participation rate to avoid the holdout problem. Given all the retail-size trades in the senior notes, this could be a major obstacle to pull off an amend & extend.

Debt-for-Equity Swap - bondholders get ~100% of the ownership and control of the company in exchange for converting the senior notes to equity to avoid a formal bankruptcy, leaving the existing equity with very little value.

Prepackaged Bankruptcy - this faces the same holdout issue as the Amend & Extend solution as you need 66 2/3% of the face value and over 50% in number to sign a restructuring support agreement. However, Chapter 11 might be generally preferred in this case to solve the unfunded pension liabilities. The old equity will simply be cancelled without any recovery, and the senior notes become the new equity owners.

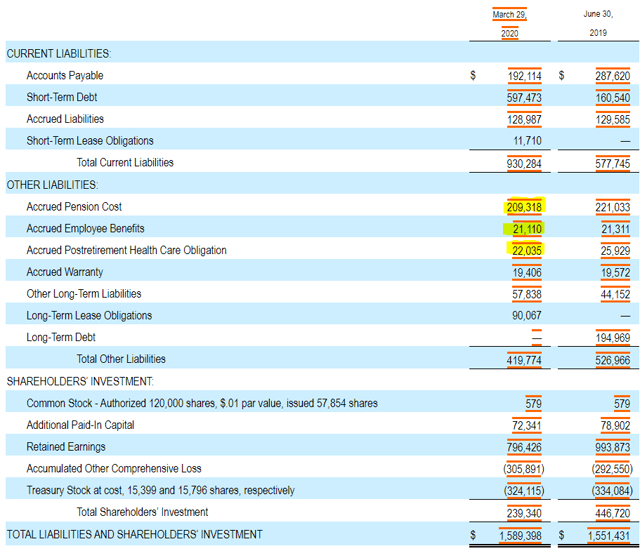

Source: Q3 10-Q

I'm puzzled by the recent rally but I think it's a combination of short covering and overall bullish sentiment of the market given the economy is being gradually opened up in the US.

The biggest risk that can kill the thesis is for a strategic or a financial buyer to provide rescue financing and/or close an assets sale that was contemplated. For any potential strategic buyer, the primary focus is that preserving liquidity so I don't think any management is brave enough to face the shareholder backslash of making an acquisition right now. For the potential financial buyers, I believe it's safer for them to buy the assets out of bankruptcy via a 363 sale where they can get the assets free of any liens and liabilities.

Conclusion

BGG's recent rally with the broad market is not justified given none of the plausible scenarios provide the existing equity with much recovery value. Existing shareholders should take advantage of this rally to recoup as much loss as possible.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in BGG over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.