Realty Income: A Best In Class REIT

by Mark RoussinSummary

- Realty Income collected 83% of April rents showing the strength of their portfolio.

- The top 4 industries in the portfolio sell essential goods, which has bode well during the pandemic.

- The company maintains a strong balance sheet with a credit rating of A-.

For much of the past month, shares of Realty Income Corporation (O) have been stuck in a trading range between $56 and $50. Shares are up only 4% over the course of the past four weeks as investors continue to digest the impact the COVID-19 pandemic will have on landlords, particularly retail landlords like Realty Income.

The bullish news for the company is the fact that much of the country is reopening meaning many of the tenants that may have been previously closed are getting a chance to re-open their doors again, if they were not able to already. Missed rental checks is a given in the near term, but the depth of the impact will deviate the winners from the losers in the REIT space and a bet on Realty Income is a smart one considering their strong investment grade portfolio.

The Monthly Dividend Company

Realty Income has long been a favorite for investors looking for REIT exposure. Part of that popularity comes from the fact that the company pays a monthly dividend, bucking the trend of traditional quarterly payments from other dividend payers. In fact, the company trademarked the name, “The Monthly Dividend Company.”

Over the years, the company has consistently raised their dividend an impressive 106x in their 51-year history, and as of last week, declared their 599th consecutive monthly dividend. This has placed the company with prestigious company, making them a dividend aristocrat.

The dividend yield as it stands right now is 5.4%, which is much higher than their five-year average of 4.2%, due to the market wide sell-off in March which saw shares fall 50%. This has pumped up the dividend yield, but due to the premium on the shares, the yield has not always been as high as others in the space.

Investment Grade Portfolio

The company operates in the net lease sector and has a portfolio that consists of over 6,500 properties leased to 630 different tenants. Another reason investors tend to flock towards Realty Income for their REIT exposure, is the fact that they own a strong portfolio of properties filled with investment grade tenants.

The company’s heavily exposed to the retail sector, with 84.1% exposure. The company’s second largest sector exposure is with industrial (10.7%) followed by Office (3.5%), and Agriculture (1.7%). Of the company’s exposure to retail, 44% of revenue is from investment grade tenants. Industrial and Office sectors are even higher with investment grade tenants accounting for revenues of 78% and 87%, respectively.

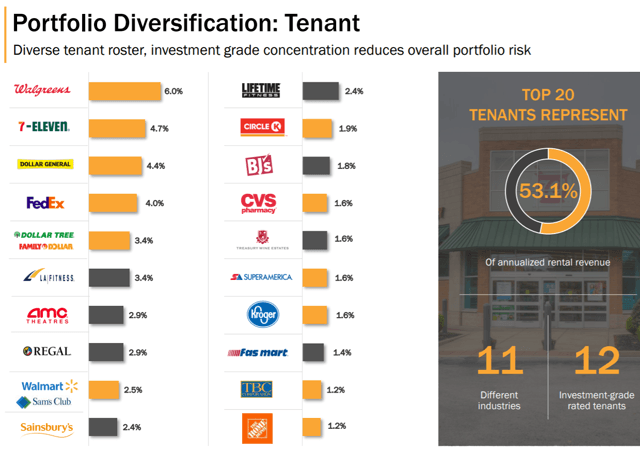

Here is a look at the company’s top 20 tenants and their percentage of revenue.

Source: Realty Income Investor Presentation

As you can see, the company retains over 53% of their annualized revenue from the top 20 tenants, of which, 12 of them are investment grade. The top tenants are filled with high-quality names, but plenty of risks abound.

Though the company is heavily invested in retail, 96% of their total portfolio rent is protected against the threat of e-commerce. Convenience stores is the company’s largest industry exposure, accounting for 12%.

Some of the risks include the exposure to theaters and gyms. As states continue to lesson stay at home restrictions, we will have to watch closely in regards to a second wave of the coronavirus. If this does not happen (fingers crossed), and vaccine trials continue to attain strong results, these risky industries could see some return of normal, which would be a big boost to landlords like Realty Income.

Short Term Headwinds From COVID-19

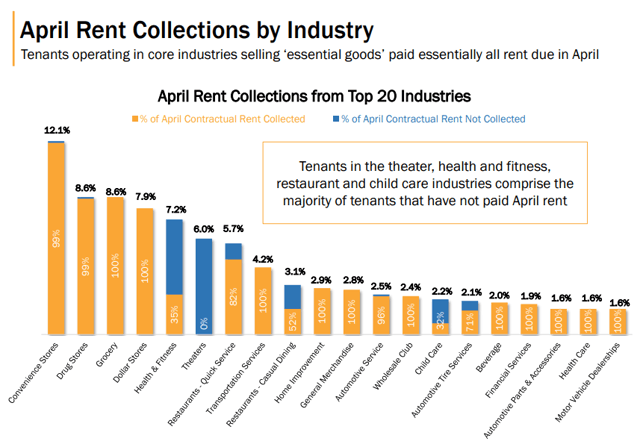

Some of the obvious short term headwinds that will hit many landlords is the increasing number of rent deferral requests. During the month of April, Realty Income received 83% of expected rent payments, of which, 99% of investment grade tenants paid their April rents. This again shows the strength of the portfolio and why shares often trade at a premium to other net-lease REITs.

Here is a look at the company’s collections by industry during the month of April.

Source: Realty Income Investor Presentation

The headwinds will be how those rent deferrals play out, if they truly only last 30 to 90 days or if they end up getting extended. Also, it will be interesting to see how the rent collections are for May and June, which will truly give investors a better look into the portfolio performance moving forward.

Theaters is obviously a large risk area for the company, as is health and fitness centers. However, I am a little more optimistic on fitness centers because that is something people enjoy and health related. Sure, some people can move the gym home, but that is a high upfront costs plus something about the motivation, at least for me, that is felt when going to the gym. Not to mention, some people merely do not have the space for a gym.

Watching these industries and the deferrals will be at the top of investors’ minds going forward, but I expect these to be short-term. Like Realty Income has done for decades now, if the portfolio experiences some defaults, which is a high probability before this is all over, they will be able to re-position these properties and possibly gain a strong long-term spread with a new lease to a new tenant. The company has done a fine job over the years vetting potential tenants, which is seen in the quality of the portfolio

Investor Takeaway

Realty Income has experienced some near term pressure in terms of the performance of their portfolio, which has resulted in a contraction in their stock price. Though I believe these headwinds to be short term, I fully expect Realty Income to thrive once this passes.

The company has proven themselves over the years and managed through numerous recessions, only to come out even stronger. Management has done a fine job continuing to strengthen the portfolio with investment grade tenants, and any experienced defaults could provide opportunities to bring in stronger tenants.

Shares of O currently trade at a P/FFO multiple of 15.8x, which is well below their five year average of 19.8x. In addition, the company yields a dividend of 5.4%, which is also well above their five-year average dividend yield of 4.2%. Given the strength of the company’s portfolio, have collected 82% of rents in a time many businesses were closed during the pandemic, should bode well for investors focused on receiving their dividend checks moving forward.

Being that O is a popular REIT, it is important to always keep the company on your watchlist to look for pullbacks in the shares. Not too often do you find shares of O trading at a significant discount. Though shares were trading in the low $40s in March, current levels are solid to begin layering in to.

Note: I hope you all enjoyed the article and found it informative. As always, I look forward to reading and responding to your comments below and feel free to leave any feedback. Happy Investing!

Author’s Disclaimer: This article is intended to provide information to interested parties. I have no knowledge of your individual goals as an investor, and I ask that you complete your own due diligence before purchasing any stocks mentioned or recommended.

Historic Market Opportunity! Act Now!

The recent market crash has created exceptional opportunities. Many high-quality REITs are now offered at >10% sustainable dividend yields and have 100-200% upside potential in a recovery.

At High Yield Landlord, we are loading up on these discounted opportunities and share all our Top Ideas with our 1,500 members in real-time.

Start your 2-Week Free Trial today and get instant access to all our Top Picks, 3 Model Portfolios, Course to REIT investing, Tracking tools, and much more.

Get Started Today!

We are offering a Limited-Time 28% discount for new members!

Disclosure: I am/we are long O. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.