Mastercard: A Major Beneficiary Of The "New Normal"

by IntegratorSummary

- Mastercard's recent operating update suggested a likely trough in business activity, with sharp improvements seen in the last few weeks.

- Cross border transactions is still a problem area, and may take quite some time to recover.

- There are many long term positives for Mastercard that are starting to emerge, which set the business up well for long term growth.

Mastercard (MA) recently reported Q1 results which were noticeably subdued compared to results in quarters gone by. The business reported revenue growth of just 5% on a currency neutral basis, well down from typical levels of mid double digit growth. While the global pandemic has taken a chunk out of Mastercard's near term growth, the business shared an important operating update recently which suggests "green shoots" of recovery are likely imminent.

Mastercard Q2 Operating Update

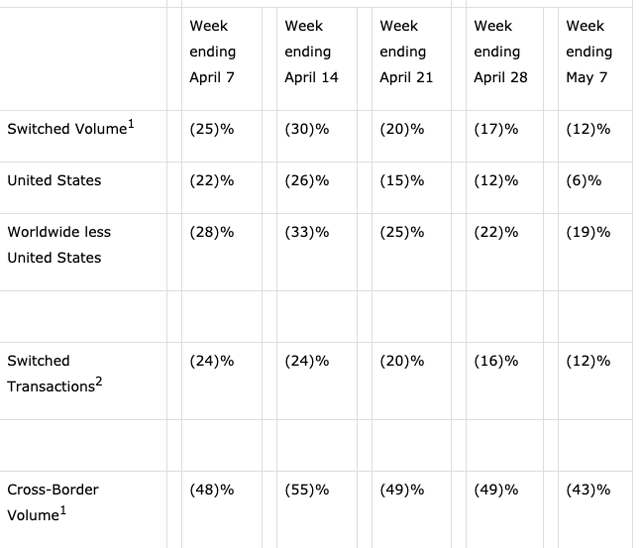

Recovery in switched volumes

MasterCard recently shared operating metrics which hinted at a trough being seen in the declines in processing volumes, with peak declines during the week of April 14 of almost 30%. Since that time, the recovery in both the number of transactions as well as the volume of transactions processed has been quite noticeable. While processed volumes are still down in aggregate year over year, there’s been a nice recovery in overall switched volumes, with Mastercard reporting a recovery in switched volumes with declines of only 12% year-over-year most recently. In the United States, the recovery in processing volume has been even more notable, with declines in switch volume of just 6% year-over-year as of the end of the week of May 7, suggestive of a fairly remarkable consumer lead recovery.

Cross border volumes still a major weak spot

Cross-border volumes are still a major weak spot for MasterCard. While switched volumes in aggregate are recovering, cross-border volume which are significantly influenced by consumer and business international travel, are still at anemic levels. At the low point, cross-border volumes were down near 55% year-over-year. While declines appear to have stabilized and a trough reached during the week of 14 April, the recovery has been quite muted with cross-border volume still down 43% year-over-year during the week of May 7.

This is particularly problematic for MasterCard given how profitable this segment is for the business. MasterCard, like Visa (V) derives high margin assessment fees on transactions that its customers undertake during international travel. These transactions have a disproportionate affect on MasterCard revenue and margin because of the fact that assessment charges can be as high as 1% of the transaction amount, or almost 4-5x the levels that MasterCard typically sees.

MasterCard has approximately 30% of overall revenue coming from cross-border transactions. With many international routes having been temporarily suspended and consumers fearful of travel resumption‘s due to both health and economic reasons, this could be a segment of the business that remains depressed for an extended period of time. While I expect a recovery here to start first on the enterprise side, the large cancellation of conferences and events will also see an elongated and tepid recovery in the segment for quite some period of time.

Cross border volume recovery will commence with sustained regional travel across borders in places such as Europe, Latin America and Asia. MasterCard alluded to as much in its results, noting that it was starting to see the beginnings of an increase in intra-Europe travel.

MasterCard will be a major beneficiary of behavioral changes

While Mastercard's business is clearly still feeling the impacts of the coronavirus crisis with depressed transaction volume impacting operating results, there are a number of green shoots that can be observed in some of the operating trends that the business highlighted.

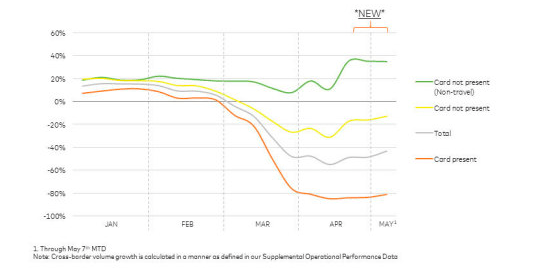

The growth in 'card not present' non-travel transactions, which is largely a proxy for e-commerce and other remote transactions, saw a steep step function increase in growth, with growth almost doubling from pre crisis levels of 20% year over year to just under 40% in the last few weeks.

Source: Mastercard Q2 Operating Update

The growth in remote transactions are significant, because Mastercard's biggest opportunity set is not necessarily taking share from other competitors such as Visa or American Express (AXP), but rather going after the still 70%+ of global consumer expenditure volume which still remains cash-based. It’s increasingly apparent that serious damage has been done to the role of cash in society as a result of the coronavirus pandemic. This can be seen on a number of fronts.

Digitization of previously physical transactions

What’s been interesting to observe during the crisis is that many transactions which were previously in person have affectively been converted to online, a trend which will likely remain in place for some indeterminate period of time. With social distancing restrictions likely to remain default behavior for the medium term in restaurants, fearful and reluctant diners have been reverting to curbside pick up models, rather than going through the hassle of dining in. No doubt, this mode of consumption is likely to be in place for some considerable period of time until more relaxed restrictions eventually emerge. The longer-term question will become whether this creates a new permanent change in behavior for consumers.

Consumers also appear to be embracing new categories of digital consumption, most notably the ordering of groceries online with delivery to the home. Similar holds true for other categories of consumption including entertainment, clothing and merchandise as evidenced from the results of businesses like Netflix (NFLX) and other online retailers.

Acceleration of e-commerce penetration

There have been reports that many consumers have stepped up or shifted the volume and spend towards e-commerce activity. In emerging markets it’s even more significant, with a significant number of consumers making their first ever e-commerce transactions. Visa recently observed that roughly 2 in 10 active Visa card holders in Latin America made their first ever e-commerce purchases. As the pandemic rages in Latin America, this is a phenomenon that will increase. Providing that experience was satisfactory, this is a shift that’s likely to remain permanent. With MasterCard having even more of its revenues coming from emerging markets than Visa, it’s likely that the pandemic will prove a major tailwind for the business and result in new 'carded' expenditure that is permanently lost to cash.

Preservation of digital payment status quo

One of the other incidental benefits to MasterCard and Visa as a result of the pandemic is a likely stalling of the potentially disruptive innovation that had sprung up in the fintech ecosystem over the last few years. While MasterCard and Visa are arguably some of the hardest business is to disrupt, given the need to simultaneously convince both consumers and merchants of the need to adopt alternative payment instruments and do so at scale with an alternative solution that’s as equally secure, there were pockets of emerging activity in new fintech spaces as 'Buy Now and Pay Later' that were starting to see quite significant traction. It will be interesting to see what depressed economic conditions do to default rates and the popularity of such alternatives.

Venture capital backed businesses are typically the first to experience the negative impacts of major economic distress disruption of the like that we are currently in. MasterCard was seeing increasing disruption in cross-border transactions processing with smaller competitors starting to take regional share. With the collapse of cross-border transactions generally and the consequent impact on venture funded businesses this disruption may take a hit once normal cross border transaction volume returns, after a likely extended recovery.

Concluding Thoughts

While it clearly will take some time for Mastercard's business to fully recover from the effects of the pandemic, initial signs are encouraging and green shoots are starting to emerge. A trough in MasterCard processed volumes has been seen with steady recovery starting to occur. While a full recovery in cross-border transactions will likely take more time, there are positive signs as far as long-term consumer behavior. A digitization of previously physical transactions as well as a multi year acceleration of e-commerce trends that were present will set up MasterCard business well and ultimately enable it to play a more meaningful hand in the war on cash moving into the future.

To see other ideas of high quality, growing businesses that are positioned to be long term wealth creators, please consider a Free Trial of Sustainable Growth.

- Ideas based on the philosophy of Project $1M, which has outperformed the S&P500 by almost 50% for 2019, and over the last 4 years

- Access to Large Cap, Emerging Leader and High Conviction Model Portfolio which all outperformed the S&P500 in 2019

- Watch list that covers a broad universe of businesses with 'unfair competitive advantages' in fast growing markets

- Exclusive ideas on potential 'Wealth Creators of tomorrow'

Disclosure: I am/we are long MA, V. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.