IBM: $80 Per Share Is More Reasonable

by Damon VerialSummary

- IBM's dedication to the dividend is both impressive and stubborn.

- I believe IBM is around 50% overvalued, stemming from its poor investment decisions and amazing ability to squander its resources, from talent to acquisitions.

- I offer an options strategy that you can ride down to $110.

International Business Machines (IBM) recently fired an unstipulated number of employees. IBM’s proclivity to downsizing its workforce is not new, but the recent set of layoffs officially brings the company’s workforce to the smallest it has had in nearly one decade. Obviously, SARS-CoV-2 has been hard on most businesses, but layoffs aren’t the only form of cost-cutting.

Cut the Dividend?

Other companies would consider cutting their dividends instead of workforce. For IBM, this is a near-impossibility. The dividend is the company and stock’s lifeblood.

Moreover, the preservation of the dividend over the workforce sends an important message to engineers and IBM’s competitors: The company is unlikely to be hiring in the near future; growth is not an ongoing happening at the company nor a planned venture. Like a captain helming a boat riddled with holes, IBM is attempting to keep its stock afloat. The chosen method is maintaining the stock’s high (for tech) and reliable dividend.

IBM is an old, stubborn company with a habit of pivoting way after the industry has passed them by. The layoffs in the past few years have been part of IBM’s attempt to become hip and cool – a failed venture to reinvent itself as a modern, versatile tech company similar to Google (GOOG) or Microsoft (MSFT). Having built and kept itself afloat more with marketing and sales than novel technology, IBM is picking a fight with tech companies on the bleeding edge of AI and cloud services – platforms on which IBM cannot prevail.

Remote Work and Red Hat

While companies such as Facebook (FB) are responding to the pandemic by pivoting to remote work paradigms, IBM maintains its strict managerial principles. We already know IBM’s stance on remote work: You cannot innovate remotely. The most innovative tech companies would disagree, but alas IBM walks forward with its fingers in its ears, its eyes focused only on the dividend.

IBM not only fails to properly invest in its employees but also fails to properly invest – full stop. The company acquired Red Hat (a great product) last July for $34B (an absurd price – more below). While this new Red Hat segment of IBM is seeing strong growth, I doubt IBM won’t find a way to ruin this long-loved Linux distribution.

IBM will need to maintain growth or stability in Red Hat’s contribution to the company’s earnings for roughly 30 quarters before the acquisition pays off. It’s not an impossibility, especially with Red Hat being a legitimately strong operating system – but in my years of analyzing the company, IBM’s general business plan is pretty clear to me: Latch onto “hot, new” technology (read: has been a household name for at least five years so that enterprise executives have at least heard of it) by creating or acquiring a virtually commoditized version of the most recent tech, position the product as at least as impressive as those offered by more tech-savvy competing companies, and use your highly efficient B2B marketing and sales team to close the deal. Here, you gain earnings growth without needing to reinvent the wheel. Simply sell repackaged tech to the non-tech-savvy enterprise decision makers. IBM’s happy because they’ve made some sales; enterprise executives are happy because they feel they’ve upgraded their technology; investors are happy because they see good numbers, further signaling that the dividend is safe. The only unhappy group is the engineering team that must work with IBM’s clunky tech.

I have many concerns here. I am doubtful that IBM is really going to update and renovate Red Hat for eight full years to keep the operating system a strongly selling product. I'm doubtful that IBM can avoid screwing up the appeal of Red Hat, such as by throwing open source out the window. I doubt IBM considered all the opportunity costs of that $34B investment as well as the interest on debt. And I doubt the unspecified number of layoffs and shunning remote work was smart moves. I certainly have my doubts.

My Subjective Valuation: IBM Is Overvalued by 50%

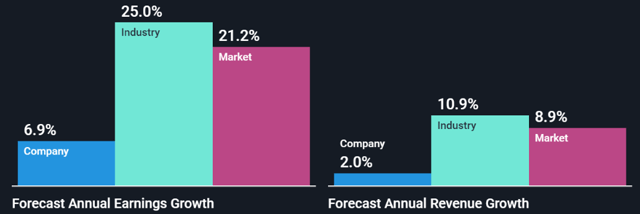

I think IBM is more of an $80 stock than a $120 stock. The company’s strength is in its war for enterprise cloud via aggressive sales and marketing. Its weakness is in its arrogance and habit of wasting its resources and acquired innovations. I think the latter outweighs the former. Considering the company’s subpar revenue as well as earnings performance and an inability to quickly pivot, I believe the downside is much higher than the upside, even when you consider the company a takeover target.

(Source: Simply Wall St)

If IBM being a takeover target is a novel idea for you, let me know in the comments section below, and I’ll write a follow-up article on the subject. For now, I just wanted to get my thoughts on this company out, considering my long history with the company and the recent layoffs.

A Practical Options Trade

On a more practical note, here’s the short trade I’m currently considering as part of my seasonal strategy:

- Buy Jun19 $115 call

- Sell Jun19 $110 call

- Buy Aug21 $120 put

- Sell Aug21 $110 put

This strategy has a delta of roughly -40, meaning for every $1 downward movement IBM makes, the strategy mimics shorting roughly 40 shares of the stock. Maximum profit is achieved at around $110, with the short options expiring mostly worthless. If you expect IBM to fall farther than $110 as it approaches that number, you can buy back the short put and gain unlimited downside exposure.

Happy trading!

Exposing Earnings is an earnings-trading newsletter (with live chat). We base our predictions on statistics, probability, and backtests. Trades are recommended with option strategies for the sake of creating high-reward, low-risk plays. We have 89% accuracy for our predictions in 2019.

-Upcoming Earnings Plays: AZO, ORCL, MU, CAMP, LQDT

Check out my methodologies in these four videos.

If you want:

- A definitive answer on which way a stock will go on earnings...

- The probability of the prediction paying off...

- The risk/reward of the play...

- A well-designed options strategy for the play...

...click here to see what Exposing Earnings members are saying.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a short position in IBM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.