BlackLine: A Software Company With A Strong Moat

by Lukas WolgramSummary

- BlackLine's focus on cross-system functionality gives the company a competitive advantage.

- BlackLine's moat comes from customers having extremely high switching costs.

- A societal shift to greater working from home adoption benefits BlackLine.

- BlackLine's Flywheel allows for constant innovation.

Introduction

The financial and accounting software company BlackLine (BL) is quickly becoming one of my favorite companies as I research and learn more. In this article I discuss the company's competitive advantages, how I think this differs from the company's moat and my flywheel model that demonstrates the key value drivers of BlackLine's business. Finally, I add a brief discussion of COVID-19 and how BlackLine will likely benefit significantly from the shift toward working from home.

Source: BlackLine.com

Cross-System Functionality As A Competitive Advantage

BlackLine states in its 10-K that its main competitive advantage comes from the fact that BlackLine software is not dependent on any single operating system and works with most major ERPs. The 10-k mentions that this cross-system functionality allows the company to focus on a broader range of customers than competing software providers that are limited in terms of compatibility. BlackLine is also able to focus on the needs of customers irrespective of updates or changes in their existing system, which brings a level of independence to BlackLine that gives them a competitive advantage. I believe this to be accurate and that BlackLine's competitive advantage is strong. BlackLine's high compatibility also protects them from the companies providing ERP software, as it's extremely unlikely these guys will create financial software that works with their direct competitor's software, although they may develop features within their own ERP software that attempts to capture some of BlackLine's business. I discuss this in the risks section below.

I consider moats to be different than competitive advantages. I like to think of moats in terms of things like barriers to entry. Moats are things that prevent other companies from taking market share, whereas competitive advantages are more often things that allow companies to produce superior products. Some businesses only have competitive advantages, some only have moats. Great businesses have both.

BlackLine, like some other software companies, has a moat built around existing customers. Customers, which are medium to large companies, are almost never going to switch to competing software, as this would entail large retraining and integration efforts that are usually not worth the company's time or resources, even if a competing product is cheaper. This is a huge moat that one will find every now and then in software. It allows BlackLine not only to keep customers but also to retarget new products and offerings to those same customers with a high chance of adoption. The more BlackLine products a company uses, the better off their customer is, and the stronger BlackLine's moat becomes. It is self-reinforcing. I believe this is a sign of a very strong business.

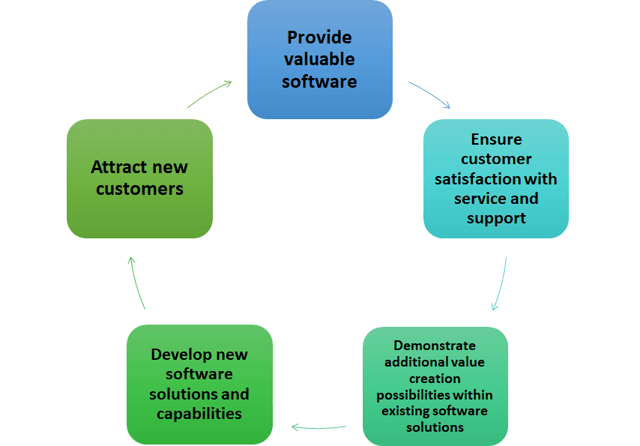

BlackLine's Flywheel

I came up with a flywheel diagram to demonstrate the key value drivers of BlackLine's business. It starts at the top, with BlackLine providing valuable software solutions for companies with complex finance and accounting tasks. BlackLine then ensures customers are achieving greater efficiency through their software support. This also gives BlackLine the opportunity to demonstrate additional features of the software that can be utilized by the customer (for an additional subscription, of course), as well as receive feedback on any additional features the customer would like to see. BlackLine can then address any issues with the development of new software solutions and capabilities, which in turn attracts new and more customers. Ultimately leading back to BlackLine's ability to provide valuable software solutions for the company's customers.

Source: Author

Working From Home During COVID-19

Technology now allows a significant portion of the population to work from home if necessary. Never have we seen a time more necessary than now with the COVID-19 pandemic. While the pandemic is delaying customer purchases for some aspect's of BlackLine's software (see the Q1 2020 earnings call), ultimately I think this societal shift will benefit BlackLine. BlackLine's software efficiencies enable workers to work from home far more efficiently. Less communication is required between finance team members as many tasks are automated and updated instantly through the cloud. This allows team members to complete their work from remote locations without having to constantly keep in touch and wait on others.

Risks To Be Aware Of

As with any stock, there are risks with BlackLine. The main risks investors in BlackLine should be aware of include the following:

- BlackLine is dependent upon the success of its customers. If several key customers' businesses begin to struggle, they may look to cut costs. This could include in the accounting and finance departments and though unlikely, some of BlackLine's products could be cut as well. This is especially true with the looming threat of COVID-19.

- BlackLine's software is meant to integrate with ERPs such as SAP (SAP) and Oracle (ORCL), however, these other software providers may look to cut BlackLine out by developing their own software. Some of these companies are substantially larger than BlackLine and have more resources than BlackLine does. BlackLine attempts to mitigate this risk by working with these companies to integrate BlackLine's software.

- Although BlackLine attempts to secure the data of its customers, a data breach of some kind could harm the company's reputation and thus its business could suffer as well.

- The company relies on third-party data centers and Google's Cloud Platform. A disruption to these would likely be outside of BlackLine's control and could result in dissatisfied customers and a loss of business.

None of these risks are major enough for me to not own the stock, but every investor should consider their own situation and what risks they're willing to accept. Add the fact that BlackLine is only just now approaching profitability, and there is some significant consideration to be done by investors as to whether the stock is right for them.

Conclusion

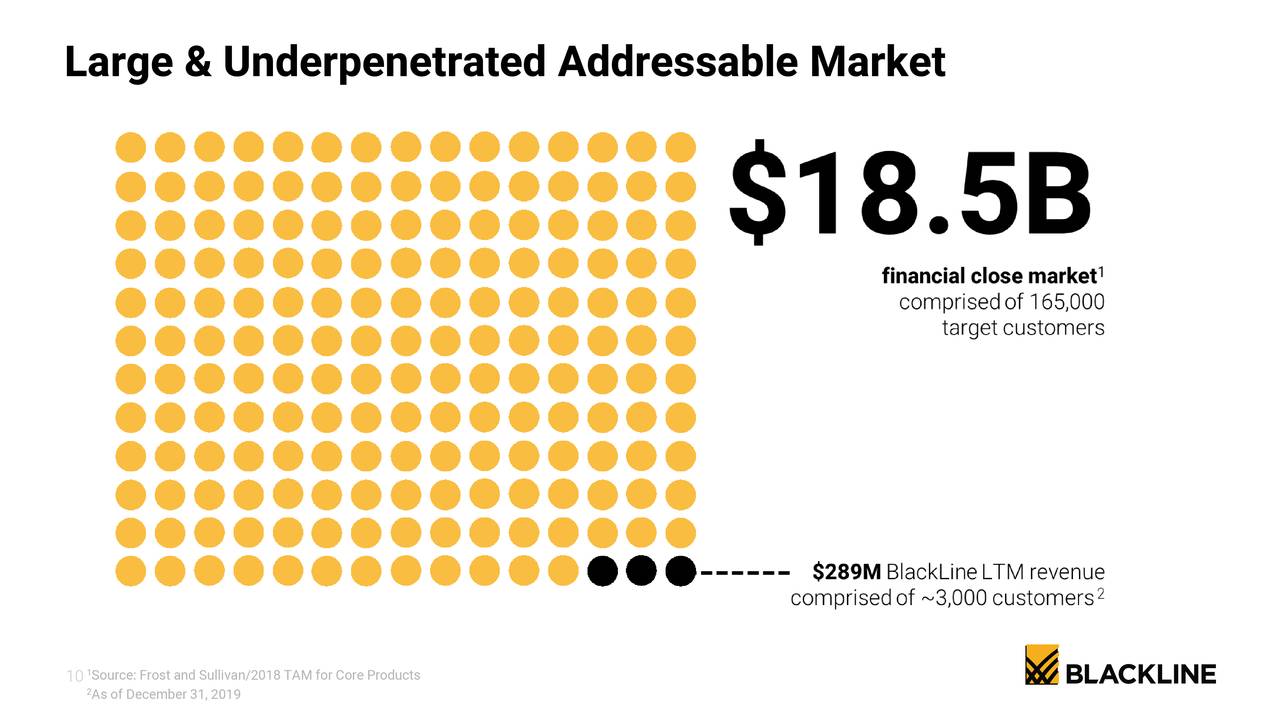

My DCF analysis from my previous article on BlackLine placed the fair value at $74.85 per share. That model used a growth rate in 2020 of 21%, declining slightly each year for the next 10 years to 5% in year 10, an operating margin of 9%, increasing to 30% by year 10, and a weighted average cost of capital of 7.33%. I still believe this model holds up, but at the time, shares were near $57. Shares now sit substantially higher at just under $70 per share. The stock still isn't quite at fair value, but it is much closer now than it was even one month ago. Still, I think one can make a compelling case for a considerably higher share price in several years if the company continues to grow into its $18 billion+ TAM, meaning the stock is likely still worth purchasing now. The opportunity in disrupting financial technology for medium to large companies remains vast compared to BlackLine's current revenue and market cap. Sure, there are competitors, but in my opinion, BlackLine is the best-positioned company in the space due to its competitive advantages and moat.

Source: BlackLine February Investor Presentation

I'll be writing more articles on great (or sometimes not so great) stocks. If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article.

Disclosure: I am/we are long BL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.