AT&T - Disney Plus Suggests T Could See Quick Returns From HBO Max

by The Value PortfolioSummary

- AT&T is launching HBO Max in 2 days. Disney Plus performed incredibly well after launch with Disney's stock going up 10% in 2 weeks.

- While the services are different, launching at a discount during COVID-19 will support increased sign ups in our view.

- Even without the service, AT&T is a FCF giant and will be able to generate significant shareholder returns in the coming years.

Disney Plus, Disney's streaming service (NYSE: DIS), was released on November 12, 2019. Over the next two weeks, on the back of much stronger subscriber counts than anticipated, Disney stock provided shareholders with double-digit returns. Now that AT&T (NYSE: T) is 2 days away from launching its much awaited HBO Max, the stakes are even bigger, and the returns could be larger.

Disney Plus' Success

Disney Plus has performed incredibly well since it was originally announced.

Disney Plus Subscriber Count - Next Level Finance

The above image highlights the trajectory with which Disney Plus has grown since its launch as compared to Netflix (NYSE: NFLX). For reference here, Netflix is a $190 billion company and Disney is a $210 billion company. So the market values Netflix's streaming business as much as Disney Plus and all of its other businesses combined.

However, with that said, Disney Plus has grown significantly with more than 50 million subscribers. For reference, Netflix's total subscriber count is almost 170 million. Now Disney Plus only costs 60% as much as Netflix, however, it's also already making $4.2 billion in revenue annually. Given Disney's annual 2019 revenue was almost $70 billion it shows the potential of a strong streaming service.

HBO Max Potential

So now that HBO Max is about to launch, with a $12 discounted price point or a $15 full price point, let's take a look at the potential of the service.

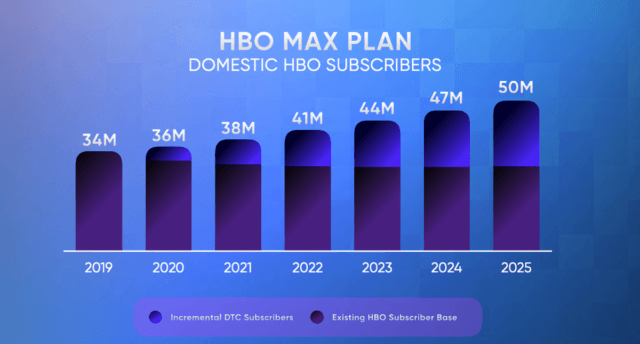

HBO Max Subscriber Growth - Motley Fool

HBO Max is expected, by AT&T, to grow significantly, even more so that the current size of HBO Max. By 2025, the company is forecasting 16 million additional subscribers, with 2 million additional subscribers this year alone. Those 2 million additional subscribers are worth $360 million / year, while 16 million additional subscribers are worth $2.88 billion.

More so, that 16 million doesn't count the fact that the existing subscriber base is expected to decline and be replaced by new subscribers. However, what's worth noting is that this assumes the service doesn't grow faster than what was originally anticipated by the company.

One way to take a look at this is to look at the relative sizes of the services. Disney Plus was originally anticipated to reach 60-90 million subscribers after 5 years, before its launch, however, it's already managed to pass that level. There's no reason why HBO Max won't be able to hit its 5-year forecast after a single year either.

In that case, on the basis of a significant increase in high margin growth, AT&T's share price could respond in the same way as Disney Plus. In fact, we expect that AT&T's share price could have an even better time as investors have continued to worry about the company's debt load and its ability to continue rewarding shareholders.

That cash flow would support growing shareholder rewards. However, even without it AT&T's shareholder rewards and cash flow are incredibly strong.

AT&T Overall Cash Flow

AT&T generates significant FCF from its existing businesses.

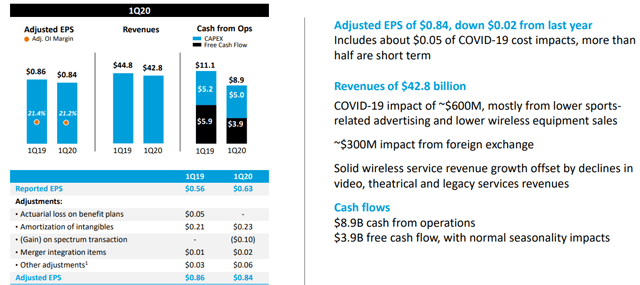

AT&T 1Q 2020 Cash Flow - AT&T Investor Presentation

AT&T's revenue and FCF have remained strong despite the variance the company faced in the 1Q 2020. The company's revenue has remained at more than $160 billion annualized and the company's FCF in a normal market is almost $30 billion annualized. That's on top of significant capital spending by the company into its businesses.

The company's additional revenue from HBO Max is expected to be significant. The company expected 2025 incremental revenue from HBO Max at $5 billion, although that could happen this year if the company follows the same trend from Disney Plus. It's worth noting that this is mostly incremental revenue, the actual cost of it is very minimal since it's simply the company utilizing its own content.

That could mean billions in additional annual FCF with a 60% margin, or a 10% increase in the company's FCF.

AT&T Potential Shareholder Rewards

Overall, AT&T has the potential to generate significant cash flow that it plans to utilize to reward shareholders.

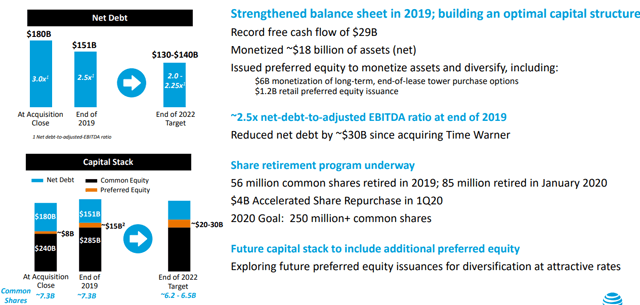

AT&T Changing Capital Stack - AT&T Investor Presentation

AT&T is planning to use its cash flow to significantly improve its capital stock and support its share price. The company's target for end of 2022 net debt debt is roughly $135 billion as the company estimates common equity making up ~$280 billion with a 6.35 billion share target. That's a share price target the company is aiming for of $44 / share a near 50% increase on prices.

Assuming the company can turn 2025 revenue into 2020 revenue from HBO Max, by achieving Disney Plus level growth, the company's FCF will grow by 10%. That should - in theory - result in a 10% higher share price now. However, it still gives the company significant room to grow as it moves towards its end of 2022 target.

HBO Max, should it achieve Disney Plus level success, will simply accelerate shareholder rewards. However, even without Disney Plus, AT&T can generate significant shareholder returns. This is a win-win scenario for investors, the potential for immediate term returns, but also the high likelihood of longer term returns regardless.

AT&T Risk

AT&T's risk is two fold.

The company's first risk is continued disruption to the company's operating businesses and capital return plans due to COVID-19. The unemployment rate as a result of lock downs is comfortably in the double-digits. Many of those people have an AT&T plan. While the country is on the path to reopening, AT&T could see at least a quarter or two of disruption. Given the company has delayed share repurchases during this crisis, the effects of COVID-19 are slowing down shareholder rewards.

The second risk to the company's business is that HBO Max effectively defines its success. While we believe HBO Max can have significant potential, fundamentally it is the next step in the company's TimeWarner acquisition. That means, if it doesn't pan out, it could make the TimeWarner acquisition much less impressive as competition in streaming grows. That could hurt shareholder rewards.

Conclusion

Disney, through Disney Plus, performed incredibly well after its launch as sign up numbers quickly hit the 5 year target. HBO Max, a well respected streaming service, launching at a discount during the COVID-19 crisis, could see subscriber numbers quickly hit their 5 year target too. That could provide billions in additional FCF.

The products are very different, and we don't know what will happen, however, it's clear that American demand for streaming services is high. However, even if it doesn't pan out, AT&T is a FCF giant. That FCF will support the potential for significant shareholder returns going forward as COVID-19 is solved and we recommend investing now.

Create a High Yield Energy Portfolio - 2 Week Free Trial!

The Energy Forum can help you build and generate high-yield income from a portfolio of quality energy companies. Worldwide energy demand is growing quickly, and you can be a part of this exciting trend.

The Energy Forum provides:

- Managed model portfolio to generate you high-yield returns.

- Deep-dive research reports about quality investment opportunities.

- Macroeconomic overviews of the oil market.

- Technical buy and sell alerts.

Disclosure: I am/we are long T. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.