Wells Fargo's Stock May Soon Reverse Lower

by Mott Capital ManagementSummary

- Wells Fargo stock has seen a massive rally off the May lows.

- Options traders are betting that the stock falls by July.

- The fundamental outlook is very weak.

Wells Fargo (WFC) has risen sharply off its May 14 lows, but it seems that the rally may not last. Options traders are betting the stock heads lower by the middle of July. The equity is not cheap when compared to its peers, and that may hurt the stock ability to rise much from its current levels as well, as it already one of the most expensive bank stocks.

The one benefit the stock has at the moment is that it trades with a price to tangible book value that is well below 1 and is one of the cheapest in the group on that metric. Still, with very low interest-rates, and uncertainty around the economic rebound, Wells Fargo stock may struggle. You can now track all of my free articles on this Google Spreadsheet I have created.

Betting Shares Fall

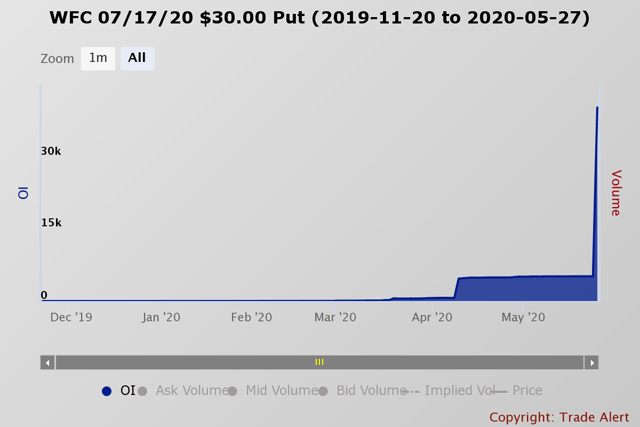

On May 27, the open interest for the July 17, 2020 puts rose by more than 35,000 contracts at the $30 strike price. These puts traded on the ASK for $4.30 per contract, an indication the puts contracts were bought. For a buyer of the puts to earn a profit, the stock would need to fall by roughly 5.5% to around $25.70 per share.

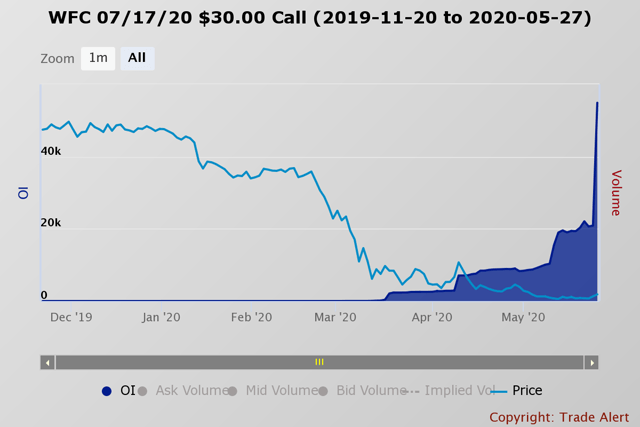

But there is more because this appears to be part of a spread transaction where the trader sold the $30 calls, with the open interest rising by about 34,000 contracts. These contracts traded between the bid and the ask for about $0.67 per contract. By selling the calls, the trader took in the premium of $0.67 per contract. The calls were sold to offset some of the cost of buying the puts.

Overall it creates a bearish bet that Wells Fargo stock is at a lower price than it is on May 27 of $27.18.

Weak Fundamentals

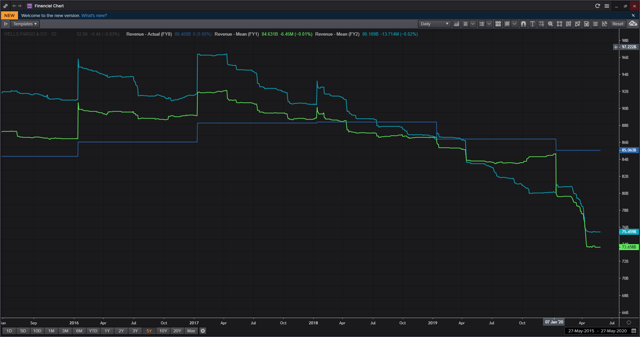

The traders may be betting that the stock moves lower because the fundamental outlook for the company looks bleak. Analysts currently forecast that revenue will fall by 13% in 2020 to $73.7 billion from 2019 revenue of $85 billion. Analysts see revenue growing to just $77.59 billion by the year 2022.

(TR Eikon)

Meanwhile, earnings are expected to plunge in 2020 to $0.96 per share from $4.38 per share in 2019, a drop of about 78%. However, earnings are expected to rebound in 2021, more than doubling to $2.78 per share and rising an additional 36% in 2022 to $3.78. However, that 2022 estimate is still well below the 2019 results.

But the stock is expensive on a P/E ratio over the next-twelve-months (NTM) trading at 15.7 times earnings estimates. This is much higher than peers Citigroup (C) and Bank Of America (BAC), which trade for 10.9 and 14 times their NTM earnings estimates. It is even higher than JPMorgan's (JPM) valuation of 14.7 times its estimates.

(TR Eikon)

Technical Trends

Technically the stock did break a downtrend and it could result in the shares rising to around $29.60 over the short-term, where a level of resistance awaits. But the big question is what will happen once the stock gets to that level. Should it fail to advance past 29.60, then there's it would likely reverse lower and head back towards support around $26.00.

Additionally, should the break out from yesterday not hold and falls below $26, it seems likely that the stock could retest its lows around $22.

Risks

There are plenty of risks to the bearish outlook highlighted above. For example, if the economy begins to pick up meaningful steam, it could be a big positive for the company's revenue and earnings power. Additionally, should the economy recover, interest rates could begin to rise, and that helps to boost net interest income for the banks, which could also help revenue and earnings.

But absent any significant economic improvement changes, it seems that Wells Fargo may continue to struggle.

Join the more than 150 members of one of the fastest-growing services on SA Marketplace, Reading the Markets. Membership has surged by over 40%, just this year. We focus on using fundamentals, technical, and options market analysis to search for a clue on the directions of markets, sectors, and stocks.

I use videos and written commentaries to get the story out. Additionally, I have started to create educational videos to help people catch on to my approach.

Hope to see you soon

- Mike

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.