SoftBank’s Vision Fund Is Planning to Cut 10% of Staff

by Giles Turner, Peter Elstrom- The London-based firm had grown to about 500 employees

- The Vision Fund reported losses of about $18 billion

The reductions could affect about 10% of the fund’s workforce of roughly 500, said two of the people, who asked not to be identified discussing personnel decisions. The Vision Fund’s headquarters are in London, with additional operations in Tokyo and California. The cuts will be across all levels of staff, said one person.

A spokesman for the Vision Fund declined to comment.

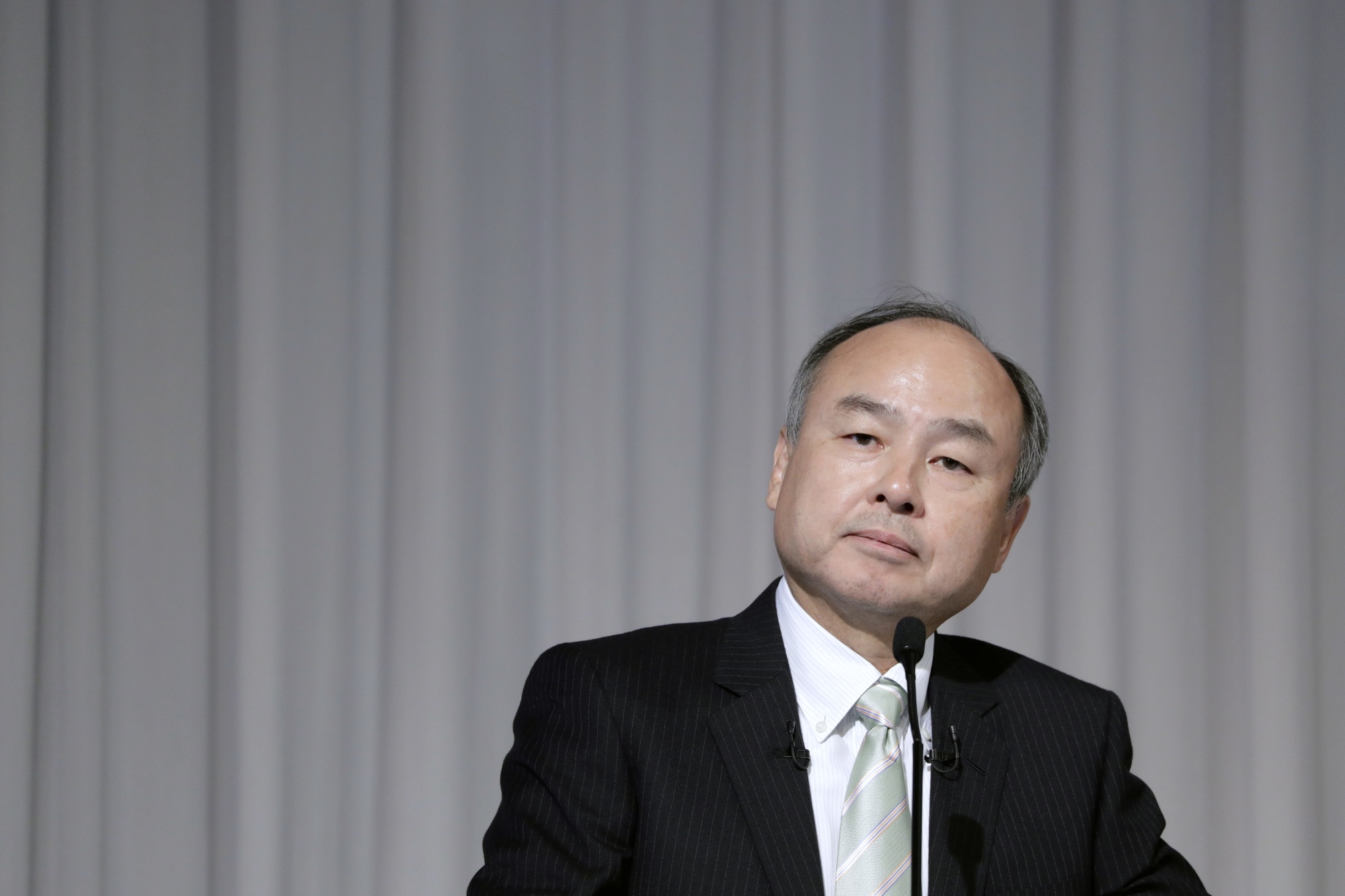

SoftBank founder Masayoshi Son and his $100 billion Vision Fund changed the tech industry by handing out enormous checks to relatively unproven startups. But the fund went from SoftBank’s main profit contributor a year ago to its biggest drag on earnings. It lost 1.9 trillion yen ($17.7 billion) last fiscal year after writing down the value of investments, including WeWork and Uber Technologies Inc.

Son originally said he hoped to raise a new Vision Fund every two to three years, but he has conceded he can’t attract money now because of the poor performance. The fund, led by Rajeev Misra, operates as a SoftBank affiliate with most of the money coming from limited partners, led by Saudi Arabia’s Public Investment Fund and Abu Dhabi’s Mubadala Investment Co.

“It makes sense that SoftBank is cutting positions at the Vision Fund as they are in an extremely difficult situation, and they may start targeting highly paid workers to cut costs,” said Koji Hirai, head of M&A advisory firm Kachitas Corp. in Tokyo.

“One side effect is that the best people at SoftBank may exit to find better funds,” said Hirai. “If so, their fund business may become even worse, sliding down from a slope.”

“Vision Fund’s results are not something to be proud of,” Son said earlier this month as he announced record losses. “If the results are bad, you can’t raise money from investors. Things aren’t good, that’s why we are investing with our own money.”

The fund has already unwound some investments, including selling a nearly 50% stake in dog-walking startup Wag Labs back to the company last year. Son has said he plans to sell off about $42 billion in assets to finance stock buybacks and pay down debt.

SoftBank disclosed it’s unloading some shares in Alibaba Group Holding Ltd. and is in talks to sell about $20 billion of T-Mobile US Inc., Bloomberg News reported. It’s also exploring a deal for its minority stake in industrial software maker OSIsoft LLC that could be worth $1.5 billion.

SoftBank shares, after plummeting in March, have recovered and are little changed for the year. The stock rose just more than 1% in Tokyo trading.

“The big picture is SoftBank is caught up with U.S.-China conflict right now, and SoftBank may need to conduct a drastic restructuring if Alibaba was delisted from New York,” said Hirai. “Its main banks and the capital markets are anxiously awaiting an outcome for the situation.”

— With assistance by Gillian Tan, Takahiko Hyuga, and Vlad Savov

(Updates with additional details starting in the first paragraph.)