Bitcoiners Go Wild After Goldman Revives Tulip Mania Comparison

by Vildana Hajric- ‘We do not recommend Bitcoin’ to clients: Goldman Sachs report

- Bank says Bitcoin does not show evidence of hedging inflation

Goldman Sachs Group Inc. just forged a lot of new enemies -- in the crypto world.

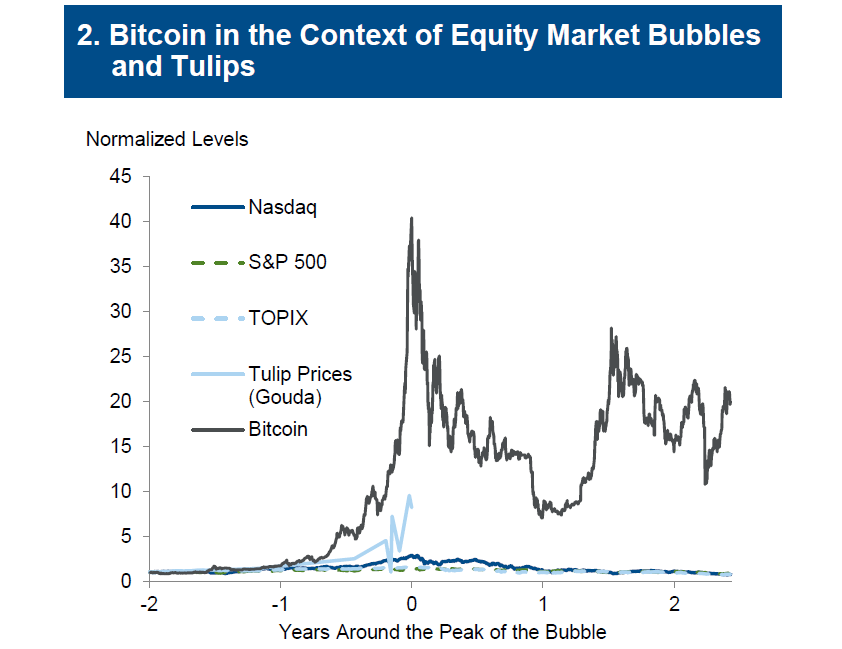

“We do not recommend Bitcoin on a strategic or tactical basis for clients’ investment portfolios even though its volatility might lend itself to momentum oriented traders,” said the Goldman report, the contents of which were discussed on a call Wednesday featuring the firm’s Jan Hatzius as well as Harvard’s Jason Furman. The report compared Bitcoin’s run to the Tulip mania of the 1600s in the Netherlands, one of the most infamous instances of speculative bubbles.

One by one, Goldman laid out rebuttals against many of the merits frequently cited by crypto evangelists that aim to hold up the superiority of the digital tokens. Cryptocurrencies, including Bitcoin, are not an asset class -- they do not generate cash flow or earnings and do not provide consistent diversification benefits. Nor is there evidence they are an inflation hedge, the report said. While hedge funds might find digital tokens appealing due to their high volatility, that allure alone doesn’t form a viable investment rationale, according to Goldman.

Bitcoin investors often cite its limited supply, capped at 21 million, as a catalyst for an ultimate price surge. But, Goldman said, cryptocurrencies as a whole are not a scarce resource. For instance, some of the largest cryptocurrencies, including the Bitcoin-offshoot Bitcoin Cash, were formed following a programming fork. The bank also cited recent illicit activities tied to cryptocurrencies, including Ponzi schemes, ransomware attacks and money laundering.

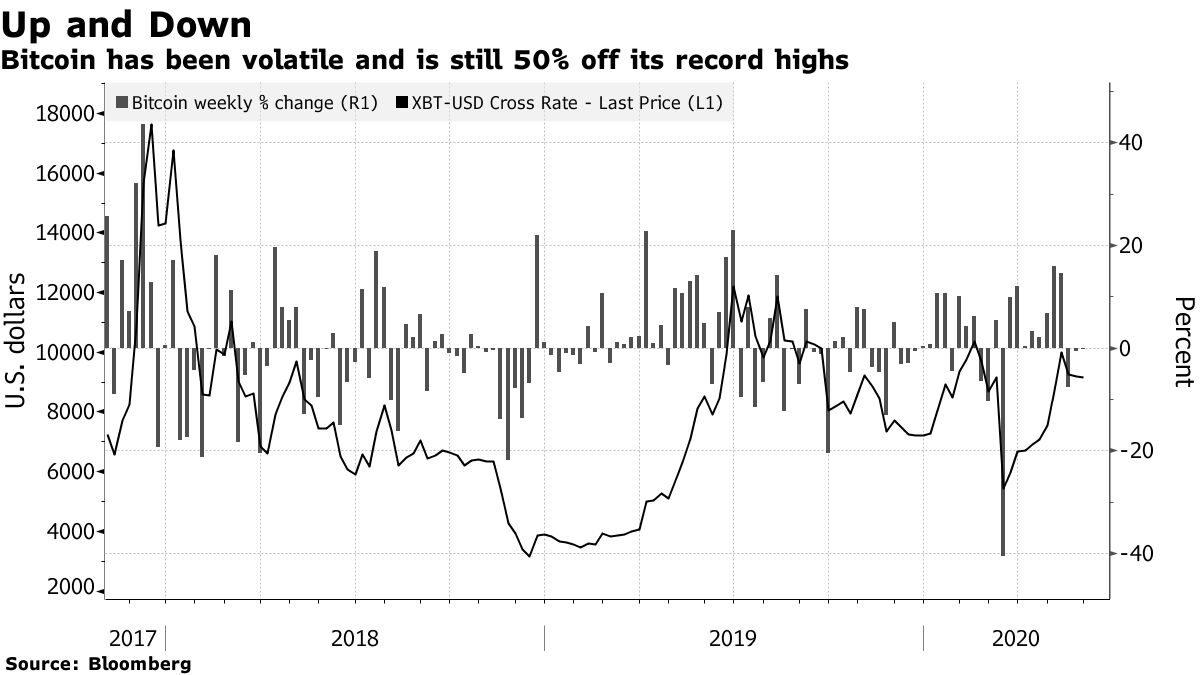

Cryptocurrencies are notoriously volatile. Bitcoin has swung around wildly during the coronavirus crash and has since recovered, advancing near 30% this year. However, it’s still down 50% from its record peak reached in late 2017. Goldman in its report highlighted Bitcoin’s extreme volatility, singling out the March 12 session as an example, when the token dropped more than 25% amid a coronavirus-induced selloff.

Bitcoin gained as much as 4.1% to $9,225 in New York trading on Wednesday.

The result of Goldman’s foray into the crypto conversation? A lot of angry advocates.

Crypto evangelists were quick to react to Goldman’s report on Twitter, with many calling it nonsense. Some pointed to other calls Goldman strategists blundered in the past, while others said Wall Street banks were too slow to catch onto the trend. Still others said they were waiting for the Federal Reserve to add Bitcoin to its reserves as a way to hedge against inflation, an argument that’s gained steam in the crypto community amid recent central bank balance sheet expansion.

“Goldman Sachs served a cold dish to the crypto community, which was largely expecting them to come out with a bullish call on the world’s number one digital asset,” Mati Greenspan, founder of Quantum Economics, wrote in a note. “Perhaps Goldman is just trying to jawbone Bitcoin to buy more for themselves at a cheaper price. Who knows?”

— With assistance by Lu Wang, and Aoyon Ashraf