Eaton Vance: Investment Manager For The Long Term

by Neutral InvestingSummary

- The investment management industry is under challenge due to investors' focus on passive products and unrelenting downward fee pressure.

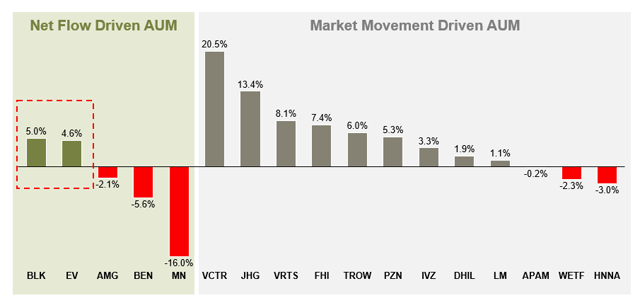

- While investment managers' AUM has increased in the past 5 years, the increase is mainly due to market appreciation, instead of net flow.

- Eaton Vance is one of the few asset managers whose net inflow contributed more to AUM increase instead of market appreciation.

Company Description

Eaton Vance (NYSE:EV) is an investment management company with an AUM of ~US$497bn as of FY19.

EV is made up of 4 investment affiliates:

- Eaton Vance Management: global equity manager

- Parametric: quantitative asset manager

- Calvert: ESG focused asset manager

- Atlanta Capital: Active managers for equity and bonds

Situation

We have observed a few driving trends in the asset management industry:

- Active management continues to be challenged as investors are now shifting their focus on passive and rule-based investments

- Intensifying downward fee pressure

- Declining profitability margin - while management fee has been declining, companies have not been addressing their cost base as a response.

Why Eaton Vance?

We did a quantitative screening of 18 investment managers and saw:

- What has been driving their AUM growth - is AUM driven by net inflows or market appreciation?

- Whether revenue has been growing in the past 5 years (2015-2019)

Investment Managers' 2015-2019 Revenue CAGR

Source: CapIQ

As you can see, only 2 companies saw revenue growth in the past 4 years and that AUM is driven by net inflow. We will discuss BlackRock (BLK) in another article.

A report by McKinsey shows several tailwinds for Eaton Vance:

- Investors are now focusing more on portfolio construction

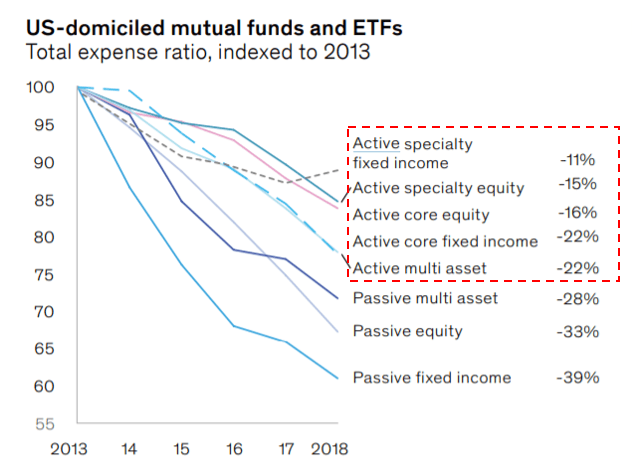

- Fee decline is not the same for every asset class. For retail-oriented funds, specialized active equity and fixed income, impact of fee compression was just half the rate of the overall market

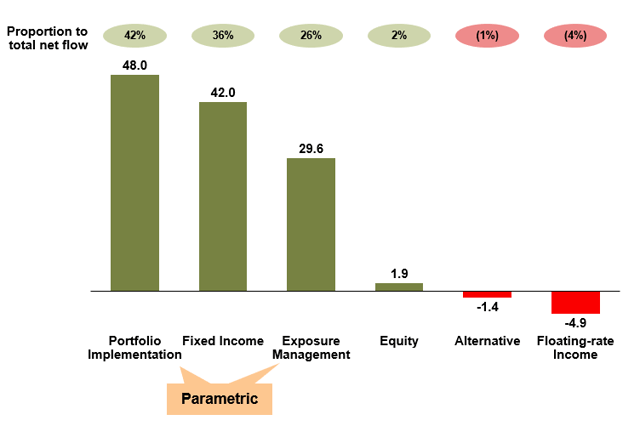

1) Eaton Vance's portfolio construction investment mandate has been the bulk contributor of net inflow

Parametric (one of EV's investment affiliates) is a quantitative investment firm that is focused on managing systematic strategies and to implement custom portfolio.

In line with the McKinsey report, Parametric's investment mandate has been the driver of Eaton Vance's consolidated net inflows.

Net flow from 2015 to 2019 (USD Bn):

Source: Company's 10-K

And, to adapt to this demand, EV is now combining Parametric's services to other funds - laddered bonds (one of EV's fund that has seen great demand). We believe combining the services will be accretive.

Growth for Parametric offerings is promising as it is just currently scratching the surface as investors are now looking more towards portfolio construction to pair with their passive index investments.

2) Fee decline for specialized active equity and fixed income is only half the rate of the overall market

Source: McKinsey

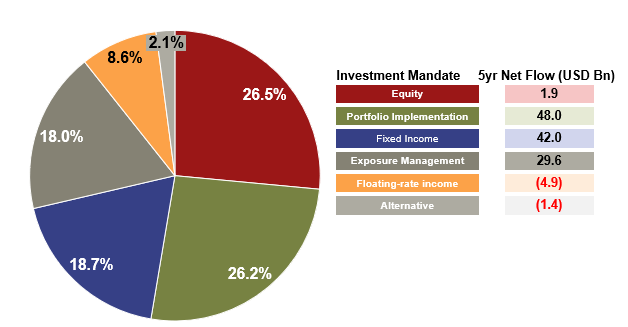

EV's AUM is mostly concentrated in fixed income and floating rate income where fee pressure hasn't been that severe. It also helps that these two investment mandates have been seeing great demand particularly in Laddered Municipal and Corporate Bond and short duration government income fund.

AUM Breakdown by Investment Mandate (2015-2019):

Source: Company's 10-K

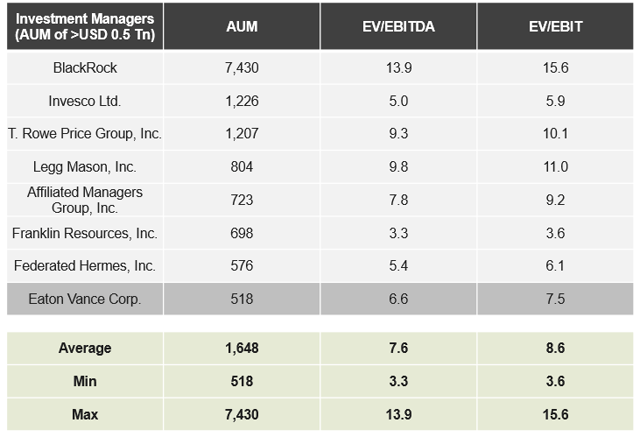

Valuation

EV is currently trading at discount to peers at 6.6x EV/EBITDA and 7.5x EV/EBIT.

Source: CapIQ

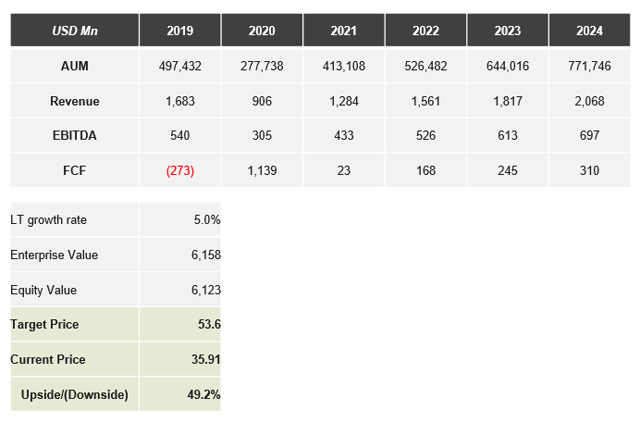

Financial Projections

Disclosure: I am/we are long EV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.