NRGU Oil ETN: As Low-Risk As It Gets

by Crude ManSummary

- NRGU is a highly leveraged(3x) ETN focused on the Solactive MicroSectors U.S. Big Oil Index.

- Being highly leveraged to a high risk industry has inherent risks, especially as an ETN, and with the issuer's credit needs and fees.

- Trading at approximately 10% of the pre-oil collapse value, the ETN appears to have nowhere to go but up.

- Confidence in that notion is found in looking at the nature of the Index the ETN is tied to, and the specific companies therein.

- This appears to be a unique opportunity to trade this as a vehicle for investing in an oil industry recovery.

Investment Thesis

NRGU - BMO MicroSectors U.S. Big Oil Index 3X Leveraged ETN (NRGU), as with most leveraged ETNs, has significant investor risk. However, as the Index that it is tied to, the Solactive MicroSectors U.S. Big Oil Index, specifically targets the 10 highest market capitalization U.S. oil stocks, and those stocks have hit bottom and are on the way up while also appearing to be relative safe havens in the industry, risk appears to be at an all-time low for the ETN. Combined with the fact that it is currently trading at approximately 10% of the pre-collapse price, this appears to be a unique opportunity to invest in an oil industry recovery, and using NRGU as a vehicle to do so.

The Vehicle

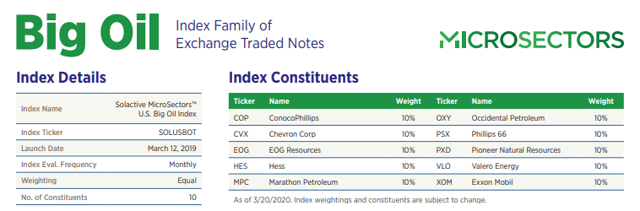

NRGU, being a highly leveraged ETN, is a unique vehicle for investing in the oil industry. Offered by Bank of Montreal (BMO), the ETN targets the Solactive MicroSectors U.S. Big Oil Index (from here forward, the "Index"), and leverages it at 3X. The Index is specifically comprised of an equal-weighted composition of the top 10 market capitalization companies in the U.S. oil industry. As these are subject to change with market conditions and the values of the specific companies it is composed of, the Index redeploys on a monthly basis.

The BMO Big Oil Fact Sheet explains more about the structure of this vehicle. For starters, as of 3/20/2020, the Index was/is comprised of ConocoPhillips (COP), Chevron Corp (CVX), EOG ReSources (EOG), Hess (HES), Marathon Petroleum (MPC), Occidental Petroleum (OXY), Phillips 66 (PSX), Pioneer Natural ReSources (PXD), Valero Energy (VLO), and Exxon Mobil (XOM). Again, being equal weighted, these all have a 10% exposure for the Index.

Source - BMO Big Oil Fact Sheet

That's a pretty solid list, overall, of companies for an Index to be tied to. There are some question marks in there, but also some of the strongest, most "safe harbor" in the industry.

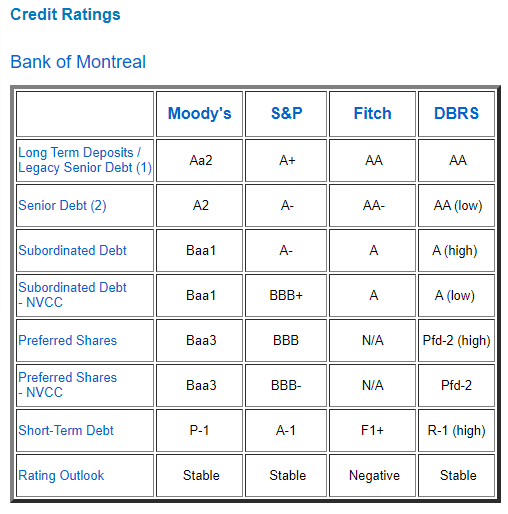

Being an ETN, there are further components of the vehicle that need to be accounted for. First of all, there are associated fees, 0.95% per annum, accrued daily. Further, as an ETN, there are no assets tied to the vehicle, and thus the credit worthiness of the issuer (BMO) is important. There are other risks with investing in ETNs, which are summarized by the SEC here. They are worth a read. As to BMO's credit worthiness, given the current state of the world economy, they have some pretty solid ratings:

Source - BMO Credit Ratings

The Bottom Found, Time To Go Up!

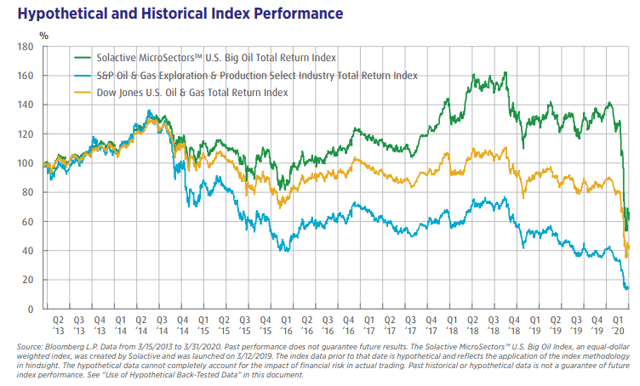

As with most everything tied to the oil industry, NRGU took a beating during the oil price crash. What had been to that point a leveraged vehicle tied to a top-performing Index, suddenly found itself cratering, as the Index it was tied to fell.

Below is the historical performance of the Index NRGU is tied to, in Green, compared to competing Indexes. Note that the current Index being at ~ 70% of value means that the 3X leveraged NRGU tied to that Index is currently at ~ 10% of value. Ouch.

Source - BMO Big Oil Fact Sheet

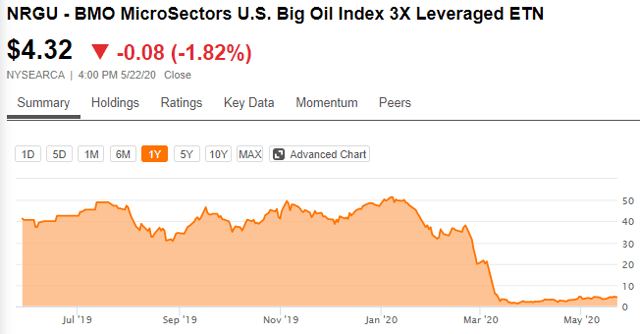

This is also reflected in the price of NRGU, as it is currently trading at $4.32/share, as opposed to the historical average of around $40/share, or roughly 10% of pre-crash levels.

Source - Seeking Alpha NRGU

However, all is not doom and gloom. Though not meant to be a "buy and hold" vehicle due to the nature of the ETN, this is a unique situation, in which all indications are that this will be on a long, steady climb, and given that the maturity date is 3/25/2039, there's plenty of time to ride it up.

Indeed, the vehicle has already improved from the bottom at $1.10/share, to nearly 4X that at current prices. With a runway up to historic levels of $40/share possible, there's still a potential 10X to be had!

Indeed, we can review the stocks the Index is tied to and see much of the same trend, with the stocks already rebounding off their bottoms, and yet being well below their historic norms:

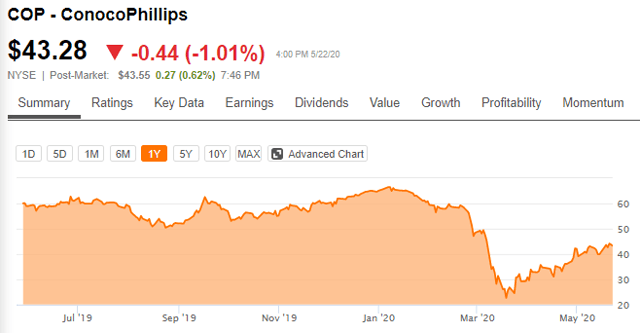

Source - Seeking Alpha COP

Source - Seeking Alpha CVX

Source - Seeking Alpha EOG

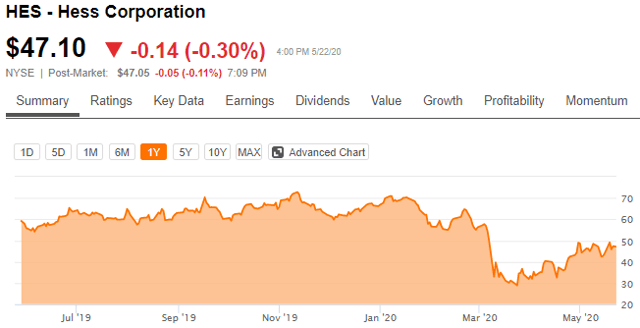

Source - Seeking Alpha Hes

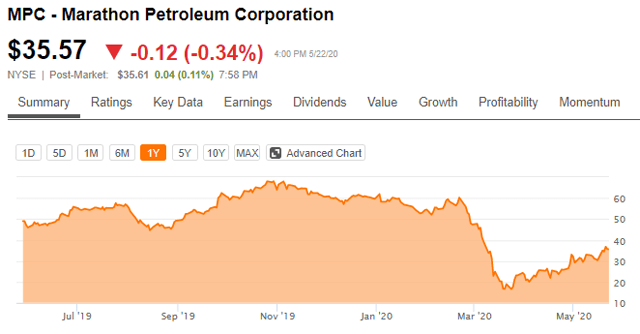

Source - Seeking Alpha MPC

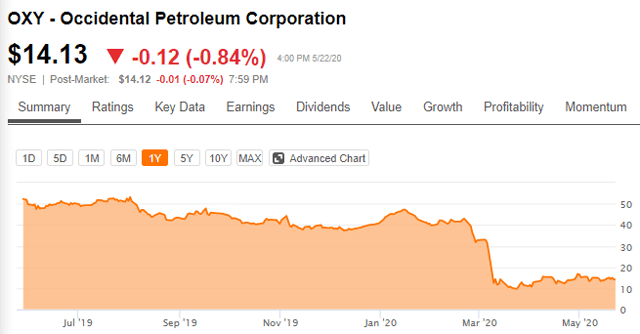

Source - Seeking Alpha OXY

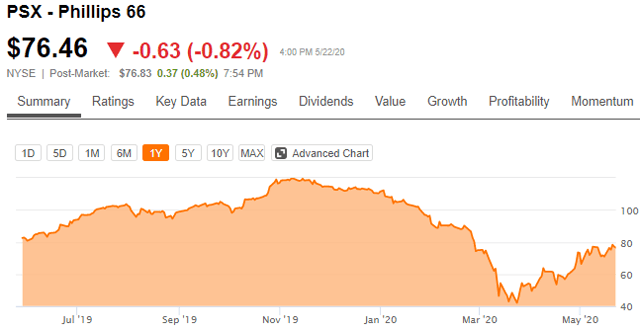

Source- Seeking Alpha PSX

Source - Seeking Alpha PXD

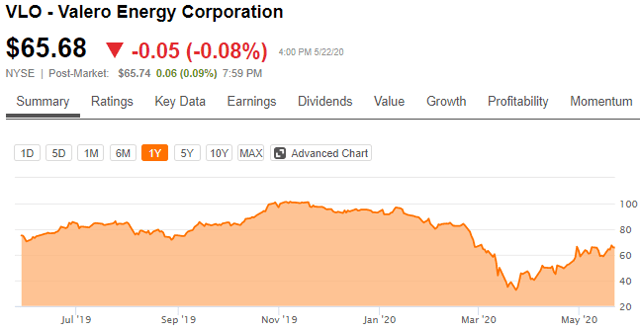

Source - Seeking Alpha XOM

Indeed, the only one of the ten that has yet to recover substantially from the lows is Oxy. Given that, it may be replaced in the index.

Overall, though, the stocks that the Index is composed of have already bounced significantly off of their lows, and show momentum in continuing to recover, as the economy opens back up and demand for oil increases.

A Unique Approach

Finding the right vehicles to use to invest in the oil sector for what appears to be an imminent, albeit drawn-out recovery, can be challenging. There are so many risks to navigate and variables that are out of individual company's controls. Further, the companies that are "safe harbors" are expensive. Just look at the ten stocks tied to this fund. The average price is $56.18/share, and that's with Oxy dragging it down! Exclude Oxy, and the average price is $60.85/share, with the low being $35.57/share and the high being $92.42/share! That's some serious dollars to put up for a share.

However, you can tie yourself to the performance of ALL of those companies at once, via the NRGU ETN. The price of NRGU is currently $4.32/share.

Thus, you can purchase 13 shares of NRGU for the average share price of the companies in the Index. That gives you a lot more shares to take advantage of a move up.

On top of that, NRGU is trading at 10% of pre-crash levels now. The stocks in the fund are trading at roughly 70% of pre-crash levels now. That means that if you assume all of these stocks and vehicles will get back to pre-crash levels, the upside in the stocks themselves is limited to a 30% recovery for a 1.43 return on investment (ROI), compared to NRGU having a 90% recovery for a 10 ROI.

Conclusion

ETNs can be risky vehicles, especially when tied to risky industries such as the oil industry. However, due to the unique situation wherein the oil industry has cratered, but the NRGU ETN is tied to stable companies, a rebound has already begun, and has a lot of room to continue. Rather than limiting risk and upside by investing in the pricey stocks the ETN is tied to through its Index, substantially more upside at a fraction of the entry price exists with using NRGU as a vehicle to play the oil price recovery.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in NRGU over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: As an owner in oil and gas wells and properties, I have a business relationship with multiple public oil and gas companies. This relationship is limited solely as a minor, 3rd party owner in the wells, wherein my only authorities are to make elections on participating in proposed wells, and subsequent operations on those wells. While I am able to discuss operations with operators, I have to make my own elections and decisions, and the operators control the process. I have minor interests in several COP Bakken wells, and royalty interests in numerous OXY operated wells.