Alteryx: Still Long

by Ishan PuriSummary

- Channel checks in May 2020 show that business intelligence is still a top priority for many companies.

- Alteryx stock has surged in the past few weeks and has come in line with other players.

- I am still long the stock given a combination of strong market tailwinds, a well-run organization, and a financial analysis I conduct.

Thesis

Alteryx (AYX) is a leading player in the business analytics space and is riding multiple market tailwinds. In a previous post, I spoke how it was being clumped together with other companies based on its revenue growth and profile, and that there was room for multiple expansion. Over the past month, we have seen that and now the business is trading closer to fair value.

Market tailwinds, channel checks, and a financial analysis lead me to continue to be long Alteryx. I will outline these reasons below.

Market Tailwinds

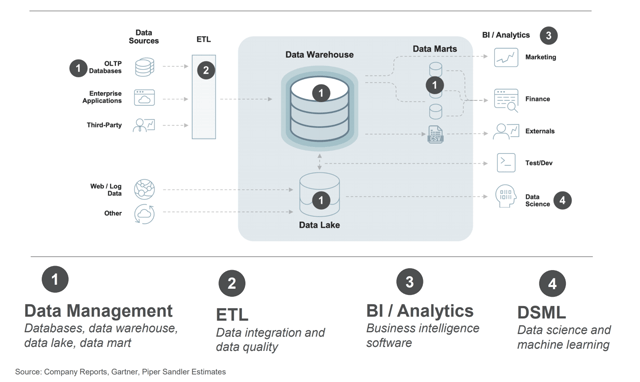

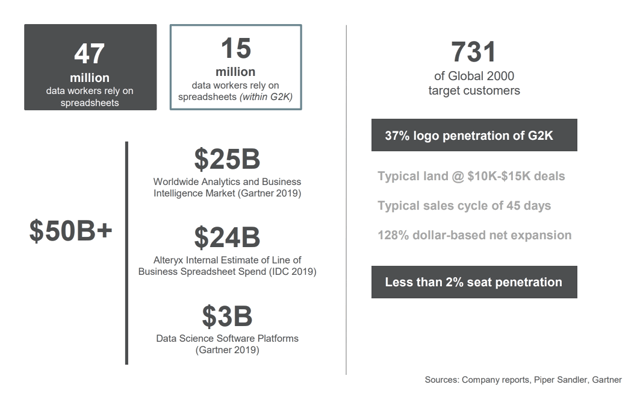

Source: Alteryx

Alteryx is a leading player in the business intelligence and analytics field. There is a major industry shift occurring today with the explosion and structuring of business data that allows companies to make more informed decisions. However, many companies cannot afford a team of PhDs to analyze this new data. Alteryx fills that gap by allowing business users and technical staff to both analyze data.

Here is a breakdown of the data ecosystem and the modern data stack:

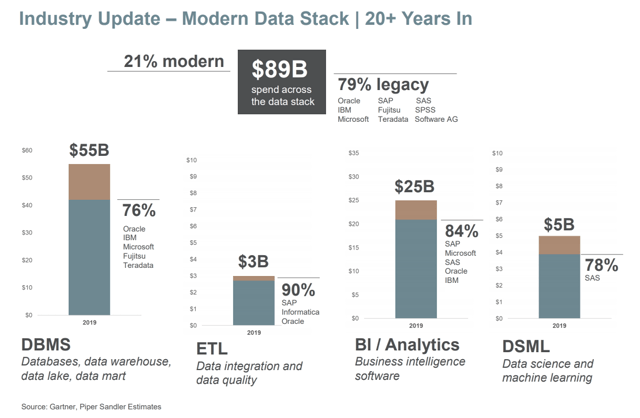

As an industry, Alteryx plays in the data science and machine learning space with many legacy vendors like SAP (NYSE:SAP), Oracle (NYSE:ORCL), and IBM (NYSE:IBM). It is capturing market share from these vendors which are mostly on-premise. It is important to note that a significant portion of Alteryx is also on-premise, likely due to customer demand.

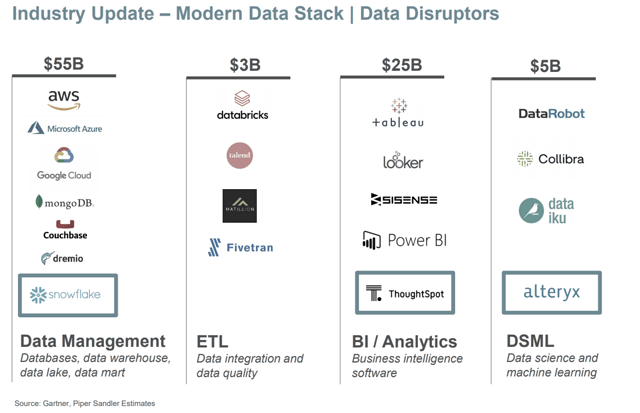

When asked about where Alteryx fits versus players like Snowflake, Couchbase, ThoughtSpot, and others, I can refer to this market map which outlines four key areas within the business intelligence universe. You can see that there are several well-funded venture companies in each of these market segments.

These are large and growing markets, and you can see that DSML itself is not as crowded as some of the other verticals.

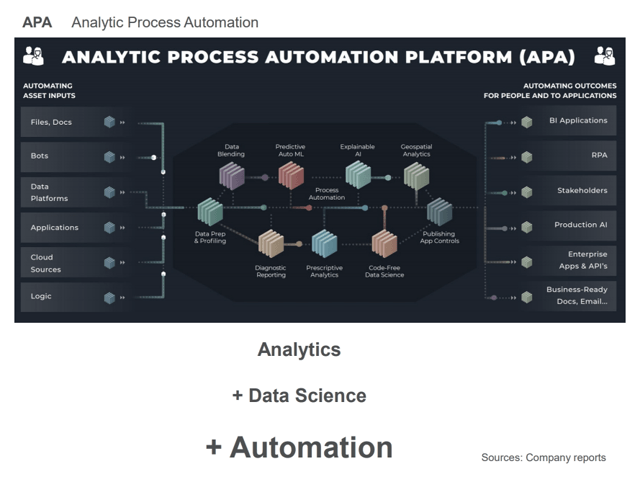

Alteryx's vision is to build data automation, as per their recent product announcement in May 2020. I believe this product vision will guide them for the next 3-5 years in the right direction. It combines elements across analytics, data science, and automation to bring insights to companies with the data they already have.

When I think about the market opportunity, it is growing. Alteryx has started with a focus on large organizations, and I do not believe it has to move downstream in the near future. Their target users are knowledge workers who often have to rely on spreadsheets today to manipulate data.

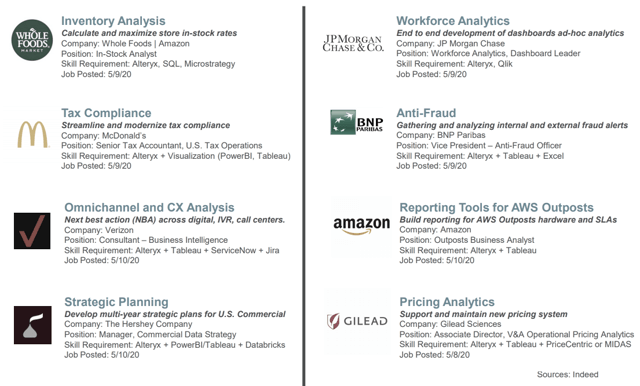

Alteryx is also a very flexible platform with different use cases. As a platform play, it can reach across industries and problem types. Here are a few examples of those, pulled from Indeed job postings.

Channel Checks

A few sell-side analysts came out with very encouraging channel checks from May 2020. First, many concurred with my analysis of the product roadmap as a clear vision for the company. Second, they conducted a series of job checks to see the growth of the knowledge workers outlined above. That data came out very strong, as companies look inside with the extra time COVID-19 has given them.

Valuation

I have been long Alteryx for some time, and the stock does move up and down dramatically at times. Given its lack of consistent profitability, the only measures investors are often focused on are revenue and revenue growth. The comparable universe is based on a financial profile, but many pure-play competitors are not public or are at a different scale.

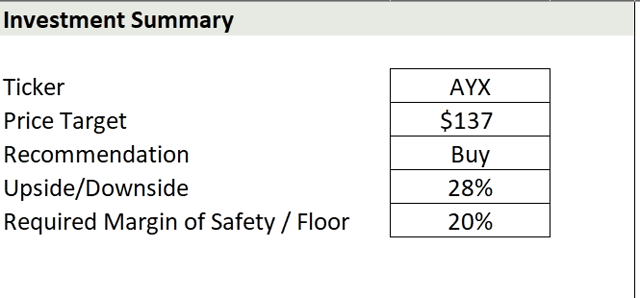

In any case, my valuation analysis, based on their filings, shows the company as near value today. I would wait for a market pullback to add. For long-term investors, it is a good time to start a position.

Source: Company materials

Disclosure: I am/we are long AYX. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.