Montage Resources: Swearing Off Debt Addiction

by Long PlayerSummary

- Current management knows first hand what too much debt can do to a company's survival chances.

- The EBITDAX ratio of 1.9 will creep upward during the current fiscal year. But it will probably remain within traditional lending guidelines.

- The EBITDAX margin is in excess of 50% of revenue.

- This company has a very profitable liquids mix of primarily oil and condensate accompanying the natural gas production.

- A conservative financial track record in the future would probably earn the common stock a higher valuation of company earnings.

Montage Resources (MR) management clearly got the memo about conservative balance sheet management. This is one management that clearly did not need a reminder because much of management has painful personal experience with debt.

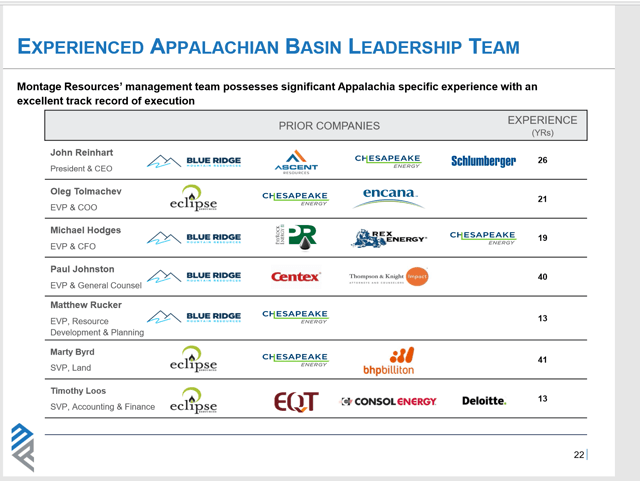

Source: Montage Resources May, 2020 Investor Presentation

The above slide reads like a "Who's Who" of Appalachian financial disasters and near misses. There are some financially solid companies there. But there is enough experience gained from financially stressed companies to keep this company management "on the wagon".

This company itself was formed when Eclipse (which was financially stretched) merged with Blue Ridge Resources (which had just emerged from bankruptcy). Therefore this management needed no excuse to head towards conservative balance sheet management.

That strategy proved to be just in time before the coronavirus calamity hit.

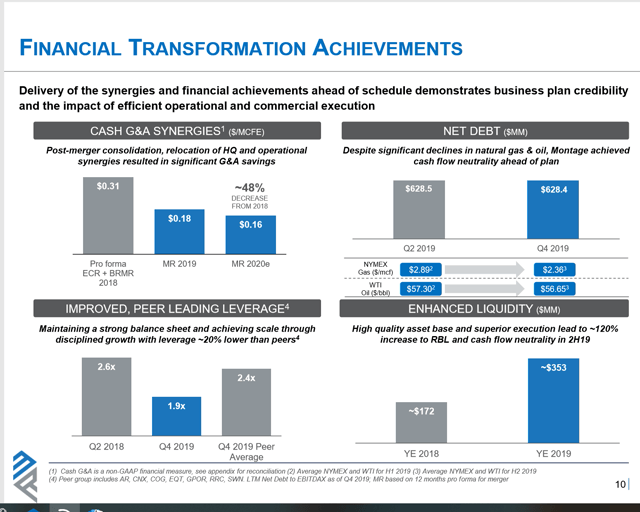

Source: Montage Resources May, 2020 Investor Presentation

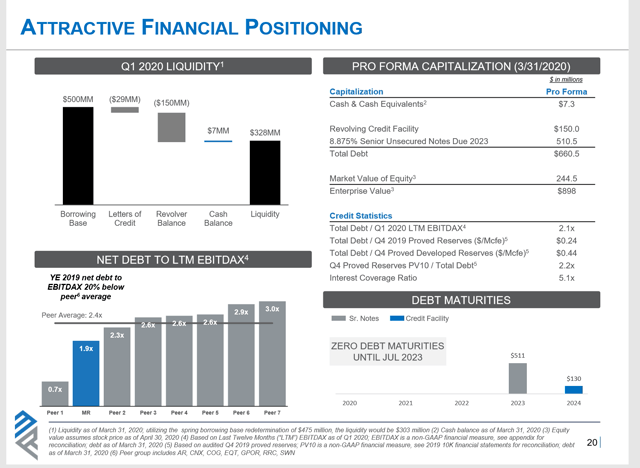

As shown above management got the debt ratio below 2.0 just before the coronavirus challenges became apparent. The latest EBITDAX reported by management for the first quarter declined about 10%. That will probably initiate a few quarters of lower EBITDAX that will push the debt ratio up a little. But the rapid production growth of the previous fiscal year and the hedging program will act as a buffer.

Management alluded to that buffer when the committed bank line at the end of redetermination came back at $475 million. During a crisis like the current one, the committed bank credit line is for all intents and purposes the borrowing base available to the company. That borrowing will be limited by covenants in the loan agreement. Therefore it is particularly important to reduce the volatility of EBITDAX during a time of weak pricing like the present.

The companies that will suffer the most are the ones that tried to get the maximum amount the banks would allow. Then when challenges like the current industry atmosphere arrive, those credit lines are sharply cut back which can financially strain an aggressive management or worse. Some of those aggressive managements do not believe in a strong hedging program either. Therefore one key part of many debt ratios used by lenders is about to take a dive in the second quarter for the aggressive crowd.

Here, management came up with a financial strategy that allowed them to maintain adequate liquidity through the current low pricing environment. The hedging should ensure minimal unfavorable change to key financial debt ratios on the balance sheet. This is a big change from the aggressive financial strategies that had Eclipse Resources looking for an all stock merger and the financial strategy that led to the reorganization that formed Blue Ridge.

Investors appear to have some assurance by the demonstration of management behavior in the current crisis that this management has learned how to navigate the volatile oil and gas industry without putting the company in jeopardy of surviving.

This leads to some investor assurance that the track record going forward will impress lenders that this company has changed its ways. In the meantime, investors will be thinking about a better safety ranking as management proves that the strong balance sheet is a higher priority than it was in the past. Once a lower risk strategy is established for the market then earnings accomplishments will be valued more in the next industry cycle.

Cost And Margin Discussion

No cost discussion is complete without talking about the effect on margin. Dry gas producers often have the lowest costs per MCF. They usually follow that up with the lowest margins as well. Incremental costs that pull out products such as pentanes, ethane, and other value added products are often worth the extra cost so they can be sold separately. Many of these products can remain in the natural gas to at least some extent should there not be a market for the product or a current market for the product.

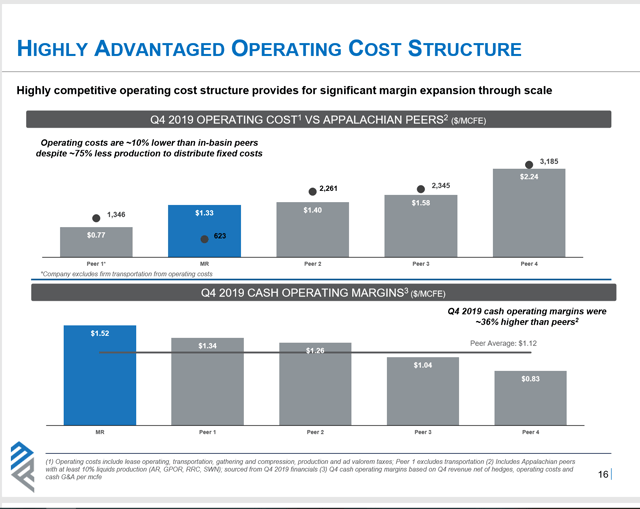

Source: Montage Resources May, 2020 Investor Presentation

Montage Resources has some of the highest liquids as a percentage of production. Plus those liquids have a relatively high value as condensate and oil. Notice above that the margin exceeds the costs per MCF. That rather wide margin implies considerable management flexibility during downtrends.

The amount of liquids encountered and the processing necessary to maximize the sales value of those liquids and the gas stream often makes it hard to compare primarily gas producers. A small amount of some of the more valuable liquids very quickly becomes a legitimate average price improvement.

As long as the price improvement exceeds the relevant costs, then that liquid will be processed separately to maximize the average selling price. A cost in this situation is known as an incremental cost. This is a cost that if incurred will improve the operating margin per unit. If current market conditions do not allow for a suitable profit, then the product remains in the natural gas stream (which lowers processing cost for that time period).

Currently, management is actually doing better by shutting in liquids rich wells. However, if history is any guide, that situation will not last and liquids will again be sought after in many gas basins.

Background

Montage Resources operates in the areas near where the three states of Pennsylvania, West Virginia, and Ohio come together. As a general rule, Pennsylvania acreage usually features a lot of dry gas. The liquids begin to enter into production in a significant quantity in the Western part of the Marcellus. Interestingly so far the first liquids going west from Pennsylvania Marcellus acreage appear to be ethane and pentanes. As one continues West towards the Utica Shale (where it becomes economical to develop), the liquids increase in value to oil and condensate.

That would be an extremely general guideline. The Utica Shale actually exists under the Marcellus in places (but right now the priority in those areas appears to be primarily the Marcellus). There is also a dry gas portion of the Utica Shale that is profitable to develop. I just tried to keep the description very general and simple.

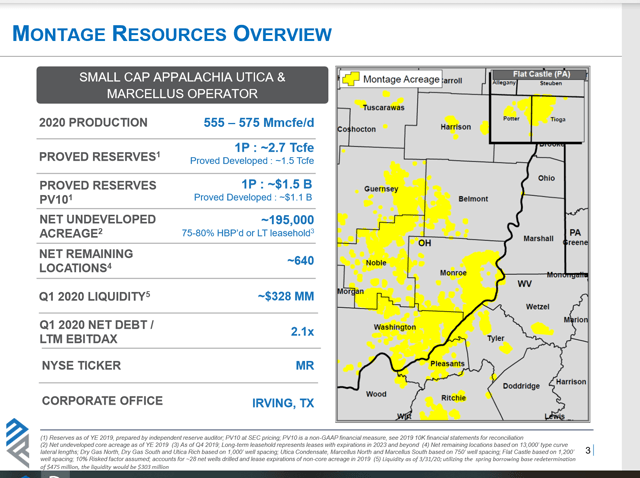

Source: Montage Resources May, 2020 Investor Presentation

Montage Resources has a fair amount of acreage that is relatively to the west. Hence the relatively large amounts (as a percentage) of oil and condensate. The Utica Shale was seen as a high cost area for a long time. The liquids in the gas stream are what makes the Utica Shale competitive with the dry gas leases in Pennsylvania.

Anytime production grows relatively rapidly as it did with Montage Resources, then the capital required to maintain production will be higher. This higher capital requirement is due to the relatively larger amount of new wells with fast declining production that often accompanies rapid production growth. Slower production growth requires less new wells. So when there is a challenge like the coronavirus, then comparatively less capital is needed to maintain production.

Value And The Future

Montage Resources is not only out of favor with the industry. But there is a financial "blot" in the history due to its own previously stretched finances and the acquisition of a company that emerged from bankruptcy to quickly decrease the ratios to more acceptable numbers.

Source: Montage Resources May, 2020 Investor Presentation

The result of all of these "knocks" is shown above. The enterprise value of the company is less than 4 times the last twelve months of EBITDAX. This common stock may rally with the price of natural gas producers. But the product mix is actually more valuable than many primarily natural gas producers due to the amount of oil and condensate as a percentage of production.

Competitor Antero Resources (AR) which also operates in the Marcellus and Utica Shale area produces a significant amount of ethane which is a good deal less profitable.

Chesapeake Energy (CHK) sold the Utica Shale properties while maintaining a Marcellus presence. Chesapeake is the operator of the Epsilon Energy (EPSN) acreage which is dry gas production.

The result is that Montage Resources has a competitive advantage over many dry gas producers that will usually result in superior profit margins as well as superior profitability. The current coronavirus demand destruction has temporarily put the "rich gas" or "liquids" strategy out of order. But if history is any guide, the superior profitability should reassert itself in the future.

Management did report that costs per MCF continue to decline. Antero Resources also reports a cost per unit decline for the current fiscal year. The Marcellus was always viewed as a low cost basin. Currently, those costs are now lowering to make the basin even more profitable and competitive.

The hedging should be sufficient for this company to survive the current fiscal year. Long before the end of the fiscal year, the recovery from the coronavirus demand destruction should be underway. That would mean that the stock of the company should begin to recovery towards some past highs as the market begins to look forward to more normal demand.

Current management appears to be making the right moves to ensure the long term survival of the company. Resuming growth should enable this company to return to at least 8 times EBITDAX. That implies a lot of room for stock price appreciation in the future. Should the market value the growth record of this company in the future the stock price could easily approach 10 times EBITDAX.

I analyze oil and gas companies like Montage Resources and related companies in my service, Oil & Gas Value Research, where I look for undervalued names in the oil and gas space. I break down everything you need to know about these companies -- the balance sheet, competitive position and development prospects. This article is an example of what I do. But for Oil & Gas Value Research members, they get it first and they get analysis on some companies that is not published on the free site. Interested? Sign up here for a free two-week trial.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in MR over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long CHK, AM, AR

Disclaimer: I am not an investment advisor, and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.