Go Long On SinoPharm Group's HKEX Ticker 1099:HK

by Motek MoyenSummary

- There are obvious risks investing on Chinese companies right now. President Trump is hell-bent on winning his re-election via anti-China tirades.

- Most U.S. stock market players will cash out their positions in Chinese companies. They fear the new US Senate bill that could delist some Chinese stocks.

- However, there’s a very attractive opportunity you can exploit in SinoPharma's low $7.44 billion market cap. SinoPharm has $5.945 billion in total cash and short-term investments.

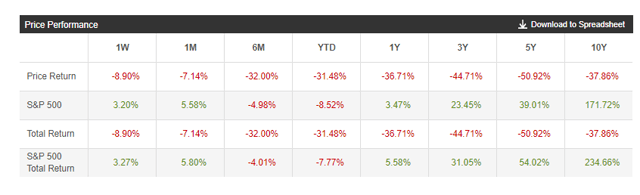

- It's no coincidence. Trump's election as U.S. President partly contributed to SinoPharm's -44.71% price performance for the last three years.

- SinoPharm Group's parent company is 51% controlled by China's state-owned Assets Supervision and Administration Commission.

The new US Senate bill requiring US stock exchange-listed Chinese companies to certify they are not owned or controlled by China's government is bad for SinoPharm Group (OTCPK:SHTDF) (OTCPK:SHTDY). SinoPharm's own website clearly states it is directly under China's state-owned Assets Supervision and Administration Commission of the State Council or SASAC. China's state's majority ownership over SinoPharm Group was also highlighted when it did its IPO in 2009.

SinoPharm stock's 3-year performance of -44.71% will only worsen because of this new political headwind. Investors now are scared of Pres. Trump's increasingly virulent anti-China propaganda. Brave investors can still exploit this stock's patent undervaluation. SHTDY's market cap is now only $7.44 billion. Compare this market valuation to SinoPharm's total cash and short-term investment holdings of $5.945 billion.

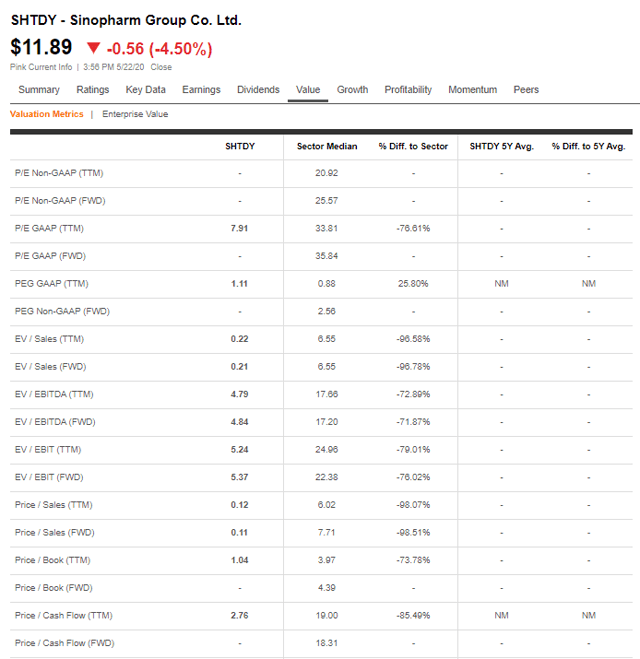

(Source: Seeking Alpha Premium)

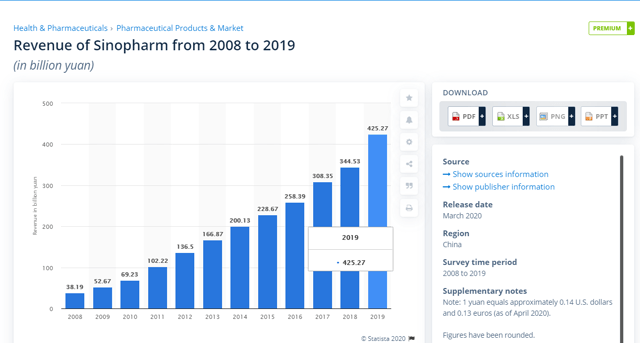

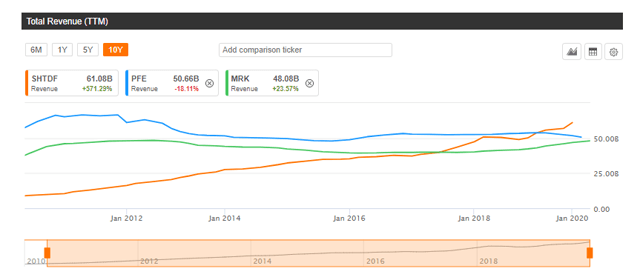

SinoPharm generates annual revenue of 425.27 billion yuan or $59.65 billion. This company's stock currently trades at just 0.11x Forward Price/Sales valuation. SinoPharm's annual revenue of $59.65 billion tops the annual sales of the world's "biggest" pharmaceutical companies. The chart below is a no-brainer statement that SinoPharm is fast-growing too.

(Source: Statista Premium)

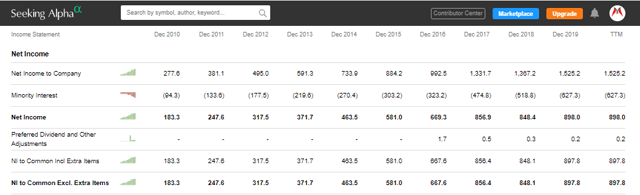

It is just unfortunate that SinoPharm's majority owner is the Profiteering Communist State of China. As per my Seeking Alpha Premium access, SinoPharm's 5-year revenue CAGR is 16.27%. This growth performance also did not prevent SinoPharm Group from making consistent profits. As per Seeking Alpha Premium's data, SinoPharm has grown its annual net income from 2010's $183.3 million to $898 million in 2019.

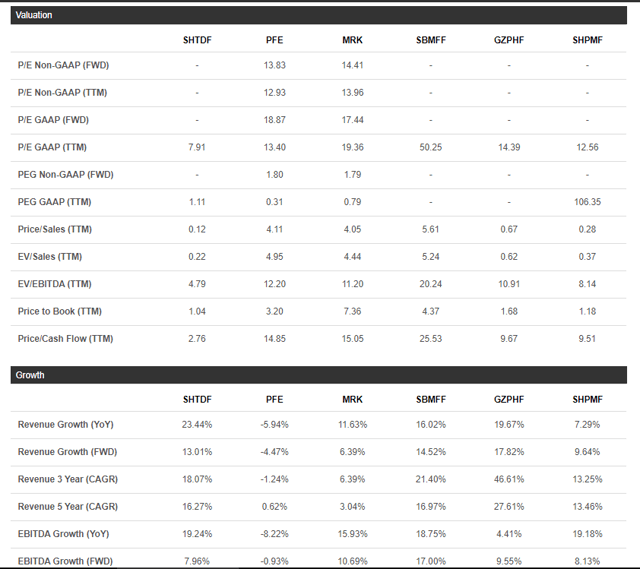

(Source: Seeking Alpha Premium)

I used MoneyChimp's calculator to come up with a 19.1% 9-year net income CAGR for SinoPharma.

Why Pres. Trump Is Unlikely To Sign The New US Senate Bill

Pres. Trump still needs to sign the new US Senate bill before it can become a law. Trump is up for re-election this year and his FUD-stirring anti-China stance is going to win him votes come November. It is best not to go long on SHTDF or SHTDY. SinoPharma might just get delisted if China's rulers don't divest their majority stake in the company.

On the other hand, many publicly-traded American companies are vulnerable to China's retaliatory measures. Some of these cash-rich companies (like Walt Disney (DIS), Tesla (TSLA), Facebook (FB), Apple (AAPL), Intel (INTC), and Microsoft (MSFT)) will vigorously lobby for Trump not to sign the new Senate bill which could delist some Chinese stocks. China's latest Hong Kong move shows it is not intimidated by foreign governments.

China and its allies Russia and North Korea tout more nuclear weapons than the U.S. China is now conciliatory. However, Trump cannot afford to keep on antagonizing China because America is really inept at making wars.

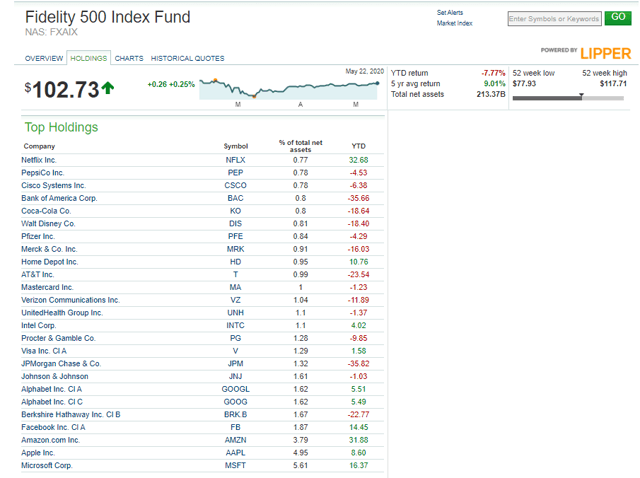

Most top US hedge/mutual fund companies and 401k fund managers are heavily invested in companies that are exposed to China retaliatory measures. Trump will likely lose his re-election campaign if Wall Street decides his anti-China re-election strategy is detrimental to the US economy. For example, Fidelity 500 Index Fund. It is a consistent campaign donor to U.S. politicians. Fidelity has compelling reasons to see to it that Trump doesn't sign a US law that will provoke China's autocratic government into penalizing the American businesses where Fidelity has investments.

(Source: MarketWatch)

Beyond Political Intrigue, SinoPharm Touts Deep-Value Aura

It is no coincidence that Trump's election as president of the United States contributed to the negative 5-year price performance of SinoPharm's stock. Investors are intimidated by Trump's consistent anti-China rhetoric. Setting this FUD aside, SinoPharm Group is now in deep-value territory. It doesn't really matter if it gets delisted in the U.S. This company's stock trades at the Hong Kong Stock Exchange. If you can, go long on SinoPharm via its HKXE ticker symbol 1099:HK.

I have access to Seeking Alpha Premium ($19.99/month) privileges. I will, therefore, use this website's data to illustrate why SinoPharm deserves a spot in your international investing portfolios. Seeking Alpha's Quant Rating does not cover SinoPharma's stock. However, I'm Filipino with 25% Mainland Chinese blood. I understood immediately that Seeking Alpha would have given SinoPharm a grade of A+ in Value. The valuation chart below is pretty self-explanatory.

(Source: Seeking Alpha Premium)

Any profitable company's stock that trades at just 0.21 forward EV/Sales (-96.78% compared sector average) and 7.91 TTM P/E (-76.51% compared to sector average) is already elevated to deep-value category. As China's biggest pharmaceutical distribution company, SinoPharm will only get bigger. SinoPharm's 10-year sales growth performance grossly outperforms that of American pharma firms Pfizer (PFE) and Merck (MRK). If you want to invest in the $1.2 trillion/year global pharmaceutical industry, SinoPharm is obviously the better growth pharma stock.

(Source: Seeking Alpha Premium)

Compare the valuation ratios of Merck and Pfizer against SinoPharm's. The 0.12x TTM Price/Sales of SinoPharm's stock is extreme undervaluation when compared to PFE's 4.11x and MRK's 4.05x. The TTM Price/Book of SinoPharm is just 1.04. SinoPharm exudes a deep-value vibe when you compare its low P/B ratio to MRK's 7.36 P/B valuation.

(Source: Seeking Alpha Premium)

Final Thoughts

Seeking Alpha should upgrade their investing strategy beyond impermanent geopolitical issues. SinoPharm's non-US stock, 1099:HK is a strong buy. This company's core business is selling medicines inside China. It is not endangered by Trump's anti-China policy. The real victims of Trump's electioneering campaign against China are those American firms who rely on the Chinese market for much of their annual sales.

Going forward, the international expansion of SinoPharm is very safe. Unlike Huawei's networking products/smartphones, SinoPharm cannot be accused of selling medicines that could be used for spying or data gathering. You should bet on SinoPharm's COVID-19 vaccine too. China's rulers already approved the third phase of the human trial of SinoPharm's inactivated COVID-19 vaccine. Pfizer's COVID-19 vaccine candidate is still in phase 1. Sadly, Merck is still on the process of "scanning" potential anti-COVID 19 vaccines.

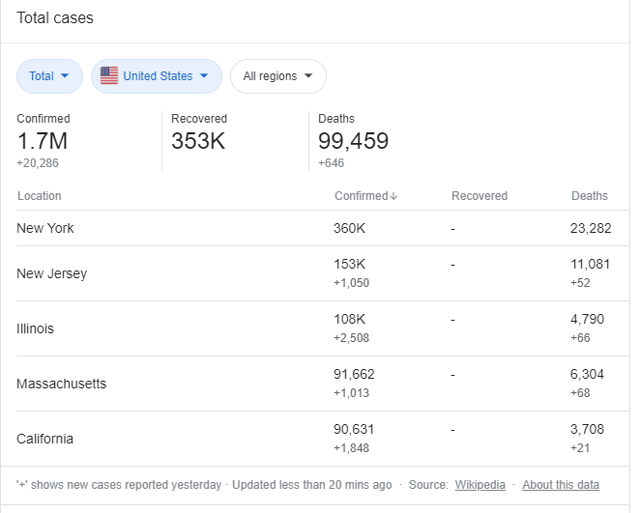

My country's President, Duterte has agreed to let the Philippines join SinoPharm's COVID-19 vaccine human trials. I trust Duterte. I don't trust Trump's catastrophic record of extremely high U.S. COVID-19 infections and death. The United States needs China because it can't seem to control America's COVID-19 outbreak.

(Source: Google Online COVID-19 Stats Tracker)

Lastly, investing in SinoPharm is clearly safe. Its current majority owner, the Profiteering Communist State of China, will never let SinoPharm go bankrupt. China is super rich - it can afford to hold $1.09 trillion of America's debt load.

Disclosure: I am/we are long AAPL, INTC, NVDA, AAPL, MSFT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: We will go long on 1099:HK very soon.